Philly Fed data have been lagging regional and national data but not in November. The report's November index on general business conditions jumped from a zero-flat trend to a prodigious 22.5 to indicate very sharp month-to-month growth. New orders rose more than 15 points to 10.4. Shipments also rose more than 15 points, to 16.8. The region's manufacturers are showing commitment by adding to their workforces as the jobs index rose more than 10 points to 13.3.

Other readings confirm strength: unfilled orders rose while delivery times and inventory contraction slowed. Input prices show steep month-to-month pressure at an accelerating rate yet output prices, that is prices manufacturers receive for their finished goods, continue to contract though now only slightly.

This report points to accelerating strength for what is already solid growth for the national manufacturing sector. Interestingly, these results contrast with Monday's weak Empire State report from the New York Fed, a report that had been significantly stronger than Philly's. Month-to-month swings in regional data shouldn't cloud what is generally a positive outlook and continued leadership for the nation's manufacturing sector.

A family of indexes that measure the average change over time in selling prices received by domestic producers of goods and services. PPIs measure price change from the perspective of the seller. This contrasts with other measures that measure price change from the purchaser's perspective, such as the Consumer Price Index (CPI). Sellers' and purchasers' prices may differ due to government subsidies, sales and excise taxes, and distribution costs.In other words, what we're looking at is what people selling goods and services are getting for their goods and services.

The Producer Price Index for Finished Goods increased 0.4 percent in October, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This advance followed a 0.4-percent rise in both September and August. At the earlier stages of processing, prices received by manufacturers of intermediate goods moved up 1.2 percent in October, and the crude goods index increased 4.3 percent. On an unadjusted basis, prices for finished goods advanced 4.3 percent for the 12 months ended October 2010, their largest year-over-year gain since a 5.1 percent rise in May 2010.Here is a chart of the overall index

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in October on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.2 percent before seasonal adjustment.

As has frequently been the case in recent months, an increase in the energy index was the major factor in the all items seasonally adjusted increase. The gasoline index rose for the fourth month in a row and accounted for almost 90 percent of the all items increase; the household energy index rose as well. The food index rose slightly in October with the food at home index unchanged.

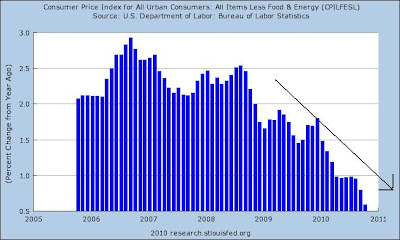

The index for all items less food and energy was unchanged in October, the third month in a row with no change. The indexes for shelter and medical care rose, but these increases were offset by declines in an array of indexes including new vehicles, used cars and trucks, apparel, recreation, and tobacco.

Over the last 12 months, the index for all items less food and energyhas risen 0.6 percent, the smallest 12-month increase in the history of the index, which dates to 1957. The energy index has risen 5.9 percent over that span with the gasoline index up 9.5 percent. The food index has risen 1.4 percent, with both the food at home index and food away from home index rising the same 1.4 percent.

Says Ataman Ozyildirim, economist at The Conference Board: “The LEI remains on an upward trend, suggesting the modest economic expansion will continue in the near term. The LEI’s growth has been slowing this year, but gains in the financial components helped its pickup in October.”Says Ken Goldstein, economist at The Conference Board: “The economy is slow, but latest data on the U.S. LEI suggest that change may be around the corner. Expect modest holiday sales, driven by steep discounting. But following a post-holiday lull, the indicators are suggesting a mild pickup this spring.”

Let's take a look at the data:

The LEIs are continuing to increase, and are doing so at a steeper rate.

Only two of ten components decreased; all others (obviously) increased.

A panel of Democrats, Republicans, economists and other experts is set to say Wednesday that a complete overhaul of the U.S. tax code is the best way to address the nation's fiscal problems—a new and likely controversial idea aimed at tackling the growing deficit.

The report, co-authored by Democratic budget veteran Alice Rivlin and former Sen. Pete Domenici (R., N.M.), follows a separate proposal last week by the two chairmen of President Barack Obama's deficit commission. The many similarities between the two offer a window into the types of proposals that might win backing as Washington launches into what is likely to be a protracted debate on deficit cutting.The most recent report, put together by a group called the Bipartisan Policy Center, will call for a one-year payroll-tax holiday in 2011 that it says will create between 2.5 million and 7 million jobs.

The plan would lower income and corporate tax rates and offset them with a 6.5% national sales or "consumption" tax as well as an excise tax on sugar drinks like soda.

The Bipartisan Policy Center was created in 2007 by former Senate Majority Leaders Howard Baker, Tom Daschle, Bob Dole and George Mitchell with the aim of finding solutions to major national issues.

Here's the deal.

The U.S is running a deficit. That means two things.

1.) Taxes have to increase.

2.) Spending has to drop. As I demonstrated last week, the real issue there is medical costs We need to find some way to lower medical spending. I have no idea what that entails,but that is the central issue going forward for the US deficit.

This magical thinking that a reworking of the tax code will solve the problem is utter crap. It's a nice idea, but the tax code is full of special interest giveaways. The only way to make simplification work is to eliminate every single giveaway and not let any return. Politically, in an age of massive lobbying by everybody and their dog, that is simply not going to happen.

So far, all we've gotten is really stupid solutions that effectively say, "we don't want to make hard decisions because we might not get re-elected."

This isn't that hard or complicated. However, it does require grown-up solutions to answers. And that is where we come up short. Washington is full of stupid people.