- by New Deal democrat

It’s a Sunday, and it’s been a while since I put up some generalized thoughts on where we are, so let’s update. I’ll go in order of my optimism on the economy, COVID, and the political situation.

The economy

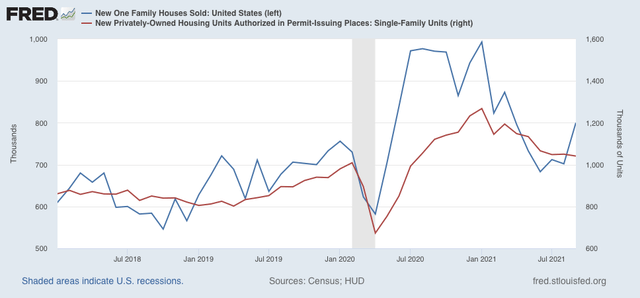

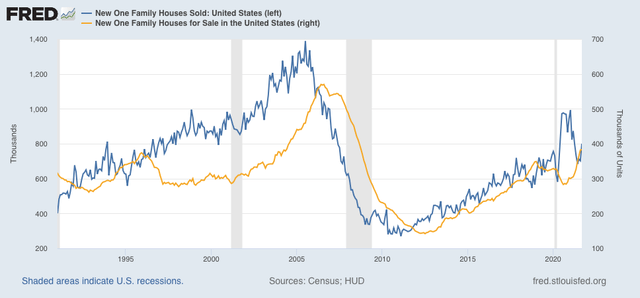

I am pretty happy about the place the economy is in right now, and for the near term future. Yes, we have inflation and supply chain issues, but we always have issues. And Q3 GDP will probably come in pretty punk on Thursday, but I’m just not concerned. Average hourly wages for non-managerial personnel are up 5.5% from one year ago. While inflation is going to pass, those wage gains are likely to prove “sticky.” For the first time since the late 1990s, labor is in a position of strength, and able to capture more of a share in the increase in economic activity.

Here’s more:

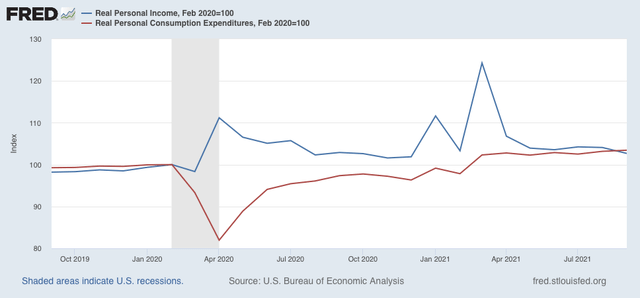

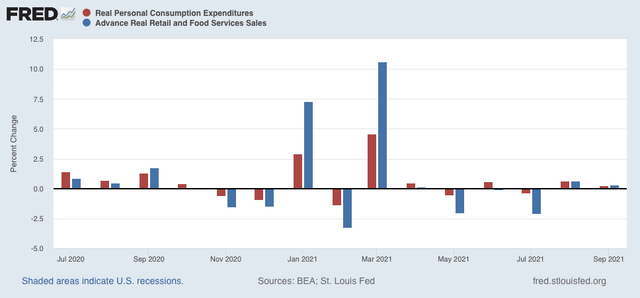

- Even after adjusting for inflation, retail spending - although down from spring’s stimulus-fueled pace - is up 12.3% since just before the pandemic hit, and up 8.1% in the past 12 months.

- Real disposable personal income is up 3.4% since just before the pandemic, and slightly higher than 12 months ago.

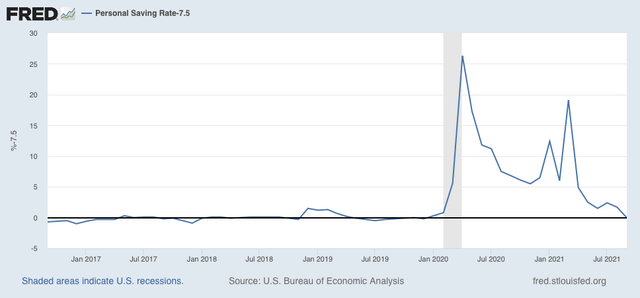

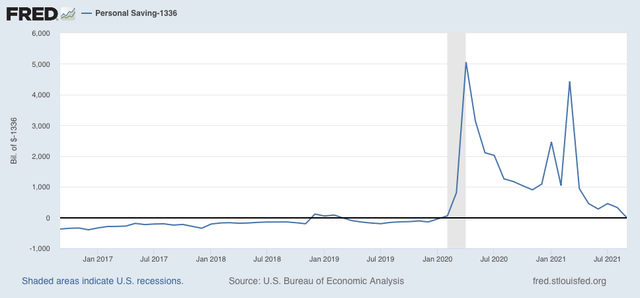

- Personal savings are up 22.9% since just before the pandemic, although down from 12 months ago.

Basically, households spent most but not nearly all of their stimulus payments, and also maintained some of their savings from being cooped up at home due to COVID. And they’re being paid more at work.

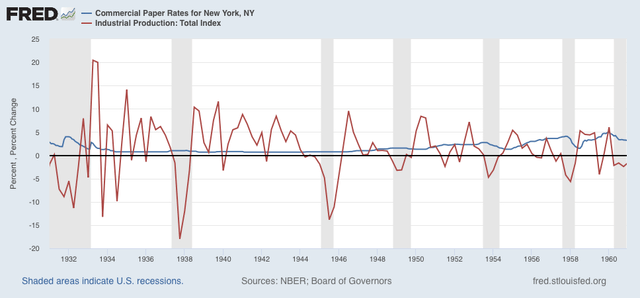

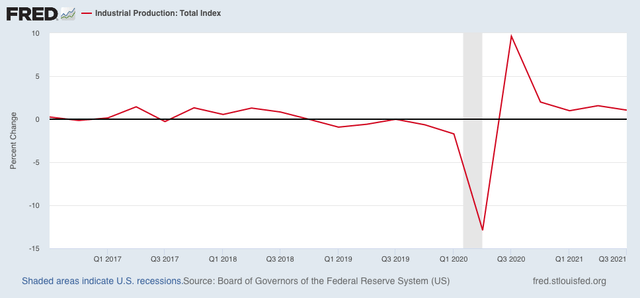

Producers are struggling to keep up with all of that new demand - that’s a big part of the supply chain issue - but forward looking data like factory new orders continue to show that production should continue to expand.

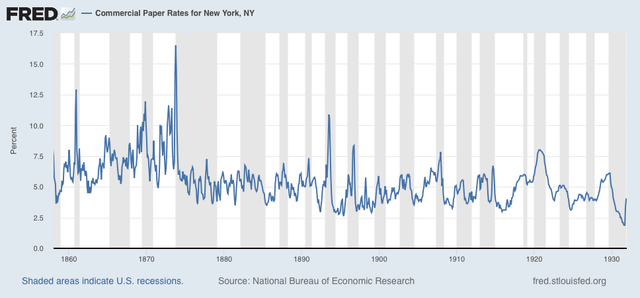

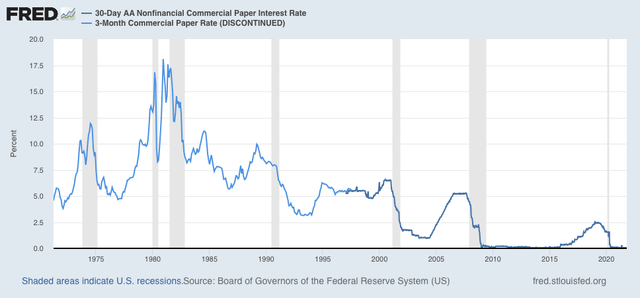

And the background financial conditions continue to show low interest rates, an open spigot for money supply, and also an open spigot for credit being granted.

Maybe sometime next year, the economy will hit a wall. But even one year out, very few indicators are showing signs of trouble. Color me optimistic.

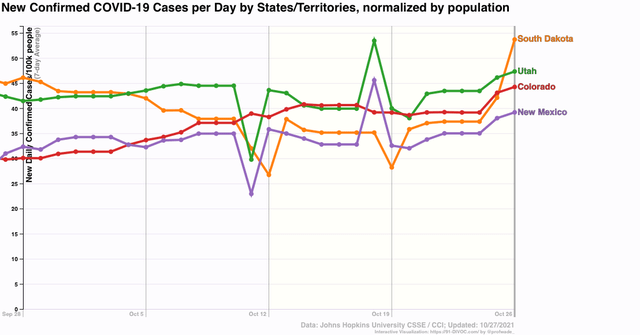

COVID

Here I am also at bottom optimistic, but much more cautiously. One thing I got wrong this year is that I expected vaccinations to continue at a 2 to 3 million per day pace, once they got available, and reluctant people saw that they really did protect the vaccinated. I did not realize the ferocity and power of the disingenuous political opposition that was originally orchestrated by Trump, but then escaped beyond even his control.

That is going to continue, but it is likely to be overcome by factors on the other side.

For example, even though lots of people over 65 are GOPers, the latest data from the CDC shows that 85% of seniors are fully vaccinated, and over 95% have had at least one shot. In other words, they may be telling pollsters that they’re against vaccines, but they quietly went out and got their shots anyway (because they know how vulnerable they are, and they don’t want to die).

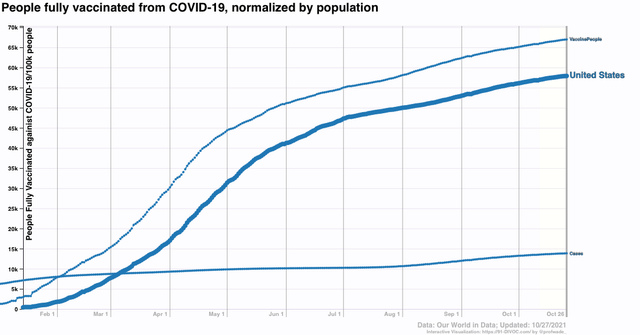

More broadly, almost 70% of all adults are fully vaccinated, and almost 80% have had one shot.

Right now 66% of the *entire* population has had at least one shot, and 57% are fully vaccinated. The percentage of people vaccinated may only be rising by about 0.1% a day, but it has, relentlessly, continued to rise. With the likely approval of vaccines for children ages 5 to 11 (who are about 8.5% of the population), we are going to see a further increase.

Even at 0.1% increase a day, by the end of this year (in two months), it’s likely that about 63% of the US population will be fully vaccinated, and 72% will have had one shot. By March of next year, those numbers will probably be at least 70% and 77%, respectively.

Add to that the fact that, on average, prior infection in the past 1.5 years is the equivalent of a single dose of vaccine, and that it is likely that a little over 2x the number of people have been infected as opposed to cases “confirmed” by tests, currently close to 14%, and probably about 30% of those not vaccinated have some resistance now, and that will probably be over 35% by spring.

In short, by the end of winter, between vaccinations and prior infections, there’s probably only going to be about 15% of the entire population that does not have some resistance. A coronavirus looking to infect its next victim is going to have a 3/4 chance of encountering someone virtually immune, and another 10% chance of encountering someone with some resistance. Not terribly good prospects for wide continuing spread.

Furthermore, I anticipate more and more vaccine mandates from the federal, State, and local governments, as well as by employers. School mandates are going to be enormously helpful where enacted. I think it is only a matter of time before we get interstate public transport mandates. Finally, entire “Blue” regions like the Northeast may finally impose quarantines with teeth on travelers from places like Florida and Texas. Too bad for them; they should get vaccinated.

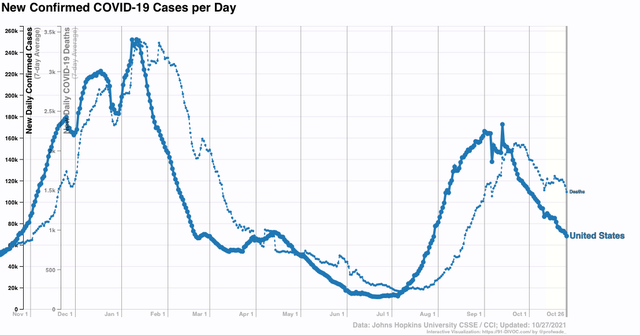

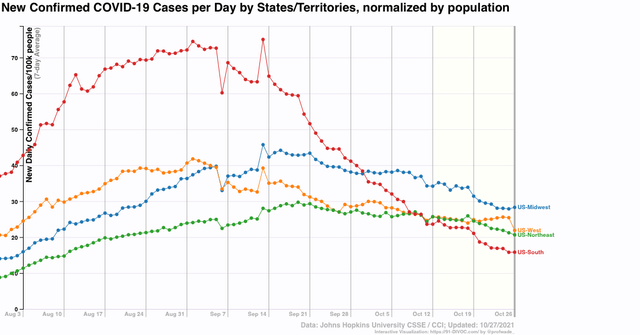

My base case right now is that we do get a winter wave, but it peaks at only about 1/2 to 2/3’s of the cases and deaths of the summer Delta wave. The next wave after that will be about 1/2 to 2/3’s of that wave, and so on. That’s what COVID turning endemic is likely to look like. By the end of next year, I anticipate it really will be “just like the flu” in terms of both infections and deaths.

The US political system

Finally, we get to the issue where I am pessimistic - but really, it is just watching what I figured out shortly after Election Day last year coming to fruition.

The President does not decree legislation. It must be passed by the Congress. And Congress has been completely non-functional ever since 2011, except on those things that are allowed to pass with a bare majority of the Senate (tax cuts and judges). This is a blueprint for continued GOP control. Everything they want they can pass with a bare majority, in a chamber weighted towards rural States to begin with. Everything Democrats want requires 60 votes, and they will never get them. A 50/50 Senate means that even 1 dissenter completely destroys any Democratic agenda item.

And here we are. Maybe some scaled down version of Biden’s economic program finally gets enacted. But the scaled down version isn’t going to be nearly enough.

And the situation with regard to voting rights in particular, and democratic integrity in general, is much more dire.

It’s pretty clear that the filibuster in the Senate is not going to be lifted for voting rights legislation, nor for legislation (that is *clearly* within Congress’s power, as to Congressional elections) dealing with gerrymandering. And Merrick Garland (who, presumably, is following Biden’s wishes) appears to be “looking forward, not back,” thus ensuring that there are no consequences even for an attempted violent overthrow of the 2020 Presidential election, and further ensuring that much more organized attempts will follow, probably successfully.

Meanwhile the Supreme Court is revving up to repeal the entire 20th Century, both as to civil rights and economic regulation.

About the only silver lining I see there is that, whether Roe v. Wade technically survives or not, it is really clear that abortions are going to be permitted to be outlawed by the States (and I don’t even put it past the Court to declare that the fetus is a “person” and that abortions *must* be prohibited). That will be the first time in the entire history of the US that a personal right that people thought they had - for the last 50 years - is taken away.

And one thing we know from behavioral economics specifically, and behavioral psychology generally, is that people react *much* more strongly to things that are taken away from them than things that they didn’t have to begin with. I expect a complete firestorm of rage when this happens, and it may very well lead to 2022 midterm election results that defy the usual trend, with a Blue avalanche giving Biden and the Democrats a much better chance to enact a real agenda, up to and including voting rights and Supreme Court reform.

But in the longer term, the Rule of Law in the US is going to end shortly, I suspect. Some day long after that, a new Constitution not encumbered with creaky 18th Century kludges will finally come into existence, long after I am gone.