See you on Monday.

The curious thing is that [prices of natural resources] graphs [for the last month] all look the same. Which suggests ... that recent market moves have a common driving factor.

The natural explanation would seem to be that markets have interpreted developments over the last month as bad news in terms of the quantities of basic raw materials that global customers will want to buy and in terms of the profits that companies around the world can expect to earn.

Such concerns would have to come not just from the fact that the European countries forced into budget austerity measures are going to be buying less... [but] a potential replay of the credit crunch that brought the world economy crashing down in the fall of 2008.

The simple fact is, the first 3-6 months of 2010 are probably going to show growth, and indeed more strong growth than few dared to hope for in 2009.

There is ... one economic indicator with an excellent track record at forecasting the economy - with one important qualifier - a year out. That is the yield curve of the bond market.

So long as there is inflation, not deflation, a positive sloping yield curve, where long term interest rates are higher than short term rates, has correctly predicted economic expansion 1 year later, without exception, since 1920, including the Great Depression.

if consumers once again have to pay over $3 a gallon for gas (which ~$90 Oil would give us), it will have a psychological as well as economic impact on consumers, and I would expect them to cut back in other areas. ... It seems [ ] likely that Oil prices will continue to increase, but slowly this time as opposed to the skyrocketing speculative blowoff that led to $147 Oil in July 2008.

Whether $90+ Oil will lead to a full-blown double-dip economic contraction, or just a slowdown later in the year, is almost impossible to gauge. It depends upon how far over $90 Oil shoots, and how long it stays there. If there is a dramatic overshooting a la 2007, there will be a double-dip. If there is a gradual increase over $90 that does not last that long before consumers cut back and the feedback loop causes price declines, then there may just be a slowdown, or if there is a contraction, it may be shallow and only last a quarter or two -- which is my best guess, and only a guess, at this point.

I think it unlikely that an export demand shock alone is sufficient to push the US economy back into recession. Menzie Chinn tackled this issue back in 2007, arguing at the time it was unlikely a rise in exports would stave off a recession. The reverse logic holds as well; US recessions look to be driven by sharp declines in domestic absorption, not exports....

[O]ne would have to consider the positive impact of the Greek crisis against any trade drag. And yes, there are positive implications. First, the weaker Euro has taken a bite out of oil prices, which fell back below $70 today. Make no mistake - keeping a lid on oil prices offers continued support for US consumers. And while we can all dream of a more balanced economy less dependent on household spending, for now it remains the best game in town. ...the overall trend in retail sales continue to look solid:

Consumers have a wind at their backs, unbelievably, and further job growth will only speed them further. Likewise, the rush to Treasuries is keeping a lid on US interest rates....

Bottom Line: The European crisis, by keeping US interest rates in check and oil prices low, may do more to help the US recovery than hurt it

Many of us have noticed that the US exports only a bit more than 1 percent of GDP to the euro zone, limiting the direct negative impact. Meanwhile, as Duy points out, the immediate impact of the euro crisis has been (a) a fall in oil prices (b) a fall in long-term interest rates. Both of these are actually positive for the US.

Against that you might set fear of financial disruption, which may drive up borrowing costs for some private sector players. But Duy is right: it’s not at all clear that this hurts prospects for growth over the next few quarters.

The OECD has recently released documentation on their new macroeconometric model. One of the experiments implemented involves a 10% euro depreciation against a basket of currencies

....

the table indicates the effect of a 10% euro depreciation would only have a modest impact on US GDP -- a 0.2 percentage point deviation relative to baseline two years out, if sustained.

Data released Wednesday by the Mortgage Bankers Association showed the mortgage delinquency rate rose in the first quarter to 9.38 percent of all loans outstanding, from 8.22 percent in same period last year.

When adjusted for seasonal variations, the default rate rose over 10 percent for the first time.

Seasonal adjustments are used to smooth out data in ordinary times, but in these extraordinary times the bankers’ group said it was not sure how much they could be trusted. In the first quarter the seasonal adjustments showed the delinquency rate worsened considerably. The raw data, on the other hand, indicated a marked improvement.

Warning that “fundamental market factors” might be exercising undue influence over the seasonal numbers, the mortgage bankers said they did not know whether the optimistic or pessimistic sequence was more accurate.

“We may be at a point where the market is changing for the better, but we can’t be sure because of the confounding effect of seasonal differences,” said Jay Brinkmann, the group’s chief economist.

Yesterday's mortgage data conflicted with this report from Reuters:

Fewer U.S. consumers are falling behind on their debt, prompting lenders to look again for ways to make their business grow.

Delinquency rates on mortgages, home equity loans and credit card bills fell in April for the third straight month, according to data that Equifax Inc (EFX.N), one of the largest U.S. credit bureaus, provided exclusively to Reuters.

The data is based on Equifax' 200 million-plus files of U.S. consumers using credit.

"If you think about the entire U.S. population as a risk portfolio, it's safe to say that the portfolio is indeed improving," said Dann Adams, president of Equifax' U.S. Consumer Information Solutions.

The only credit product in which delinquency continues to rise is student loans, where 11.2 percent are late, up 0.7 percent from March and 3.5 percent from last year.

"It's a tough labor market," Adams said. "It's difficult for many to start repaying those loans."

So, the MBA says one thing while Equifax says another. This should be interesting.

For more on seasonal adjustments, see this post from Silver Oz.

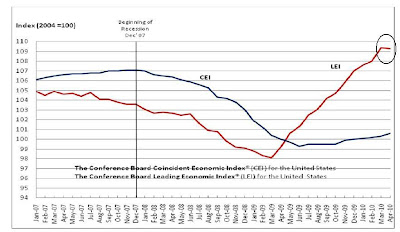

The Conference Board Leading Economic Index®(LEI) for the U.S. declined 0.1 percent in April, following a 1.3 percent gain in March, and a 0.4 percent rise in February.

Says Ken Goldstein, economist at The Conference Board: "These latest results suggest a recovery that will continue through the summer, although it could lose a little steam. The U.S. LEI declined slightly for the first time in more than a year, and its six-month growth rate has moderated since December. Meanwhile, the coincident index, a measure of current economic activity, has been improving since mid-2009."

More Americans unexpectedly filed applications for unemployment benefits last week, showing firings remain elevated even as employment climbs.

Initial jobless claims rose by 25,000 to 471,000 in the week ended May 15, exceeding the median forecast of economists surveyed by Bloomberg News and the highest level in a month, Labor Department figures showed today in Washington. The number of people receiving unemployment insurance and those getting extended payments fell.

Some companies are trimming payrolls to boost or maintain profits, even as employers have added jobs each month this year. Unemployment may take time to recede as more jobseekers enter the workforce and fail to find work.

“Claims remain uncomfortably high,” Aaron Smith, a senior economist at Moody’s Economy.com in West Chester, Pennsylvania, said before the report. “The improvement in continuing claims has slowed noticeably.”

Applications were projected to drop to 440,000 from 444,000 initially reported for the prior week, according to the median forecast of 44 economists in a Bloomberg survey. Estimates ranged from 425,000 to 448,000. The Labor Department revised the prior week’s figure up to 446,000.

There were no special factors behind the jump in claims last week, a Labor Department spokesman said.

The sideways movement of initial claims has been a concern of mine for the last several months. This increase is not good and indicates the the labor market is not healing as quickly as we would like.

Here's a chart of the data:

The only drawback to this chart is it is parabolic -- th erate of ascent is incredibly steep which no price chart usually maintains for long. In addition, the heavy volume could be a buying climax with the addition of an exhaustion gap. However, that's one possible technical interpretation. The fundamental picture is gold bullish as traders express their concern with the EU situation by purchasing safe assets -- here, gold.

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to improve for a tenth consecutive month in May, albeit at a slower pace than in April. The general business conditions index fell 13 points, to 19.1. Similarly, the new orders and shipments indexes also moved lower but remained at positive levels. The inventories index dropped back to a level near zero after rising into positive territory in March and April. The prices paid index continued to climb, reaching its highest level of the year, while the prices received index was little changed and positive. The index for number of employees rose for a fifth consecutive month, reaching its highest level since 2004. Future indexes suggest that activity is expected to expand further in the months ahead, but the level of optimism was noticeably lower in May than in recent months.

Construction of new homes rose more than expected in April but new building permits fell sharply, signaling the industry's rebound could be short-lived.The results show builders ramped up to meet demand from buyers seeking to take advantage of federal tax incentives, but are now scaling back their plans.

Building permits, a gauge of future activity, sank 11.5 percent to an annual rate of 606,000, the lowest since October 2009, the Commerce Department said Tuesday. Analysts were expecting a slight dip to a rate of 680,000.

Home sales have rebounded this year. They were helped by low mortgage rates and two government tax credits — $8,000 for new buyers and $6,500 for current owners who buy and move into another property. To receive the tax credit, borrowers had to have a signed offer by April 30 and must close the deal by the end of June.

Fewer U.S. consumers are falling behind on their debt, prompting lenders to look again for ways to make their business grow.Delinquency rates on mortgages, home equity loans and credit card bills fell in April for the third straight month, according to data that Equifax Inc (EFX.N), one of the largest U.S. credit bureaus, provided exclusively to Reuters.

The data is based on Equifax' 200 million-plus files of U.S. consumers using credit.

"If you think about the entire U.S. population as a risk portfolio, it's safe to say that the portfolio is indeed improving," said Dann Adams, president of Equifax' U.S. Consumer Information Solutions.

The only credit product in which delinquency continues to rise is student loans, where 11.2 percent are late, up 0.7 percent from March and 3.5 percent from last year.

Three months of decreases is a good sign. I'm not confident enough to call a top yet, but this is a good sign nonetheless.

Obviously Gov. Schwarzenegger does not read Bonddad. He explained that the significant economic pain accruing to working class people resulting from his state budget was due to the “sour economy” and he went on to compare California to Greece.{sigh} So much ignorance and lack of reading comprehension all packed tightly into 4 little sentences. I wonder if it takes practice, or whether it just comes naturally?

If he were a regular reader of the “chicken in every pot” Bonddad blog he would know that the recession is over, the economy is growing and California’s budget problems are ‘lagging indicators’.

Don’t you just hate uninformed politicians?

The Liscio Report, a newsletter that tracks state tax revenues, says 94% of the states that the Liscio report tracks saw sales tax revenue increase in April from April 2009. That's up from just 18% of states in March.For the math impaired, 94% of 50 is 47 states, meaning only 3 states had YoY shortfalls in April. And California wasn't one of them. According to California Comptroller John Chiang:

The average gain is around 2.5%, adjusted for population....

What that means is that March was a good month because sales-tax revenue in any given month reflects activity of the month before.

⇒ Compared to April 2009, General Fund revenue in April 2010 was up $142 million (1.4%). The total for the three largest taxes was above 2009 levels by $150 million (1.6%). This increase was driven by sales taxes that were $450 million higher (103.2%) than last year. However, corporate taxes were down by $115 million (-7.6%), and personal income taxes came in slightly below last April by $186 million (-2.5%)TSince California's revenues actually went UP, what was the problem? Mr. Chiang continues:

Compared to estimates from the 2010-11 Governor’s Budget, total General Fund revenues in April were $3.6 billion lower (-26.4%) than expected. Personal income taxes were well below expectations by $3.1 billion (-30.0%), and corporate tax revenues came in below projections by $541 million (-28.1%). Sales tax revenues were $123 million better (16.1%) than anticipated.In other words, the problem isn't actual tax collections, which were up -- and in the case of sales tax receipts, have been up YoY for 4 months in a row. No, the problem in California is the pie-in-the-sky budget projections set by Der Gubernator. Surprise, surprise.

I’ve been hearing some muttering about the April tax receipts, which are well below those of a year ago. Doesn’t that mean that all hopes of recovery, either in the economy or in the budget, should be abandoned?Now, I don't want to sound callous to the uncounted Californians who will suffer through budget cuts that are now being proposed. But they aren't being proposed due to collapsing state revenues, because California's revenues have improved. They are being imposed because politicians lied last year in their future projections.

No.

Read the CBO’s Monthly Budget Review (pdf) for the lowdown. Basically, April non-withheld income tax payments were way down — because those payments reflect 2009 income, which was way below 2008. But those tax receipts that reflect the current state of the economy — payroll, withheld income, and corporate — are all rising.

“Reverse diversification” boosted global demand for long-term U.S. financial assets to a record as the European fiscal crisis may be beginning to translate into increased demand for dollar assets.Purchases of equities, notes and bonds totaled $140.5 billion in March, more than double economists’ projections, after net buying of $47.1 billion in February, the Treasury Department said yesterday. Treasury purchases rose by the most since June as China, the largest lender to the U.S., added to its holdings for the first time since September.

“Diversification was a major deadweight on the dollar last year and reverse diversification is now a major source of vulnerability for the euro,” said Alan Ruskin, head of foreign- exchange strategy at Royal Bank of Scotland Group Plc in Stamford, Connecticut. The crisis may result in 2 percentage points of “growth divergence in the U.S.’s favor,” he said in a telephone interview yesterday.

Signs of a sustained economic recovery, including a rebound in earnings and stock prices, may increase demand for U.S. investments as concerns mount about the sustainability of government debt in Europe. The world’s largest economy has expanded for three consecutive quarters and added 573,000 jobs in the first four months of the year. Russia cut the share of euros in its international currency reserves to 43.8 percent at the end of 2009 from 47.5 percent a year earlier, Interfax reported yesterday, citing central bank data.

‘Fear Was Misplaced’

The dollar has strengthened 7.2 percent so far this year while the euro has slumped 8.7 percent, according to Bloomberg Correlation-Weighted Indices. The euro dropped to $1.2235 yesterday, the lowest level since April 2006.

The Standard & Poor’s 500 Index in March rose 5.9 percent, its biggest gain since July 2009, while the Dollar Index, a gauge of the U.S. currency’s strength against six other major currencies, gained 0.9 percent. Treasuries declined 0.9 percent in March, according to an index compiled by Bank of America Corp.’s Merrill Lynch unit.

“Foreign institutions and individuals are still turning to the U.S. as a safe haven,” said Paul Christopher, senior international investment strategist at Wells Fargo & Co. in St. Louis. “There was some concern foreigners were abandoning the U.S. currency. That fear was misplaced.”

I've covered the market moves extensively in the "yesterday's market" posts. Suffice it to say, US assets are currently a safe haven asset. This has incredibly important implications.

1.) Low interest rates: as traders bid up Treasury bonds, yields drop. This means US borrowing costs -- which could easily get out of hand right now -- are contained (at least for now).

2.) Lower commodity prices: commodities are price in dollars. A stronger dollar means lower commodity costs, which in turn means lower inflationary pressure. This also means the cost of oil will be kept in check, helping US consumers.

3.) Weaker exports. A strong dollar means US exports are now more expensive, lowering the amount of exports foreigners are willing to buy.

Personally, I think what has happened over the Great Recession is jobs that would have disappeared by natural attrition over a period of say 5-10 years were accelerated out of existence by the recession. For example, a manufacturer was thinking, "I'll continue to move in the area of automation at a slow rate." But then the recession hit and he said, "no time like the present to at least start getting rid of people."

For the last two years, the weak economy has provided an opportunity for employers to do what they would have done anyway: dismiss millions of people — like file clerks, ticket agents and autoworkers — who were displaced by technological advances and international trade.The phasing out of these positions might have been accomplished through less painful means like attrition, buyouts or more incremental layoffs. But because of the recession, winter came early.

This is a central problem to the long-term unemployment the country is facing. Consider this:

Ms. Norton is one of 1.7 million Americans who were employed in clerical and administrative positions when the recession began, but were no longer working in that occupation by the end of last year. There have also been outsize job losses in other occupation categories that seem unlikely to be revived during the economic recovery. The number of printing machine operators, for example, was nearly halved from the fourth quarter of 2007 to the fourth quarter of 2009. The number of people employed as travel agents fell by 40 percent.

This “creative destruction” in the job market can benefit the economy.

Pruning relatively less-efficient employees like clerks and travel agents, whose work can be done more cheaply by computers or workers abroad, makes American businesses more efficient. Year over year, productivity growth was at its highest level in over 50 years last quarter, pushing corporate profits to record highs and helping the economy grow.

But a huge group of people are being left out of the party.

Millions of workers who have already been unemployed for months, if not years, will most likely remain that way even as the overall job market continues to improve, economists say. The occupations they worked in, and the skills they currently possess, are never coming back in style. And the demand for new types of skills moves a lot more quickly than workers — especially older and less mobile workers — are able to retrain and gain those skills.

There is no easy policy solution for helping the people left behind. The usual unemployment measures — like jobless benefits and food stamps — can serve as temporary palliatives, but they cannot make workers’ skills relevant again.

I've covered one big reason for this problem: educational achievement. The data indicates that higher educational levels leads to higher wages and lower rates of unemployment.

But consider this chart, which is a 10-year chart of output per hour in logarithmic scale:

Output per hour increased during the great recession, indicating that productivity increased. Simply put, despite a massive drop in employment, the amount of work done increased, telling business they could indeed get by with less. That means the from a business owners perspective, the massive cut in payrolls was a good thing, as it lowered their fixed costs (by lowering payroll expenses which are usually some of the largest a company faces) but didn't hurt overall output.

Industrial production increased 0.8 percent in April after having risen 0.2 percent in March. The rates of change for both January and March were revised up, but the rate of change for February was revised down; nevertheless, the cumulative change over those months was only slightly lower than previously reported. Manufacturing output climbed 1.0 percent in April for a second consecutive month and was 6.0 percent above its year-earlier level. The increases in manufacturing continued to be broadly based across industries. Outside of manufacturing, the output of mines rose 1.4 percent, and the output of utilities decreased 1.3 percent. At 102.3 percent of its 2002 average, total industrial output in April was 5.2 percent above its year-earlier level. The capacity utilization rate for total industry advanced 0.6 percentage point to 73.7 percent, a rate 6.9 percentage points below its average from 1972 to 2009, but 4.5 percentage points above the rate from a year earlier.

The output of most major market groups rose in April. The production of consumer goods increased 0.2 percent, the result of higher output of consumer nondurables. The output of consumer durables was unchanged; declines in automotive products and in home electronics offset advances in appliances, furniture, and carpeting and in miscellaneous goods. The production of consumer nondurable goods moved up 0.3 percent, with the output of non-energy nondurables rising 0.3 percent and the output of consumer energy products gaining 0.5 percent. All major categories of consumer non-energy nondurables recorded increases, although most of the gains were small; the exception was paper products, which moved up 1.0 percent. For consumer nondurable energy products, higher fuel production was partly offset by a decrease in residential sales by utilities, which moved down for a third consecutive month.

.....The production index for durable goods advanced 1.1 percent in April; all major categories of durables strengthened with the exception of motor vehicles and parts and aerospace and miscellaneous transportation equipment. Gains of 2.0 percent or more were recorded for nonmetallic mineral products; primary metals; machinery; and electrical equipment, appliances, and components.

Nondurable manufacturing climbed 1.0 percent in April. The output of petroleum and coal products jumped 3.6 percent, the index for plastics and rubber products expanded 2.7 percent, and the production of paper climbed 2.4 percent. The indexes for textile and product mills, for printing and support, and for chemicals also increased, while the indexes for food, beverage, and tobacco products and for apparel and leather were little changed.

In other words, since 1980, facing stagnated real wages, the only way American consumers have been able to significantly improve their lifestyles is either:

- to take on more debt, using assets which have appreciated in value as collateral (stock investments, housing), or

- to refinance their existing debt at lower interest rates.

When consumers were unable to do either of those things, they cut back on spending, triggering consumer-led recessions.

You can see that for long periods of time in the 1980s, 1990s, and 2000s, consumers were able to spend more by refinancing their existing debt at lower interest rates. By contrast, when interest rates were stable, or even rising as in the 1970s, and wages failed to keep up with inflation, a recession ensued within several years (the only exception was the Y2K recession, which wss investment/tech led and was not a consumer recession)....That's exactly what happened as squeezed consumers cut back, their ability to refinance debt terminated by the collapse of the housing bubble.

Only twice in the last 27 years has the consumer been unable to refinance debt or tap into his or her stock or house ATM. ... [T]he 3rd and final time is almost certainly near.