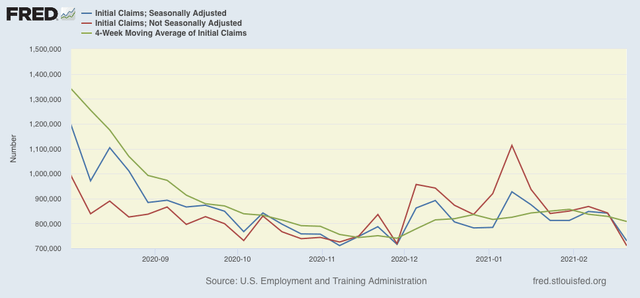

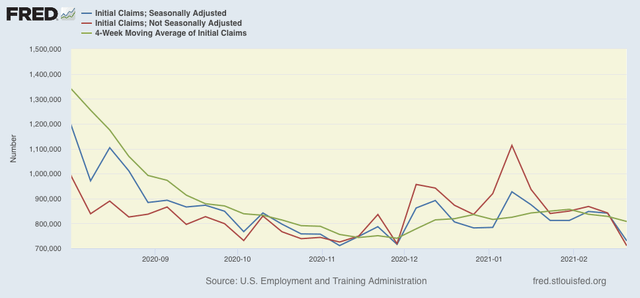

Let me start off this week’s review of initial jobless claims by pre-debunking something I am sure is going to be said elsewhere: a lack of reporting in Texas did *not* appreciably skew this week’s numbers. Applying the same workaround I did for Hurricanes Sandy and Harvey, I.e., subtracting the affected State’s data from the unadjusted number, to see how much it is at variance with all the other States, shows that Texas’s underreporting due to its electricity crisis was less than 20,000 at worst in a week with little seasonal adjustment. In other words, being very generous, the “real” seasonally adjusted number of initial claims at worst probably would have been only about 30,000 higher - I.e., 760,000 - but for Texas issues.

Additionally, last week’s nationwide numbers were actually revised *down* by 20,000, unlike the two prior weeks which saw very large upward revisions.

With those two introductory remarks out of the way, let’s look at the data.

This week, on a unadjusted basis, new jobless claims declined by 131,734 to 710,313. Seasonally adjusted claims decreased by 111,000 to 730,000. The 4 week moving average declined by 20,500 to 807,250.

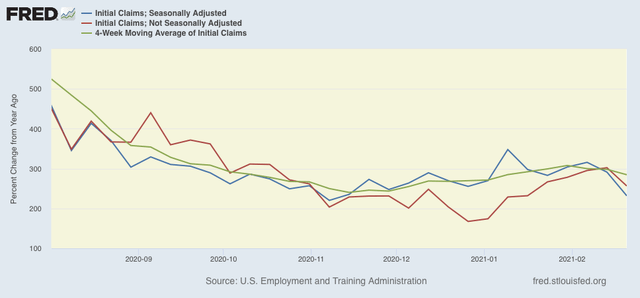

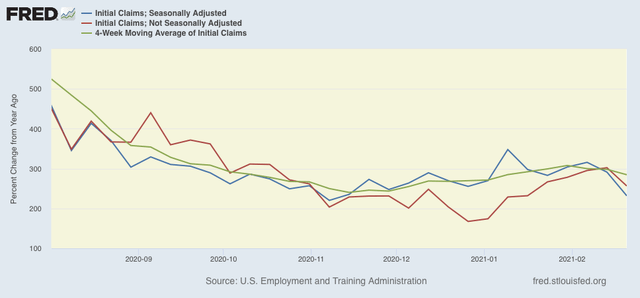

Here is the close up since the end of July (these numbers were in the range of 5 to 7 million at their worst in early April):

The good news is that recent increases seem to have plateaued. Nevertheless both adjusted and unadjusted claims remain above their worst levels at the depths of the Great Recession.

Because of the huge swings caused by the scale of the pandemic - typically claims only vary by 20,000 or less from week to week, but since the start of the pandemic, swings of 50,000 or 100,000 per week have happened as often as not, recently I began posting the YoY% change in the numbers as well, since they will be much less affected by scale. As a result, there is less noise in the numbers, and the trend can be seen more clearly:

The recent elevation in new claims compared with their November lows is clear. As of this week, it also appears clear, especially in the 4 week average, that claims have plateaued. As spring begins in the warmer parts of the country, we can expect increased outdoor activity and a relative recovery in employment servicing those activities.

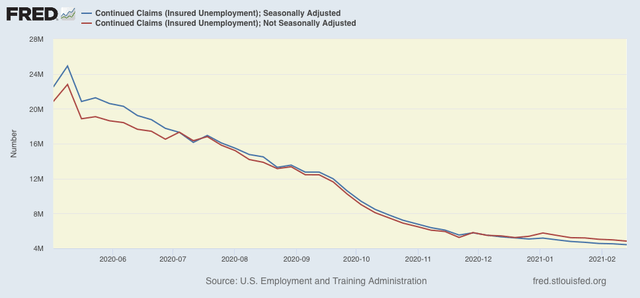

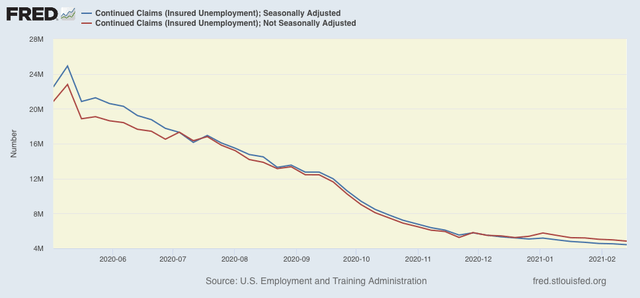

Meanwhile continuing claims, which historically lag initial claims typically by a few weeks to several months, made new pandemic lows yet again this week. Seasonally adjusted continuing claims declined by 101,000 to 4,419,000, while the unadjusted number declined by 143,320 to 4,828,027:

I had suspected that we would see an upward reversal, but obviously that did not happen. Continued claims remain at levels last seen in autumn 2009, only a few months after the Great Recession.

I continue to expect that the onset of better weather in spring (fewer indoor activities) and more vaccinations will mean that we have finally put the worst of the job losses behind us.