Saturday, March 2, 2019

Weekly Indicators for February 25 - March 1 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

Last year the most significant developments were in the long leading indicators. Now that is translating into the short leading indicators.

As always, clicking and reading not only should be educational for you, but rewards me a little bit for my efforts.

Friday, March 1, 2019

Manufacturing holds on in February

- by New Deal democrat

The theme for most reports remains that the government shutdown in December and January, plus a 30 year record cold snap for a week in January, put a real dent in the economy. That certainly was the message of December personal spending and December and January personal spending this morning.

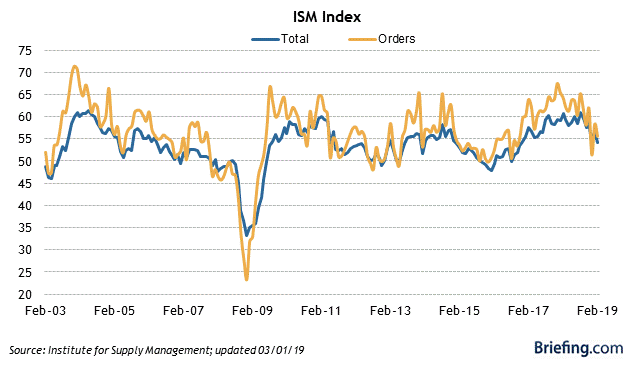

But it looks like there was no significant damage to manufacturing. This week three regional Fed banks reported February manufacturing in their region, followed by the Chicago PMI, and finally ISM manufacturing this morning.

At the end of January, the average new orders reading of the five regional Feds was +5. After much storm and drang, notably a big downdraft in the Kansas City region, but an even bigger updraft in Richmond, the average for February increased +1 to 6.

One regional Fed that does not report is Chicago, but the Chicago PMI’s new orders index, which has been running hotter than the other regional reports for months, also bounced back strongly in February, from 53.2 to 68.4 (which is still not quite as positive as it was for a number of months earlier last year). Subtracting 50 to make this compatible with the Fed indexes gives us an increase in the average from +5 in January to +10 in February.

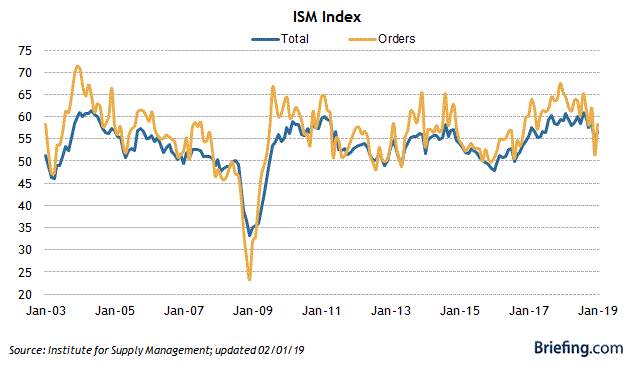

Finally, this morning the ISM new orders index for February declined to 55.5 from January’s 58.2 reading. The total index declined from 56.6 to 54.2, the lowest in nearly two years (h/t Briefing.com):

But it looks like there was no significant damage to manufacturing. This week three regional Fed banks reported February manufacturing in their region, followed by the Chicago PMI, and finally ISM manufacturing this morning.

At the end of January, the average new orders reading of the five regional Feds was +5. After much storm and drang, notably a big downdraft in the Kansas City region, but an even bigger updraft in Richmond, the average for February increased +1 to 6.

One regional Fed that does not report is Chicago, but the Chicago PMI’s new orders index, which has been running hotter than the other regional reports for months, also bounced back strongly in February, from 53.2 to 68.4 (which is still not quite as positive as it was for a number of months earlier last year). Subtracting 50 to make this compatible with the Fed indexes gives us an increase in the average from +5 in January to +10 in February.

Finally, this morning the ISM new orders index for February declined to 55.5 from January’s 58.2 reading. The total index declined from 56.6 to 54.2, the lowest in nearly two years (h/t Briefing.com):

This of course is still well into positive territory, and in line with most of this expansion. It is also in line with the average of the regional Fed reports. Chicago looks like the outlier.

The bottom line remains that manufacturing is decelerating from its torrid pace last summer, but is still expanding decently. Because I anticipate further slowing in the economy over the next 6 to 9 months, I am still expecting further deceleration in manufacturing. Whether it goes beyond that into outright contraction is very much an open question.

Thursday, February 28, 2019

Initial claims not at cautionary levels yet

- by New Deal democrat

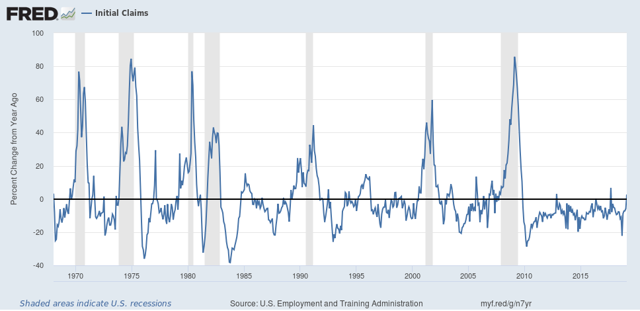

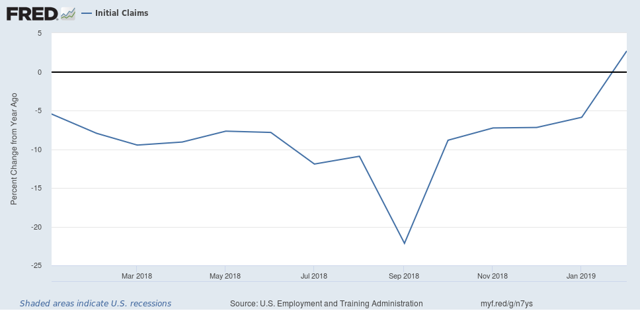

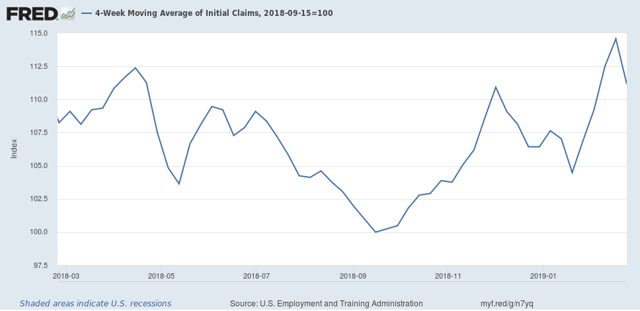

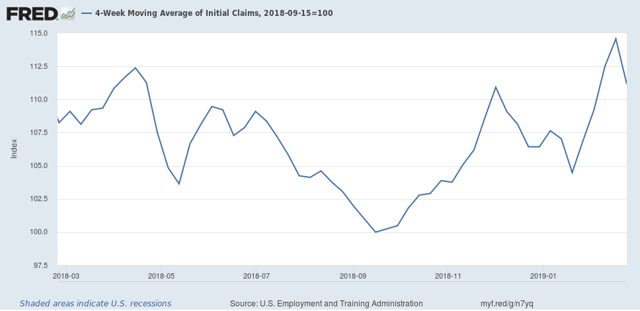

Initial jobless claims are an important short leading indicator, typically turning up 3-9 months before a recession. A problem is the necessity of filtering out signal from noise.There are two ways I measure claims in order to do so: (1) how much has the less noisy four week average risen from its low? And (2) have initial claims, averaged monthly, turned higher YoY?

Let’s start with the first measure. A 10% increase off of an interim low in claims is not unusual, and has happened every year or two for the entire 50+ year period that records have been kept. By the time they are up 15% from their bottom, not only is it almost always a signal of recession, but frequently the recession is imminent.

To distill signal and still give reasonable warning, the caution signal I employ is a rise of over 12% from a low. Measuring so, we see that initial claims as of this week are up about +11.5% off their lows:

Note that I am discounting the previous few weeks because they were distorted by layoffs due to the government shutdown. The four week average now does not appear to have any special factors.

Next, here is the long view of initial claims YoY measured monthly:

In any given expansion, there is usually at least one month where claims are higher YoY. But if that happens for two months in a row, more often than not it has signaled that a recession is approaching.

Note that the big distortion in claims happened at the end of January. Even so, on average January 2019 was lower than January 2018. But February saw more initial claims being filed on average than one year ago. Still, we won’t have a caution signal unless March also sees higher claims than March of last year.

The bottom line is that, while initial claims are close to the levels at which they would give a warning, they aren’t quite there at this point.

Q4 GDP: mixed signals for the future (UPDATED with graphs)

- by New Deal democrat

I didn’t post anything yesterday, so I’ll make up for it with two posts today.

This morning we finally got the very delayed first look at Q4 GDP. As per my usual practice, I am less interested in what happened in the rear view mirror, which was an annualized gain of +2.6%, than what the number tells us about what lies ahead.

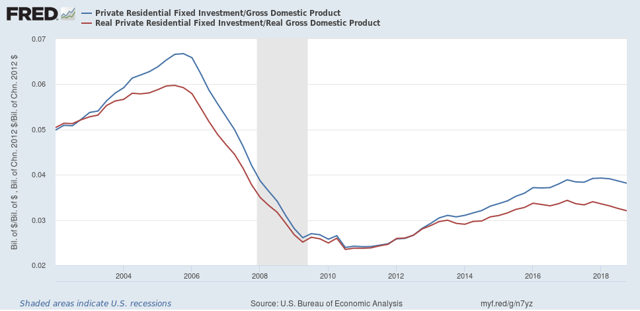

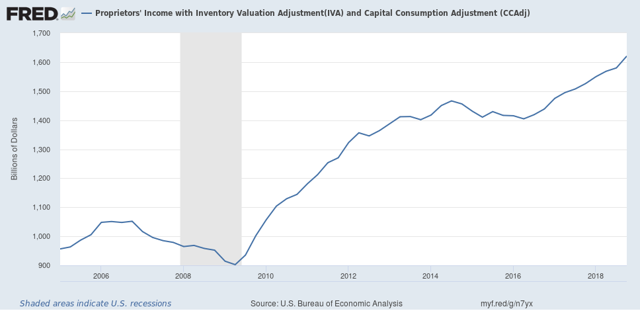

The two forward-looking components of GDP are (1) private fixed residential investment, and (2) corporate profits. Both of these are long leading indicators, I.e., giving us an idea about where the overall economy will be a year or more out from here.

In that regard, the news was mixed.

Private residential fixed investment declined -0.9% q/q. This is in keeping with the downturn in housing construction that we have seen in the monthly data. Note that residential investment as a share of GDP declined in both nominal (blue) and real (red) terms:

Private residential fixed investment declined -0.9% q/q. This is in keeping with the downturn in housing construction that we have seen in the monthly data. Note that residential investment as a share of GDP declined in both nominal (blue) and real (red) terms:

Meanwhile, corporate profits as is usual won’t be reported until the final revision in GDP one month from now, but proprietors’ income rose, was. While it does not always move in the same direction as corporate profits, and sometimes lags, it a good placeholder. Here the news was positive, as proprietors’ income rose +2.6% q/q:

I’ll supplement the above with graphs later. (UPDATE: DONE)

But the takeaway is, that in the rear view mirror, there was no recession in Q4. While one important leading sector of the economy, housing, continued to deteriorate, the producer side of the economy in the form of proprietors’ income, kept humming along. While enough long leading indicators of the economy did decline in 2018 to continue to justify being on “recession watch” for later in this year, and particularly Q4, there is no sign of deterioration on the producer side of the economy, so if a recession does develop, it will likely be centered on consumers and secondarily on manufacturing.

But the takeaway is, that in the rear view mirror, there was no recession in Q4. While one important leading sector of the economy, housing, continued to deteriorate, the producer side of the economy in the form of proprietors’ income, kept humming along. While enough long leading indicators of the economy did decline in 2018 to continue to justify being on “recession watch” for later in this year, and particularly Q4, there is no sign of deterioration on the producer side of the economy, so if a recession does develop, it will likely be centered on consumers and secondarily on manufacturing.

Tuesday, February 26, 2019

December housing permits and starts mixed, support slowdown scenario

- by New Deal democrat

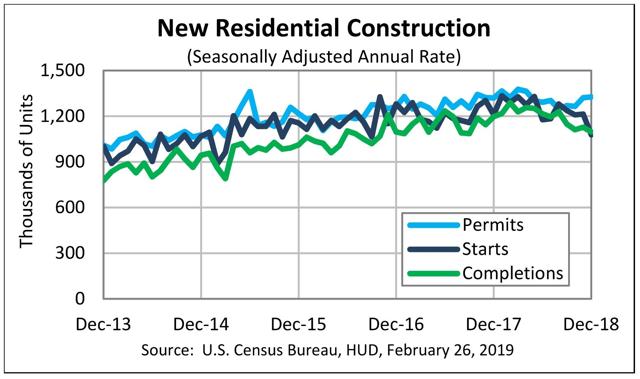

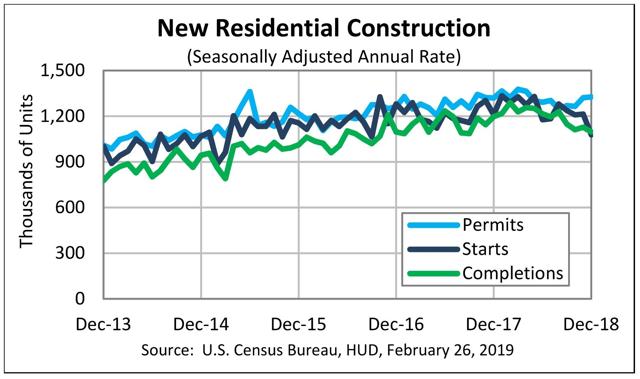

This morning we finally got December housing permits and starts. Remember that starts are more volatile than permits, and single family permits are the least volatile of all.

Here’s what the overall data looks like:

While starts and completions laid an egg, permits actually went up a little bit.

In particular, for housing to be outright recessionary, I would want to see single family housing permits down -10% from peak at minimum. This morning’s data has them down only about -6.5% off peak, just slightly above their worst showing of 2018.

In other words, this morning’s report says slowdown rather than recession to me.

On a side note, the talking heads on CNBC were bemoaning that lower mortgage rates hadn’t led to an substantial increase in housing starts. But as I’ve pointed out many times, permits and starts follow interest rates with about a 3 to 6 month lag. In other words, consistent with a bottom in housing construction this spring.

I’ll have more to say probably tomorrow at Seeking Alpha. When the post goes up, I’ll link to it here.

Monday, February 25, 2019

At last! Missing long leading metrics and manufacturing in the spotlight this week

- by New Deal democrat

This week manufacturing and some important data long delayed by the government shutdown will be in the spotlight.

First, manufacturing: as the below graph of ISM manufacturing and new orders shows, in the last 8 months, manufacturing has slowed from white hot expansion to just weakly positive:

As of last Friday, the rolling average for new orders in the five Fed regional indexes was just +1 above completely stalled — it had been as high as +28 in spring 2018!

Between today and Thursday, three remaining Fed regions — Richmond, Kansas City, and Dallas— will report their February manufacturing indexes. Also on Thursday, the Chicago PMI gets published. That one has been the most positive of any region for the past year. Finally, on Friday ISM publishes its national February manufacturing report.

It’s possible that by the end of this week we will have evidence that manufacturing is in outright contraction. We’ll see.

Meanwhile, data on three long leading indicators — building permits, residential investment, and proprietors’ income — that have been delayed by as long as two months, finally get reported, on Tuesday (permits for December) and Thursday (as part of the Q4 GDP report).

A couple of weeks ago I went ahead and made a “preliminary” forecast for the second half of 2019, using substitutes for this data, that included me going on “Recession Watch” for Q4 of this year. The missing data, once reported, could either consolidate or alleviate that forecast.

Subscribe to:

Comments (Atom)