- by New Deal democrat

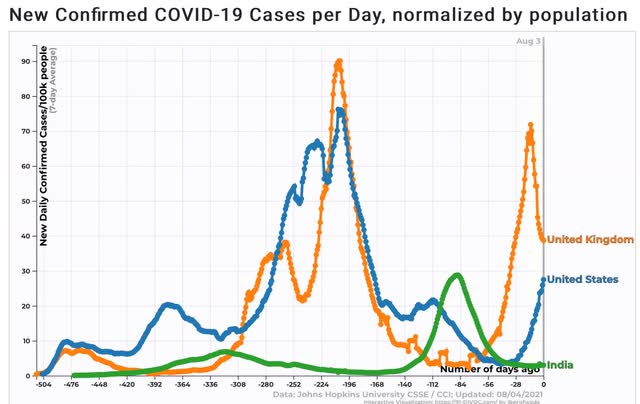

It seems pretty clear that Delta burns through the dry tinder very fast - on the order of 9 to 12 weeks from onset to peak, based on the experience of the UK and India, respectively. The US is 7 weeks past its trough in cases, so it is a fair hypothesis that the Delta wave will reach its peak at some point in the next 2 to 5 weeks - roughly at some point in the second half of August or early September.

But what does that mean for the number of cases and deaths? And what exactly is the “dry tinder” for Delta?

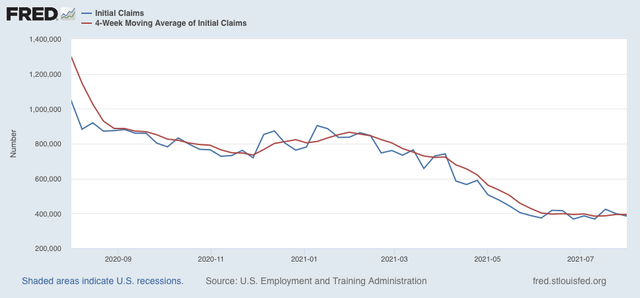

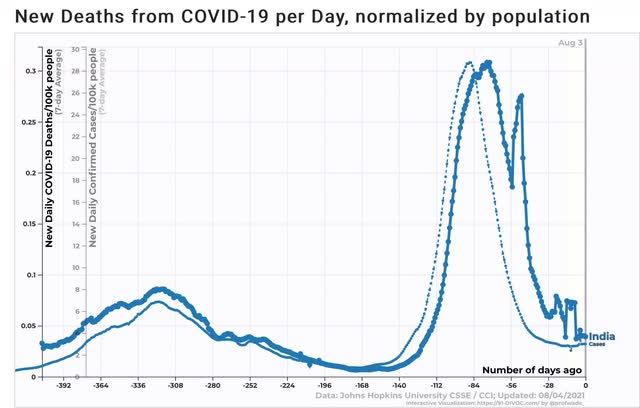

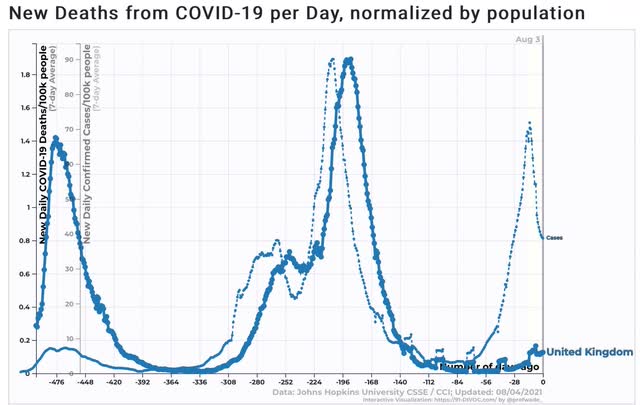

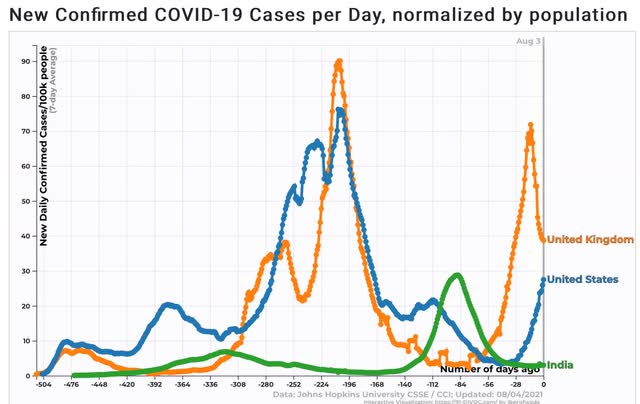

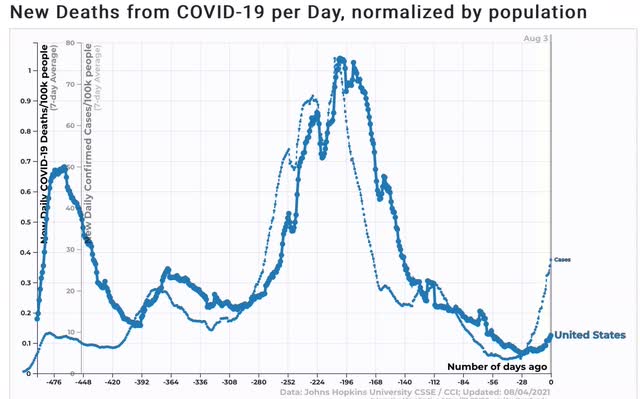

Let’s start with a graph of the 1 week average in cases per capita for the US, UK, and India, all of which have seen Delta wave spikes:

As I indicated above, from prior trough to peak took 12 weeks in India, and 9 weeks in the UK. During that time, in India *confirmed* cases rose 35x. In the UK it was 25x. Seven weeks in, the US has seen an 8x rise in cases. If we use the UK and India as our range, when it comes the peak in the US will be about 280,000 to 400,000 cases/day!

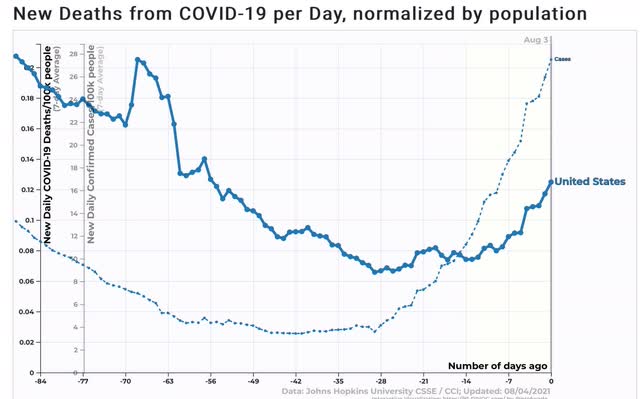

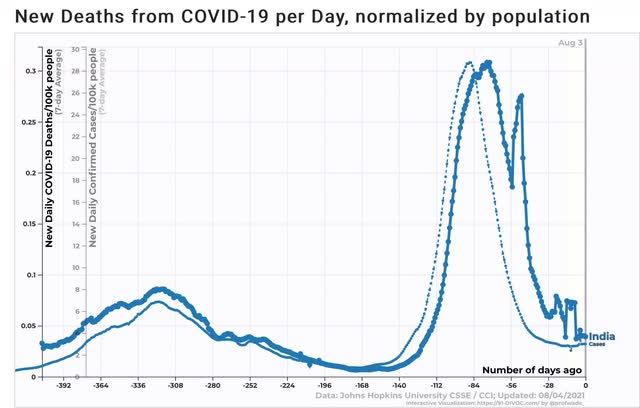

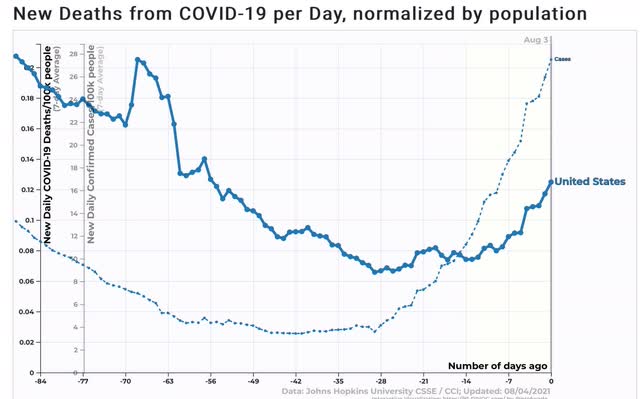

Now let’s turn to deaths.

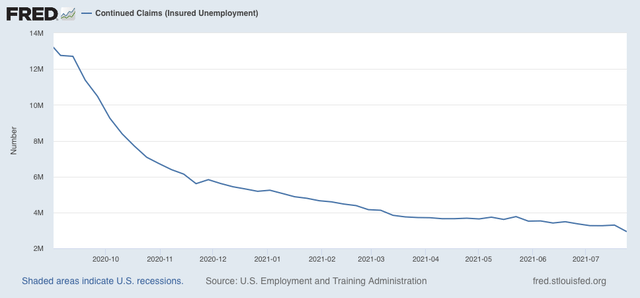

In India, deaths peaked 3 weeks after the peak in cases, up 43x from their previous trough:

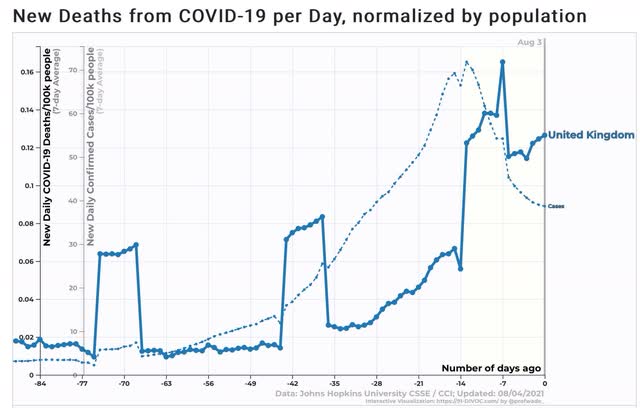

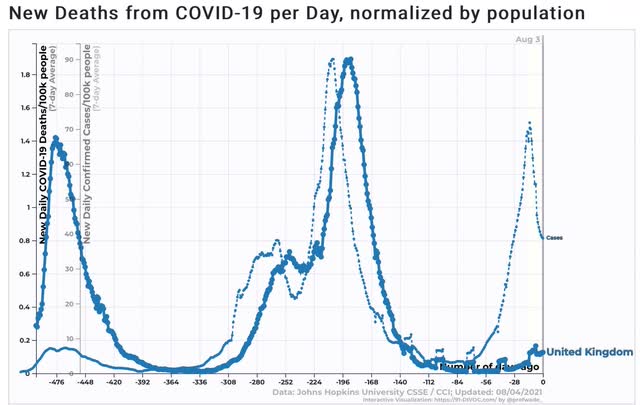

In the UK, many have taken heart from the fact that the rate of deaths is but a small percentage of previous peaks:

But deaths are presently at 12.6x their trough just before Delta, 2 weeks after the peak in cases. Another doubling to the same 25x multiple as the UK had in cases, before deaths peak in a week or two seems a reasonable estimate:

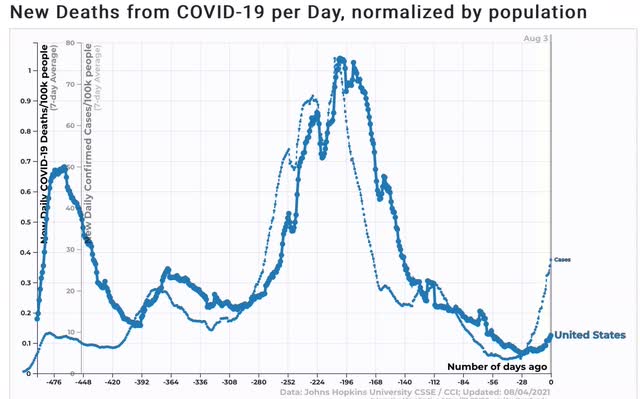

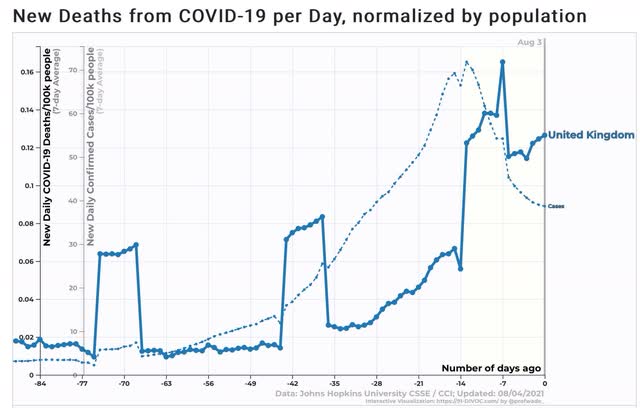

Similarly in the US, deaths are only about 1/8 of their worst levels in previous waves:

But deaths are 1.9x the level of their trough 4 weeks ago, and 1.7x from 2 weeks ago:

If these keep increasing at the same pace, that is a range of between 774 to 1720 deaths per day when the peak arrives.

Turning to the second issue, what exactly is the “dry tinder” for Delta? Is it the unvaccinated? Everybody? Or just those with a particular genetic or other predisposition? If it is one of the first two, then in a couple of months the US will have stumbled into herd immunity. If it is the latter, then the door is open for yet another variant to raise hell this winter.

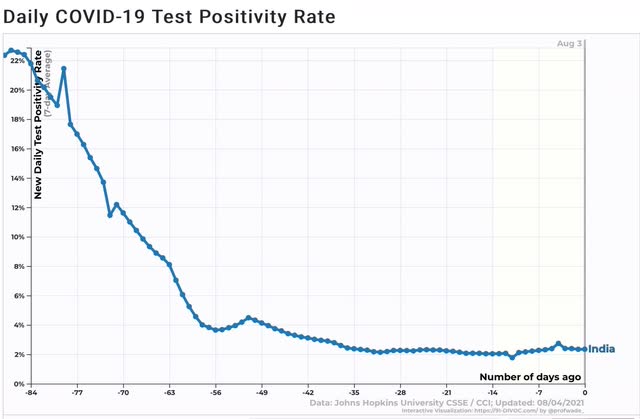

In India, a study showed that seroprevalence increased by more than 50% of the entire sampled population post-Delta, rising from 14% to 78% of the population. If this is true, then it appears that an absolute majority of the unvaccinated population at least is likely to become infected by Delta, whether or not the case is “confirmed.” In India, the “confirmed” cases only rose by 2% of the population!

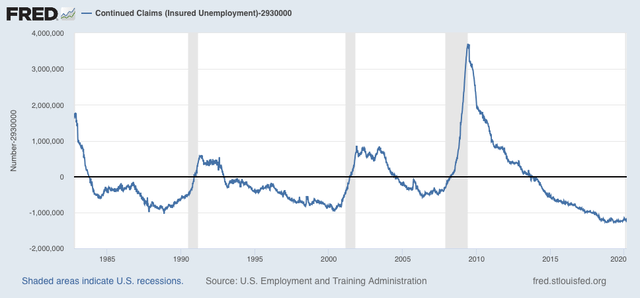

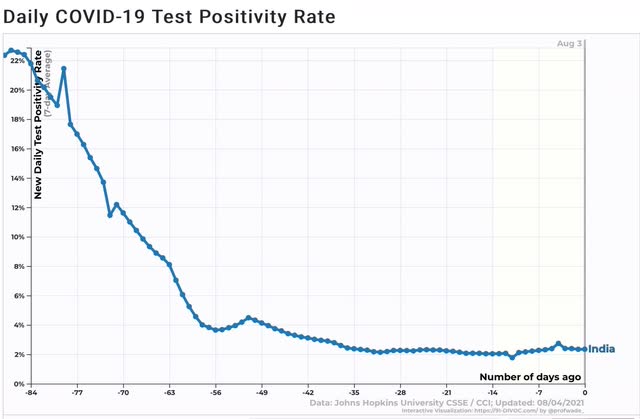

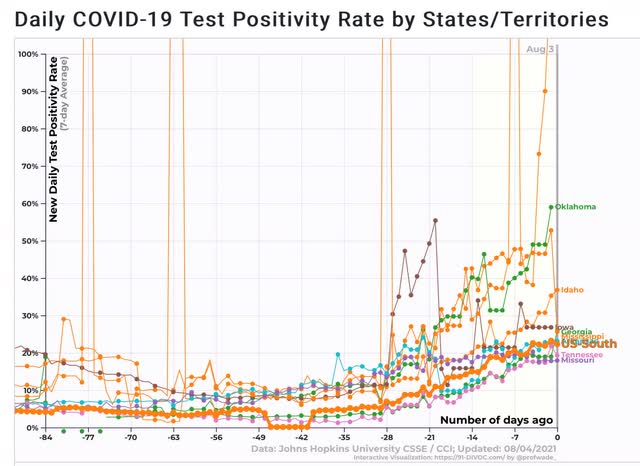

In India, the positivity rate for COVID testing peaked at about 22.5% 12 weeks ago (I have truncated the graph because of a glitch in the data from early 2020):

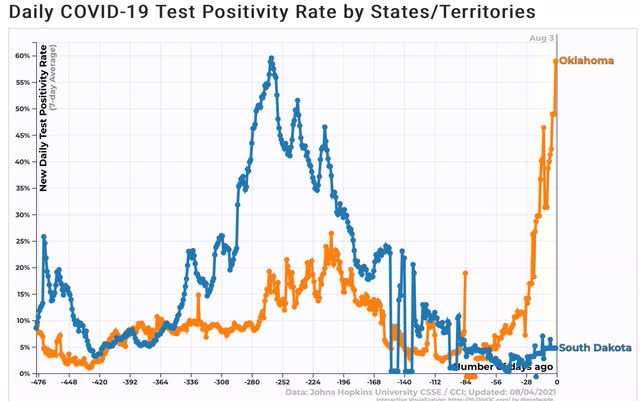

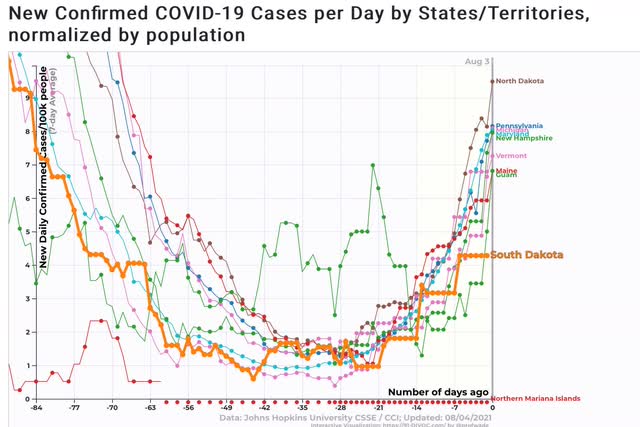

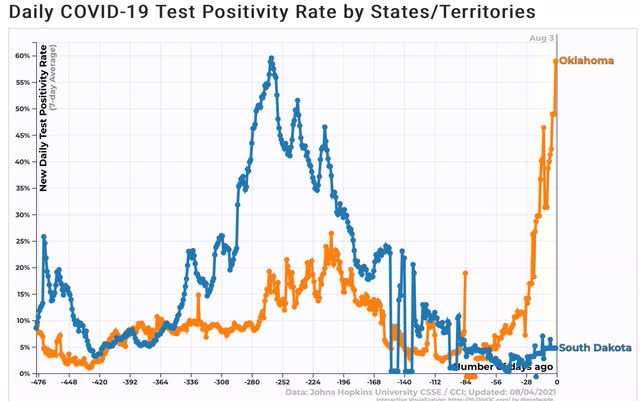

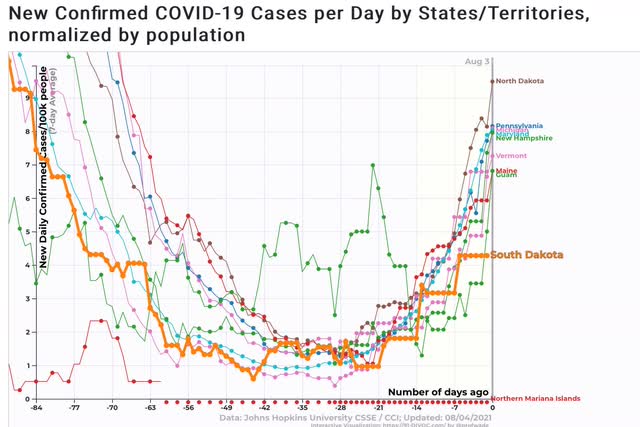

Now let’s consider the curious cases of South Dakota, which had a horrid outbreak last fall with over 60% positive test rates (similar to that of Oklahoma right now):

but which is among the States with the lowest per capita new infections now:

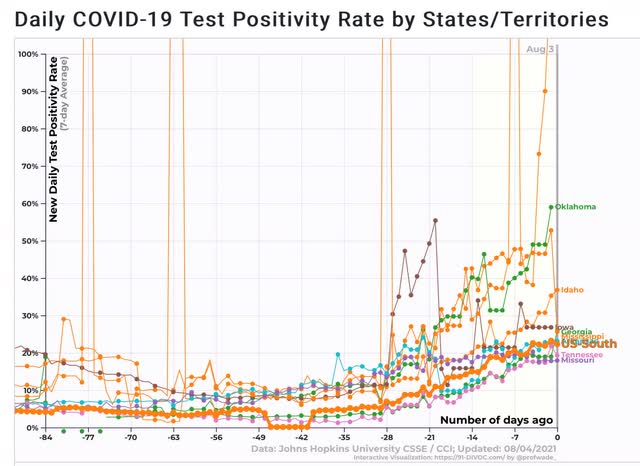

If over 50% of the population of India got infected with Delta and only showed a 22.5% positivity rate, what are we to make of the US, which as of a week ago had roughly a 12% positivity rate (the most recent data), but where many States are running higher (the top 10 are shown below, plus the regional South as a whole:

Testing is running at close to a 20% rate in the South.

To a virtual certainty there are simply multiples of actual cases that are going undiagosed.

If I am correct that Delta is going to infect at least 50% of the US’s unvaccinated population over about the next month, then the remainder of this month and September are going to be brutal. But if about 70% of US adults are fully vaccinated by then, and over half of the rest have antibodies due to recent Delta infection, then with over 85% of US adults immune either the easy or the hard way, by late this autumn there may an actual return to near-normal life.