- by New Deal democrat

For the last 8 months, initial and continuing claims have been remarkably consistent. Initial claims have varied between 194,000 and 228,000, and continuing claims have with the exception of three weeks right at the new year varied between 1.787 million and 1.829 million.

That rangebound trend continued this week as initial claims were unchanged at 212,000, and the four week average was also unchanged at 214,500. With the usual one week delay, continuing claims rose 2,000 t0 1.812 million:

Indeed, with the exception of last spring, initial claims have been essentially rangebound for the entire last 2 years!

For forecasting purposes, the YoY% change is more important. There, initial claims are down -5.5%, the four week average down -3.8%, and continuing claims are higher by 4.3% — still the lowest YoY reading for continuing claims in the past 13 months:

Needless to say, this suggests continued economic expansion in the next few months.

A reader over at Seeking Alpha several weeks ago asked what these looked like compared with population, since that is a more true measure of the tightness of the jobs market. Here’s the post-pandemic look:

The 4 week average of initial claims is 0.13% of the entire civilian labor force, while continuing claims are 1.1%.

Let’s compare that with the entire pre-pandemic record:

The 4 week average of initial claims is tied with the lowest ever pre-pandemic reading it had in 2019, while continuing claims are lower than the entire 50+ year pre-pandemic period except for 2017-19.

This in short remains a very tight labor market, where finding a new job is easier than at almost any time ever before the pandemic.

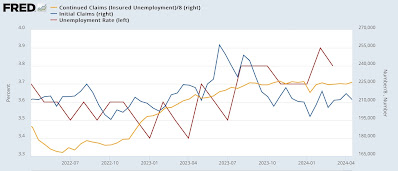

Finally, let’s update the Sahm rule implications with the first two weeks of April under our belt. Remember that both initial and continuing claims lead the unemployment rate, the former by more than the latter:

As per form, the unemployment rate followed jobless claims higher last year. Initial claims are now lower again, and continuing cliams remain flat. This suggests no further upward pressure on the unemployment rate in the months ahead, and likely some downward pressure towards 3.7% or 3.6%. In short, the Sahm rule is not going to be triggered.