- by New Deal democrat

Back in March I took a look at how producers and consumers reacted to periods of high political policy uncertainty, concluding that usually in the past consumers had reacted first, somewhere between almost simultaneously to with a one quarter delay, and producers reacted afterward to the downturn in demand by cutting back on new orders, especially for durable goods.

The interesting twist this time is that consumers are bracing now for an upturn in prices, and even more for some empty store shelves. So this time around, rather than pulling in their horns, consumers are front-running tariffs and shortages by stockpiling supplies.

This has been showing up in the weekly Redbook consumer spending updates, which track retail spending YoY. For the last five weeks, it has had among the highest YoY readings since late 2022:

Some of this in the first several weeks probably had to do with Easter week being three weeks later this year than last year, but the surge in spending has continued for several weeks beyond that period, so clearly more is going on - and it is almost certainly front-running of expected supply disruptions.

Consumers have also continued to spend on restaurants, typically one of the first places where they cut spending:

Again, there was a big YoY spike in early April due to the YoY change in Easter week, but the pattern of 7%-8% or so increases YoY has continued.

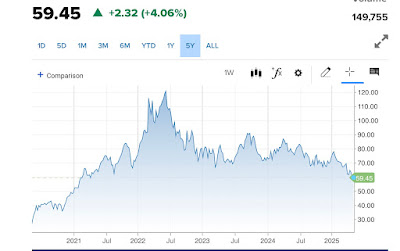

Another tailwind for consumers is that oil prices have fallen below $60/barrel, the lowest price in over four years:

This is likely to result in gas prices back under $3/gallon shortly.

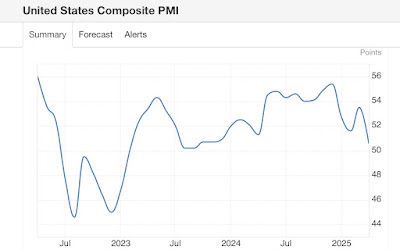

The other reversal from past episodes of uncertainty is that it is importers and producers relying on those importers who have cut back. Yesterday I noted that the ISM services index had rebounded somewhat in April over March. But the S&P has a competing Purchase Managers Index, which only has about a 20 year history; and one difference there is that they do calculate a composite manufacturing + services economically weighted index.

And in April that composite index declined to a two year low:

The index is still slightly above 50, so it indicates a slightly expanding economy, which is the same result I came to using an economically weighted average of the ISM indexes.

In any event, although the economy remains at heightened risk, the “instant recession” some saw in early April has not materialized.