- by New Deal democrat

I suspect these updates are going to be much less frequent from now on; for example, if a significant new wave is evident.

That’s because, as we start our fourth year of the pandemic, the good news is that it is far less lethal than it was during its first two years. From March 2020 through March 2021, 500,000 Americans died of Covid. Another 500,000 died in the next 12 months. But since last March, only 100,000 have died so far (an average of roughly 400 per day, mainly seniors, and mainly unvaccinated):

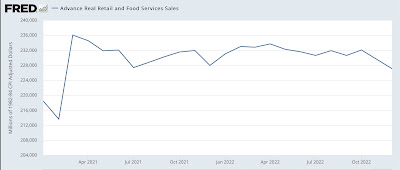

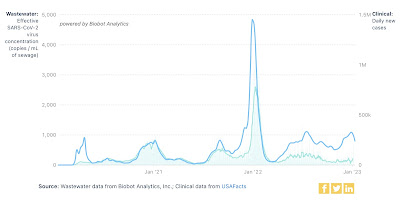

The bad news is that any hope that vaccinations would put an effective end to the pandemic - in terms of infections - is long gone. The virus has continually mutated to become more and more infectious, and far more evasive of the defenses erected both by previous exposures and by vaccinations, as the original strains through Delta were replaced by Omicron BA.1, then BA.2, then BA.2.12.1, then BA.5, and now the Alphabet soup featuring BQ.1&1.1 and XBB.1.5:

This is perhaps best shown by the situation in Puerto Rico and Rhode Island, two of the very best jurisdictions for the percentage of people who are vaccinated (thin line). Despite this, both had serious waves of infections throughout 2022:

One thing I considered is that perhaps COVID deaths were merely replacing deaths from influenza among the elderly. This does not appear to be the case.

In 2019, the last year before COVID, the CDC estimated that there were 26,400 deaths from the flu, with a huge range of error from 19,100 to 96,800. This year so far the estimate is 27,600 with a range of error from 16,000 to 48,000.

Further, here’s what flu infection levels looked like during the 2019 season:

This winter, we had an even worse peak, which occurred (so far, anyway) several months earlier:

But as I said at the outset, at least COVID appears to be far less lethal now than in its first two years.

Here’s what hospitalizations looked like from autumn 2020 through the end of winter 2022:

Hospitalizations peaked at 117,700 on January 9, 2021; and then at 154,000 on January 15, 2022.

Hospitalizations appear to have just peaked again on January 3, at 47,600:

Similarly, deaths peaked on January 14, 2021 at 3380; and on February 1, 2022 at 2600:

As shown in the first graph above, this year deaths appear to have peaked on January 11, at 596. This is all in the face of what Biobot waste water levels suggest his been a higher level of infections that has persisted for over half a year, at a rate of roughly 1 in 1000 persons daily +/-200, as shown in the second graph at the beginning of this post.

So, the good news appears to be that, just like during the first two winters of Covid, the waves have peaked as soon as the infections from Holiday social get-togethers have worked through the population. Even the super-infectious XBB.1.5 has not created a wave meaningfully bigger than BA.2.12.1 did late last spring, in terms of “real” infections, hospitalizations, or deaths.

But the bad news is that we appear to be resigned to a future where perhaps 130,000 more people, most of them seniors, die in excess of what otherwise would be the case, each and every year, and most needlessly, as the percentage of the population being vaccinated has all but ground to a halt.