- by New Deal democrat

Today is a holiday, so no new economic news. So let’s take a look at some of the leading indicators I was tracking last week for the employment report, and some leading indicators for the economy within that report itself.

In the JOLTS report for August last week, quits rose slightly from their 30 month low set in July, leaving the declining trend intact. Since the quits rate has historically led the YoY% change in wages, I anticipated a further deceleration in wage growth, and that did happen, as YoY wage growth declined from 4.5% to 4.3%:

Meanwhile, initial jobless claims for the month of September were higher by 10.4%, indicating that the YoY% change in the unemployment rate should tend towards 3.8% or 3.9%:

The unemployment rate did indeed “stick” at 3.8%, unchanged from August. Here’s what the absolute levels of claims and the unemployment rate look like:

I suspect that initial claims will rebound this month, but we’ll see. If they remain lower, that would bode well for the unemployment rate in coming months.

The one trend that did not continue in September was deceleration in job growth, particularly on a 3 month basis. Here’s what the YoY% change in growth looks like monthly (blue) vs. quarterly (red):

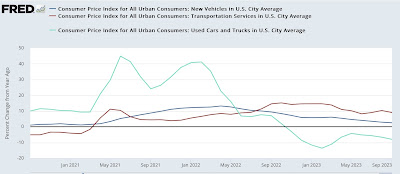

What is particularly impressive is that the leading jobs sectors of construction and goods-producing as a whole have continued to improve. Manufacturing jobs also increased in the past two months, and for the past year are about flat, but have not declined in any meaningful fashion:

Within construction, residential building jobs also rebounded in the past couple of months and are generally flat for the past year, while nonresidential construction jobs have continued to increase and civil engineering construction jobs have increased sharply:

The one leading jobs sector which has continued to decline is temporary help, but even there it is possible that the 2021-22 surge was the actual anomaly, as shown in the below graph showing the past 20 years:

Another leading indicator, indeed one of the 10 components of the “official” Leading Index is the manufacturing workweek. In the post-WW2 period through the 1970s, any significant decline generally meant a recession was near at hand. But since 1983, a ar age factory hours have usually been well above the “full” 40 hour work week. Only declines to below roughly 40.5 hours a week have been consistent more often that not with recessions. To show that, below are the YoY change in the average factory workweek (red) vs. the absolute level of average hours, minus 40.5 hours (blue):

There have been many YoY declines in the workweek, but most of those where the workweek remained above 40.5 hours did not result in actual recessions.

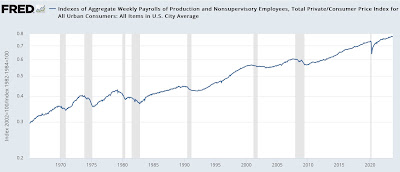

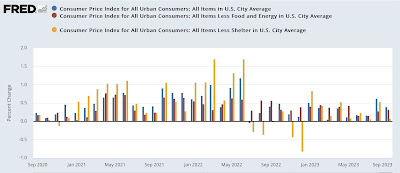

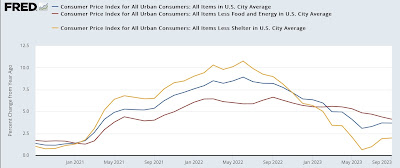

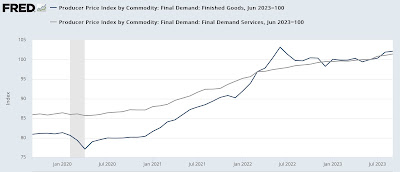

Finally, let’s take a look at the fundamentals-based comparison of aggregate nonsupervisory payrolls YoY vs. consumer inflation YoY. Remember that when the former is less than the latter, it is a nearly perfect coincident indicator of recession:

Real aggregate payrolls consistently increased in the first part of this year (i.e., the lines got further apart). Unsurprisingly, the economy improved. YoY nominal aggregate payrolls have continued to decelerate, and I expect that trend to continue. The important question is whether YoY CPI also continues to decelerate, or whether that trend has ended. I suspect the latter is true, but much will have to do with the immediate future course of energy prices.

The bottom line for now is, we simply haven’t seen a widespread downturn in the leading sectors within the jobs report., although there are signs that the decelerating trend is likely to continue, despite September’s strong showing.