- by New Deal democrat

I really need to rouse myself to write a long form piece on interest rates, housing, and the economy to post over at Seeking Alpha. Ugh!

In the meantime, here are a few quick hits on some important or noteworthy new data

1. New home sales - interest rates bite, but don’t panic

New home sales are the most leading, but most noisy, of housing data. Yesterday they were reported as having declined -18.3% to 775,000 annualized, a 9 month low, and 204,000 below their July peak (blue in the graph below):

For comparison, the much less volatile single family permits declined -9.8%, and remains above every other month in the past 10 years except for December and January.

Some of this was the increase in interest rates. Some of this can be chalked up to the Big Texas Freeze.

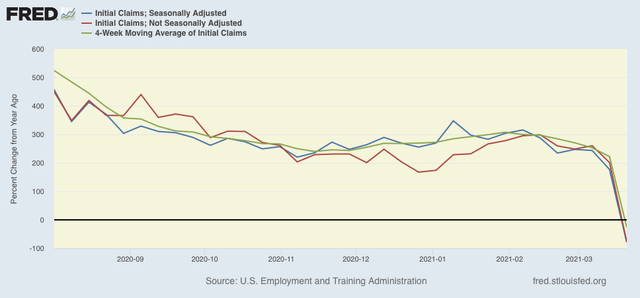

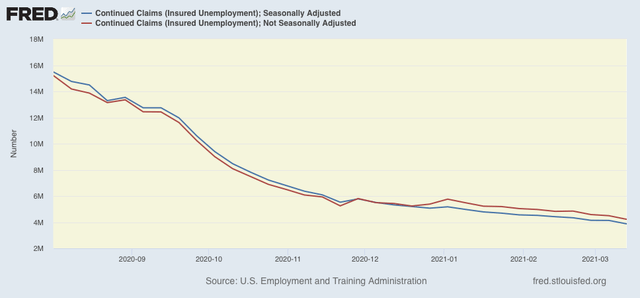

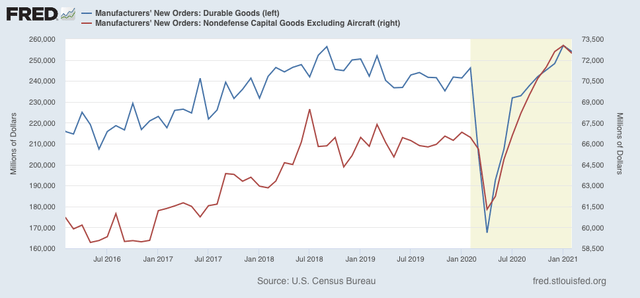

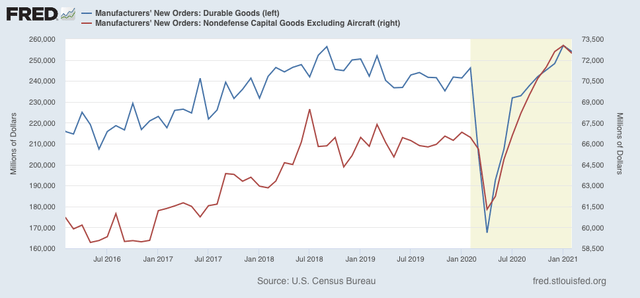

2. Durable goods orders

Similarly, the decline in durable goods orders in Febuary. reported this morning was likely also affected by the Big Texas Freeze:

A reminder: yes, winter occurs every year, but the season is very volatile, and the big weather events of winter do not always strike in the same month each year. I am discounting this decline unless it is confirmed for March.

Further, “core” durable goods orders remain at 10 year highs excluding January, and overall durable goods orders are only behind 2 months in that period.

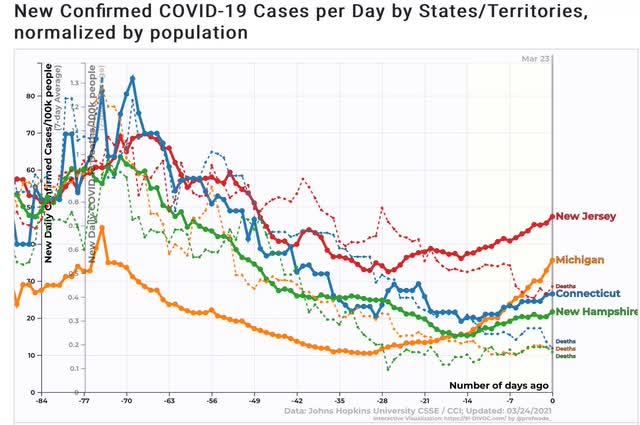

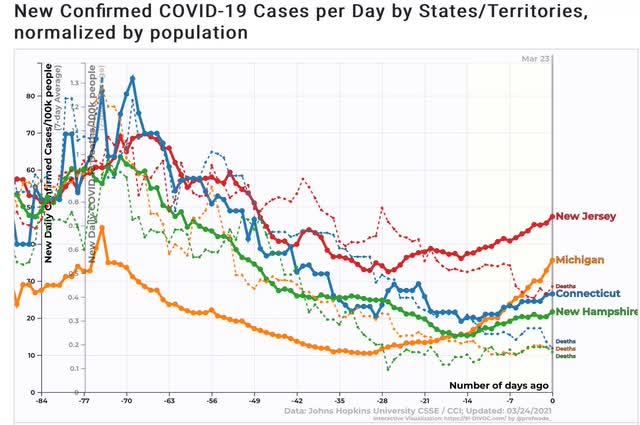

3. Coronavirus cases are rising sharply in several States.

As new, more infectious mutations of the virus spread, several US States have shown big increases in cases over the last month, particularly Michigan, but also including New Jersey, Connecticut, and New Hampshire (but not New York!):

Despite this, deaths have not risen in any of them - even though 28 days has passed since the inflection point in cases. Typically deaths lag cases by about 14 days, so this is a good sign that the new cases are among younger, unvaccinated people.

4. Vaccinations are still working!

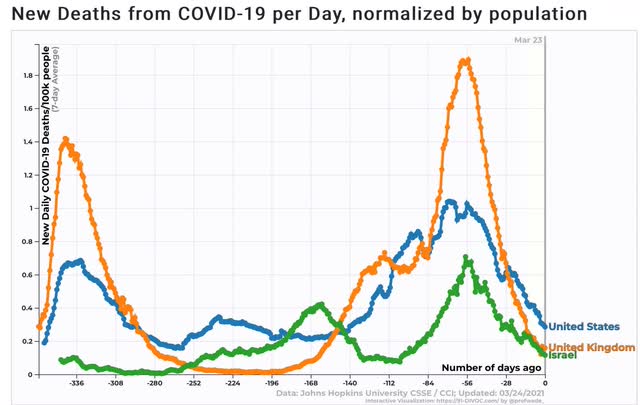

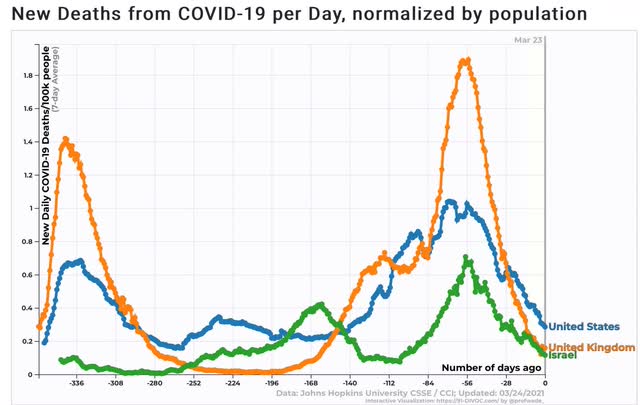

In the US, UK, and Israel, the 3 poster children for good vaccination programs, deaths from coronavirus continue to drop:

The US recorded 940 deaths on average over the past 7 days. If the rate of decline continues, in 2 weeks the US will be under 500 deaths per day for the first time in over a year.

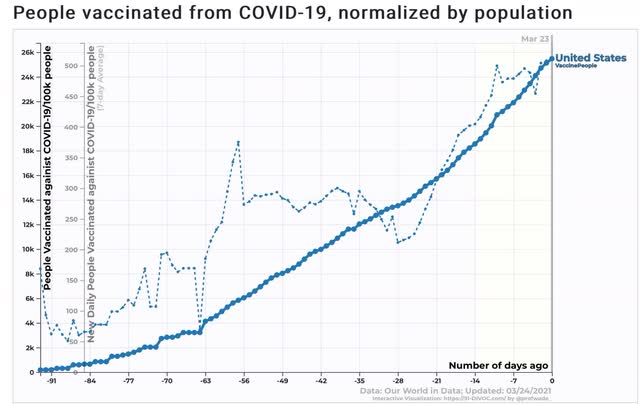

5. And the US rate of vaccination continues to improve.

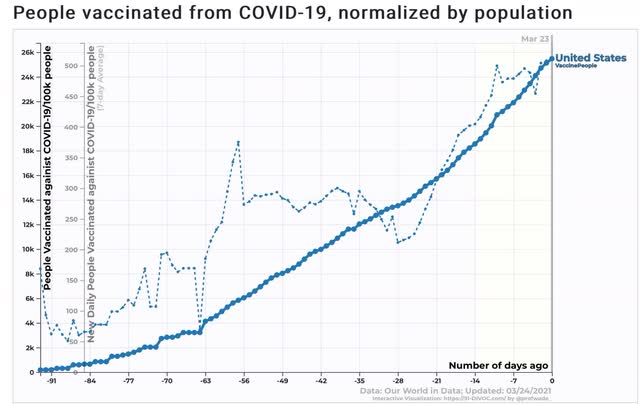

A full 25% of the entire US population has received at least one dose of vaccine, while the average daily rate of vaccination has also continued to increase:

According to the CDC, 70% of all people 65 years of age and older have received at least one dose of the vaccine. It appears that, just like there are no atheists in foxholes, among senior citizens there are no - or at least very few - true “anti-vaxxers” when it come to COVID.