- by New Deal democrat

For the last year, consumer prices have mainly been about two things: (1) the huge rise, and then fall, in gas prices; and (2) the phantom menace of owner’s equivalent rent dragging shelter prices higher, even as actual house prices peaked, and new rental prices declined as well. That remained the case this month.

Last month I wrote that “I suspect that oil prices have bottomed for the while, and so the virtuous decline in gas prices that has followed is at an end . . . In short, I do not expect the string of excellent CPI reports to continue.“

That was certainly true in this morning’s report for January. Energy prices increased 2.0% for the month, the highest since June. Overall prices rose 0.5% for the month, also the highest since June. But core inflation came in at +0.4%, still elevated but about average for the past year.

Still because the price increases in January were less than one year ago, YoY price increases continued to decelerate. At 6.3%, total inflation (blue below) was the lowest YoY since October of 2021. At 5.5% and 6.2%, core inflation (red) and prices ex-energy (gold) had the lowest YoY increase since December 2021. And energy YoY (gray, right scale) at 8.2% YoY was far below its 42% peak of last June:

At +0.5% for the month and 10.1% YoY, food inflation remains a problem, but even that metric has decelerated from peak:

New car prices were only up 0.2% for the month and 5.8% YoY, while used vehicle prices declined -1.9% for the month and -11.6% YoY. Nevertheless they are up 20.1% and 37.2% respectively since the onset of the pandemic:

Finally, as I noted at the outset, the phantom menace of owners’ equivalent rent continues to drag both total and core inflation higher. OER increased 0.7% for the month (slightly below its 0.8% monthly peaks, but YoY OER is up by yet another new record of 7.8% (blue in the graph below). This contrasts with actual house prices YoY as measured by the FHFA, which have declined sharply since last summer’s peak of 20%, and as of October were up 11% (red):

If the FHFA index continues to decline in its next several reports at its latest trend, then for January its actual reading will be only about +5.3% YoY - as OER will probably continue to rise at least slightly.

Replace the phantom menace of OER with actual house prices, and total inflation would probably be about 0.8% less, or about 5.5% YoY, and core inflation would be about 1.0% less, or 4.5%.

The bottom line is that the virtuous input of lower gas prices is probably over, but inflation - at least if we were to measure it by actual rather than fictitious prices - is decelerating substantially (with the exception of food, which remains problematic), and could approach the Fed’s target by spring sometime.

ADDENDUM: I wanted to emphasize further the impact of shelter on recent, and especially this morning’s, CPI.

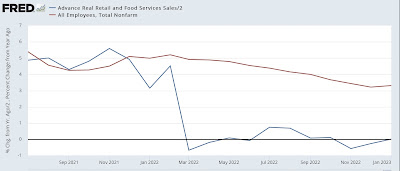

First of all, CPI ex-shelter has actually *declined* -0.8% since last June:

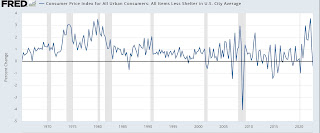

This isn’t exactly unprecedented, but as the graph below that shows the q/q% change in CPI ex-shelter shows, it didn’t happen at all between the 1960s and the turn of the MIllenium, and it has happened a number of times since the housing bust of 2006 on:

To really show you the impact of OER vs. actual house prices on shelter, the below graph shows the YoY% change in CPI ex-shelter(blue), currently at 5.7%, CPI for shelter (which uses OER, red), and the FHFA monthly house price index through its most recent reading (gold):

Again, if house prices were used in CPI instead of OER, and continue to decline as per their recent trend, then inflation would be on track to be close to the Fed’s target by spring sometime.

And even if there is a justification for using OER for inflation, given its 1 year+ lag of house prices, there is no reason for the Fed not to use a house price-adjusted CPI measure for setting interest rates.