- by New Deal democrat

As an initial note, there is no significant economic data until Thursday this week, so don’t be surprised if I play hooky for a day or two....

Today let’s take a look at the latest coronavirus information.

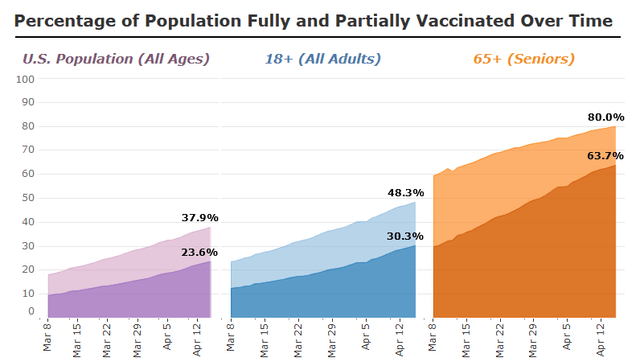

There’s much progress on the vaccination front. I’ll let the CDC’s numbers speak for themselves:

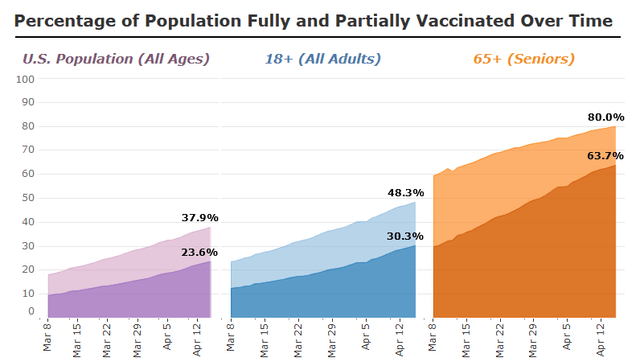

Here’s the information graphically by age group as of last week:

I’m encouraged by the fact that, despite many stories of vaccine hesitancy or refusal, over 80% of seniors already have had one dose. I suspect that widespread hesitancy is likely to be gradually overcome in younger demographics as well.

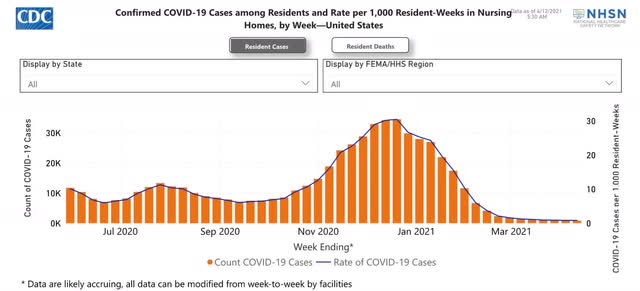

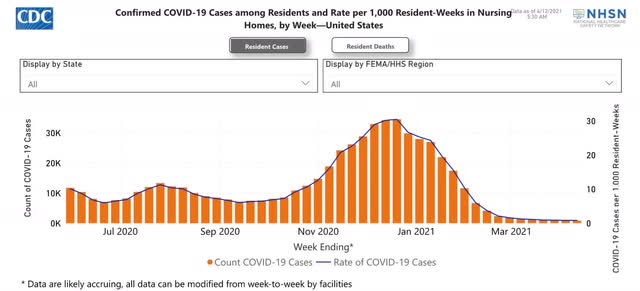

Cases in nursing homes and other adult residential facilities have all but disappeared, down 97% as of last week:

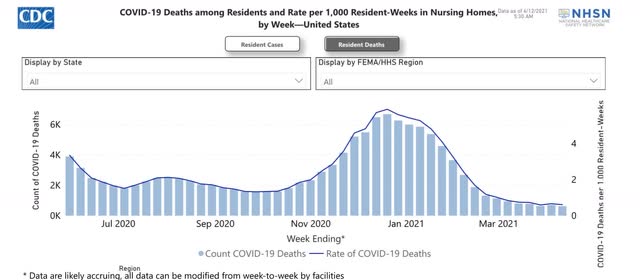

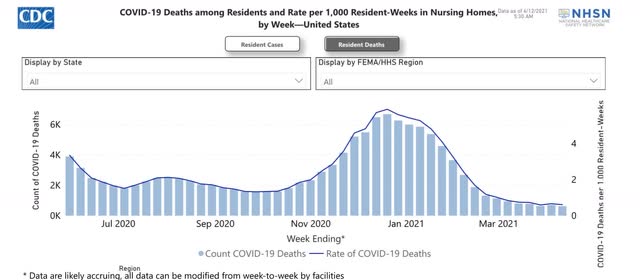

Deaths in those facilities are down 90%:

Hopefully these will decline further in coming weeks as well.

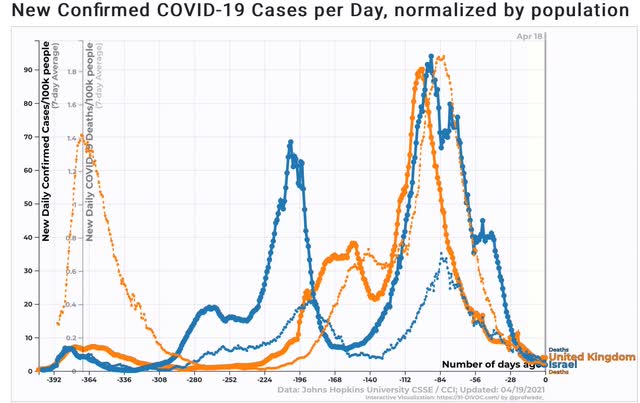

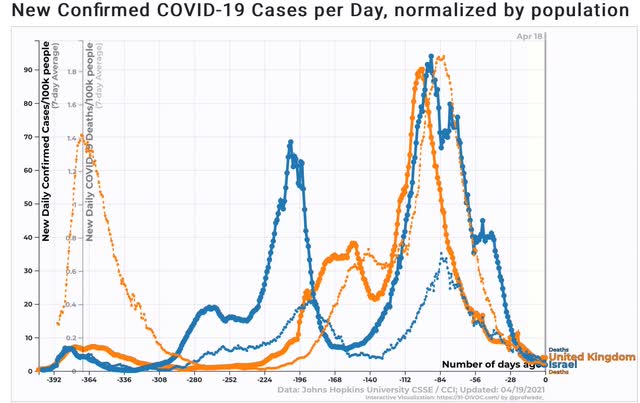

The news is also good on the international vaccination front, as both poster children for the combination of good vaccination programs coupled with temporary nationwide lockdowns, Israel and the UK, show declines in both cases and deaths of roughly 95%:

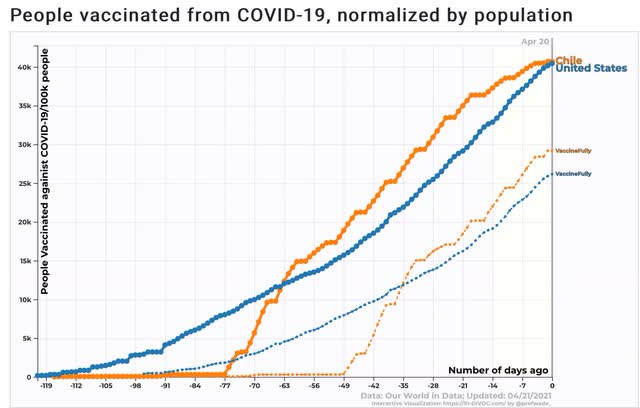

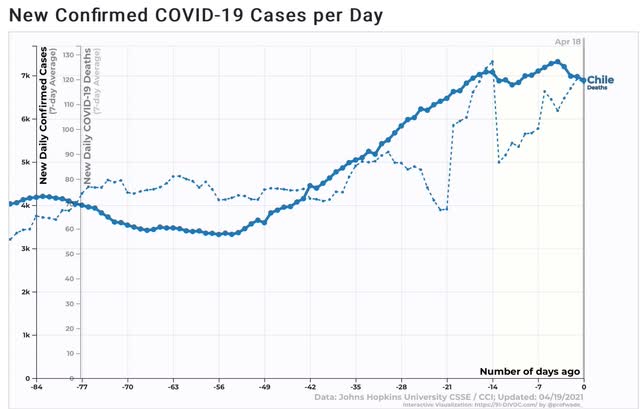

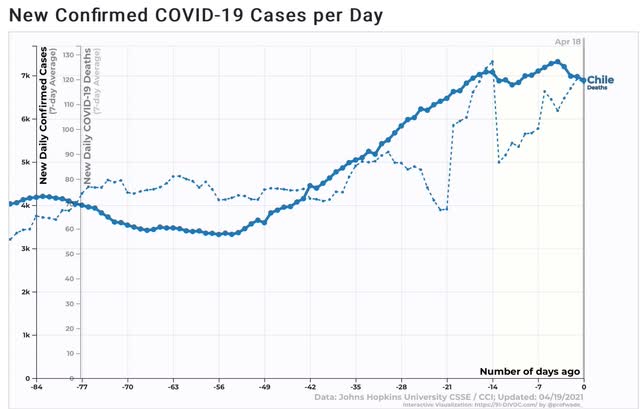

Meanwhile, the negative poster child of Chile at least seems to have hit a plateau in new cases, although deaths are still increasing at a similar rate as cases did recently:

Perhaps coincidentally (not shown), cases in Chile plateaued when over 35% of the population had received at least one dose of vaccine, and 20% were fully vaccinated.

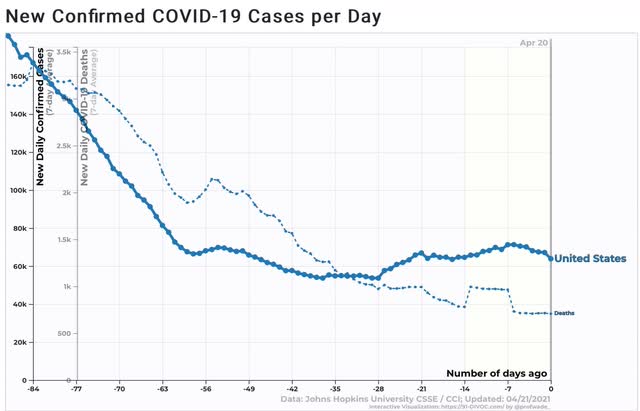

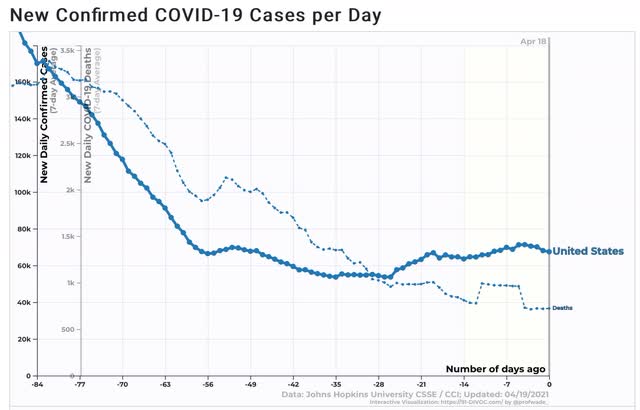

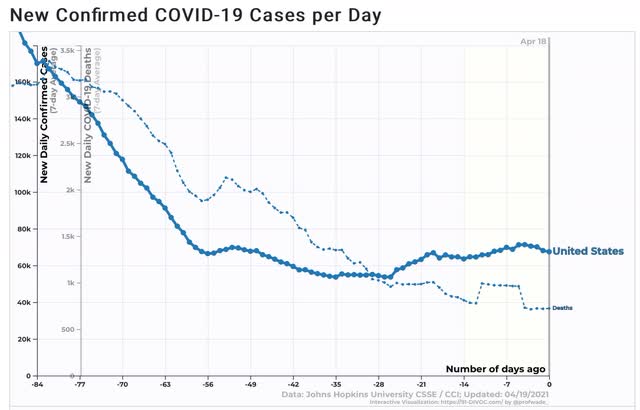

Turning to the US, the recent upturn in cases also looks like it may be plateauing, and deaths have still been declining slightly:

As we are nearly 28 days out from the upturn in cases, unfortunately I suspect deaths will shortly turn up as well.

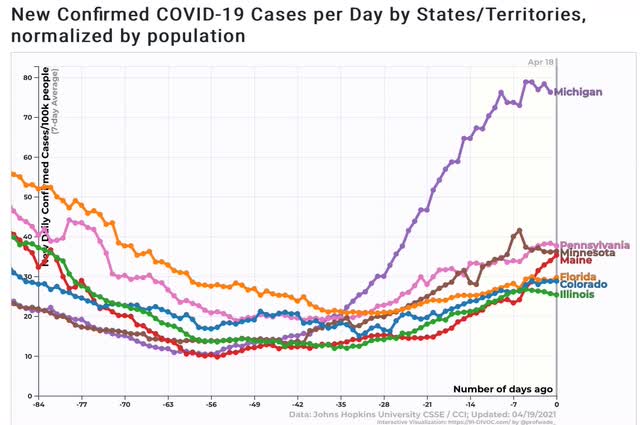

The US’s mixed nationwide result belies the fact that about half the States are still showing huge declines in cases, while almost half have had a big increase.

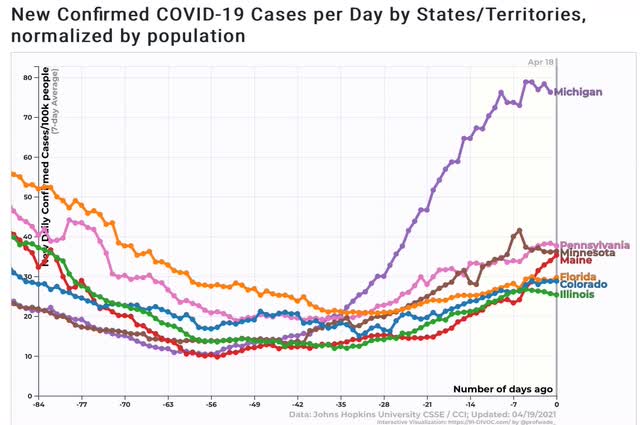

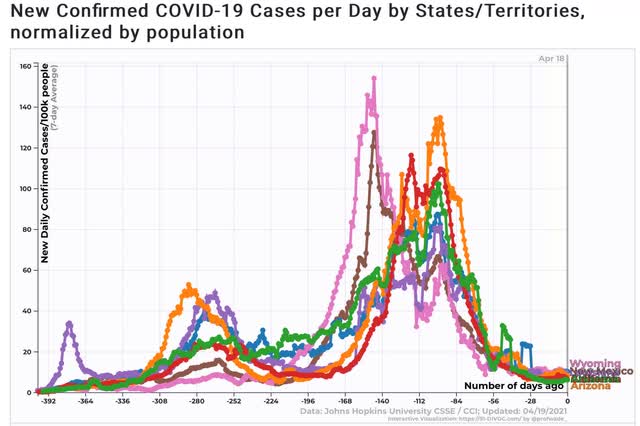

Here are the bad boys and girls:

CT, DE, IN, MA, NH, and OR are almost as bad. Michigan is in a (bad) league of its own.

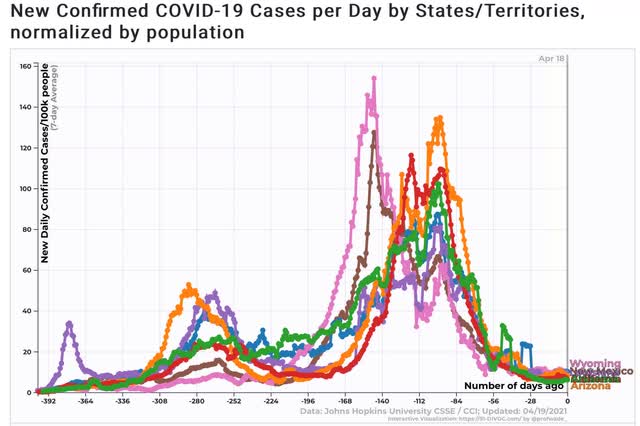

Here are the good boys and girls:

Similarly, I could also have included GA, ID, KS, KY, MS, MO, MT, NV, OK, TN, and UT.

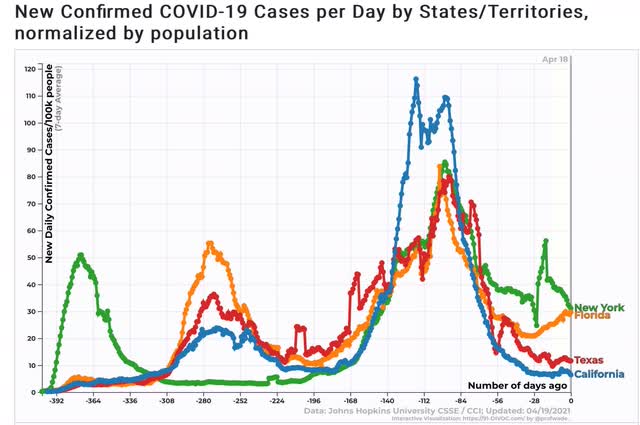

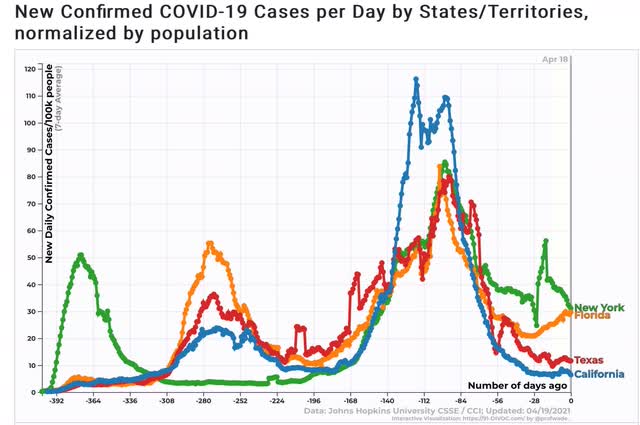

Here are the 4 big States of CA, FL, NY, and TX:

California, after a horrible winter, is doing excellent! Perhaps surprisingly, Texas is not far behind. Florida and to a lesser extent New York have been problem children.

If we can overcome vaccine reluctance, I am very hopeful that by the 4th of July the pandemic will be largely behind us.