- by New Deal democrat

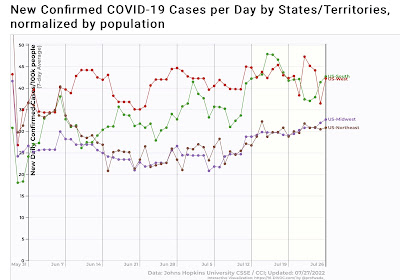

No economic news of note today, and as usual insufficient Covid reporting over the weekend to make an update of that worthwhile, so let me dig out something from the back burner that I wanted to do for myself.

Last year I read Eric Foner’s 600+ page tome on Reconstruction, and this year read a treatment of “Lincoln and the Fight for Peace,” which described his final days and to the extent available his coalescing view of what Reconstruction should entail. I didn’t want to forget the main points, so I made a bullet-point synopsis:

1. John Wilkes Booth won.

2. Why? Lincoln was replaced with Johnson, a loyalist Southern Democrat. Whereas Lincoln wanted to follow up the South’s complete surrender with a magnanimous peace for the masses, but to exclude the Confederacy’s leadership, and to require that the South accept the result of the war, Johnson’s intent was to restore Confederate States without restriction, i.e., to continue white supremacy, except with slavery technically outlawed. This poisoned the first several years of Reconstruction, until Congress wrested control.

3. The original sin of Reconstruction: no redistribution of all or at least some of Plantation land to the slaves whose uncompensated labor sustained it. Slaves were free but impoverished. Therefore no economic power.

4. Reconstructed Southern States went on a spending spree trying to attract railroads and other improvements. But in part because of the political fragility of Reconstruction, railroads and industry declined. Which created a vicious cycle, as it made Reconstruction even more fragile.

5. The North didn’t believe in racial equality either. Before the passage of the 15th Amendment, several Northern States defeated voting rights for Blacks, either Legislatively, or via failed ballot initiatives. As a general rule, the North wanted the racial issue settled, so they could move on.

6. In the final days of the lame duck period of his Presidency, Johnson issued pardons to all of the Confederate political and military leadership, enabling them to return to power, including both State and Federal elective office, which they subsequently did in droves - and also including 3 members of the Supreme Court that upheld segregation in Plessy vs. Ferguson. This was directly contrary to Lincoln’s plan, which would have specifically excluded them. In fact, Lincoln hoped Jefferson Davis would escape to South America, thereby depriving him of being either a martyr or a rallying point.

7. When white insurgency via the KKK and other insurgent groups started (many of them including those former Confederate military leaders), Reconstructed governments in the South were afraid to use military muscle, or to break “norms.” So white violence unpunished except in a few places where the Federal government stepped in.

8. On top of that, when the railroad investment bubble burst in the Panic of 1873, plunging the country into a deflationary recession, the North lost all remaining interest in expending energy on Southern Reconstruction. White insurgents pressed forward, toppling almost all of the Reconstructed Southern governments.

9. The contested Presidential election of 1876 was the final nail in the coffin of Reconstruction, as the Northern GOP traded the election of Rutherford B. Hayes to the Presidency in return for an end of Reconstruction in the South.

Had (at least large portions of) Plantation land been redistributed to the slaves who worked it, Freedmen would have had a base of economic power to hang on politically as well. They would have needed much less economic intervention and support from the Reconstructed State governments.

It’s possible that the alacrity (between 1863 and 1869) with which freed Blacks were given full legal equality, but much more importantly, equal voting rights, was in large part responsible for the strength of the White backlash. In his final days, Lincoln seemed to favor a gradualist approach: immediate granting to voting rights to Black Union soldiers, plus those Blacks with property or education, with the remainder dealt with in some fashion later. *Maybe* had Black voting rights been phased in over a generation (with steps based on, e.g., education - as public schools, a priority for Freedmen, were one enduring legacy of the Reconstructed governments), with Federal protection in the interim, *perhaps* White fury would not have insisted in rolling back all of the progress made, and by 1900 Blacks would have been better off than they were under Jim Crow.

But the fact remains, the White backlash that reversed Reconstruction is a major example of a violent sustained insurgency that was successful, systematically rolling back rights that were explicitly guaranteed in the Constitution. That insurgency remained successful for 80 years.

That opponents of the White violent insurgency now are making the same mistake of being afraid to violate “norms” in order to defeat it that the Southern Reconstruction governments made, makes me very pessimistic for the future of this country over the next few decades.