Saturday, May 11, 2019

Weekly Indicators for May 6 - 10 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

There was a classic “flight to quality” in long term bonds this past week, which drove their yields down. Which is a good thing for mortgage applications and housing.

As usual, clicking over and reading helps put a couple extra pennies in my pocket.

P.S. If you read carefully, you can see where autocorrect did me dirty in the last paragraph of the conclusion!

Friday, May 10, 2019

Gas prices fail to ignite overall inflation in April, but real wages flat so far for 2019

- by New Deal democrat

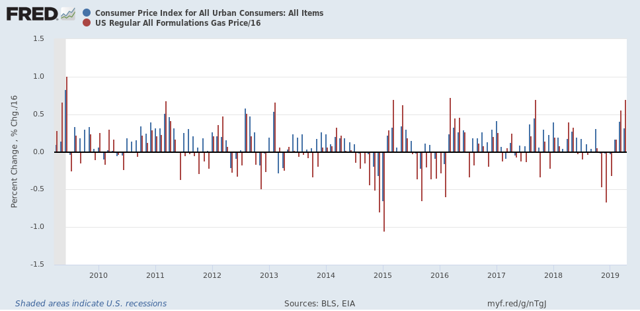

The consumer price index rose +0.3% in April, just as in March mainly as a result of a big monthly increase in gas prices. This is actually a surprisingly small increase because, as I pointed out last month, almost every time gas prices have increased by as much as they did — up 9% in March and 11% for April — consumer prices as a whole have gone up at least +0.4%. I’m showing just the last 10 years in the graph below (wages in blue, gas prices in red):

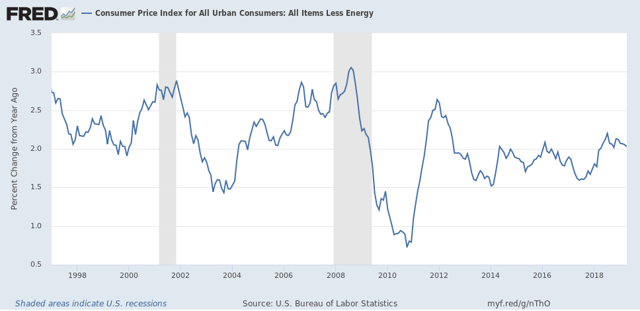

Ex-gas, consumer inflation ex-energy has been remarkably stable between 1.5% and 2.5% YoY ever since gas prices made their long term bottom in early 1999. The only big exceptions were in the year before each of the last two recessions:

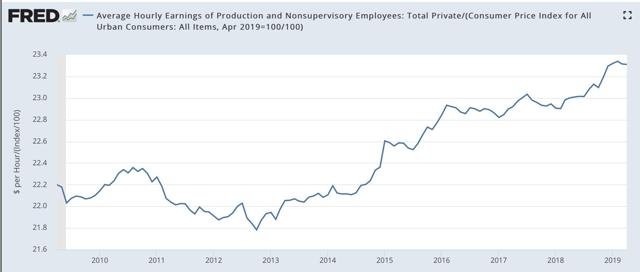

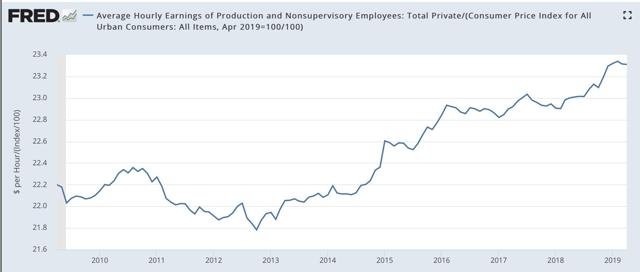

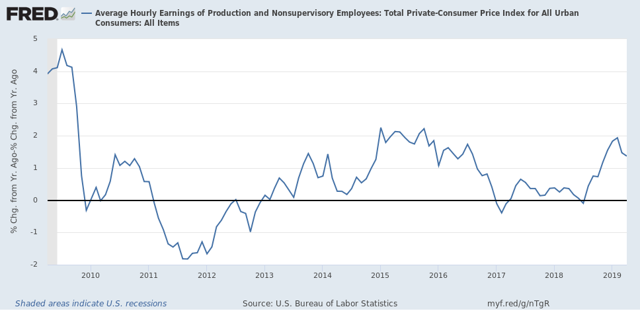

Now let’s turn to wages. Nominally, wages for non-supervisory employees increased +0.3% in April, so after inflation they were flat, as they have been all this year so far:

YoY non-supervisory wages nominally were up +3.4%. With YoY inflation rising to +2.0%, in real terms, real wages are only up +1.4%, a decline from their YoY high in February:

YoY non-supervisory wages nominally were up +3.4%. With YoY inflation rising to +2.0%, in real terms, real wages are only up +1.4%, a decline from their YoY high in February:

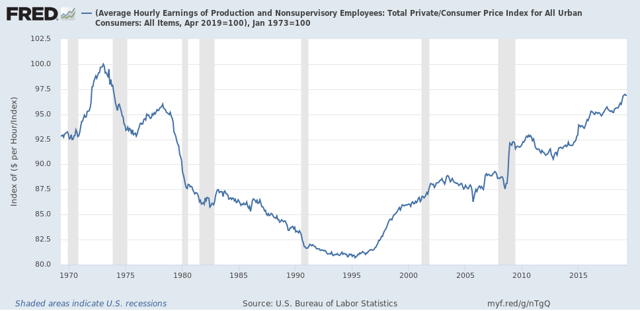

In the long view, real wages are still -3.1% below their January 1973 peak, and -0.1% below where they were in February:

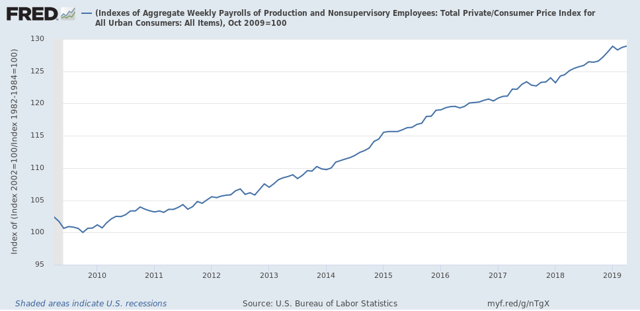

Finally, here are aggregate real wages. This tells us how much more American workers as a whole in real terms since the bottom just after the Great Recession. These improved to 28.9% above their low, but only tied with their January peak:

While in real terms American workers have made no progress so far this year, nevertheless it’s no surprise that in public opinion polls, Americans feel pretty good about the economy right now. Unemployment is lower than it has been in several decades. Underemployment is at least approaching its lows in the past 25 years. And wage growth, while subpar in historical terms, has improved to the point where it is not the kind of source of discontent it was in the first years of this expansion. I don’t expect this to change unless there is a further jump in gas prices, or else a significant tightening of consumer credit.

Thursday, May 9, 2019

Are initial jobless claims showing a re-assertion of an underlying weak economic trend?

- by New Deal democrat

I don’t normally comment on initial jobless claims, but I’m following them with particular interest at this point. Here’s why.

Last spring the long leading indicators were still at least weakly positive. I saw growth ahead through Q1 of this year, and getting questionable in Q2. By last summer, the enough long leading indicators were down that I called for a slowdown in the economy by midsummer of this year - I.e., about 2-3 months from now.

And then ... Trump’s incipient trade war, the government shutdown (the equivalent of 800,000 layoffs without pay, followed by mass-rehiring with pay about 60 days later), and an ill-timed Fed rate hike immediately after a partial inversion of the yield curve, got together and caused a mini-recession in production, sales, and income. This mini-recession spanned 1 month in Q4 of last year and the first two months of Q1 this year. So the quarterly GDP numbers for both quarters looked good, but the monthly and weekly data deteriorated sharply.

Once these distractions were over, most of the data rebounded. On top of that, Easter came very late this year, and it looks like there were some issues of unresolved seasonality.

So, instead of smooth but slowly decelerating sailing, we got a sudden braking followed by a re-acceleration. So most of the non-permabear punditry nowadays is close to singing “Happy Days are Here Again!”

So, either I’ve been wrong - always a possibility! - or else the underlying decelerating trend ought to start reasserting itself by now. And one big place it ought to start re-asserting itself is - wait for it! - initial jobless claims. Hence why I am paying particular attention to them.

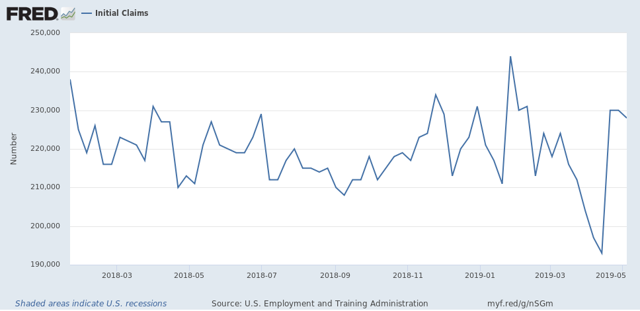

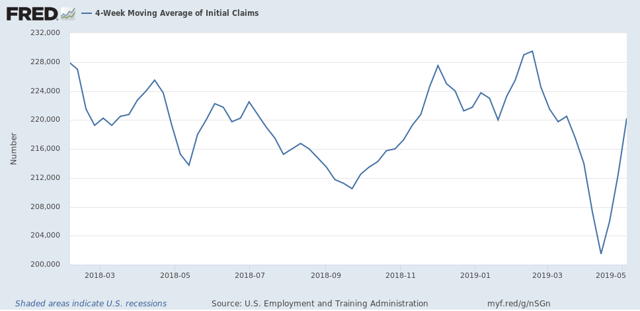

Now that my lengthy introduction is over, let’s get to the data. First, here are weekly new jobless claims since late January of 2018:

Notice that, with the exception of the three weeks just before Easter this year, they have been in a 210k to 235k range. The three weeks just before Easter broke through the trend to the downside: 204k, 197k. And 193k. The three since then have been at the top end of the trend: 230k, 230k, and 228k.

Here is what the 4 week moving average looks like over the same period:

This helps show the trends: last summer’s mini-boom, the autumn and winter weakness, the post-shutdown through Easter rebound, and then the last 3 weeks’ weakness.

So, to smooth out the remaining Easter seasonality, if you average the two weeks just before and just after Easter, you get 212,500. If you expand that to the three weeks before and after Easter, you get 213,667.

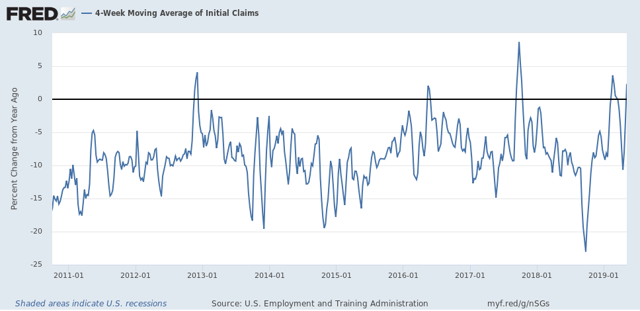

Now let’s look at the YoY% change in the 4 week moving average:

Notice that with the exception of the three week downward spike just before Easter, the recent YoY comparisons have been worse. The only comparable times were superstorm Sandy in 2012, the hurricanes of 2017, and briefly during the 2016 shallow Oil patch centered recession.

Unadjusted, the current 4 week average is 2.3% worse than one year ago. Averaging the four weeks around Easter makes it +0.5% worse. Averaging the current 6 weeks makes it -0.7% better. But whichever averaging we use, the YoY change is very weak compared with the last 9 years.

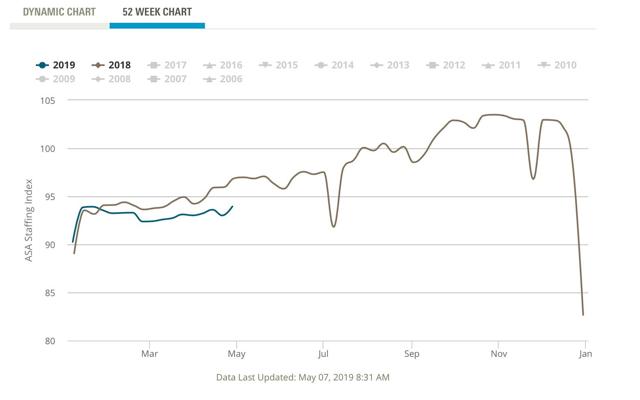

Before I go, let me cite two other items of data. The American Staffing Association’s Index of temp jobs deteriorated further on a YoY% basis this week:

Either this index has been wrong, or the strong temp jobs number in the April jobs report was an outlier.

Finally, the recent new records in the stock market have been another source of “Happy Days are Here Again!” But if you step back and take a longer term view:

It looks much more like the market has gone sideways in about a 10% range since January of last year. As of yesterday’s close, the S&P 500 was only 0.2% above the January 2018 peak.

In short - at least as of this week! - it looks like the underlying weak economic trend is re-asserting itself.

Wednesday, May 8, 2019

Economic indicator death match! The yield curve vs. mortgage rates

- by New Deal democrat

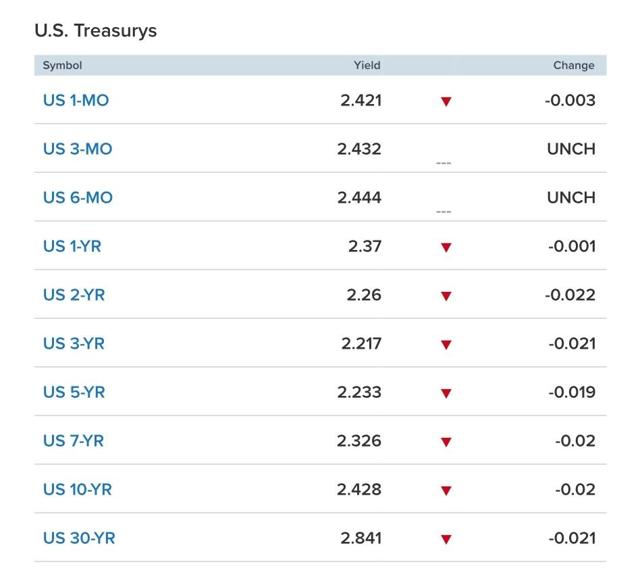

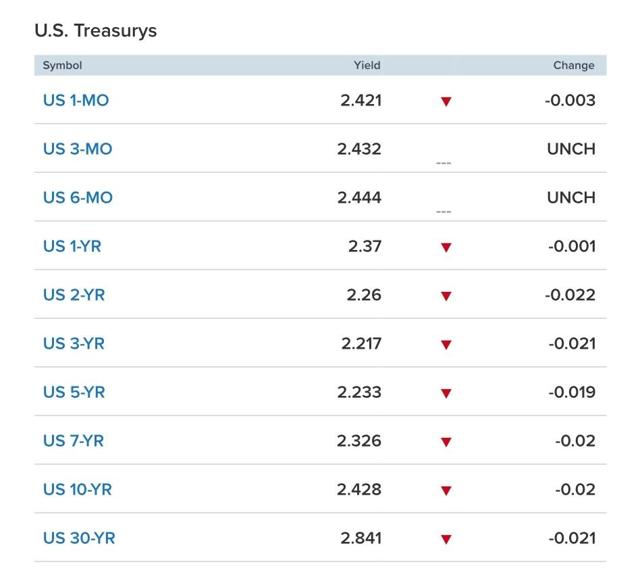

This morning the 10 year vs. 3 month interest rate spread inverted again:

With the exception of the 30 year and spreads between 5 and 30 years, the entirety of the yield curve has inverted. And don’t forget, the intermediate term 2 year through 5 year spread has been inverted for nearly half a year!

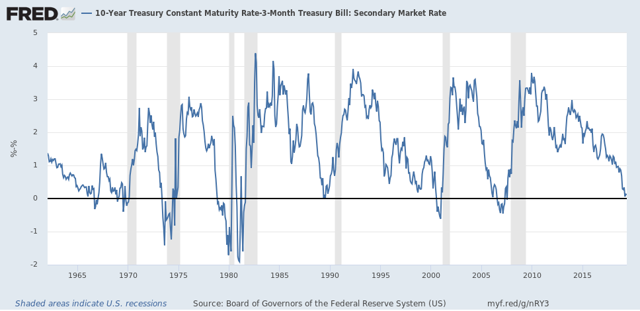

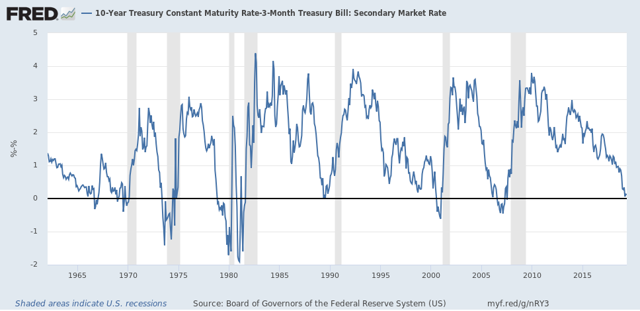

Here’s a long-term view of the 10 year minus 3 month spread:

Here’s the thing: no matter which yield curve measure you choose, you still have to deal with the fact that it inverted in 1966 and 1998 (doesn’t show up in the above graph because it was only for a few days), and no recession followed within 24 months, although in the former case there was a substantial slowdown.

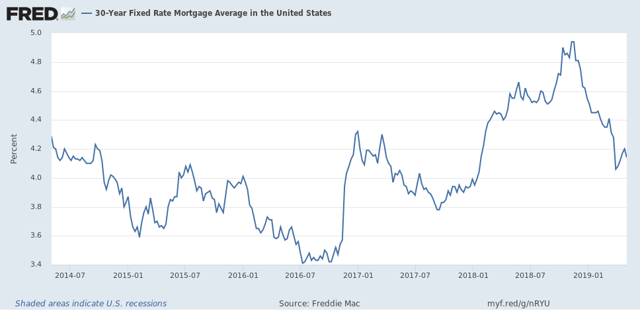

But since the inversion is because the 10 year has fallen so much, it is putting a bottom under the housing market. As of yesterday, mortgage rates have fallen back to 4.20%:

Mortgage applications are picking up again. This morning’s report shows them up 5% YoY. And that renewed housing activity should filter through into the wider economy by next year.

Bottom line: either the yield curve or the housing market are giving a false signal.

Tuesday, May 7, 2019

March JOLTS report: Hiring and discharges show signs of late cycle deceleration

- by New Deal democrat

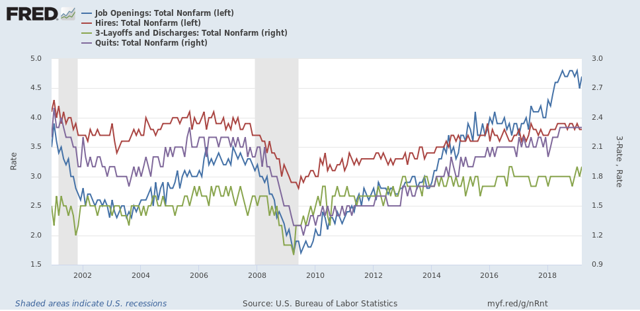

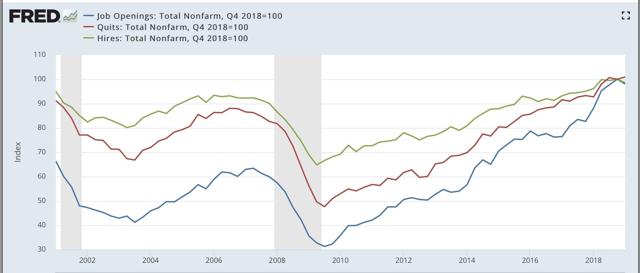

The JOLTS report on labor is noteworthy and helpful because it breaks down the jobs market into a more granular look at hiring, firing, and voluntary quits. Its drawback is that the data only goes back less than 20 years, so from the point of view of looking at the economic cycle, it has to be taken with a large dose of salt.

With that disclaimer out of the way, today’s JOLTS report for March generally showed a slight backing off from their recent best readings of this expansion. All of the series are off their best levels, and three of the five noteworthy ones continued to decline:

- Quits declined slightly (less than -0.1%) and are -2% off their peak of two months ago.

- Hires declined slightly to about -4% off their October peak.

- Total separations rose declined to about -4% off their peak in last July.

- Job openings rose and are now down -2% from their November all time high, reversing February’s sharp decline.

- Layoffs and Discharges declined about -5% (a good thing) and remain about 7% above their September 2016 low, although well below their levels of most of the past 18 months.

Let's update where the report might tell us we are in the cycle.

First, below is a graph of the *rates* of hiring, quits, layoffs, and openings as a percentage of the labor force since the inception of the series (layoffs and discharges are inverted at the 3% level, so that higher readings show fewer layoffs than normal, and lower readings show more):

During the 2000s expansion:

- Hires peaked first, from December 2004 through September 2005

- Quits peaked next, in September 2005

- Layoffs and Discharges peaked next, from October 2005 through September 2006

- Openings peaked last, in April 2007

As of this report, hires and openings *possibly* show signs of having made a cyclical peak at this point, with quits steady and layoffs and separations at their best level of the cycle.

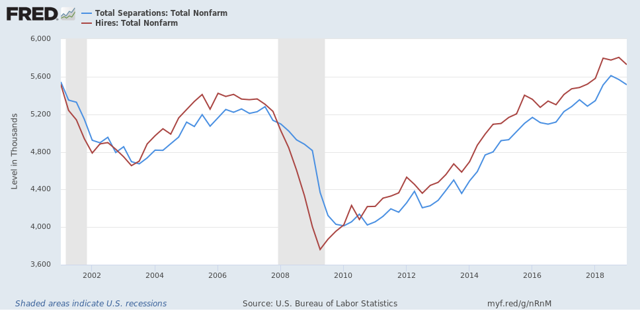

Next, here's an upd ate to the simple metric of "hiring leads firing," (actually, "total separations"). Here's the long term relationship since 2000 through Q1 of 2019:

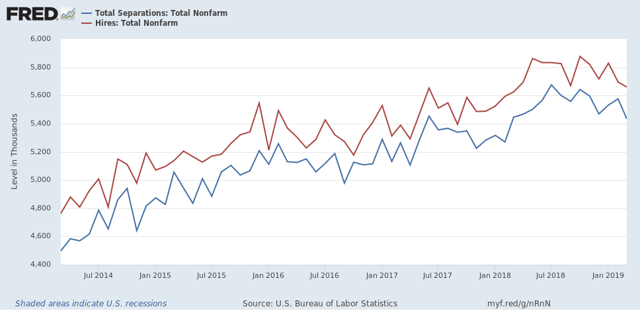

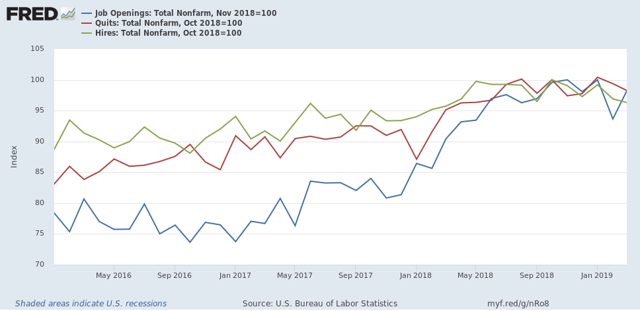

Here is the monthly update for the past three years:

In the 2000s business cycle, hiring and then firing both turned down well in advance of the recession. Importantly, both may have made their cyclical peak last summer in and autumn. If so, that would be sin line with what happened during the 2000s expansion, when hires peaked first, but it is obviously too soon to know for sure.

In the 2000s business cycle, hiring and then firing both turned down well in advance of the recession. Importantly, both may have made their cyclical peak last summer in and autumn. If so, that would be sin line with what happened during the 2000s expansion, when hires peaked first, but it is obviously too soon to know for sure.

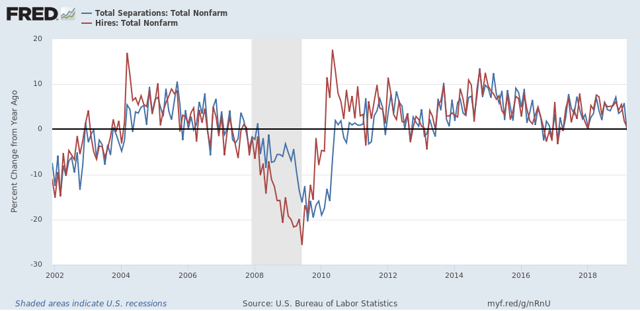

Last month I wrote there was deceleration but no sign of a significant downturn. This month there is, and total separations are now negative YoY:

Finally, let's compare job openings with actual hires and quits. As you probably recall, I am not a fan of job openings as "hard data." They can reflect trolling for resumes, and presumably reflect a desire to hire at the wage the employer prefers. In the below graph, the *rate* of each activity is normed to 100 at its July 2018 value:

Now, here is a close-up of the last three years:

In 2018, my take was that employees have reacted to the employer taboo against raising wages by quitting at high rates to seek better jobs elsewhere. If the dam were finally breaking, we should see the hiring rate increase, and quit rate level off. That is not the case, as quits have continued to increase slightly, while hires have decreased slightly.

In summary, with the exception of the decline in layoffs and discharges, the March JOLTS report reflected some weakness. Further, if the pattern on the last cycle holds, then we may have begun to see the late cycle deceleration, in which case I will be watching to see if the quits rate begins to turn down as well.

Monday, May 6, 2019

Scenes from the April jobs report

- by New Deal democrat

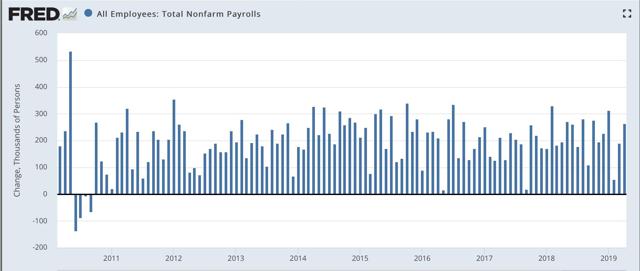

The headline news in Friday’s employment report was excellent. But underneath those headlines, all is not well.

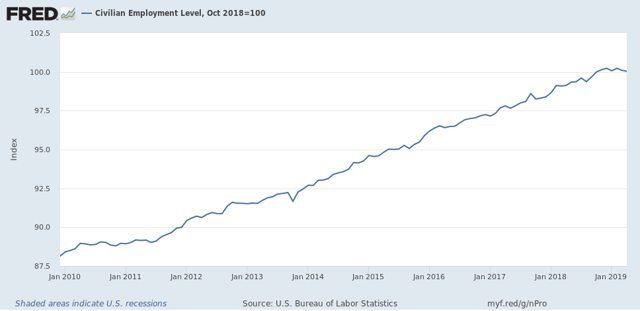

Let’s celebrate the excellent headlines first. Adding 263,000 jobs in April was one of the dozen best reports of this entire expansion:

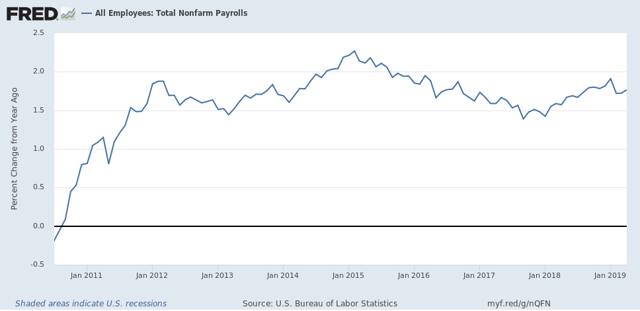

Next, here is the YoY% change in nonfarm payrolls, showing an uptick after the deceleration in the prior two months:

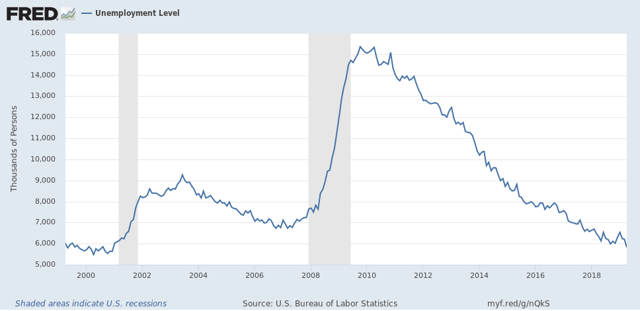

The total number of unemployed was at the lowest level in 20 years:

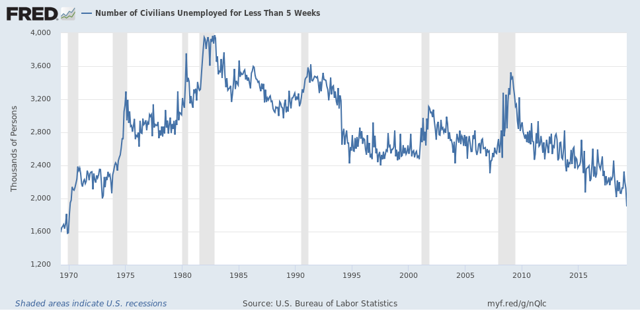

The number of short term unemployed people (less than 5 weeks) reached its lowest level in 49 years:

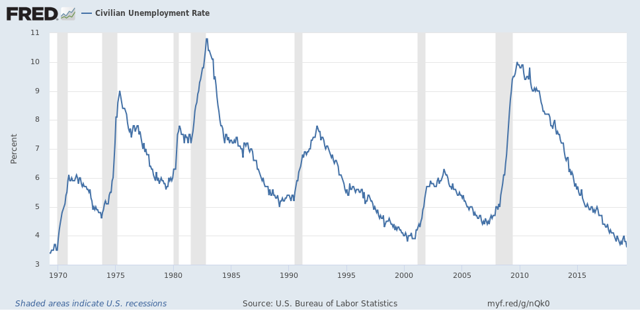

And the unemployment rate was the lowest in 50 years:

This is great news. But before you break out into a cheer of “Happy Days are Here Again!” Let’s look under the hood.

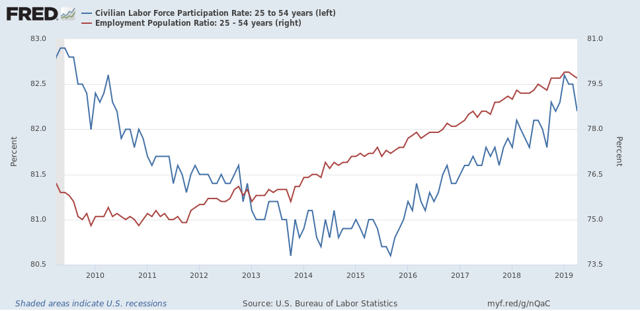

I’m going to start with the household survey, that gives us the unemployment rate. As was widely noted already Friday, both the labor force participation rate and the employment to population ratio for prime age 25-54 workers declined:

Had the participation rate simply remained at the level it was in March, the unemployment rate would have risen to 3.9% rather than declining to 3.6%.

And as I also already noted on Friday, when we measure by the household survey, only 63,000 more people are employed than half a year ago:

Sometimes this is a harbinger of things to come in the payrolls survey. Sometimes it is just noise.

In short, in the household survey, there were 103,000 fewer people who held jobs. There were also 387,000 fewer people who were unemployed. But there was a jump of 646,000 people who weren’t even in the labor force. This discrepancy will most likely resolve itself one way or the other in the next few months.

Now let’s turn to the employers’ payrolls survey, from which we get the headline jobs number. For the past few months, I have been forecasting a jobs slowdown. That has been based in part on the natural progression from long to short leading indicators to coincident indicators.

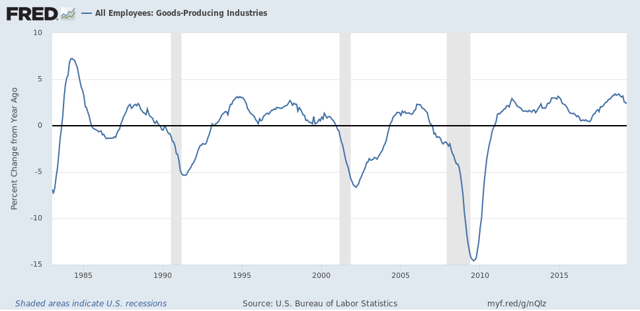

Further, even when the spread between short and long term bonds simply gets tight, historically employment growth has almost always faltered. And goods-producing employment - inclu ding manufacturing and construction jobs - *always* has.

So what I’m going to look at here is which sectors in the April report improved outright, and which either declined or showed deceleration. Because there’s an important difference.

Further, even when the spread between short and long term bonds simply gets tight, historically employment growth has almost always faltered. And goods-producing employment - inclu ding manufacturing and construction jobs - *always* has.

So what I’m going to look at here is which sectors in the April report improved outright, and which either declined or showed deceleration. Because there’s an important difference.

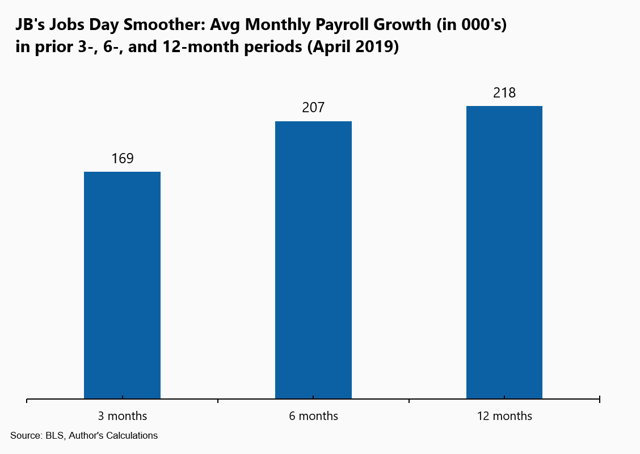

First, Jared Bernstein typically compares the 3-, 6-. And 12-month average in employment growth to show the trend. Here’s his graph:

This shows a decline in the job growth trend overall. For this trend to continue next month, May’s number basically must be under 200,000.

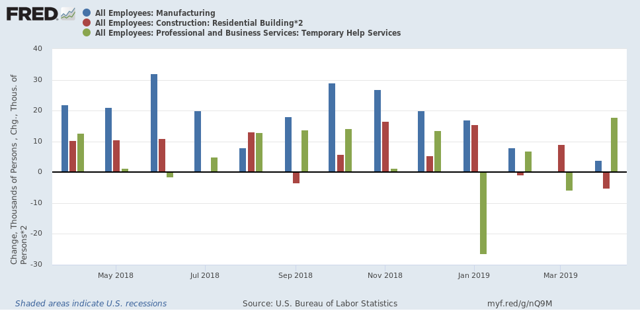

Next, just as I did last month, let’s break out the monthly gains or losses among manufacturing (blue), residential construction (red), and temporary jobs (green):

In the past four months, two of the three have faltered, with sharp deceleration in manufacturing and residential construction. Temporary jobs bucked the trend in April with the biggest gain in over twelve months. Since the American Staffing Association’s index of temporary jobs has been in a steepening YoY decline since January, I am anxious to see what happens next month with this number.

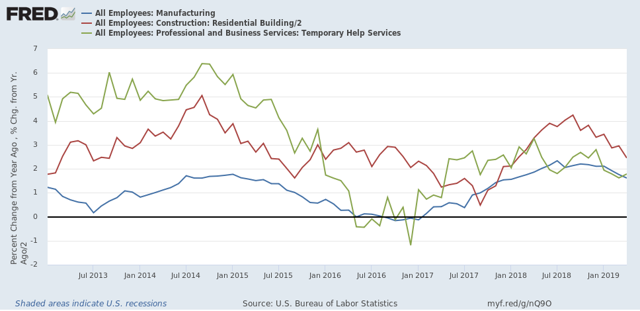

Here is the YoY look at the same three sectors, showing that all three have decelerated substantially - although none is negative YoY:

Here is the YoY look at the same three sectors, showing that all three have decelerated substantially - although none is negative YoY:

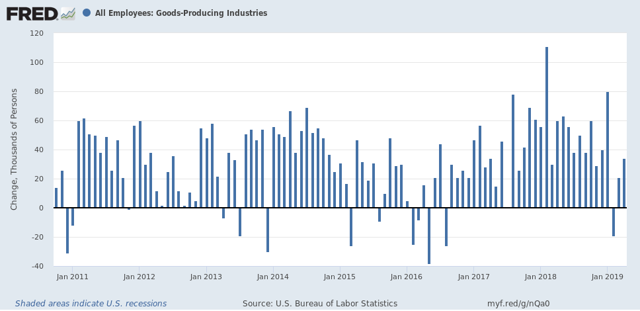

Next, here are goods-producing jobs (which include but are not limited to manufacturing and construction). At the beginning of March I wrote that I expected these to slow down to a rate of +7000/month. Here is what they look like since the jobs expansion began:

My forecast didn’t happen, at least not this month! But even with April’s 34,000 gain, the average of the past three months is +12,000, the lowest since mid-2017, and are three of the four lowest in the past twelve.

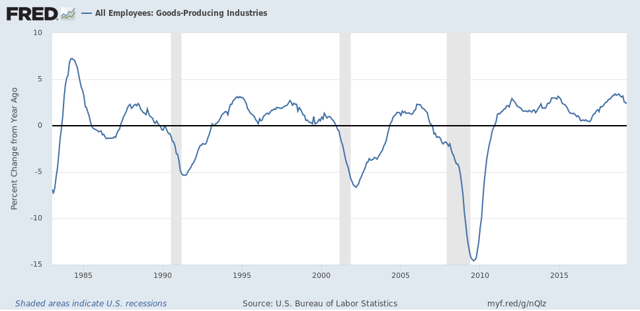

Here is the YoY look:

Again, we see deceleration, but certainly not a negative number. For there to be real trouble, I would expect this to fall to less than 1/2 of its recent best YoY% gain of 3.4%, in other words, 1.7% or less.

Again, we see deceleration, but certainly not a negative number. For there to be real trouble, I would expect this to fall to less than 1/2 of its recent best YoY% gain of 3.4%, in other words, 1.7% or less.

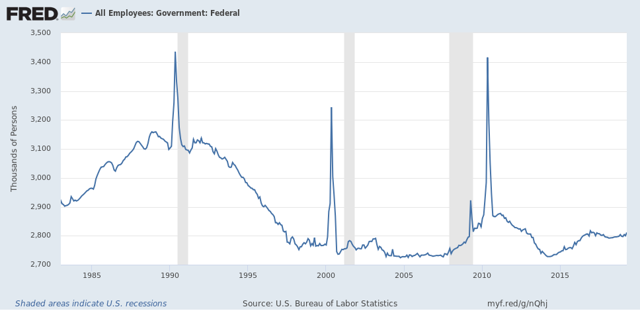

In contrast, the three sectors that contributed the most to April’s big payrolls number were professional and business jobs, education, and federal government employment.

What is important about those three is that they are definitely *not* leading sectors. Federal government employment, for example, frequently goes *up* during recessions:

(Unfortunately, FRED doesn’t give me a way to separate out census employment, which is those huge spikes.)

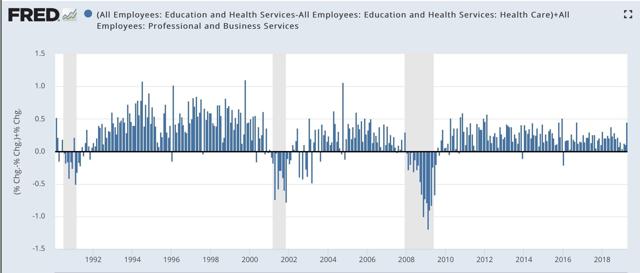

And here is what professional jobs plus education look like as m/m% gains over the past 30 years:

April was one of the 10 best gains of this entire expansion for these two sectors. But note that employment gains in these two sectors typically continues right up until one or two months before a recession, and in the case of 2001, a month or two after it began.

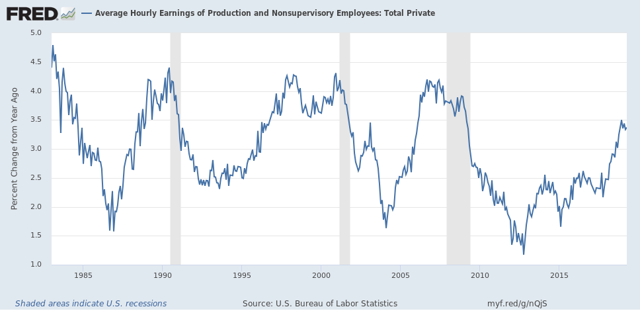

Finally, here’s look at nominal YoY wage growth for non-supervisory workers. (We don’t have inflation yet for April):

This has declined slightly since December. Since gas prices have headed higher, dragging. Inflation with them, workers’ real wage growth is decelerating as well.

In summary, the employment situation for April is that:

1. The headline jobs and unemployment numbers are excellent.

2. Higher paying professional and educational jobs led the way.

BUT

3. There was a significant drop off in labor market participation, without which the unemployment rate would have risen, not fallen.

4. The trend in total jobs is decelerating gains.

5. This trend is especially pronounced among several of the leading sectors, including manufacturing and residential construction jobs.

6. Meaning that the outsized gain was among more lagging job sectors.

7. Finally, wage growth is leveling off.

Subscribe to:

Comments (Atom)