- by New Deal democrat

There’s no significant economic news this week until Wednesday’s CPI report, and as a side note, I might be offline for a day or two later this week. In the meantime, today and tomorrow let’s take a look at some of the important information from last Friday’s employment report.

Today, I’m taking a look at the leading employment sectors and several other leading components of the report.

To recapitulate from my monthly updates, there are 5 leading indicators in the report:

1. The manufacturing work week (which is 1 of the 10 components of the Index of Leading Indicators).

2. Manufacturing employment.

3. Construction (especially residential construction) employment.

4. Temporary help

5. The number of unemployed less than 5 weeks (this series is similar to, but noisier than, initial claims - but the data starts years earlier, so there is a longer record).

Here are the first 4 series all normed to 100 as of their highest month:

Both the manufacturing work week and temporary help employment have been down for over a year. Manufacturing employment has declined very slightly (-1,000) in each of the past two months. Finally, residential construction employment, which had been increasing as the number of housing units under construction also did, also appears to have peaked in January.

Because each individual sector has waxed and waned with great variation in past cycles, below I show them YoY for the past 40 years leading up to the pandemic:

A marker of all of the recessions in the past 40 years prior to the pandemic is that all 4 turned negative prior to each recession, with the sole exception that the manufacturing work week was flat YoY prior to the 2008 recession. When even 2 of the 4 were positive YoY, there was no recession.

Here is the same graph for the past 12 months:

Temporary help and the manufacturing work week are negative. Manufacturing and residential construction employment are decelerating, but still positive. If their current paces of deceleration were to continue, residential construction employment is on track to turn negative in 3 months; manufacturing employment in 8.

Finally, the number of persons who have been unemployed for less than 5 weeks decreased slightly in March, but at 2.722 million, is at a level higher than all but 4 months in the past 2 years:

Here is the historical track record of this indicator, averaged quarterly YoY for 70 years prior to the pandemic:

While it is indeed noisy, it has turned higher YoY in the quarter of, and almost always prior to, the onset of recessions.

Here is the quarterly YoY view since Q4 of 2020:

The only reason it was not higher YoY in Q1 of this year is the comparison with the extremely weak month of January 2022 which was included in the average.

To summarize: all 5 of the leading components contained in the jobs report have turned down (or in the case of short term unemployment, up) from their best levels. Several are already at levels consistent with recession. The remaining ones are on track to signal recession within 3 to 6 months.

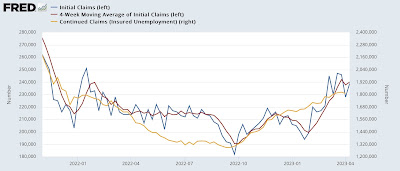

Tomorrow: unemployment indicators