- by New Deal democrat

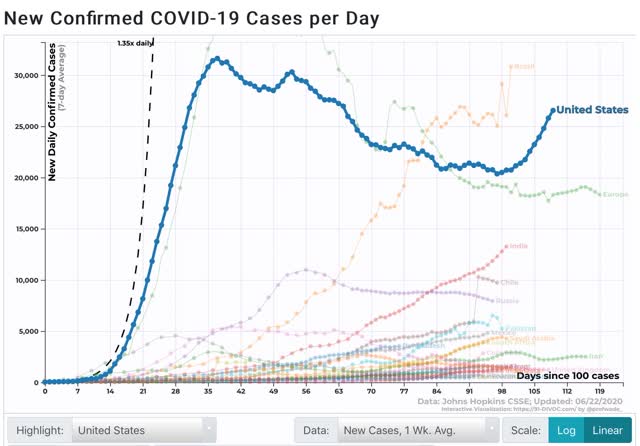

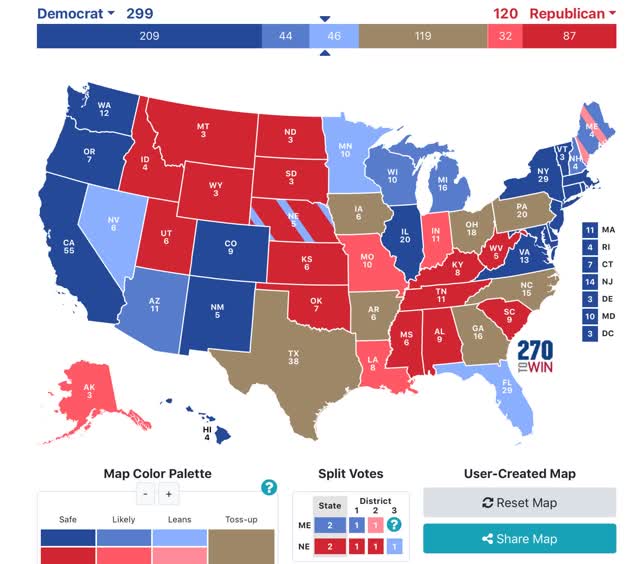

Total US infections: 2,480,786, 44,373 new cases

Total US deaths: 125,120, 619 new deaths

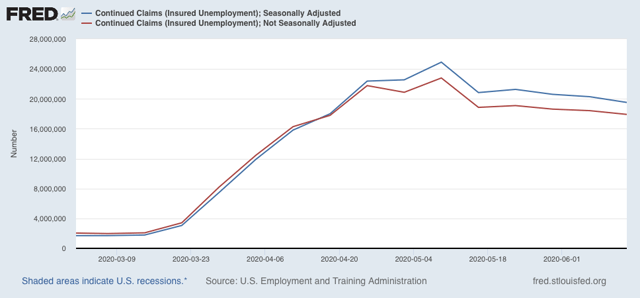

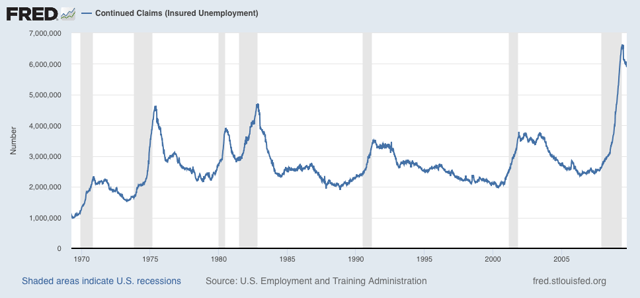

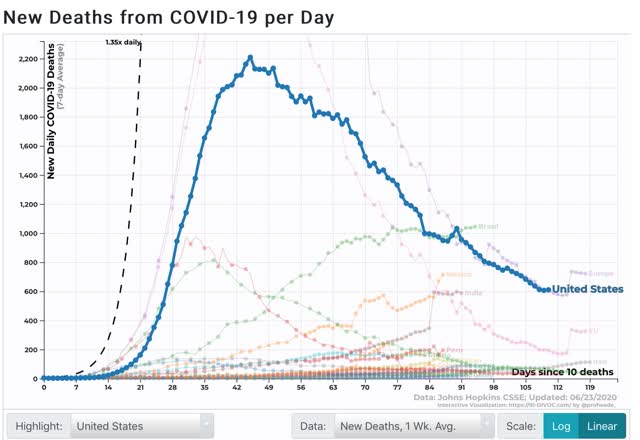

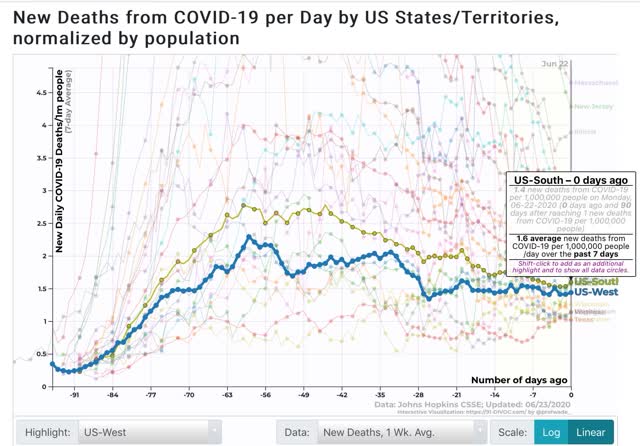

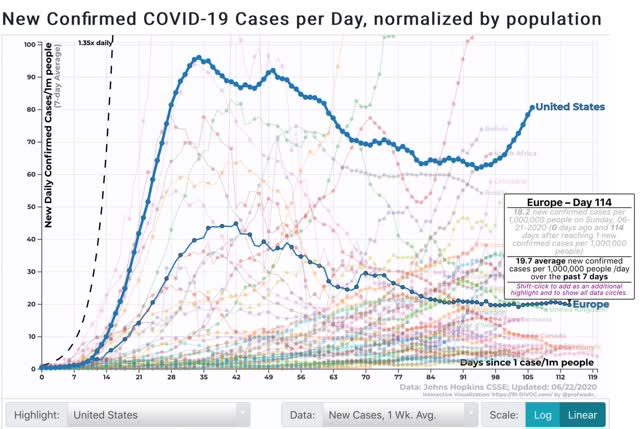

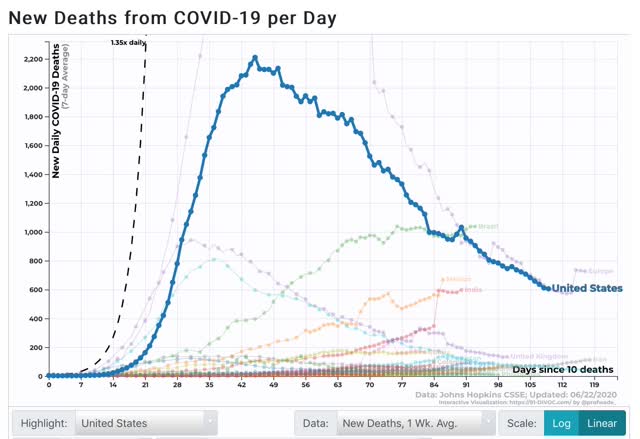

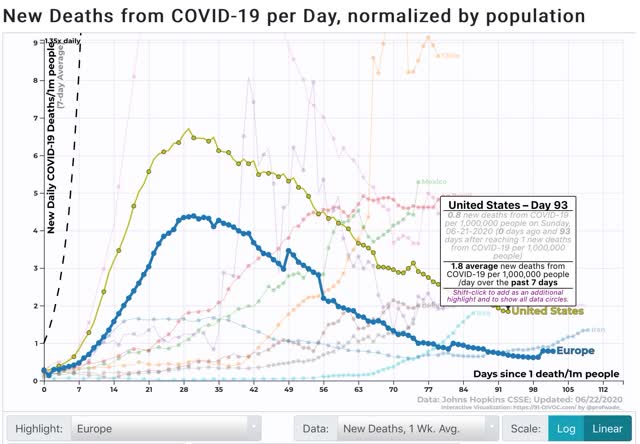

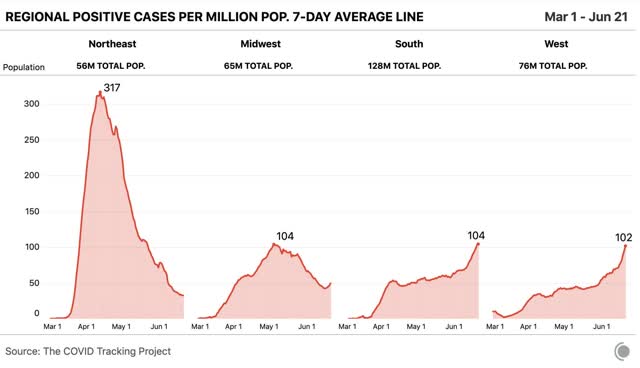

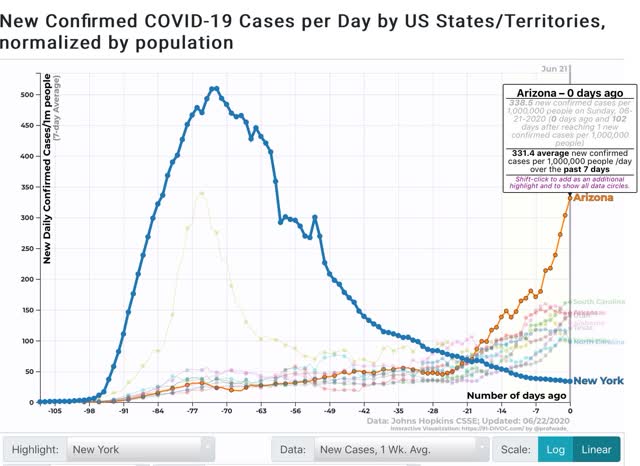

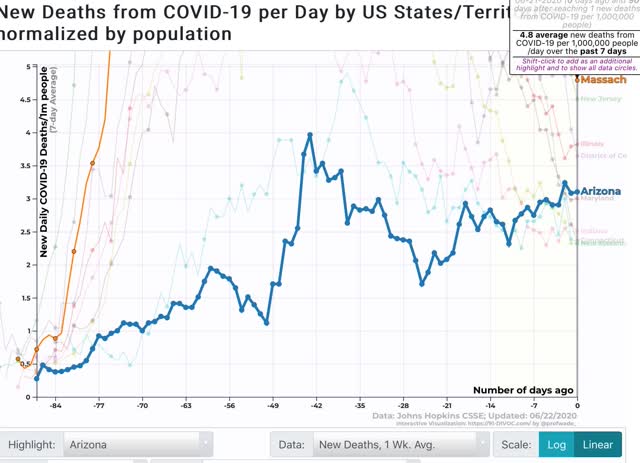

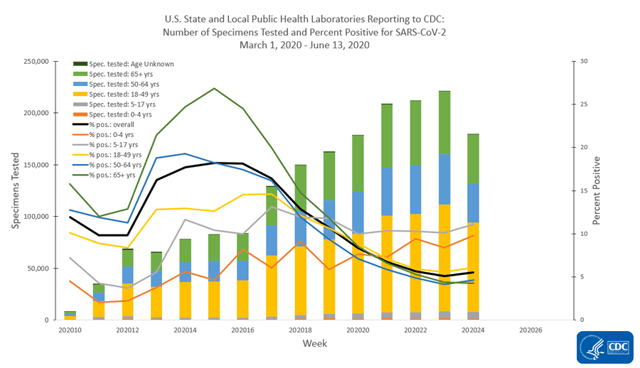

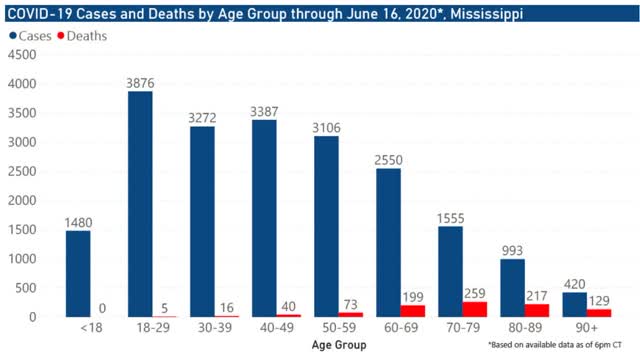

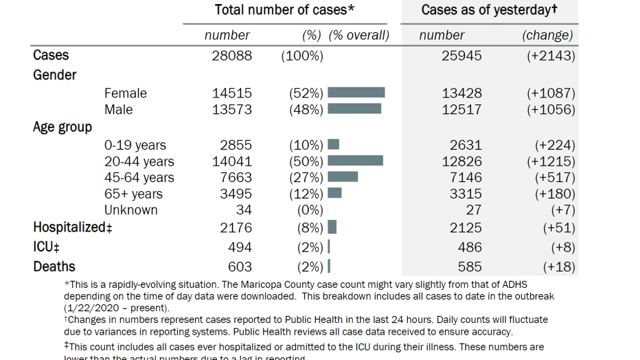

A quandary over the past month has been why deaths declined so much more than new cases, while cases were declining; and more recently why deaths have continued to decline in the face of soaring new infections.

Is it because of better treatments? Changing demographics - e.g., fewer nursing home cases, more younger people? Or is something more even more fundamental with the nature of the virus itself going on? In short, should we expect deaths to continue to decline, or to turn up following the increase in new infections?

I am expecting deaths to begin to rise again, imminently.

Here’s why: the progression is:

- first, infections increase/decrease

-second, hospitalizations increase/decrease

-finally, deaths increase/decrease.

The problem in the US data has been that hospitalizations have been missing from almost all compilations. That’s because not all States - and most especially, Florida - track hospitalizations.

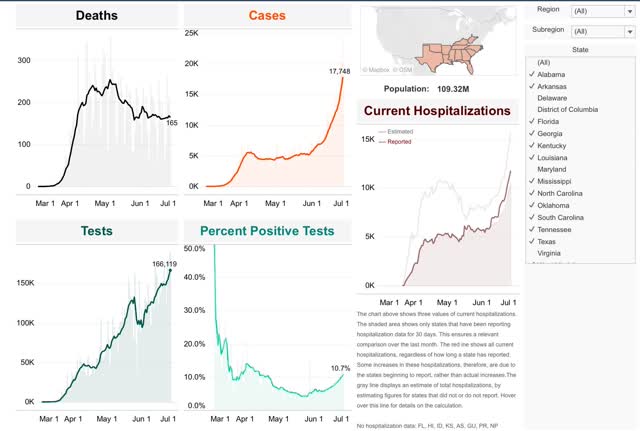

Conor Kelly, however, *does* track reported hospitalizations from all States which have reported for at least 30 days, which totals roughly 40 States. So if deaths are going to start to increase again, it should first appear in this data. Further, if this is because of the reckless reopening of some States, it should most plainly appear in those regions. With that in mind, here is the data.

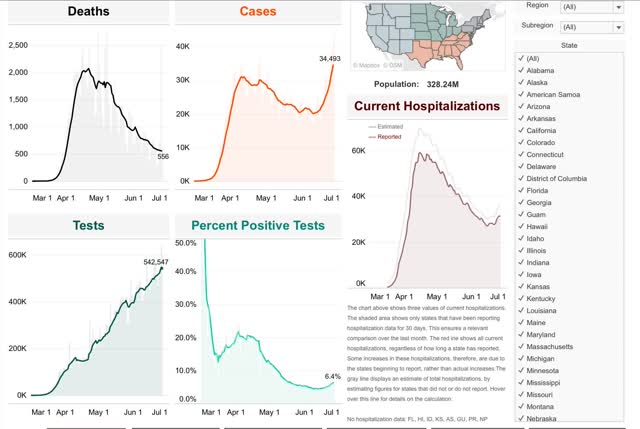

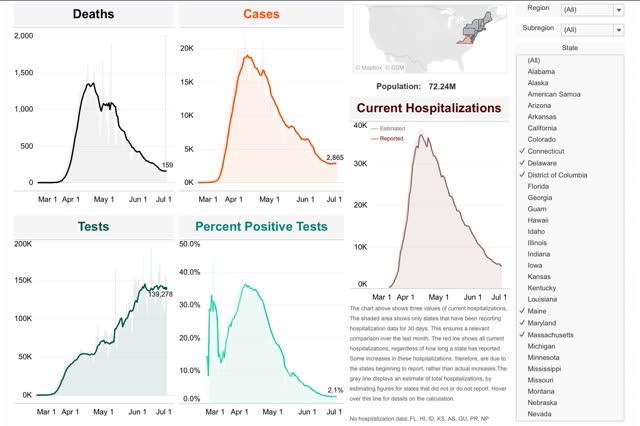

Total US hospitalizations bottomed on June 14 at 26,441. In the 12 days since, they have risen by almost 14% to 30,065:

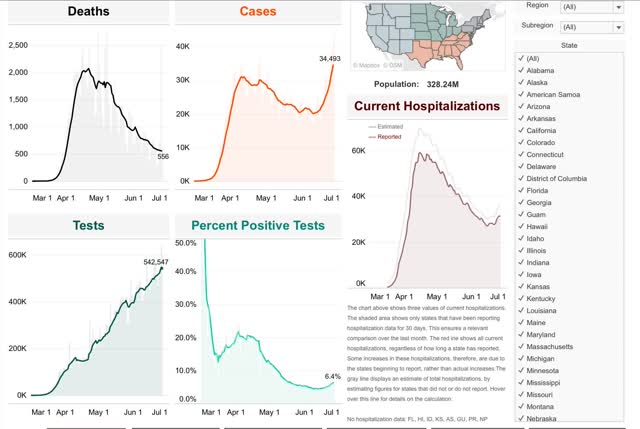

One benefit of Conor Kelly’s compilation is that it allows users to generate customized regions of States. So, for example, here is the data for the East Coast megalopolis from Maine through Virginia:

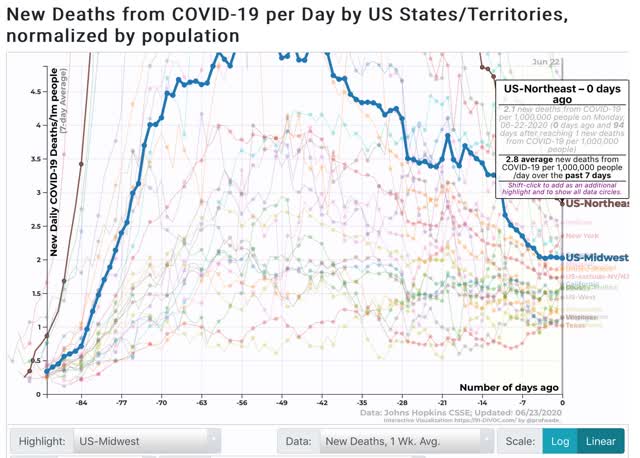

Cases have risen very slightly in the past few days, while hospitalizations have continued to fall. Deaths have flattened.

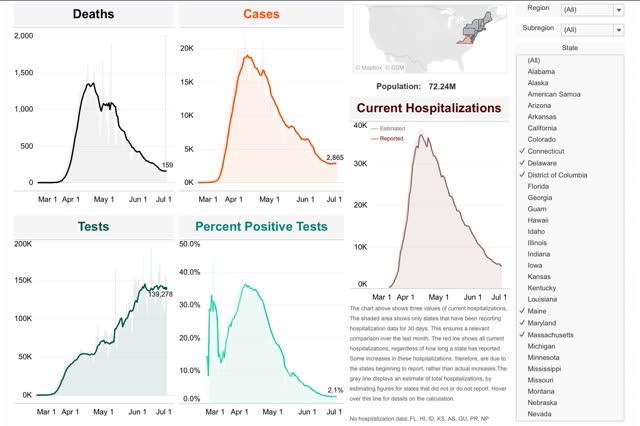

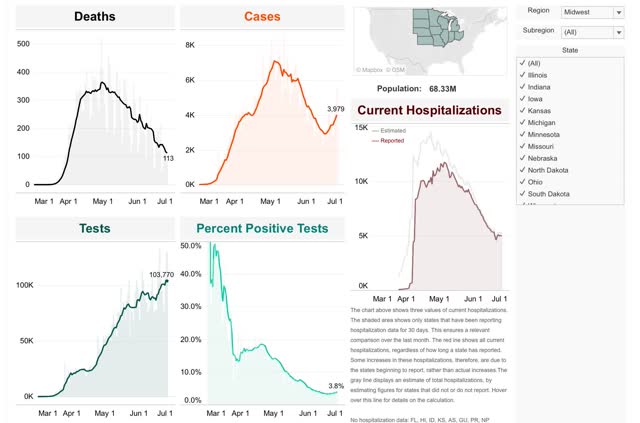

In the Midwest, cases have risen by about 25% in the past 12 days. Hospitalizations have flattened, while deaths have continued to decline:

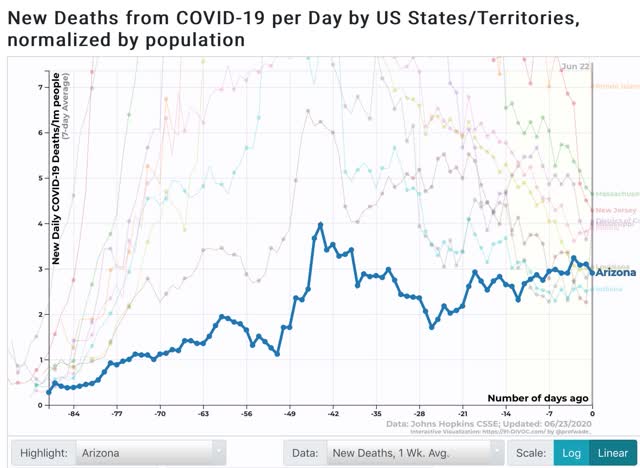

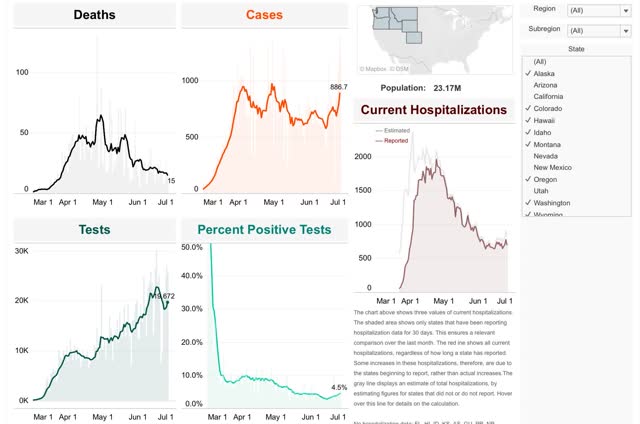

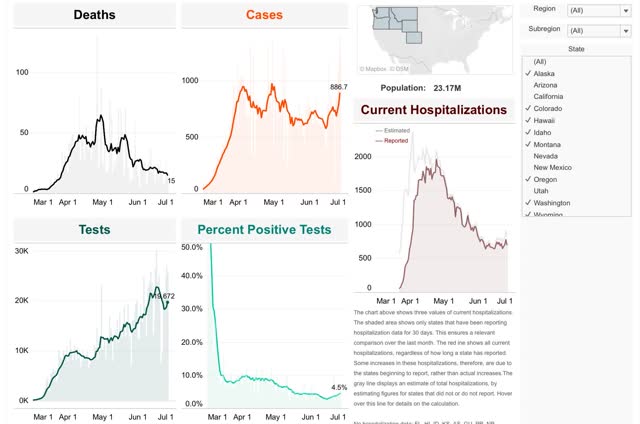

In the northern West, case started rising a month ago, after May 26. Hospitalizations bottomed two weeks later on June 7. Deaths started to creep up at the same time:

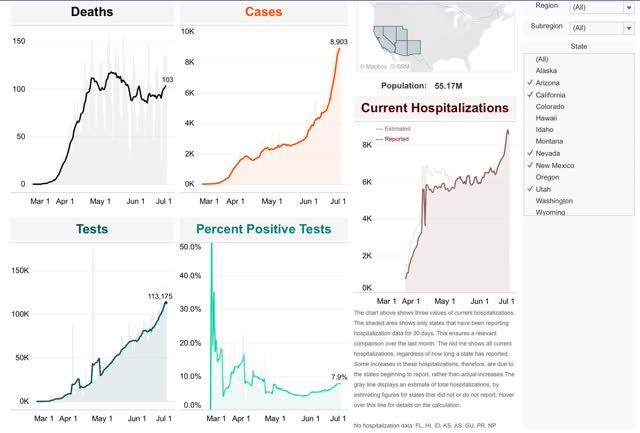

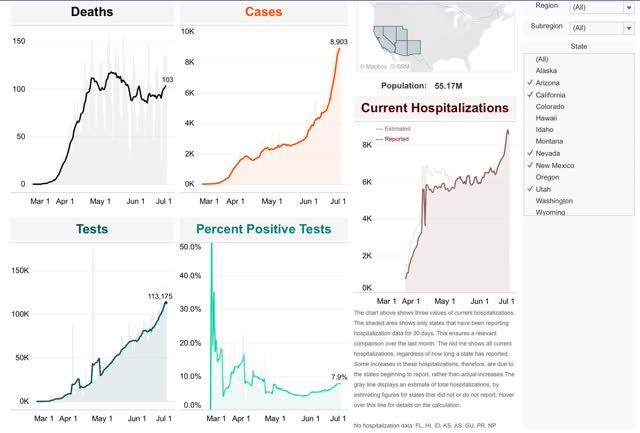

In the Southwest, cases never decreased. But there was an inflection point for increased cases on May 28, which had 3,528 new cases. By June 26, that had more than doubled to 8,758 new cases:

The inflection point in hospitalizations followed on June 14, since which time the number has increased by over 35%. The upward inflection in deaths followed on June 20.

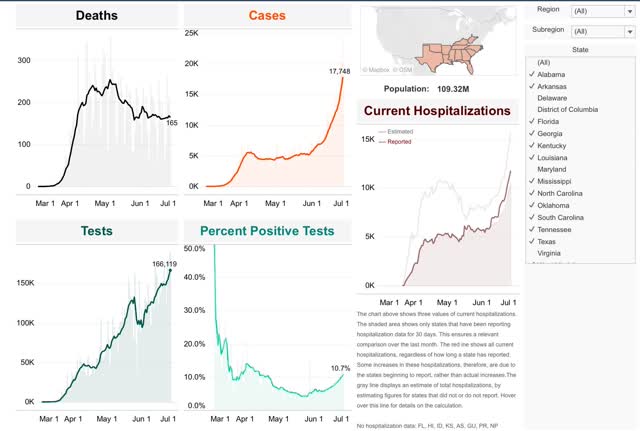

Finally, in the Deep South, cases actually bottomed on April 27 at 4,337, with an upward inflection point at May 27, on which there were 5,171 new cases. Since then new cases have more than tripled to 17,748:

Hospitalizations reached their inflection point on June 6 at 5,791. Since then they have nearly doubled to 10,565. Deaths bottomed on June 18 at 160 and have risen slightly since then to 165.

In short, while there is considerable variation, in general deaths have lagged hospitalizations by about 1 to 2 weeks. We are now nearly 2 weeks after the bottom in hospitalizations for the US as a whole. Thus I expect deaths to start increasing, at least slowly, in the next few days.

Total US deaths: 125,120, 619 new deaths

A quandary over the past month has been why deaths declined so much more than new cases, while cases were declining; and more recently why deaths have continued to decline in the face of soaring new infections.

Is it because of better treatments? Changing demographics - e.g., fewer nursing home cases, more younger people? Or is something more even more fundamental with the nature of the virus itself going on? In short, should we expect deaths to continue to decline, or to turn up following the increase in new infections?

I am expecting deaths to begin to rise again, imminently.

Here’s why: the progression is:

- first, infections increase/decrease

-second, hospitalizations increase/decrease

-finally, deaths increase/decrease.

The problem in the US data has been that hospitalizations have been missing from almost all compilations. That’s because not all States - and most especially, Florida - track hospitalizations.

Conor Kelly, however, *does* track reported hospitalizations from all States which have reported for at least 30 days, which totals roughly 40 States. So if deaths are going to start to increase again, it should first appear in this data. Further, if this is because of the reckless reopening of some States, it should most plainly appear in those regions. With that in mind, here is the data.

Total US hospitalizations bottomed on June 14 at 26,441. In the 12 days since, they have risen by almost 14% to 30,065:

One benefit of Conor Kelly’s compilation is that it allows users to generate customized regions of States. So, for example, here is the data for the East Coast megalopolis from Maine through Virginia:

Cases have risen very slightly in the past few days, while hospitalizations have continued to fall. Deaths have flattened.

In the Midwest, cases have risen by about 25% in the past 12 days. Hospitalizations have flattened, while deaths have continued to decline:

In the northern West, case started rising a month ago, after May 26. Hospitalizations bottomed two weeks later on June 7. Deaths started to creep up at the same time:

In the Southwest, cases never decreased. But there was an inflection point for increased cases on May 28, which had 3,528 new cases. By June 26, that had more than doubled to 8,758 new cases:

The inflection point in hospitalizations followed on June 14, since which time the number has increased by over 35%. The upward inflection in deaths followed on June 20.

Finally, in the Deep South, cases actually bottomed on April 27 at 4,337, with an upward inflection point at May 27, on which there were 5,171 new cases. Since then new cases have more than tripled to 17,748:

Hospitalizations reached their inflection point on June 6 at 5,791. Since then they have nearly doubled to 10,565. Deaths bottomed on June 18 at 160 and have risen slightly since then to 165.

In short, while there is considerable variation, in general deaths have lagged hospitalizations by about 1 to 2 weeks. We are now nearly 2 weeks after the bottom in hospitalizations for the US as a whole. Thus I expect deaths to start increasing, at least slowly, in the next few days.

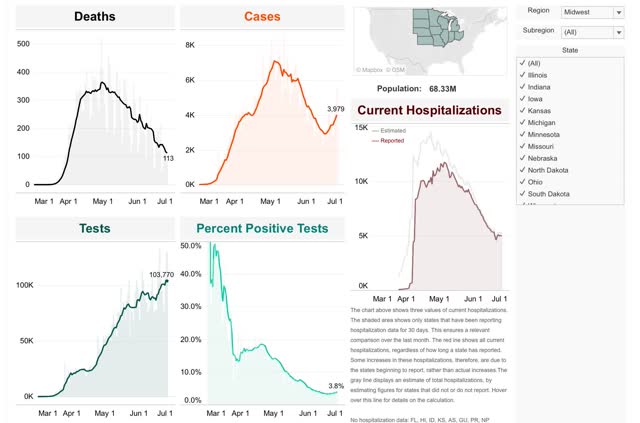

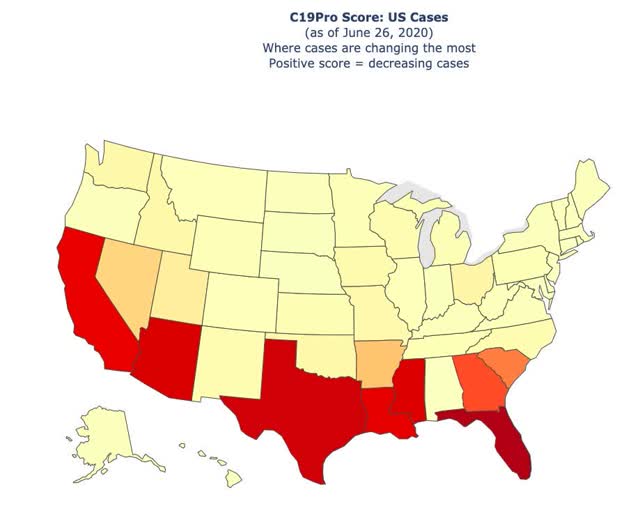

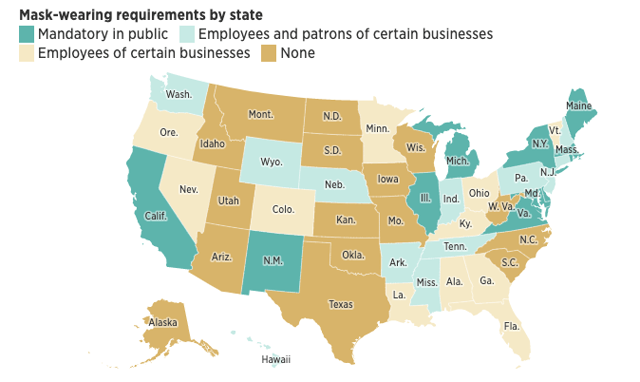

Turning to some of the drivers of the increase in cases, here are two charts. The first is a chart of which State have increasing (red and orange) vs. decreasing (yellow) cases in the past week; the second is a chart of mask-wearing regulations by States:

With the very notable exception of California on the one hand, and the sparsely populated States of the northern Plains and Rockies, mask-wearing, or the lack thereof, is highly correlated with increases or decreases in new cases.

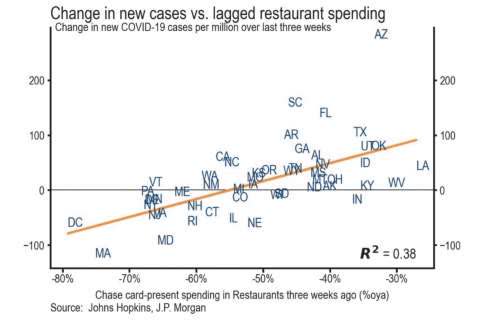

Another big correlation with new cases has been restaurant reopening, as shown in the below graph comparing cases with restaurant spending:

Confined indoor spaces, air-conditioned recirculating ventilation, and the necessary lack of mask-wearing in order to eat or drink sure seems to be a recipe for spreading the virus.

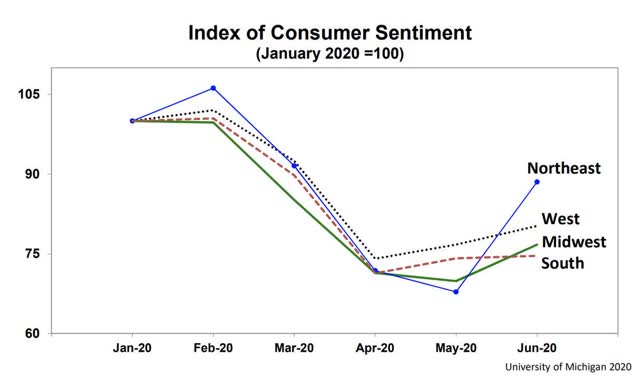

And if the public does not have confidence that the virus has been contained, the economy is not going to be able to sustain reopening for very long, as shown in the below graph of consumer confidence by region:

Only in the Northeast, where the virus has been very well contained (for now) has there been a big rebound in consumer confidence.

Finally, it’s worth noting that this is even showing up in the stock market:

As of Friday, the S&P 500 was less than 5% above where it was at its January 2018 peak. If deaths start to rise substantially, as I believe they will, portions of the economy are going to shut right back down again, whether by law or regulation, or simply because customers stop showing up.