Saturday, July 20, 2019

Weekly Indicators for July 15 - 19 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

There were a number a changes among the short leading indicators this week at the margins, in a somewhat surprising direction. Since I’ll be posting my semi-annual updates of my short and long term forecasts over the next week or two, there is a lot for me to think about!

Anyway, as usual, clicking over and reading should be educational for you, and also rewards me a little bit for the effort I put into this enterprise.

Friday, July 19, 2019

My updated look at housing sales and construction

- by New Deal democrat

My midyear 2019 update on housing construction and sales is up at Seeking Alpha.

Among other things, I go through nine metrics and show the order in which they typically turn, with very significant lags between the first and last indicators. As a result, housing is telling us very different things about the economy over the next 6 - 9 months vs. the next 12 - 18 months.

Judging by the comments there, people still want to see the prices as leading sales, even though almost always sales turn up or down first before prices do.

As an aside of that, Wolf Richter has a very good piece up about the downturn in foreign purchases of US housing. Well-heeled foreigners, and in particular Chinese buyers, have been very important marginal drivers of the high end real estate market, especially in California, New York, and Florida.

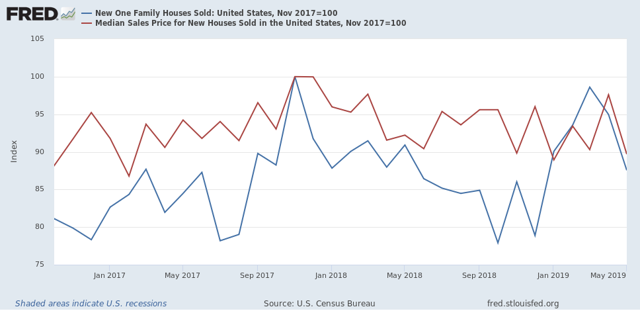

That foreign buying has fallen off a cliff in the last year or so probably explains a lot of the reason why the median price of new homes has fallen so quickly and dramatically along with the 2018 downturn in new home sales, as shown below:

Thursday, July 18, 2019

Initial claims still weakly positive, most consistent with slowdown

- by New Deal democrat

I have started to monitor initial jobless claims to see if there are any signs of stress.

My two thresholds are:

1. If the four week average on claims is more than 10% above its expansion low.

2. If the YoY% change in the monthly average turns higher.

Here’s this week’s update.

My two thresholds are:

1. If the four week average on claims is more than 10% above its expansion low.

2. If the YoY% change in the monthly average turns higher.

Here’s this week’s update.

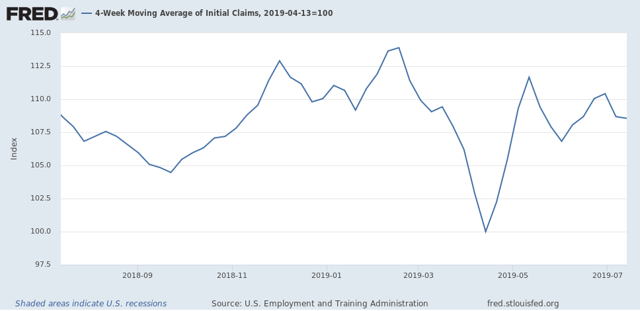

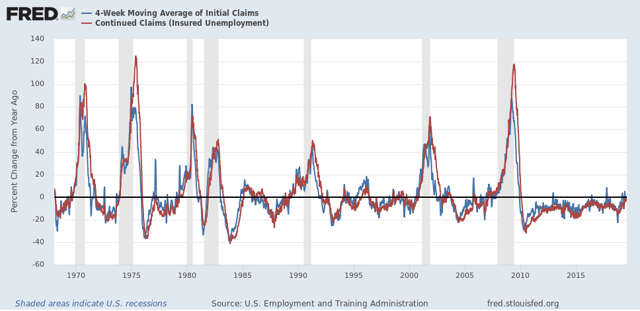

Initial jobless claims last week were 216,000. This is average for the past 18 months. As of this week, the four week average is 8.6% above its recent low:

and at 218,750, is only 250, or -0.1%, lower than this week last year:

This remains positive.

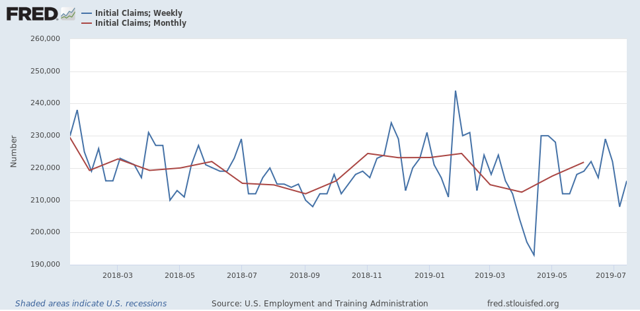

Last July, initial claims averaged 215,250 (red). Through the first two weeks, it is 212,000 this year (blue), which is also positive:

So this too remains positive.

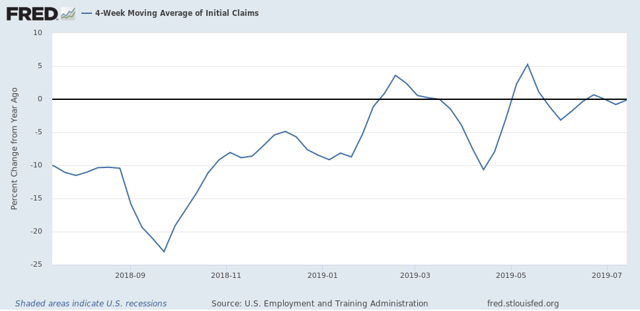

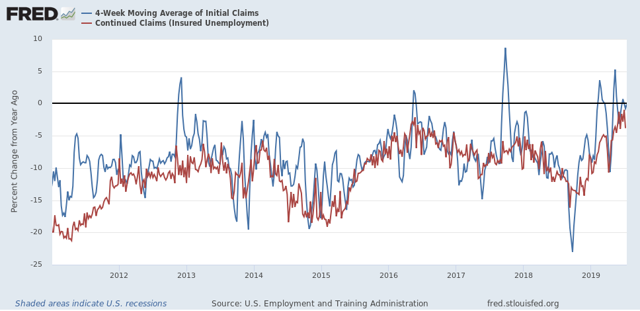

Finally, let’s compare the YoY% change in initial claims (blue) with continuing claims (red):

Comparisons have been getting closer to crossing the threshold from lower to higher, but this week moved lower to -3.8% YoY. A longer term view shows that - so far - this is most consistent with the 1984, 1994, and 1996 slowdowns, and not a recession:

Wednesday, July 17, 2019

June residential construction report a decidedly mixed bag

- by New Deal democrat

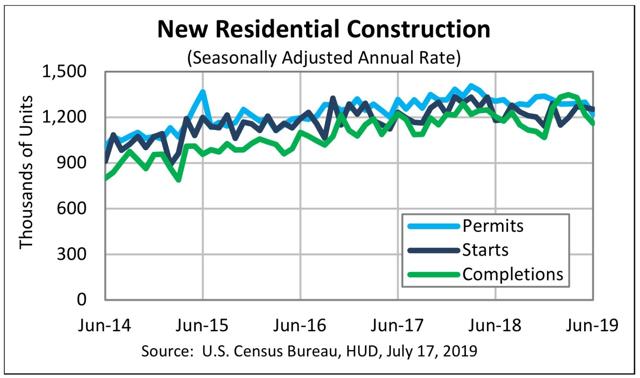

The Census Bureau’s report on residential construction for June was a decidedly mixed bag. Here’s their graph of permits, starts, and completions:

On the positive side, even though starts declined slightly in June, the three month average, which is the best way of looking at this measure due to its noisy m/m readings, improved to the best number in 13 months. Starts are real economic activity, and bode well for 2020. Single family permits (not shown above) - the least noisy of all the leading housing indicators - also improved to 813,000, suggesting that April’s reading of 786,000 may have been their low.

On the negative side, total permits declined to 1.22 million annualized, which is the lowest reading in over 2 years, and is -13.2% below their March 2018 peak of 1.406 million. This is a bigger decline than that which preceded the 2001 recession. In other words, it is consistent with what might be seen in advance of a producer-led recession.

Additionally, total completions (green in the graph above) fell to a five month low. Since residential construction employment generally turns shortly after completions turn, this renewed decline in the past several months means that we can expect to see declines in this leading employment sector as well in the next several months.

As I said at the beginning, a very mixed bag. I’ll have a more detailed post up at Seeking Alpha probably tomorrow.

Tuesday, July 16, 2019

June consumption was strong, while production was weak

- by New Deal democrat

This morning’s retail sales and industrial production releases for June are consistent with my take that the consumer sector of the economy is doing OK, while the production sector remains in trouble.

Let’s start with retail sales.

Retail sales are one of my favorite indicators, because in real terms they can tell us so much about the present, near term forecast, and longer term forecast for the economy.

This morning retail sales for June were reported up +0.4%, while May was revised downward by -0.1%. Since consumer inflation increased by less than 0.1% last month, through the magic of rounding, real retail sales also rose +0.4%. The strength of the past two months means that YoY real retail sales are now up +1.7%.

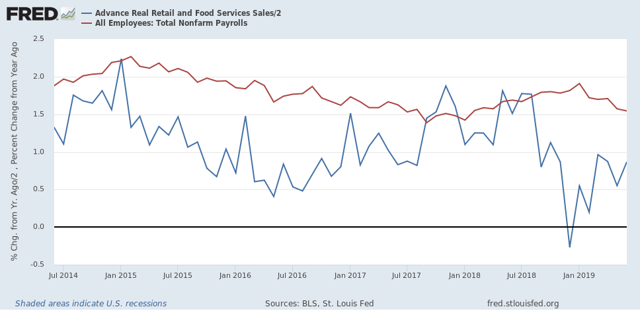

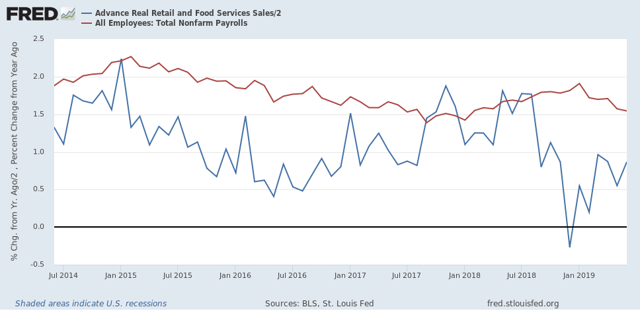

Here is what the last five years look like:

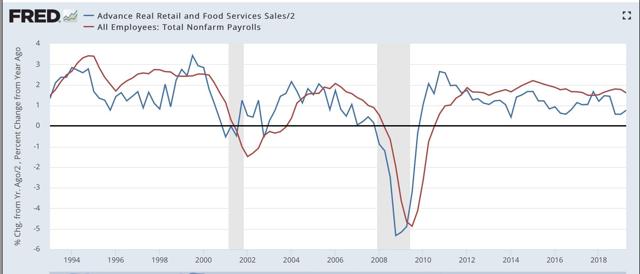

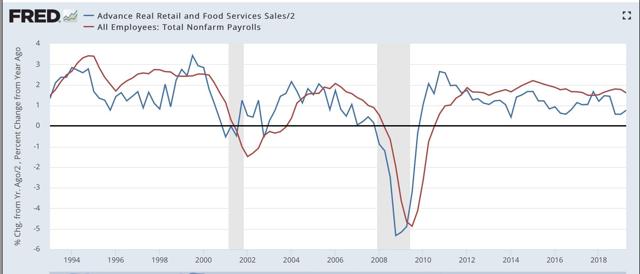

Next, although the relationship is noisy, because real retail sales measured YoY tend to lead employment (red in the graph below) by a number of months, here is that relationship for the past 25 years, measured quarterly to cut down on noise:

Now here is the monthly close-up of the last five years. You can see that it is much noisier, but helps us pick out the turning points:

I still expect some softness in the employment reports in the next few months, but the renewed strength in real retail sales means that it may pass.

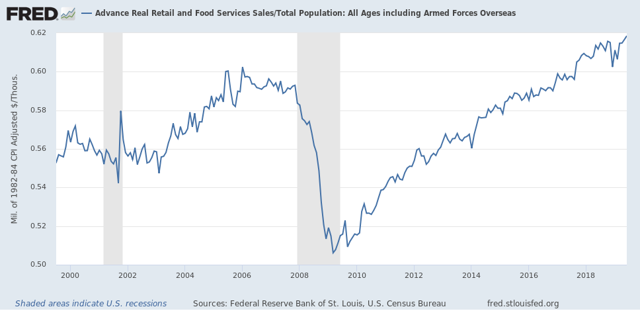

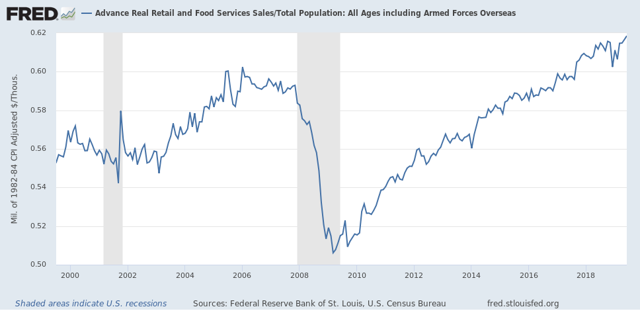

Finally, real retail sales per capita is a long leading indicator. In particular it has turned down a full year before either of the past two recessions:

As these made yet another new high in June, that is an argument against any actual downturn in the economy for the rest of this year.

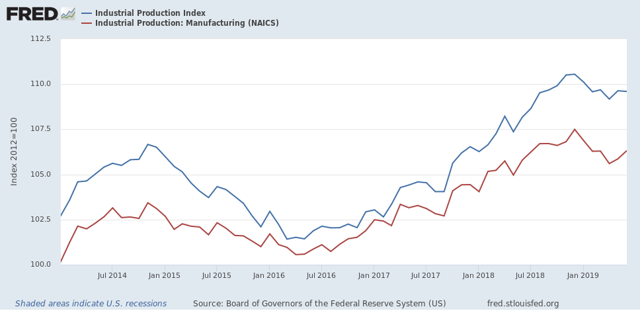

But if the consumer side of the economy looks pretty good, the production side continued to lag in June, as industrial production as a whole was unchanged. Manufacturing production did increase +0.4%:

This morning retail sales for June were reported up +0.4%, while May was revised downward by -0.1%. Since consumer inflation increased by less than 0.1% last month, through the magic of rounding, real retail sales also rose +0.4%. The strength of the past two months means that YoY real retail sales are now up +1.7%.

Here is what the last five years look like:

Next, although the relationship is noisy, because real retail sales measured YoY tend to lead employment (red in the graph below) by a number of months, here is that relationship for the past 25 years, measured quarterly to cut down on noise:

Now here is the monthly close-up of the last five years. You can see that it is much noisier, but helps us pick out the turning points:

I still expect some softness in the employment reports in the next few months, but the renewed strength in real retail sales means that it may pass.

Finally, real retail sales per capita is a long leading indicator. In particular it has turned down a full year before either of the past two recessions:

As these made yet another new high in June, that is an argument against any actual downturn in the economy for the rest of this year.

But if the consumer side of the economy looks pretty good, the production side continued to lag in June, as industrial production as a whole was unchanged. Manufacturing production did increase +0.4%:

On the one hand, both may have bottomed in April, following the “mini-recession” brought on by the January government shutdown and some trade war fallout. On the other, both remain significantly below their expansion peaks set six months ago.

If an actual downturn is going to begin in the production sector, it will show up first in the new orders portions of the regional Fed indexes, the average of which has remained above zero so far.

Monday, July 15, 2019

The consumer vs. the producer economy

- by New Deal democrat

Prof. Edward Leamer wrote over a decade ago that, in a consumer led recession, first housing turns, then vehicle sales, then other consumer goods.

What do home and vehicle sales tell us now about the economy, vs. corporate profits? This post is up at Seeking Alpha.

As usual, clicking over and reading puts a penny or two in my pocket.

Sunday, July 14, 2019

WARNING: another “debt ceiling debacle” is looming, and could cause nearly immediate recession

- by New Deal democrat

It’s time to start to get seriously worried about another “debt ceiling debacle.” In 2011, the GOP refused to authorize a “clean” debt ceiling hike. The hike in the debt ceiling, for those who may not know, is necessary for the US government to pay debts that *it has already incurred.*

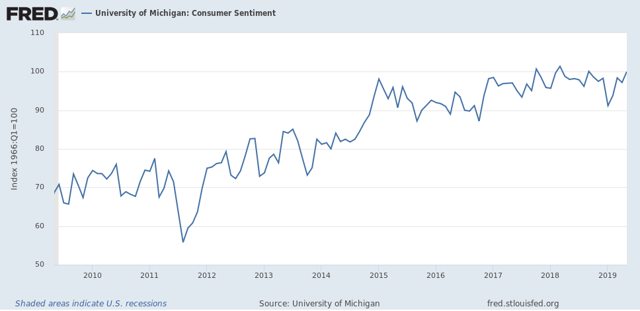

In 2011, as a result of the impasse, US creditworthiness was downgraded from AAA to AA. Consumer confidence plummeted:

Note the next largest spike downward occurred during the government shutdown at the beginning of this year.

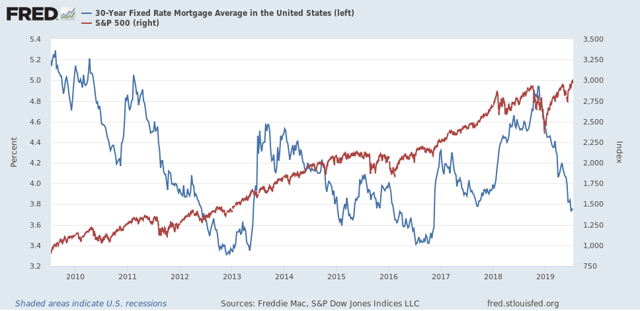

In both cases - the debt ceiling debacle and the government shutdown - Long bond rates (mortgages, shown in blue below) plunged in a “flight to safety,” and stock prices (red) also plunged about 15%:

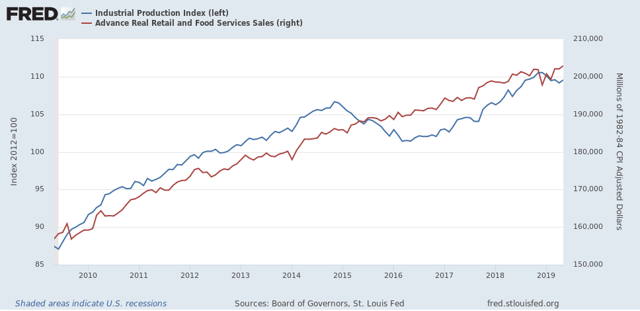

We know, of course, that the stock market is not the “real” economy. In 2011, consumers nevertheless continued to spend (red in the graph below) and industry continued to expand (blue), but during the government shutdown at the beginning of this year, both went sideways or declined:

As I write this, it is almost certain that the economy is already in a slowdown. It is dicey enough that, although I see slowdown as the most likely scenario, I already am on “Recession Watch” for a possible downturn centered on Q4 of this year. Another knock like the “mini-recession” we had from December through February as the result of the government shutdown is the last thing we need.

But we may be about to get it. Congress is scheduled to go on recess after August 2, and not return until after Labor Day in September. According to various news organizations,

Treasury Secretary Steven Mnuchin put his request on paper for Congress to act on the debt ceiling before the August recess, writing to congressional leaders Friday that there’s a chance Treasury could run out of cash in early September.

Pelosi and Republican leaders are looking to strike a multi-year deal to lift the nation’s $22 trillion debt limit and nix Congress’ stiff spending caps, which threaten billions of dollars of cuts at year’s end.

“I am personally convinced that we should act on the caps and the debt ceiling,” Pelosi told reporters on Thursday evening, adding that it should be done “prior to recess.”

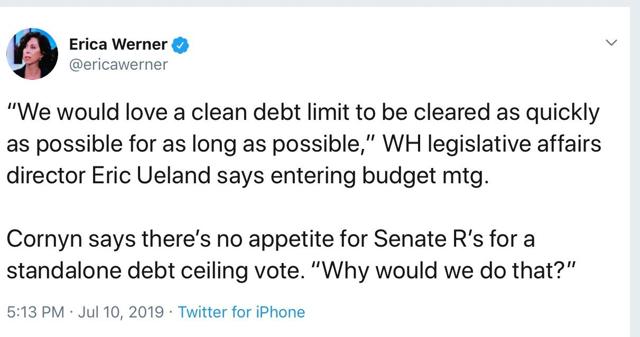

But here is a giant sticking point:

Meanwhile, Mitch McConnell, who may be evil but is nevertheless by far the shrewdest operator in Washington, is keeping his cards close to his vest:

[telling] a weekly leadership press conference that lawmakers wouldn’t let the United States default on its debt, but he didn’t offer a clear pathway to approving a debt ceiling increase.

“Time is running out, and if we’re going to avoid having either short- or long-term CR or either a short- or long-term debt ceiling increase, it’s time that we got serious on a bipartisan basis to try to work this out [...]” McConnell said. A CR, or continuing resolution, would fund the government at current spending levels.

Asked if Congress had to raise the debt ceiling before the August recess, McConnell sidestepped the question, saying lawmakers are in close contact with Mnuchin about the timeline but that he doesn’t “think there’s any chance that we’ll allow the country to default.”

Way back in 2011 I railed against Obama enabling the GOP’s debt brinksmanship, arguing that it only set a precedent for further blackmail. And here we are.

But as cagey as McConnell may be, as we saw with the government shutdown, Trump is not only willing to hold hostages, but to execute some in order to try to get his way and please his base. All it will take is a few segments on Fox TV for him to once again blow up any deal McConnell brokers.

There are three workweeks left until Congress’s summer recess. If for any reason we actually go over the brink this time, there is an excellent chance that the slowdown almost immediately tips into recession.

Subscribe to:

Comments (Atom)