- by New Deal democrat

Consumer prices were unchanged in July, as two very disparate trends canceled out one another. YoY prices increased 8.5%, below June’s multi-decade record of 9.0%:

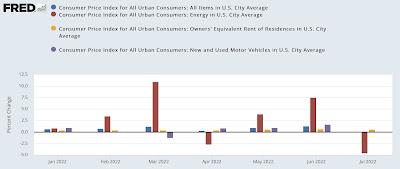

The two disparate trends are shown in the below bar graph of monthly changes since the end of last year. On the one hand, energy prices (red) declined -4.6% in July; but owner’s equivalent rent (gold) - which is 1/4 of the entire index - increased 0.6%. Motor vehicle prices (purple) were unchanged, as was total inflation (blue):

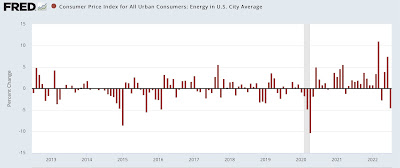

July’s decline in energy prices was the steepest since 2015-16, with the exception of the pandemic lockdown months:

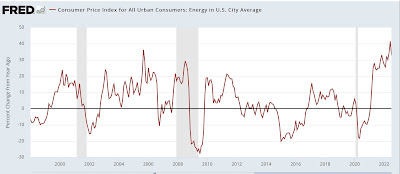

But YoY energy prices are still up 32.9%:

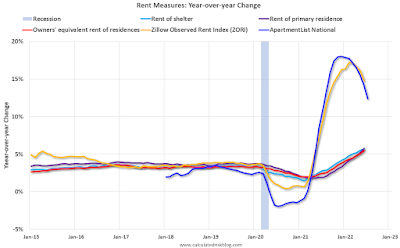

But as indicated above, that was completely counterbalanced by housing, as shown below by the YoY% changes in the FHFA house price index (blue) vs. owner’s equivalent rent (red):

OER has continued to accelerate on a YoY basis, up 5.8% in the last 12 months, the highest since September 1990, clearly following house prices with roughly a 12 month lag. Since house prices had not meaningfully decelerated through May, the last month measured in the index, it is still likely that OER has not hit its YoY peak. We are likely to see the highest YoY% increase for OER ever before this episode is over.

While vehicle prices were unchanged overall, the situation was slightly different for new cars, which increased 0.6% in July, and are up 10.4% YoY, vs. used cars, which declined -0.4% for the month, and are up 6.6% YoY:

Finally, since average hourly earnings for nonsupervisory employees increased 0.4% in July, after rounding real average hourly wages increased 0.3% for the month. Real wages are nevertheless down 3.0% from December 2020:

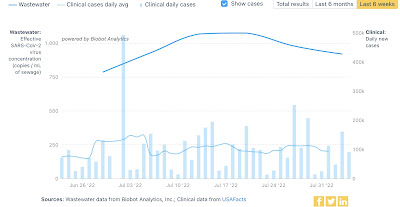

While so far energy prices are continuing to decline in August, they will almost certainly not decline by as much as they did in July. Meanwhile OER, as indicated above, is likely to continue to increase. So I am not expecting an abrupt cooling off of consumer inflation.