- by New Deal democrat

This morning’s reports on personal income and spending continue to show a consumer that is doing alright. Meanwhile durable goods orders continue to show a production sector that is struggling.

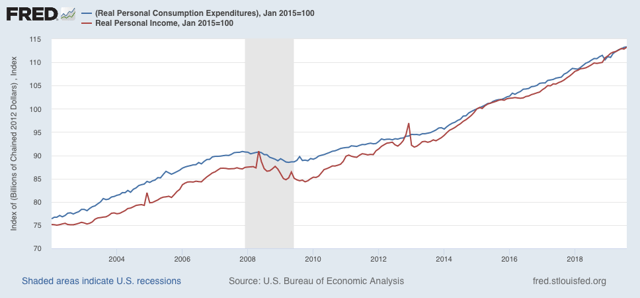

First, real personal income (red in the graph below) rose +0.4% in August, while real personal spending rose +0.1%. Since July spending (blue) was revised down -0.1%, the result was a wash:

The rising trend remains intact.

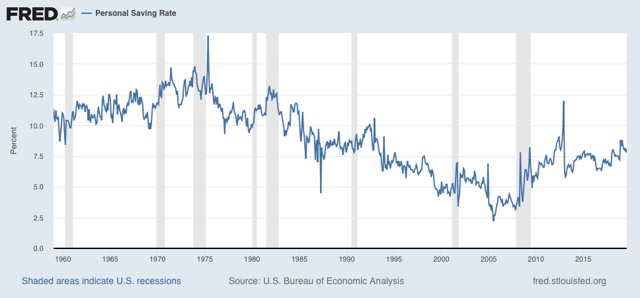

In general, spending has slightly lagged income in the past few years. Thus the personal saving rate has increased:

Overall the savings rate has increased since before the Great Recession, meaning that households are being more cautious with spending. This is a real change in the trend of declining savings that started in about 1980.

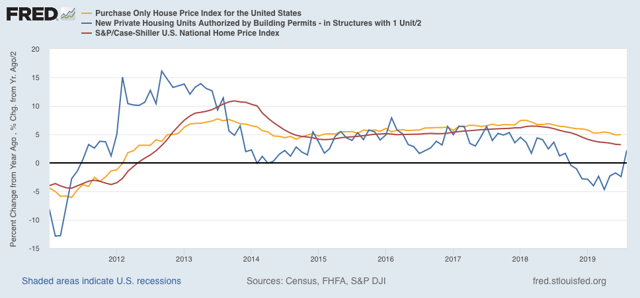

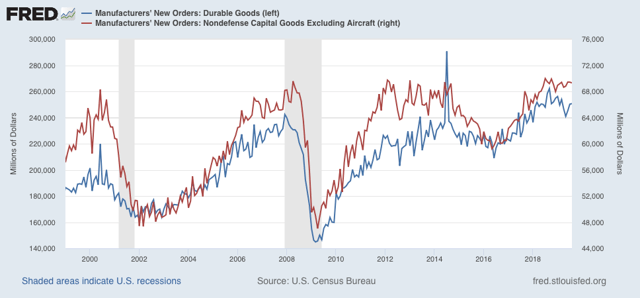

Meanwhile, durable goods orders for August (blue in the graph below) were up a slight +0.2%, while “core” durable goods orders (minus defense and Boeing)(red) declined -0.2%:

Because there are unique issues with the Boeing 737 Max, I think “core” orders are less helpful than usual. The bottom line is that durable goods orders remain in decline compared with the end of last year, similar to but not as bad as prior to the producer-led 2001 recession.

In short, the consumer continues to do OK. The weakness has been on the producer side, although not enough at this point to signal a recession.