- by New Deal democrat

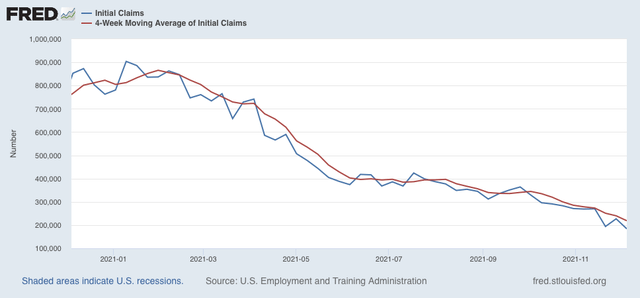

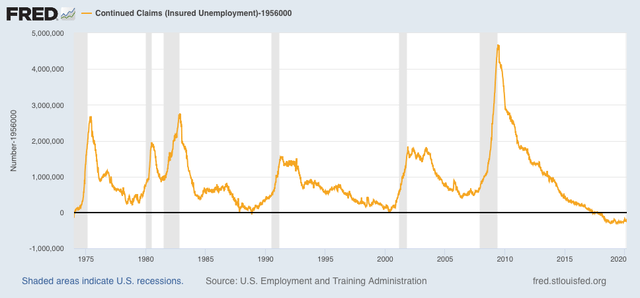

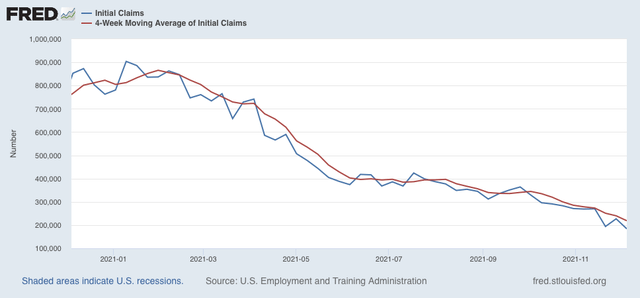

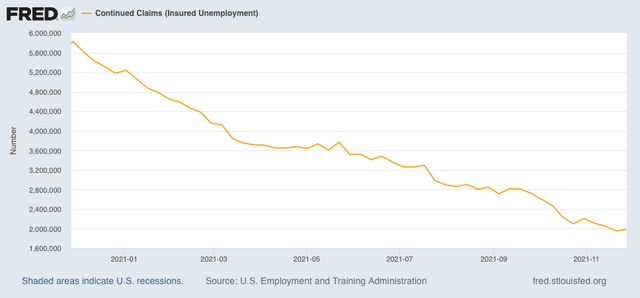

Initial and continuing jobless claims continue at or near their best levels in the past half-century.

Initial claims declined 43,000 to 184,000, a new 50 year low, while the 4 week average declined 21,250 to 218,750, also a new pandemic low, and in the past 50 years only bettered by the period from late 2018 until February 2020:

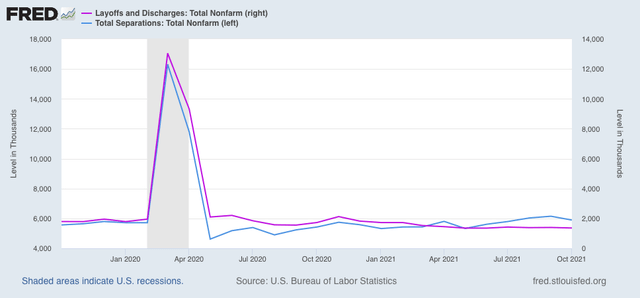

For all intents and purposes, nobody is getting laid off.

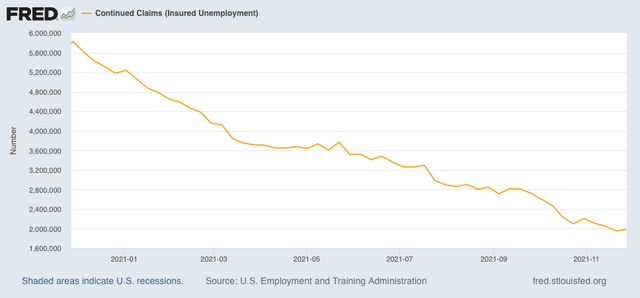

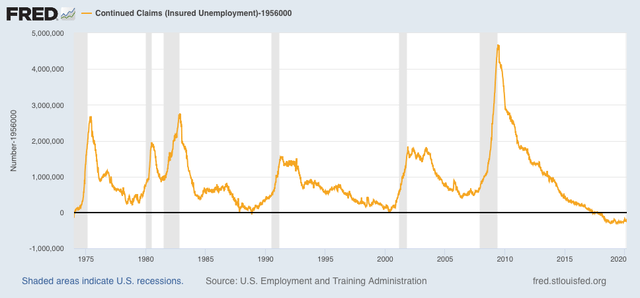

Continuing claims rose 38,000 to 1,992,000 from last week’s pandemic low:

Still, since 1974, aside from last week, only two weeks in the late 1980s, and the last 3 years of the last expansion were below this number:

This is further confirmation of what was reported yesterday in the JOLTS report for October, where layoffs and discharges were a hair above their all time low set in May.

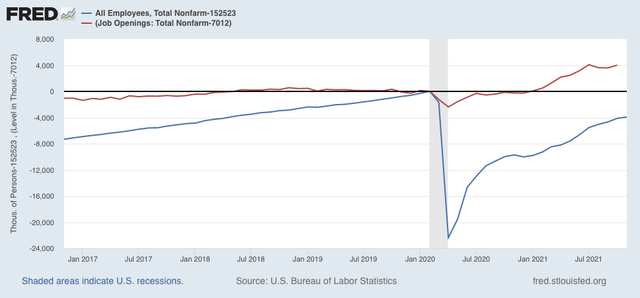

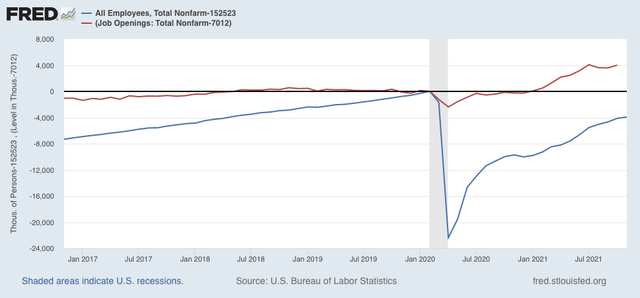

Below is a comparison of total jobs from the monthly jobs report, vs. job openings from the JOLTS report, both set to 0 as of February 2020 just before the pandemic:

Note that since autumn one year ago, the two have been running in parallel, with job openings roughly 8,000 to 10,000 above the level of workers compared with just before the pandemic.

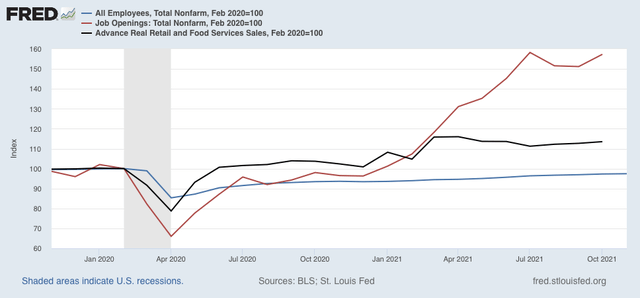

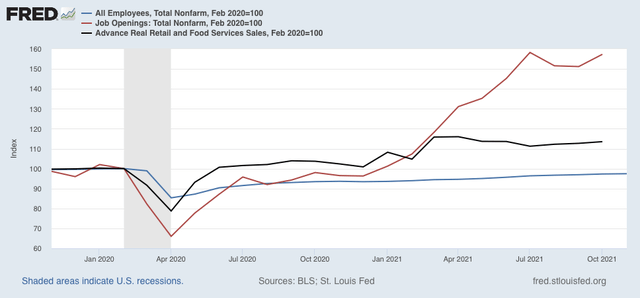

Adding in real retail sales (black in the graph below) helps put the two series in perspective:

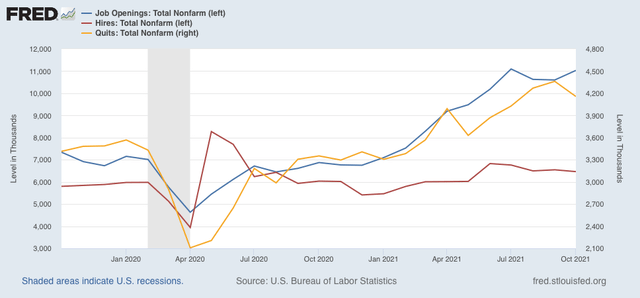

Before the pandemic hit, job openings were running at approximately 7 million a month. They returned to that level by January of this year, and have since increased to about 11 million per month.

Similarly, real retail sales returned to their pre-pandemic level in June of 2020, and began taking off from that level in January of this year.

In other words, we have had a persistent situation going back at least 12 months where the level of sales in the economy justified a level of employment in the aggregate equal to that just before the pandemic hit, but there was a huge shortfall in the number of employees actually hired to perform that work.

The imbalance really took off with the arrival of vaccines at the beginning of this year, together with further Congressional stimulus.

Right now we still have roughly a 4 million shortfall in employees compared with just before the pandemic, and about 4 million new job openings over and above that which existed just before the pandemic. Over and above that, sales are running over 10% higher than they were just before the pandemic.

Most importantly, it is the pandemic dangers themselves, and their secondary effects, which are responsible for this shortfall. Jobs which require face to face interactions with unvaccinated Covidiots are going to go unfilled unless there is a very big $$$ premium to undertake that risk. The shortage or unavailability of child care for other potential workers is keeping them from the workplace.

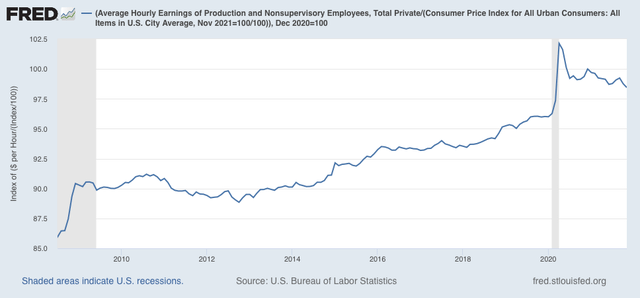

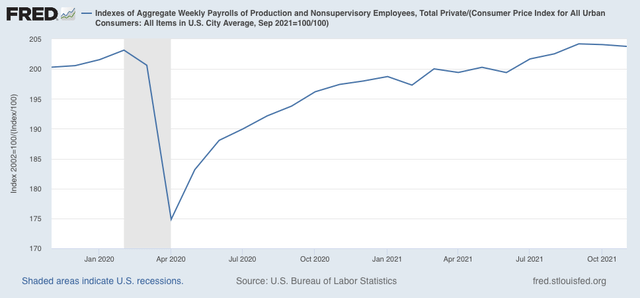

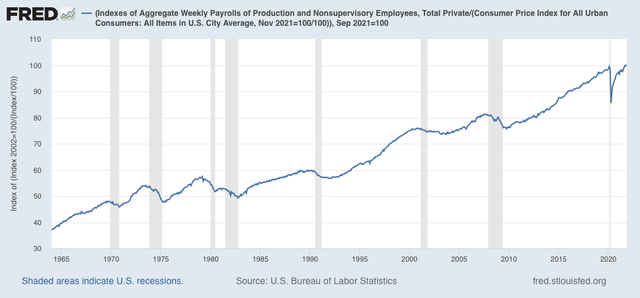

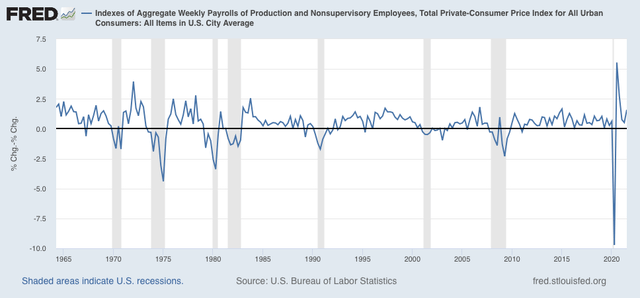

The shortfall in available workers has, unsurprisingly, led to a competition for workers, which means wages are going up sharply, as the employer paying the least is having their jobs unfilled.

Take care of the pandemic, and the shortfall in jobs, both in payrolls and in openings, will be resolved. Until then, it will persist.