The pace of economic activity appears to have slowed markedly, owing importantly to a decline in consumer expenditures. Business equipment spending and industrial production have weakened in recent months, and slowing economic activity in many foreign economies is damping the prospects for U.S. exports. Moreover, the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit.

The crisis has yet to affect the job market in Europe's largest economy, Germany. The number of unemployed people there fell to 2.997 million from 3.081 million in September, translating into a fall in the jobless rate to 7.2% from 7.4%, data from Germany's labor office showed. German labor-office think tank IAB said it expects the first signs of adverse economic effects to feed into the work force in the second half of 2009. Some economists say those signs could emerge earlier.

"Unfortunately, this is probably just [Germany's] last hurrah. With the economy slipping into a serious recession, unemployment looks set to shoot up significantly next year," said Holger Schmieding, an economist at Bank of America in London.

Consumer gloom is dragging down retail sales in the region and is likely to feed through to weaker output. Spanish retail sales in September fell 5.6% on the year in calendar-adjusted terms after falling 5.9% in August and 6% in July, data from Spain's National Statistics Institute showed.

Manufacturers' selling-price expectations fell for a third consecutive month in October. The indicator that measures consumers' price expectations over the next 12 months edged up to plus 19 from plus 17, indicating more people expected prices to rise over the coming year. But October's figure was well below June's plus 31, indicating consumers think the inflation peak has passed.

Japanese Prime Minister Taro Aso unveiled a stimulus package with five trillion yen ($51.5 billion) in new government spending to buttress Japan's economy against the fallout from the global financial crisis.

.....

The stimulus package is the country's second in two months, and follows similar moves by governments world-wide. Japan, which economists say faces a steep recession, announced a set of stimulus steps in August with about 1.8 trillion yen in new spending to tackle high energy and material costs. The Bank of Japan is also considering a cut in Japan's already low interest rates for the first time in seven years.

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 0.3 percent in the third quarter of 2008, (that is, from the second quarter to the third quarter), according to advance estimates released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.8 percent.

.....

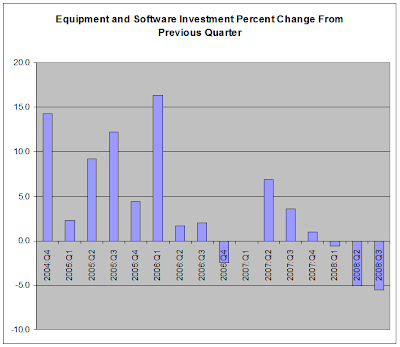

The decrease in real GDP in the third quarter primarily reflected negative contributions from personal consumption expenditures (PCE), residential fixed investment, and equipment and software that were largely offset by positive contributions from federal government spending, exports, private inventory investment, nonresidential structures, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

General Motors Corp. said its third-quarter vehicle sales dropped 11% world-wide, the latest indication that growth overseas has stopped offsetting declining sales in North America.

GM, marking its third straight quarterly drop, sold 2.11 million vehicles in the quarter. That pushed GM, until recently the world's largest auto maker by sales, further behind Toyota Motor Corp., which last week reported third-quarter global sales of 2.24 million vehicles, down 4%.

In North America, a slumping U.S. market and a consumer shift to smaller cars from trucks, on which GM depends for much of its revenue, are hurting the auto maker. Until this year, overseas growth had kept GM's total vehicle sales rising, but sales in Western Europe have slid and key emerging markets show signs of weakness as economic and credit turmoil hurt consumer confidence.

While both presidential candidates enter the campaign’s final week promising to be the better fiscal steward, each has outlined tax and spending proposals that would make annual budget deficits worse, analysts say, with Senator John McCain likely to create a deeper hole than Senator Barack Obama would.

Both John McCain and Barack Obama have proposed tax plans that would substantially increase the national debt over the next ten years, according to a newly updated analysis by the non-partisan Tax Policy Center. Compared to current law, TPC estimates the Obama plan would cut taxes by $2.9 trillion from 2009-2018. McCain would reduce taxes by nearly $4.2 trillion. Obama would give larger tax cuts to low- and moderate-income households and pay some of the cost by raising taxes on high-income taxpayers. In contrast, McCain would cut taxes across the board and give the biggest cuts to the highest-income households.

But for the long run, they say, the president’s fiscal record will hinge on whether he can achieve the health care cost savings each promises, which in turn will help control the fast-rising expenses for Medicare and Medicaid. Neither candidate has a comprehensive proposal to address unsustainable growth in those programs.

Home prices in 20 major U.S. cities dropped 1% in August compared with July and fell a record 16.6% from the previous year, according to the Case-Shiller home price index published Tuesday by Standard & Poor's.

Prices have fallen 20.3% from their peak in June 2006.

"The downturn in residential real estate prices continued, with very few bright spots in the data," said David Blitzer, chairman of the index committee at S&P.

Prices have fallen in all 20 cities compared with a year ago. In the past year, Phoenix and Las Vegas have had the largest declines, down nearly 31% in both cities. Prices had fallen the least in Dallas (down 2.7%) and in Charlotte (down 2.8%). Prices fell more than 20% in six cities.

Wounded by the financial crisis, U.S. consumer confidence plunged in October, reaching an all-time low in the series' 41-year existence, the Conference Board reported Tuesday.

Despite falling gasoline prices, the October consumer confidence index fell to 38 from an upwardly revised September reading of 61.4. Economists surveyed by

MarketWatch had expected an October reading of 52. See Economic Calendar.

Expectations turned "significantly more pessimistic," with the percentage of consumers expecting business conditions to worsen over the next six months rising to 36.6% from 21%, and those expecting fewer jobs rising to 41.5% from 26.9%.

"Their earnings outlook, as well as inflation outlook, is also more pessimistic, and this news does not bode well for retailers who are already bracing for what is shaping up to be a very challenging holiday season," said Lynn Franco, director of the Conference Board Consumer Research Center.

U.S. life insurers are in talks with the government for potential investments as companies jockey for the remaining $90 billion of the $250 billion set aside to prop up ailing financial companies.

The Treasury has been ``asking us how we can fit into the program,'' said Jack Dolan, spokesman for the Washington, D.C.- based American Council of Life Insurers, declining to name companies that may participate.

Life insurers, including MetLife Inc. and Prudential Financial Inc., have lost more than half of their value this month on concern that investment declines will squeeze liquidity and force them to raise capital. American International Group Inc., once the world's largest insurer, ceded control to the U.S. on Sept. 16 after losses from bad bets tied to housing.

Sales of new houses in the U.S. were unexpectedly rising before credit markets froze this month, having rebounded from a 17-year low thanks to a drop in prices.

Purchases increased 2.7 percent in September to an annual rate of 464,000 from 452,000 the prior month that was less than previously estimated, the Commerce Department said today in Washington. The median sales price decreased to a four-year low.

"Retail executives are expecting this to be the toughest holiday season in more than 15 years," said Doug Hart, a partner in BDO Seidman's retail and consumer products practice. The pessimism is "pretty broad across all the categories," except at discounters, which typically do well in an economic downturn.

Thirty-nine percent of the executives said they expect same-store sales to decline this holiday season, 41% said they expect flat sales and 20% said they expect sales to rise. Last year, only 5% of chief marketing officers told BDO Seidman that they expected sales to fall and 41% said they expected to ring up higher sales.

In a more ominous sign, 65% of the executives said they don't expect to see a meaningful economic turnaround until the third quarter of 2009 at the earliest. The survey, conducted Sept. 22 through Oct. 17, involved executives at retail companies with sales of more than $100 million, said BDO Seidman, an accounting and consulting firm.

Asian markets swooned for the second straight trading day as fearful investors pulled out of the region's equity and currency markets, leading to a 12.7% drop in Hong Kong and a 6.4% drop in Tokyo.

.....

Markets in Shanghai, the Philippines and Taiwan also fell, while Mumbai and Bangkok were down intraday.

In Europe, the pan-European Dow Jones Stoxx 600 index fell 5% to 188.82, a level not seen since early 2003. The U.S. looked set for a dismal opening: The S&P 500 index futures contract was trading 4.3% lower at 828.70.

A rash of new job data show the labor market is now the worst it's been since the two prior recessions in 2001 and the early 1990s. One of the starkest indicators is that the number of people who have been unemployed for 27 weeks or more reached two million in September. That's 21% of the total unemployed, and approaching the prior peaks of about 23% in 2003 and 1992. The prospects of these job seekers grow dimmer as layoffs spread beyond the financial, home-building and auto industries.

Also in September, companies saw 2,269 mass layoffs -- in which at least 50 people are let go at once -- more than at any time since September 2001. And while the unemployment rate is at a five-year high at 6.1%, a broader measure of weakness that includes people who have stopped looking for work or whose hours have been cut to part-time is 11% -- the highest in 15 years.

What worries many economists is that labor markets usually reach their weakest point after a recession has ended. During the so-called "jobless recovery" following the 2001 recession, jobs continued to be shed after it was officially declared over. But the current weakness comes as the country heads into a recession that is now forecast to be deeper and longer than previously thought.

"No one thinks we are anywhere near the bottom of this, and we're already rivaling these other recessions," says Heidi Shierholz, an economist at the Economic Policy Institute, a left-leaning think tank in Washington.