- by New Deal democrat

This will be income, spending, and housing week, but that won’t start until tomorrow. While there’s no news today, there was an important update to employment data last week; namely, the QCEW for Q3 of last year.

As a refresher, the Quarterly Census of Employment and Wages is just that, a *census* rather than a survey. It includes something like 95% of all businesses, and is taken from their tax reporting. This means it is not an estimate or guess, but very close to a full itemized count. The drawback being, of course, that it doesn’t get reported until almost 6 months later.

Since at least June of 2023, the QCEW has been telling us that the monthly jobs report has been over counting employment. The recent benchmark revisions downwardly revised 2023 and 2024 employment by about -600,000.

And the Q3 2024 QCEW tells us it will probably have to be revised down further.

Since the QCEW is not seasonally adjusted, the only way to measure is YoY. Also, unfortunately FRED does not pick up the data for easy putting in graphic form. But here is the crucial chart:

To cut to the chase, in the first five months of last year, employment grew either 1.3% or 1.4% YoY. That suddenly downshifted in June, and remained anemic through September, with YoY growth of 0.8% to 1.0%.

Now leet’s compare that with a graph of the YoY% growth in nonfarm payrolls:

With the recent benchmark revisions, the YoY growth rate in jobs for the first five months of last year is now estimated at 1.4%-1.6%, only slightly higher than the QCEW. But in the JUne through September period, it is 1.2% or 1.3%, significantly higher than the QCEW.

According to the crrrent nonfarm payrolls numbers, the economy added almost 2 million jobs during the 12 months from September 2023 through September 2024. If we bring that down to a 0.9% gain (the average of the June through September YoY gains as measured by the QCEW, that brings us down to a 1.4 million job gain, a difference of -600,000, primarily centered on the last four months of that period.

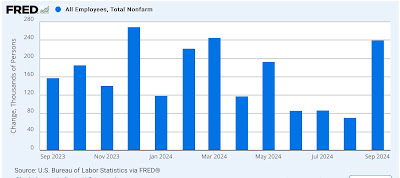

Now here is a graph of the monthly gains in jobs during that same 12 month period:

The current estimate of job gains in the June through September 2024 period is 486,000, including three very anemic months. If we apply the YoY downshifting of the QCEW during those months, all of those gains disappear.

At the same time, it’s important to note that all of the QCEW numbers for 2024 are preliminary at this point. In 2023 there was a similar cratering of the QCEW, strongly suggesting actual job losses - that subsequently disappeared when the QCEW for that year was finalized.

Finally, let me emphasize that the above does not mean there was a recession last year. Almost all of the other important indicators showed continued growth through the period. And the QCEW also reports wage growth, and there it showed continued aggregate wage growth of 4.4% and 4.5% in Q2 and Q3 of last year, very much in line with aggregate nonsupervisory payrolls from the monthly reports:

Still, it’s another cautionary signal that the economy last year (which also means the economy going into the November elections) probably was not as strong as was thought at the time.