- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

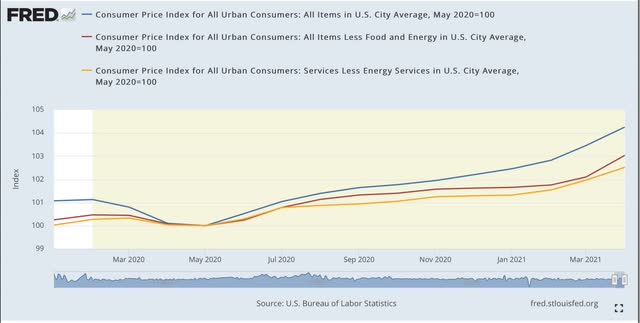

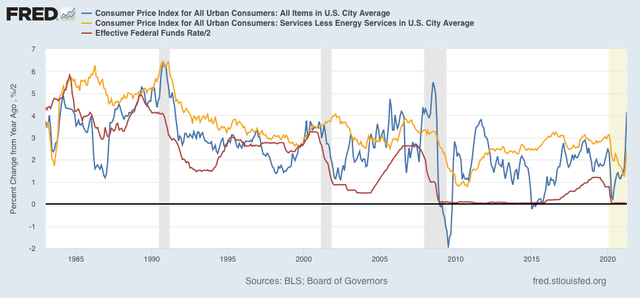

The big news in this past week, even though it has been expected for several months, was on the inflation front. That doesn’t affect the nowcast, and hasn’t affected the short term forecast yet. The long term forecast continues to be buffetted by increased interest rates.

In my commentary this week, I make reference to supply constraints. I bring this up here because I read a tweet today by someone whose political analysis I respect, showing a graph of the spike in lumber prices, and stating that lumber was “in a bubble.”

No it’s not. The defining feature of a bubble is speculation on the continuing increase in prices. Fifteen+ years ago it was “everyone knows real estate only goes up!” In 1999 it was “everyone knows these internet companies are going to completely take over commerce!” In 1929 it was “stock prices have reached a permanently high level!” In the 1700s it was “the price of land in the Mississippi Valley is going to explode!” - which was sort of correct, but it took 200 years to happen. As they say, “being early” is a synonym for “being wrong.”

What is happening with lumber, and computer chips, is similar to what happened during the Oil Embargo of the 1970s. This is a supply constraint. Product cannot (in the 1970s, would not) be supplied fast enough to meet the demand. So the way the product gets rationed is to raise prices until enough buyers stop buying.Whether it is a significant problem or not depends upon how quickly the pace of supply can be increased, a question that I do not pretend to know the answer to.

In any event, as usual, clicking over and reading will bring you up to the virtual moment, and bring me my lunch money.