To that end here are some pictures of our children.

See you on Monday

| Year | Nonfarm housing starts | 2009 equivalent |

|---|---|---|

| 1920 | 247 | 699 |

| 1921 | 449 | 1236 |

| 1922 | 716 | 1953 |

| 1923 | 371 | 994 |

| 1924 | 893 | 2350 |

| 1925 | 937 | 2423 |

| 1926 | 849 | 2177 |

| 1927 | 810 | 2042 |

| 1928 | 753 | 1867 |

| 1929 | 509 | 1252 |

| 1930 | 330 | 805 |

| 1931 | 254 | 615 |

| 1932 | 134 | 322 |

| 1933 | 93 | 221 |

| 1934 | 126 | 300 |

| 1935 | 221 | 522 |

| 1936 | 319 | 748 |

| 1937 | 336 | 781 |

| 1938 | 406 | 937 |

| 1939 | 515 | 1179 |

| 1940 | 602 | 1368 |

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers were flat in July. The general business conditions index increased to a level close to zero, rising 9 points, to -0.6. The new orders index rose above zero for the first time in several months, and the shipments index also climbed into positive territory. The inventories index slipped to a record-low -36.5. The prices paid index rose above zero for the first time since November, while the prices received index held below zero. Employment indexes remained well below zero. Future indexes continued to be relatively optimistic about the six-month outlook, but were somewhat less buoyant than in June. The capital spending index fell several points, but remained above zero.

Not so fast, say the plan's authors. Larry Summers, director of the National Economic Council, says the stimulus already has contributed to the economy's recent stabilization. And Summers insists unemployment might already have hit 10% if the president hadn't acted. "I think the stimulus is just about on track, progressing about as we expected," he tells USA TODAY.

As of July 3, the administration says, about $217 billion of the stimulus is being felt throughout the economy. That breaks down into: $43 billion in payroll tax relief plus $174.9 billion the government has committed to contracts.

In Boulder, Colo., Blake Jones, president of Namaste Solar, says the stimulus saved about 15 jobs at his small manufacturer. A $3 billion Treasury Department program converted an existing tax credit for solar investments to a direct payment, prompting commercial customers who no longer could benefit from a tax credit to go ahead with projects.

"The outlook was very bleak. ... Now we're anticipating not losing business, but we may continue growing," Jones said.

While critics complain that the stimulus has been slow out of the gate, Summers says the administration always planned for the stimulus to work over a two-year period. So far, the modest economic boost from the government coffers has been overwhelmed by other developments. Oil prices have risen from roughly $35 a barrel in February to just under $60 today, draining more than $165 billion from the economy on an annual basis. Partly in response, the July reading of consumers' expectations for the future took its biggest dive since October.

2. While the auto layoffs anomaly is a fair criticism, the proper way to deal with it is to spread the adjustment over the last ~10 weeks, with the result that the 4 week moving average would still be under 600,000 or about 10% under the peak from April, which suggests that this is a "real" indicator of nearly imminent GDP recovery.

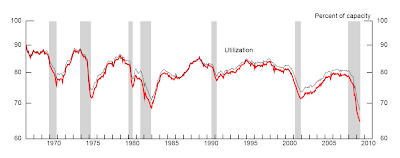

Industrial production decreased 0.4 percent in June after having fallen 1.2 percent in May. For the second quarter as a whole, output fell at an annual rate of 11.6 percent, a more moderate contraction than in the first quarter, when output fell 19.1 percent. Manufacturing output moved down 0.6 percent in June, with declines at both durable and nondurable goods producers. Outside of manufacturing, the output of mines fell 0.5 percent in June, and the output of utilities increased 0.8 percent. The rate of capacity utilization for total industry declined in June to 68.0 percent, a level 12.9 percentage points below its average for 1972-2008. Prior to the current recession, the low over the history of this series, which begins in 1967, was 70.9 percent in December 1982.

Intel Corp's quarterly results and outlook blew past Wall Street forecasts on better-than-expected consumer demand for PCs, especially in Asia, setting an auspicious tone for the technology sector.

Shares of Intel, the world's largest chipmaker, jumped 8 percent on the report, driving Standard & Poor's 500 stock index futures sharply higher and bolstering technology shares such as arch rival Advanced Micro Devices Inc.

Intel projected third-quarter revenue at $8.1 billion to $8.9 billion, compared with analysts' average forecast of $7.8 billion, according to Reuters Estimates.

CFO Stacy Smith said fourth-quarter gross margins could scale the high end of a "normal" range -- which Intel defines as 50 to 60 percent -- due partly to declining production costs for new generations of chips and other factors.

Intel's strong showing came despite what it described as weak demand from the corporations that traditionally are big buyers of computer equipment, and comments by Intel executives that Microsoft's forthcoming Windows 7 operating system is unlikely to revive corporate spending this year.

"You have an $8 billion quarter with very little enterprise spending taking place," said Broadpoint Amtech analyst Doug Freedman. "The consumer is healthier than we expected."

For the first nine months of the fiscal year, declining receipts from individual income and payroll taxes account for almost 60 percent of the overall decrease in receipts. Those collections are down by almost $200 billion. Withholding of income and payroll taxes fell by about $80 billion (or 6 percent) compared with receipts in the first three quarters of 2008, primarily because of the ongoing effects of the recession on wages and salaries and the effective tax rates on that income. Receipts from corporate income taxes have declined sharply, falling by $133 billion (or 56 percent).Outlays through June were $457 billion higher than in the same period last year, CBO estimates. That total includes $147 billion for the Troubled Asset Relief Program (TARP), recorded on a net-present-value basis, and spending of $83 billion in support of Fannie Mae and Freddie Mac. Spending for all other federal programs rose by nearly 14 percent (or $275 billion) relative to outlays in the first nine months of fiscal year 2008. In contrast, net outlays for interest on the public debt declined by more than 25 percent (or $49 billion) because of lower short-term interest rates and lower costs for inflation-indexed securities.

| Year | week | False High | week | False Low | % decline | Weeks to new high | Weeks to false low | Weeks to next High |

|---|---|---|---|---|---|---|---|---|

| 1974 | 2/09 | 321 | 5/11 | 290.5 | (-9.4%) | 8/10 | 13 wks. | 26 wks. |

| 1981 | 12/26 | 551 | 1/16 | 521 | (-5.4%) | 2/13 | 3 wks. | 7 wks. |

| 1982 | 2/13 | 552.5 | 3/6 | 534 | (-3.4%) | 3/27 | 3 wks. | 6 wks. |

| 1982 | 4/24 | 587 | 5/22 | 583 | (-0.7%) | 6/5 | 4 wks. | 6 wks. |

| 1982 | 6/19 | 601 | 7/31 | 570 | (-5%) | 8/21 | 6 wks. | 9 wks. |

| 1990-1 | 12/29 | 456 | 1/19 | 438 | (-4%) | 2/2 | 3 wks. | 5 wks. |

| 2000 | 8/26 | 313 | 10/14 | 297 | (-5%) | 11/18 | 8 wks. | 13 wks. |

| 2001 | 1/6 | 352 | 1/20 | 338 | (-4%) | 2/10 | 2 wks. | 5 wks. |

| 2008-9 | 12/20 | 546 | 1/10 | 524 | (-6%) | 1/24 | 3 wks. | 5 wks. |

| 2009? | 4/4? | 659? | 7/4? | 606? | (-8%) | --- | 13 wks.? | --- |

Investors are betting that strength in banks could juice the entire economy.Rising financial stocks propelled the stock market to its biggest one-day gain in six weeks Monday after an influential banking analyst raised her rating on Goldman Sachs Group Inc. The bank reports earnings on Tuesday.

Meredith Whitney said also on CNBC that hard-hit Bank of America Corp. is inexpensive given the assets on its books.

Her upbeat, albeit still cautious, tone on banks helped lift the Dow Jones industrial average 185 points in relatively thin trading volume. It was the best performance for the blue chips since June 1 and follows a month of often directionless trading in which investors looked for any fresh sign that the economy was improving, not simply licking its wounds.

Goldman has long been considered the strongest bank amid the economic downturn, but Bank of America has been one of the hardest hit by loan losses. Any improvement in banks' profits could shore up their financial position and free money for lending.

Investors latched on to Whitney's comments because she has for years offered one of the more pessimistic -- and accurate -- assessments of the banking business. While she remains cautious about the industry over all, the shift in tone gave the market a jolt.

However, also note the possibility of a bear trap is pretty high right now

The trade gap decreased to $26 billion in May from April's $28.8 billion, the Commerce Department said Friday. Exports rose 1.6% in May to $123.3 billion on a seasonally adjusted basis. Imports fell 0.6% to $149.3 billion.

"It's a very good sign for GDP," says Paul Ashworth, senior U.S. economist for Capital Economics in Toronto. "The economy didn't shrink by much in the second quarter, and there's an outside chance it recorded a gain." Forecasting firm Macroeconomic Advisers increased its second-quarter GDP forecast from minus 1.6% to plus 0.2% on the news.

.....

To be sure, the good news on the U.S. export front was tempered by the decline in imports, which underscores how American businesses and consumers spent gingerly on imported goods. That is bad news for overseas economies that rely on the U.S. market. And trade overall remains far below levels from before the financial crisis.

"Arithmetically this suggests trade is going to be a big positive boost, but largely as a result of imports falling at a rapid pace," says Ted Wieseman, economist at Morgan Stanley in New York. Because exports boost GDP and imports drag it down, the narrowing of the trade gap helps boost the overall growth figure. Exports accounted for 13% of GDP in 2008.

This new American economy, Summers hopes, will be “more export-oriented” and “less consumption-oriented”; “more environmentally oriented” and “less energy-production-oriented”; “more bio- and software- and civil-engineering-oriented and less financial-engineering-oriented”; and, finally, “more middle-class-oriented” and “less oriented to income growth that is disproportionate towards a very small share of the population”. Unlike many other economists, Summers does not believe that lower growth is the inevitable price of this economic paradigm shift.