- by New Deal democrat

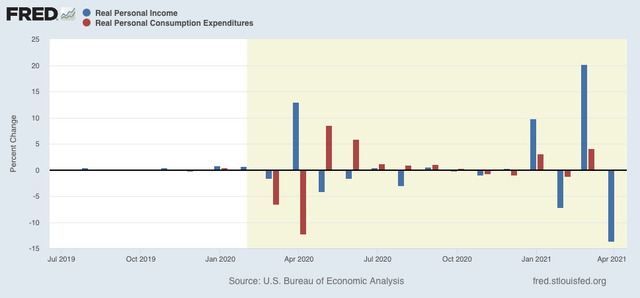

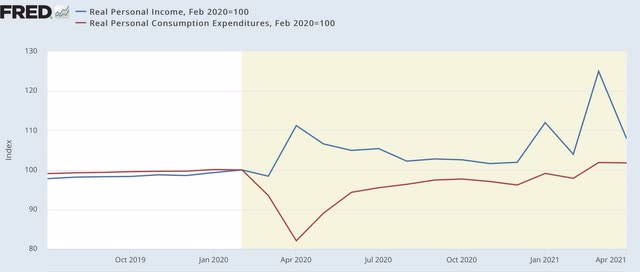

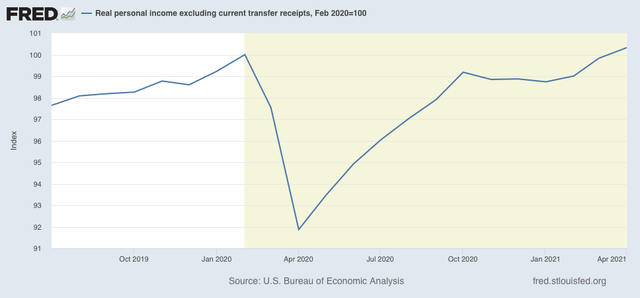

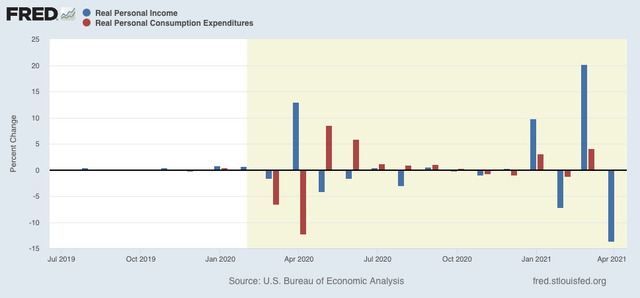

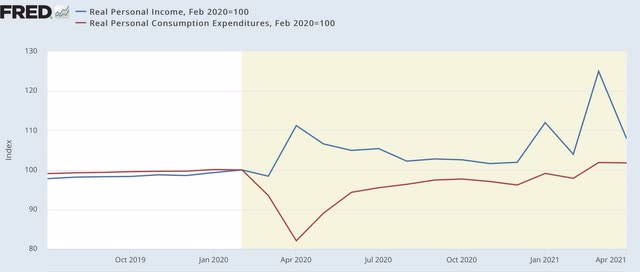

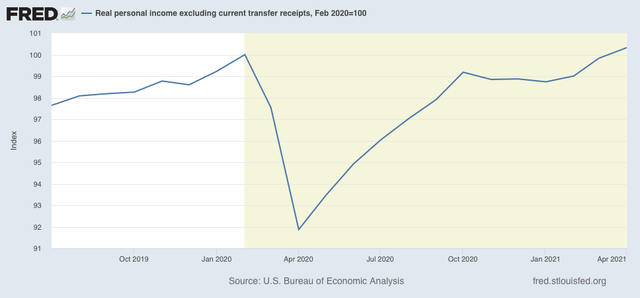

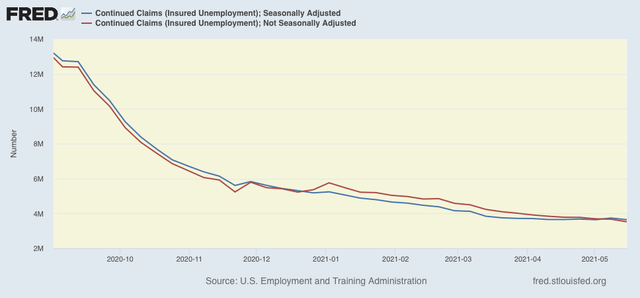

The last of the 4 monthly coincident markers for whether the economy is in recession vs. expansion was reported this morning for April. Let’s take a look.

- by New Deal democrat

The last of the 4 monthly coincident markers for whether the economy is in recession vs. expansion was reported this morning for April. Let’s take a look.

- by New Deal democrat

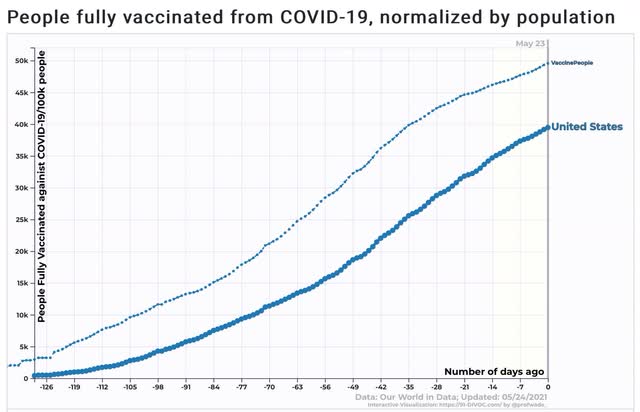

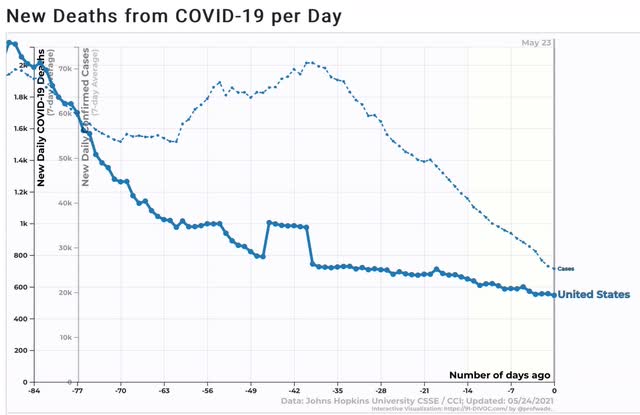

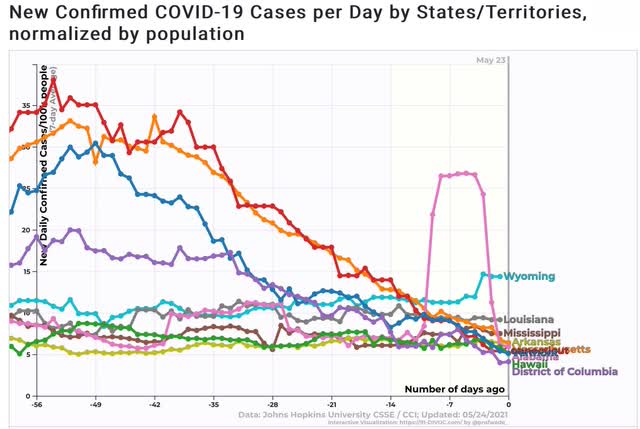

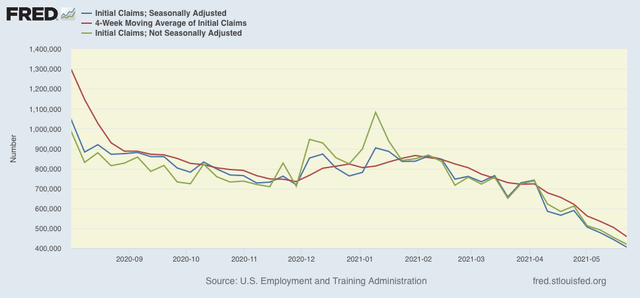

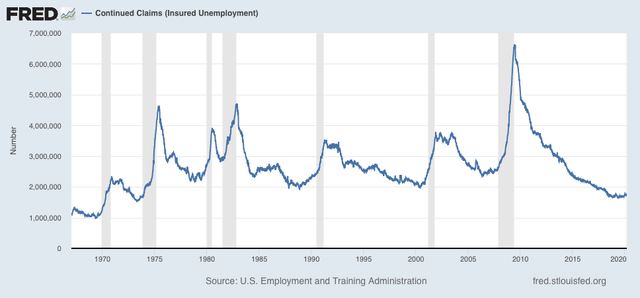

New jobless claims continue to be the most important weekly economic datapoint, as increasing numbers of vaccinated people and outdoor activities have led to an abatement of the pandemic - both new infections and deaths are near their lowest points in a year.

We have hit my objective for new claims to be under 500,000 by Memorial Day. Even better, we are already approaching my second objective, which is for them to be below 400,000 by Labor Day.

REMINDER: Because of the unprecedented number of layoffs during the early lockdowns, for the last year I have given heightened importance to the non-seasonally adjusted numbers. After May is over, their importance recedes and I expect to discontinue tracking them.

New jobless claims declined 38,000 to 406,000. On a unadjusted basis, new jobless claims declined 34,131 to 420,472. The 4 week average of claims also declined by 46,000 to 458,750. All of these were new pandemic lows.

- by New Deal democrat

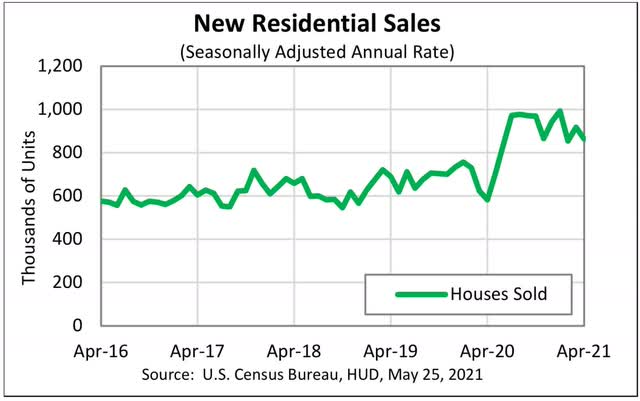

Now that we have all of the April housing data, my comprehensive look at this long leading sector is up at Seeking Alpha.

It’s pretty clear that sales and new construction have peaked in the short term. So, what happens when all of those people who would have put their houses on the market in 2020, but didn’t because of the coronavirus, decide to put them on the market later in 2021 or in spring 2022?

As usual, clicking over and reading puts a penny or two in my pocket to reward me for my efforts.

- by New Deal democrat

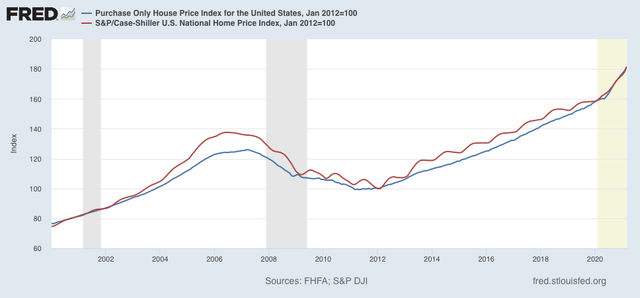

This morning both new home sales and two price indexes for houses were released for April, completing our view of that important long leading sector.

- by New Deal democrat

No, that won’t happen. But, even so, that is the current trajectory. Let’s start with the overview: