- by New Deal democrat

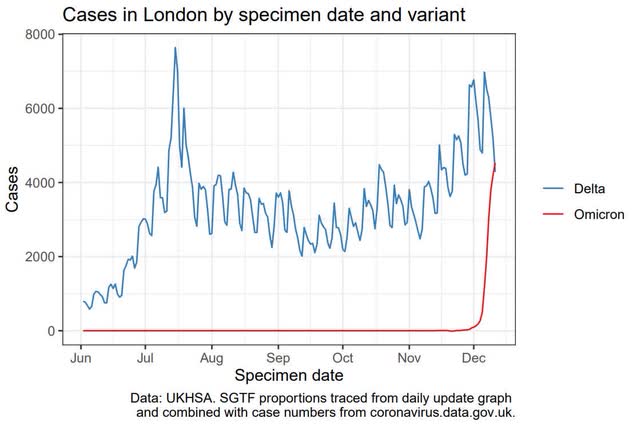

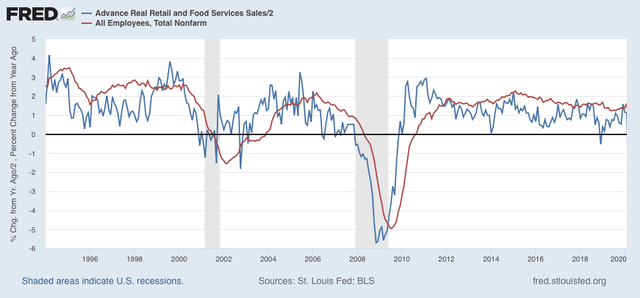

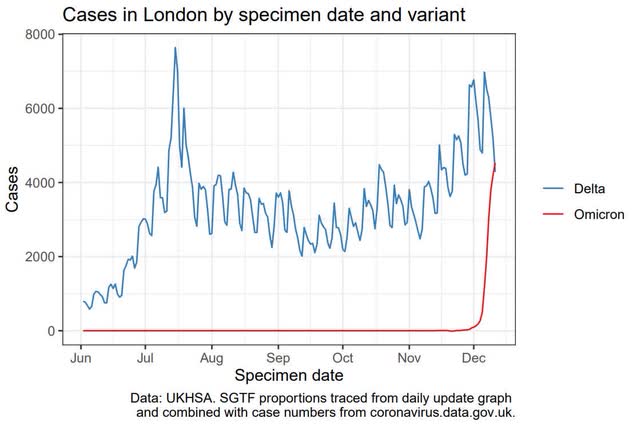

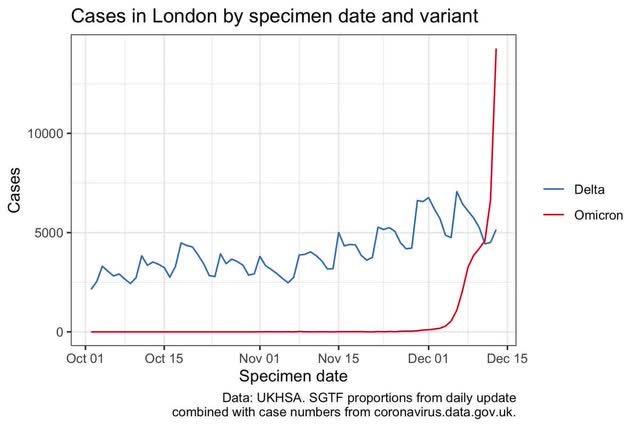

Here is a graph of the growth in Omicron vs. Delta cases in London from 2 days ago:

Shocking, isn’t it?

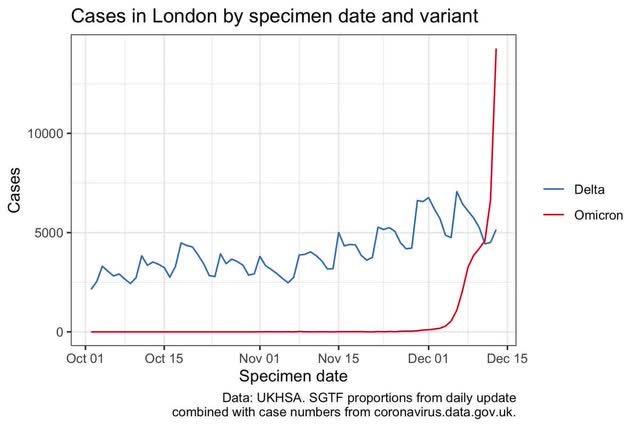

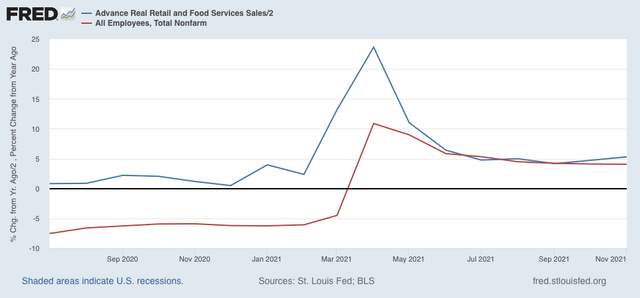

Now here is the same data, updated yesterday, just one day later:

Do I have your attention? In one day, the number of Omicron cases literally went through the top of the previous graph.

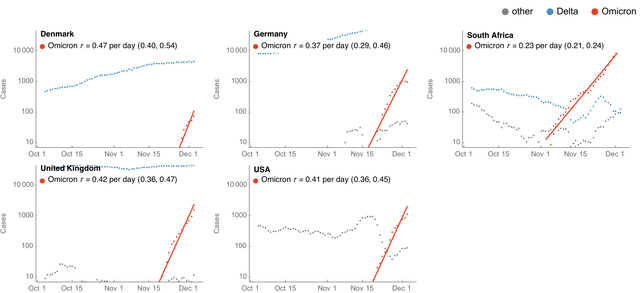

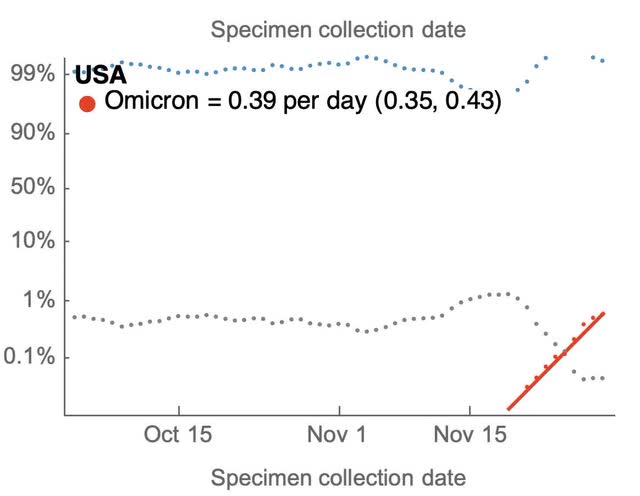

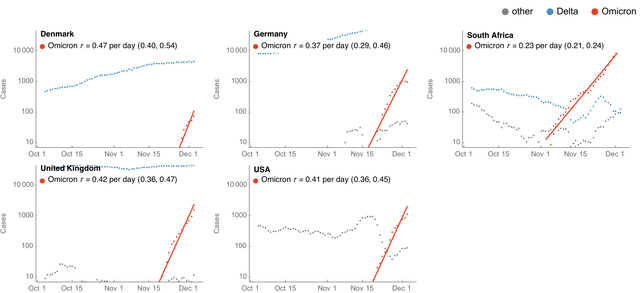

Dr. Trevor Bedford, a geneticist who was the first to demonstrate that there was community spread of Covid-19 in the US back in late February 2020, is now tracking the daily exponential growth of Omicron, with a 10 day lag because that is how long it takes for reliable testing data to be accumulated. Here are his current graph of 5 countries including South Africa, the UK, and the US:

https://github.com/blab/rt-from-frequency-dynamics/tree/master/results/omicron-countries

Depending on the country, the number of Omicron cases is doubling every 2 to 3 days.

As of 10 days ago, he estimates about 1000 cases per day in the US were Omicron. If we use 3 days as the doubling time, that is close to 10,000 cases today.

Projecting that rate of growth forward, here is what we get:

- about 100,000 cases a day by December 27

- 1 million cases a day by January 6

-10 million cases a day by January 16.

This in a health system where many hospitals have already reached their limit.

Will it get that bad? Exponential growth keeps going until, well, it doesn’t (see, e.g., Delta during July and August, peaking quickly just before Labor Day).

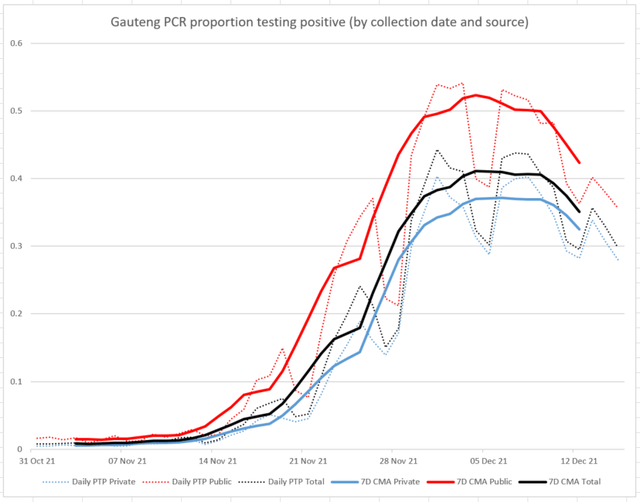

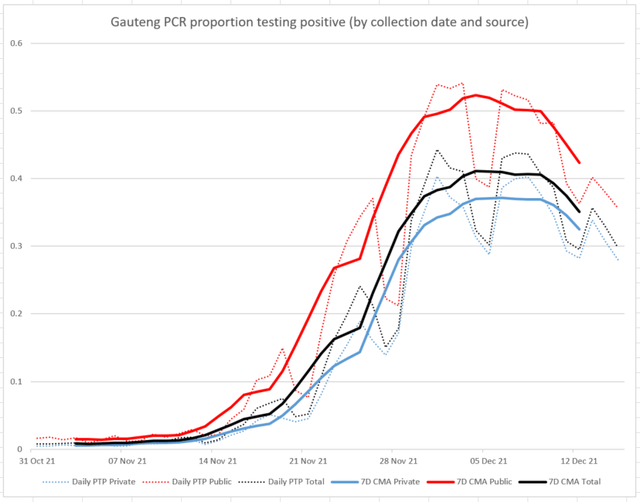

In that regard, in South Africa, Omicron May have peaked a few days ago, see:

If Delta burned through the dry tinder in about 2 to 3 months, in South Africa Omicron sped that up to about 30 to 45 days.

In South Africa, cases went from 400 to 24,000 in 4 weeks, an 60-fold increase.

Two other countries with major Omicron spread, Denmark and Norway, went from 400 cases each to 8000 and 4000, respectively, a 20-fold and 10-fold increase. Interestingly (although I won’t bother with the graph, in Norway cases seem to have peaked in the last few days after 12 weeks of increase). The good news is, if South Africa and Norway are the templates, then like Delta there is a certain subset of the population that is uniquely susceptible, and once Omicron infects those people, it runs out of fuel.

Consistent with, and maybe because of this, here is Dr. Andy Slavitt:

https://mobile.twitter.com/Porter_Anderson/status/1471683867304206337

“We’re in store for a quick, fast-spreading, and hopefully soon-to-be-over wave that’s going to overwhelm hospitals. All of us who take advantage of the science will be in good shape. For the country as a whole, this is going to be a rough January.”

As cases rise, when could they peak? He says: “I talked to a dozen scientists or so in the last couple of days and the consensus seems to be forming around the third week in January.”

In the US, the post-Delta trough was about 75,000 cases per day about 6 weeks ago. A 10-fold increase like Norway would be 750,000 cases per day. A 50-fold increase, like South Africa, would be 3,750,000 cases per day.

Since the consensus spoken of by Dr. Slavitt is late in January, that appears to be consistent with the worst-case scenario.

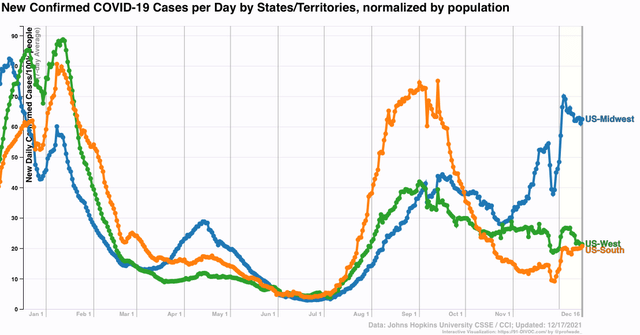

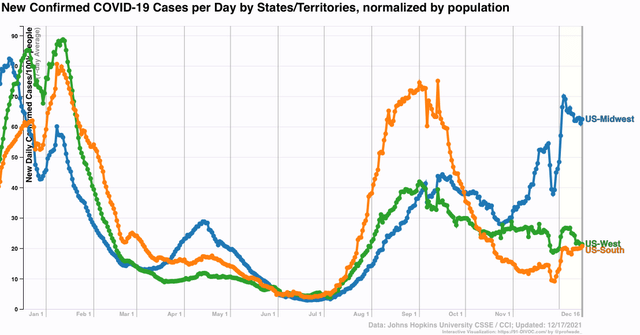

While cases in the South, West, and Midwest are generally still much better than they were one year ago at this point:

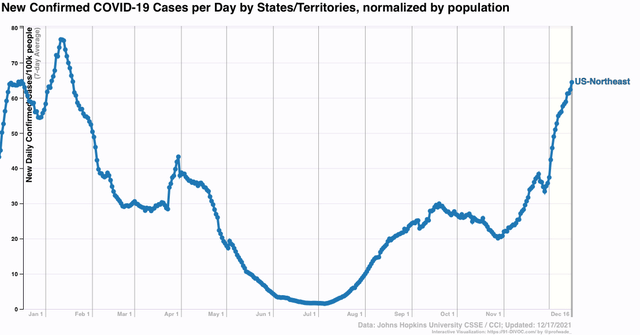

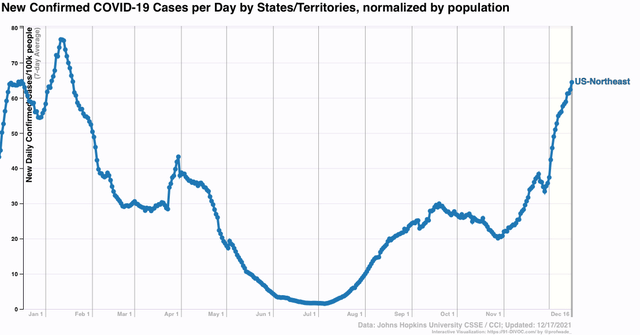

In the Northeast, where there is evidence Omicron is already a significant share of total infections, cases are already close to their all-time daily highs, and look to exceed those numbers by Monday or Tuesday:

I am afraid this is what the US as a whole is looking at within a week or two, if not within days.

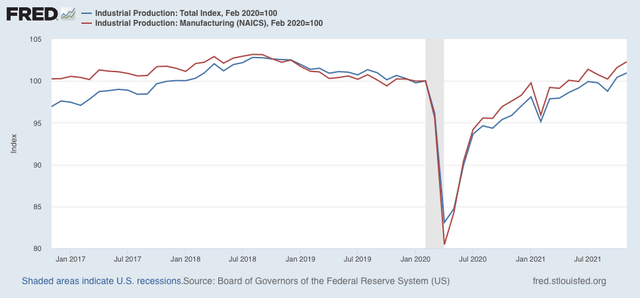

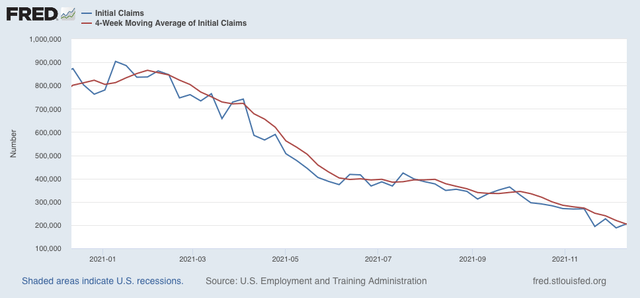

If the above is true, at some point between now and New Year’s Day there is going to be a March 2020 style nearly instant crash in public and economic activity.

Please use extra caution, even if you are fully vaccinated and boostered. Stay safe!