- by New Deal democrat

The drought in economic data continues today. So let me continue on the issue of energy, tying into yesterday’s note on hybrid and electric vehicles.

Here’s an eye-opening graph from JP Morgan via

Carl Quintanilla’s social media feed, showing an 80% decline in shipping through the Suez Canal following Houthi attacks on commercial vessels at the entrance of the Red Sea:

That’s a much bigger decline than can be explained by the alleged limitation of Houthi attacks on shipping tied to Israel and the US.

There is some financial media speculation that this is leading to a big increase in shipping costs, which could create another inflationary push due to supply line constriction. Well, yes and no. Here are container ship rates from Harpex for the past year:

Shipping rates *declined* in the first two months after the Israeli-Hamas conflict started, and only rose in the past month. While that increase may appear sharp, had I taken the graph back two years instead of one, it would show the index at 4500! So a move from 800 to 950 is pretty tame.

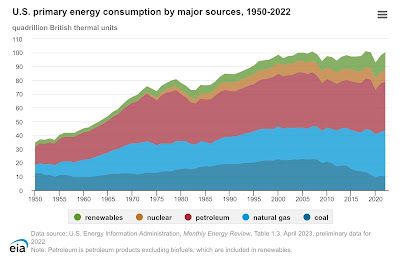

On the other hand, the attacks on shipping in the Red Sea highlight for the umpteenth time the economic and social cost of dependency on energy sources from the Middle East. Here’s another graph from Quintanilla’s social media feed, showing how much energy is consumed in the US by source:

Over the past 50 years, the US has become much more energy efficient, cutting its energy needs per unit of GDP by about 70%, in particular by coal and oil.

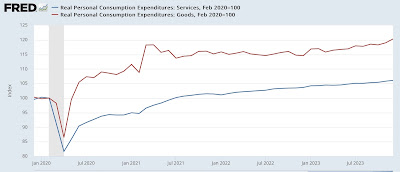

But as the above graph shows, this is not by shifting away from fossil fuels so much as it has been a shift towards natural gas. It also doesn’t show the trend in renewable energy sources, such as solar and wind. Here’s what the trend in those look like compared with other energy sources since the onset of the pandemic (h/t Kevin Drum):

On a percentage increase basis, solar and wind energy are both making great strides. But this is because of the small number base.

And indeed, renewables as a share of US energy generation have now surpassed coal:

On the longer term time frame, gains in energy efficiency have been offset by population growth. Hence the growth in the total amount of energy used up until 2005:

The big decline in the use of coal only takes it back to 1960s levels. Fossil fuels in total still make up 80% of US energy usage. And the big growth in renewables still only takes them to less than 15% of total usage.

Taking this back to the effects of turmoil in the Middle East, phasing out oil fueled power plants as well as internal combustion engines is a must. Coal should continue to be phased out as quickly as possible, and ultimately nuclear power (at least as a bridge) and renewables, together with switching to battery powered consumer appliances, should be the way forward.

.