- by New Deal democrat

Welcome to 2025! The data this year starts out with jobless claims for the last week of 2024, which of course is heavily influenced by seasonality.

The news was mainly good this week, with claims declining -9,000 to 211,000, the lowest number in over half a year. The four week moving average, which is particularly important in the midst of Holiday seasonality, declined -3,500 to 223,250, about average for the past six weeks. With the typical one week delay, continuing claims declined -52,000 to 1.844 million:

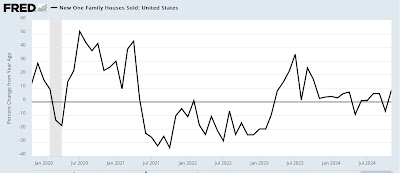

As usual, the YoY% comparisons are more important for forecasting purposes, and here the news is not so good. Initial claims were higher by 6.6%, and the four week moving average by 8.5%. Continuing claims were also higher by 1.6%:

The poor comparison of the four week moving average is particularly noteworthy, because, excluding the hurricane affected weeks of early October, it is the worst YoY read since September 2023. It is *not* recessionary, since it has not even crossed the 10% threshold, and I would need to see it remain above that threshold for a sustained period of time. But it does indicate a significant weakening of the employment situation.

The jobs report for December won’t be released for another week, but we now have almost all the information we will have to compare with the unemployment rate, which typically follows jobless claims. The below graph presents the YoY% of the data, which in the case of the unemployment rate, becomes a percent change of a percent:

The immigration situation makes this particularly hard to read. The best I can say is that, absent effects from the surge in immigration in the past several years, the unemployment rate probably would not have increased over 4.0% this summer, and even the present initial claims monthly averages forecast an unemployment rate in the range of 3.9%-4.1%. Anything above that is likely due to the continued effects of the immigration situation.