- by New Deal democrat

As I’ve indicated a number of times recently, right now I consider the report on personal income and spending co-equal to the employment report as the most important monthly data. For March, it was a mixed bag.

Nominally, personal income rose 0.3%, and personal spending was unchanged. Because the applicable deflator rose 0.1%, real personal income rose 0.2%, and real personal spending declined less than -0.1% (also rounding to unchanged) for the month.

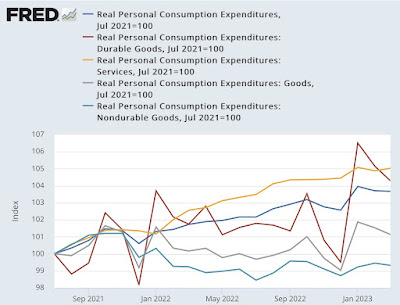

Since the pandemic began, real income is up 4.0%, and real spending is up 7.6%. Because much of this was distorted by several rounds of stimulus, here’s the view normed to 100 as of July 2021:

Real personal spending has risen fairly consistently, while real personal income fell and then rose again with the rise and fall of gas prices last year:

Additionally, the pesonal savings rate rose slightly again to 5.1%, which is good for individuals, but due to the “paradox of saving,” bad for the economy as a whole.

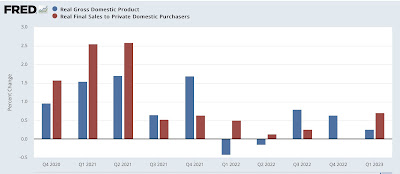

Digging in to some further details, there was much dancing around the maypole yesterday that real spending in the Q1 GDP report was up 3.4%, a very healthy number. But I noticed that the quarterly increase was well below both the January and February monthly increases, so I suspected we would see either a big decline or some significant downward revisions today - and we did, especially for February, as shown below:

Basically, extra seasonal distortions around the post-pandemic Holidays gave us a big downdraft in November and December, and a big updraft in January. Compared with September and October, February and March were only up +0.6%.

Further decomposing real personal spending by types of purchase, we see that real spending on non-durable goods since July 2021 has actually declined, while total spending on goods is only up 1%. The big increases since July 2021 have been on services, and on durable goods (mainly cars), which declined sharply in November and December and then rose sharply in January:

In other words, the lion’s share of the big quarterly jump in consumer spending in yesterday’s GDP report was a spending spree on cars in January, driven by seasonal distortions.

Finally, let’s turn to the indicators that the NBER uses to determine the onset of and end of recessions, two of which were updated this morning.

The good news is that real personal income less government transfers (red in the graph below) rose 0.3% in March to a new high. The bad news is that real manufacturing and trade sales (blue) for February declined -0.4% from their recent high in January:

Note that industrial production, perhaps the most important coincident indicator, remains down about -0.5% from its September peak. On a YoY basis, real personal income less government transfers is up 2.1%, real manufacturing and trade sales are up 0.1%, and industrial production is up 0.5%:

The historical record going back over half a century shows that when all three of these coincident indicators have been at the YoY levels they are now, with one exception we have already started a recession:

The sole exception was 1989, when we were 6 months away.

To sum up: there was good news on real personal spending on services, and on real personal income less government transfers. Depending on further revisions, it is unlikely that the NBER will ignore growing nonfarm payrolls and declare that there was a cyclical peak in January.

But the news of real personal spending on goods was negative, as were real manufacturing and trade sales for February. Personal savings increased, consistent with consumers becoming more cautious in advance of a recession. And yesterday’s good Q1 GDP news on consumer spending turns out mainly to have been a car-buying spree in January.