- by New Deal democrat

No important economic data today, and no significant COVID updates over the weekend. Let me make a few comments and then turn to the bond market, particularly as it reflects the international situation.

I have no more insight into the Ukraine matter than probably any other well informed average citizen. It feels like the closest Russia and the US have come to actual war since the Cuban Missile Crisis in 1962 - but only in relative terms. I have a recollection back then of walking to the bus stop in the morning, and being told by my older sibling unit that the world might end at noon. I think I simply nodded and accepted that this was something that I had been taught in religion classes would happen sooner or later anyway.

In the Korean War, Soviet pilots apparently did fly North Korean jets. And during Vietnam, Russia and China openly armed the North Vietnamese. Similarly, after the Russian invasion of Afghanistan in 1979, the US openly aided the Taliban. None of those acts on either side were consistent with neutrality, but were accepted as better than open conflict between the superpowers.

This is a little different, both in location and magnitude. Ukraine is not just adjacent to Russia, but was formerly part of the USSR itself. The closest Cold War analogy is Cuba. There was the matter of the Bay of Pigs, but after that the US accepted that Cuba was allied with the USSR - so long as the USSR did not equip Cuba with any offensive weapons, and as those of us alive at the time well recall, nuclear weapons in particular.

As to magnitude, Putin was clearly told there would be severe sanctions, but obviously he had concluded, based on his experience as to Chechnya and Crimea, that they would be manageable. Instead, the entire West, including all of Europe both via the EU and NATO, as well as the US, Canada, and Japan as well, have essentially declared economic war on Russia. Whether or not Russia ultimately succeeds in militarily conquering Ukraine, Russia’s complete freeze-out from the Western economic and financial system is going to remain.

It is all well and good to argue what Putin “rationally” ought to do or not do, but as I always remind people, that didn’t exactly work out with Kaiser Wilhelm II 100 years ago. Let us hope that cool heads prevail.

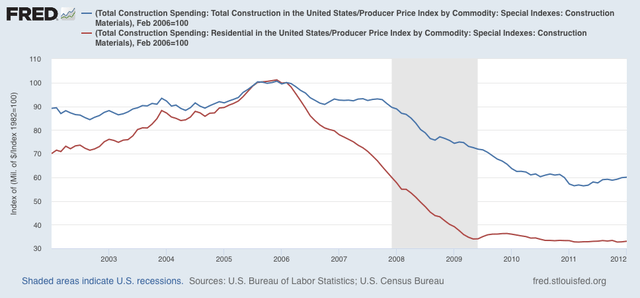

As I write this, the 10 year Treasury bond is trading at roughly 1.89%. This is about 0.10% below where it was trading most of last week. It is the beneficiary of what traders call a “flight to safety,” i.e., pulling back from more risky assets to ride out the storm in a more plain, but stable, investment. This is about in the middle of its range over the past five years:

No particular sign of stress there.

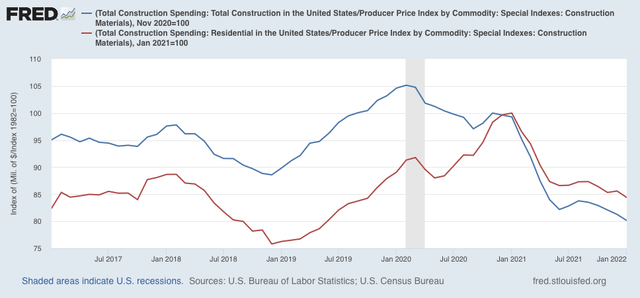

Meanwhile gas prices have risen to $3.62/gallon, according to gas buddy, continuing their rise from $3.25 just two months ago. This will inflict some further stress on consumers, but it is hardly the makings of a crisis:

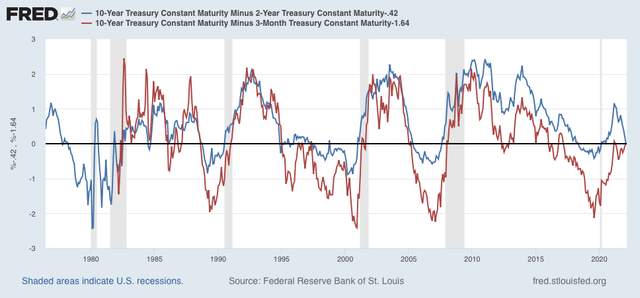

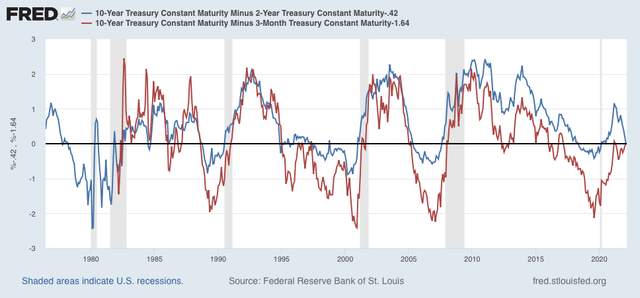

Finally, as I commented in my weekly article at Seeking Alpha, while the 10 year minus 2 year Treasury spread is down to 0.42%, not only is that not a yield curve inversion, it isn’t even particularly tight looked at from a longer term perspective. Below is the 10 minus 2 year spread (blue), minus -0.42% so that the current spread shows as 0, and the 10 year minus 3 months spread (red), currently 1.64%, normed to 0 as well:

Similar spreads occurred anywhere from 2 to 7 years before the next recession over the past 40+ years.

So, at least economically speaking, the current international political crisis is not showing signs of spilling over into any kind of economic crisis in the West.