- by New Deal democrat

This morning gives us the last of our three measures of home sales, prices, and inventory, new home sales. These are the most important of the three because while they are very noisy and heavily revised, they are the most leading of all housing metrics, and so they can tell us about the underlying upward or downward pressure on the economy going forward one year or more. Additionally, the construction of new homes has a much bigger impact than the sale of existing homes.

In May, new home sales declined 99,000 to 623,000. April’s initial number of 743,000, which had been a 3 year high, was revised downward by -21,000. In the below graph I also show single family permits (red, right scale), which lag slightly but are much less noisy:

Both have until now been rangebound. New home sales this month were close to the bottom of that range, while permits made a new 2 year low.

Over the same 2.5 year period of time, prices also stalled, and then began a very slow deflation on the order of -1% -5% YoY. In absolute terms that trend continued last month. While the median price of a new single family home increased 15,200 to $426,600 in May, that is average compared with the last 2.5 years:

On the other hand, this was the second highest YoY% increase in the median price of new homes in the past 2 years, up 8.1%, suggesting that the deflating trend may be ending. The below graph compares the one month and quarterly average of the YoY% change in new homes compared with the YoY% change in the FHFA and Case Shiller Indices, which were reported yesterday:

.

Before 2018 (not shown), typically the series moved in tandem. Since then, as you can see, with the exception of 2021-22, the median price of existing homes has increased substantially more than that of new homes. For a rebalancing to occur, these should start to converge - and that may be happening.

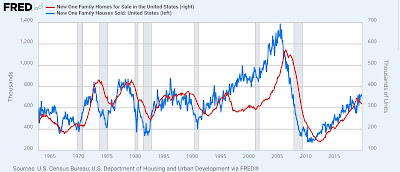

Finally, after a slight decline in April, the inventory of homes for sale rose 7,000 to 507,000, another post-pandemic high:

This is significant because in the past recessions have happened after not just sales decline, but the inventory of new homes for sale (red, right scale) - which also consistently lag - also decline (as builders pull back:

To summarize, new home sales, while weak in May are not signaling recession, and in fact the relative firmness in prices this month, compared with the continued deceleration of price increases in existing homes, is most consistent with an ongoing rebalancing of the market.