- by New Deal democrat

December personal income and spending had some material for both optimists and pessimists.

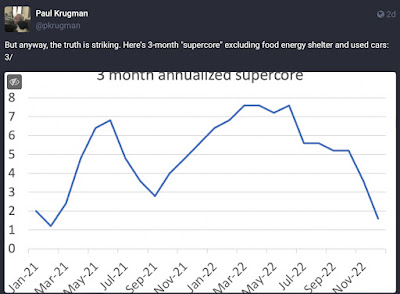

Let’s look at the good news first, mainly having to do with inflation. Both the total and core personal consumption deflator continued their overall deceleration in December, with the former up +0.3% for the month, and the latter, said to be much beloved by the Fed, up just enough to be +0.1% rather than unchanged. There’s been a lot of discussion about the abatement of inflation since June, and this is in line with that idea, as shown by the quarterly changes in both of the above metrics:

The quarterly changes in both deflators is at their lowest levels since Q1 2021.

The YoY% change also declined for both:

Similarly, real personal income excluding transfer receipts, one of the four coincident indicators typically used by the NBER to determine if a recession has occurred, also increased nicely, by 0.2%, in December, to a new all-time high:

If you wanted to tout good news, there it is. The bottom line is: a decline in gas prices from $5 to $3 in 6 months can do a world of good to inflation data.

Now let’s start to segue to the bad news.

Here is an update to the graph I’ve been running for about the past year, showing real personal income (red) and spending (blue) normed to 100 in May 2021, right after that spring’s stimulus spending splurge:

As noted above, real personal income continued to increase in December, and is up 1.3% since June, when gas prices were $5/gallon. But they remain -1.4% below their level of May 2021. And the increase in real personal spending appears to have reversed, down for the second month in a row, by -0.3%. It is down -0.5% since its peak at 4% over May 2021 levels.

Further, the personal saving rate increased 0.5% for the month, and is up 1.0% from its lowest level of 2.4% in September (which except for July 2005 was its all-time lowest reading):

Why is this bad? Because as expansions go on, consumers tend to go more and more out on a limb, i.e., their saving rate goes lower. When bad things start to happen, they pull in their horns, i.e., their saving rate increases. Although this is a noisy metric, it is one of the hallmarks of the onset of a recession, and is a crucial part of my “consumer nowcast” model, which turned negative about 3 months ago.

Also, real personal income excluding transfer receipts, discussed above, is only up 0.3% YoY. It has been essentially flat YoY since June. Here’s what that looks like historically:

A flat to negative YoY change in this metric has, with only one exception, for the past 60+ years meant a recession is occurring.

One final note: the personal income deflator goes into the calculation of real manufacturing and trade sales, another one of the “big 4” coincident indicators of recession used by the NBER. It declined for the second month in a row, by-0.4%:

It joins industrial production to become the 2nd of the “big 4” to have apparently rolled over. As discussed above, real personal income less transfer receipts remains positive (but with gas prices increasing again in January, it will have a much more challenging comparison next month), as does jobs growth.

To recapitulate: there was good news today on the inflation front, perhaps helping the Fed pause in raising rates; but there was bad news on most of the indicators which immediately precede or are coincident with a recession.