- by New Deal democrat

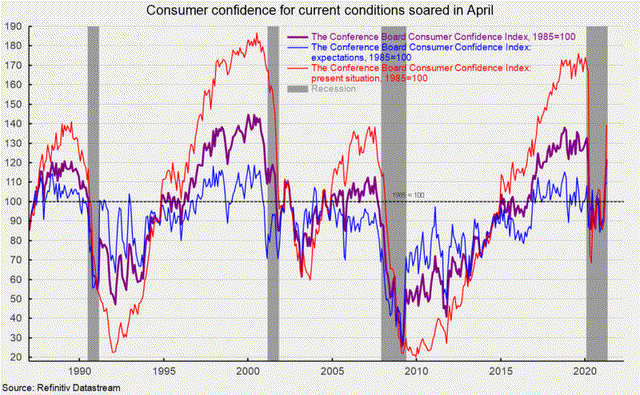

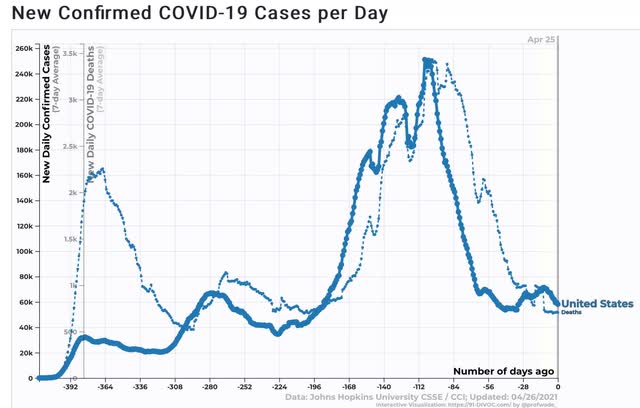

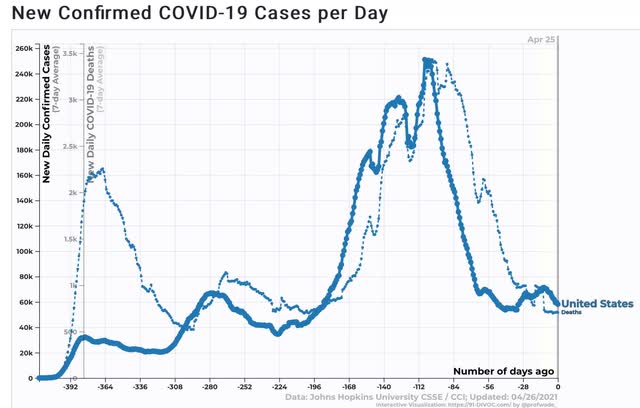

Let’s start with an overview of total cases and deaths in the US:

1.7 in every 1,000 Americans has died of COVID-19. 9.7% of the entire population has had a *confirmed* infection. Probably another 5% to 10% have been infected, but were never tested.

With large-scale vaccinations, plus the onset of warmer weather (so fewer indoor gatherings), the incipient “4th wave” appears to have reversed:

In the past 7 days, an average of 58,164 cases per day were confirmed, vs. the recent low of 53,663, and down from 71,234 12 days ago. Deaths in the past 7 days averaged 706 per day, just above the recent low average of 697 4 days ago. Note of course that this is still above last spring’s low in deaths, and about 3x the number of daily cases last spring.

That deaths have not increased almost 35 days after the recent upturn in cases means that the vaccines are working, and also that cases are becoming more concentrated among unvaccinated younger people.

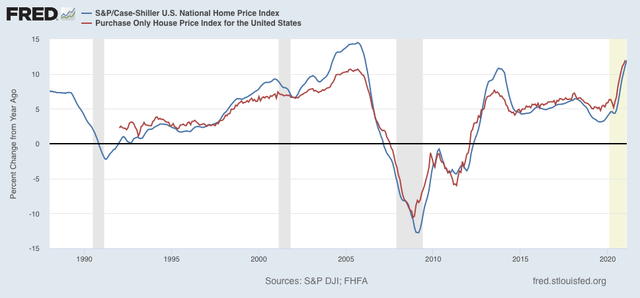

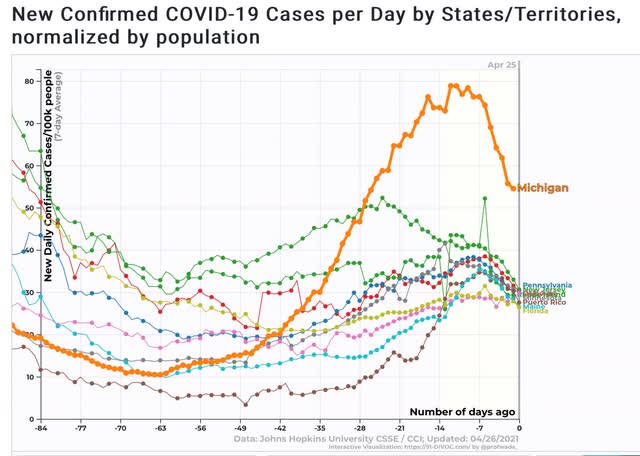

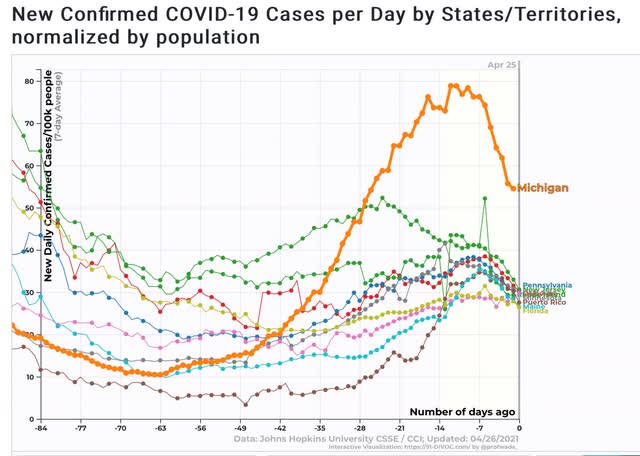

In Michigan and the Northeast, new cases have also turned down:

Some of that might be increased vaccinations, and some may be renewed panic and vigilance among the affected populations.

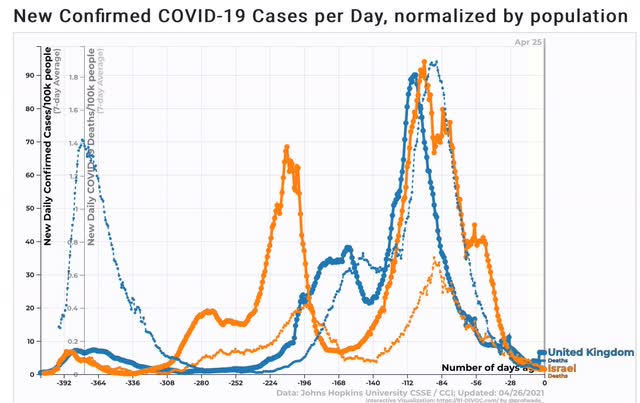

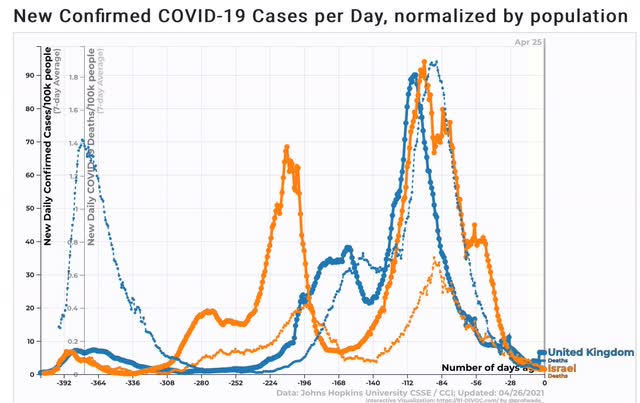

Meanwhile, the success stories continue overseas in the cases of Israel and the UK, two countries with successful vaccination regimes that were accompanied by temporary lockdowns:

New cases and deaths are down in both by over 95%. Israel recorded *no* deaths for the last 2 days.

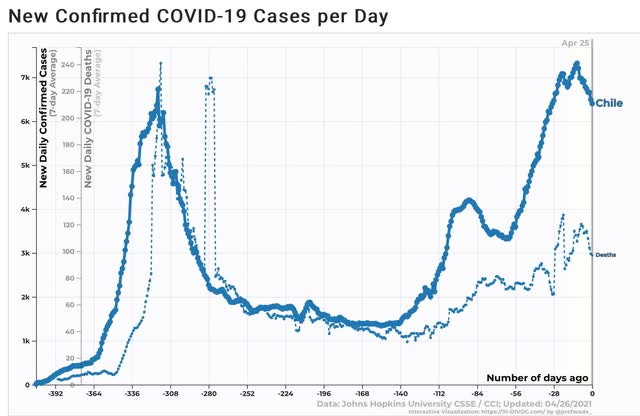

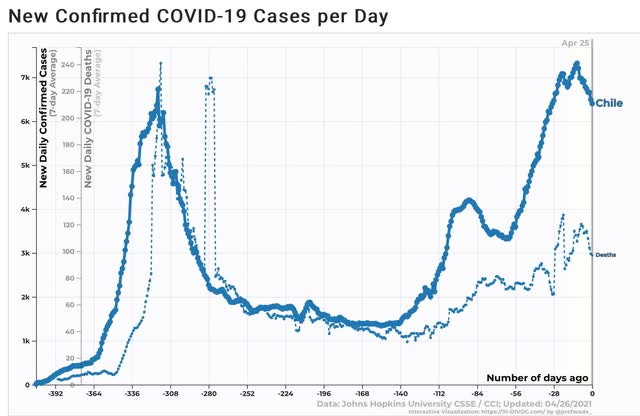

And both infections and deaths in Chile (which has been using the less effective Sinovac vaccine) have also turned down decisively in the past week:

As you have probably already read, the EU is going to open its borders to vaccinated Americans. I imagine Canada will follow suit shortly. This will put added pressure on the vaccine-hesitant and resistors to go ahead and get the shot.

I’m becoming more and more optimistic about the situation in the US by late summer.