- by New Deal democrat

Imagine a game like musical chairs, except that some players are the chairs (employers) as well as people who want to sit in the chairs (potential employees), and players, both sitters and chairs, are continually entering and exiting the game.

The game would be in equilibrium if the number of sitters and chairs are always equal. If there are more sitters than chairs, sitters will be unsuccessful (unemployed). If there are more chairs than sitters, the chairs will be empty (unfilled job openings). In the former case, we would expect wages to go down (or at least increase more slowly vs. inflation); in the latter, we would expect wages to increase more sharply.

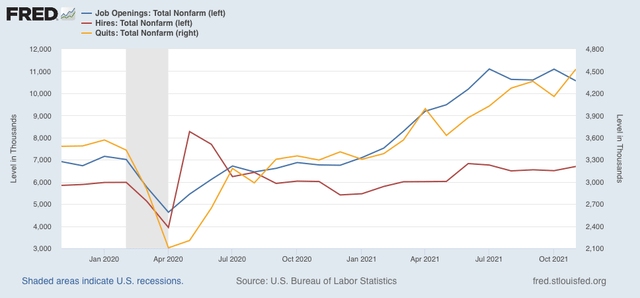

The JOLTS report for November, released yesterday morning, continued to show that there are far more chairs than there are those wanting to sit in them. As a result, wages have continued to increase sharply - even accelerate a little more.

To the details . . .

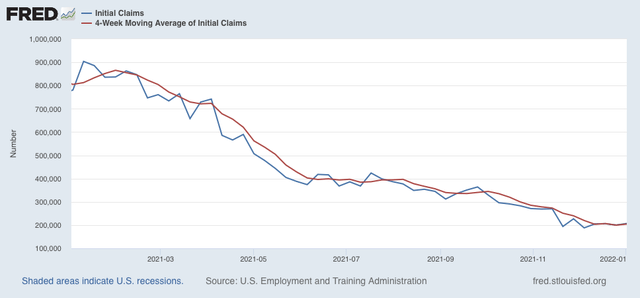

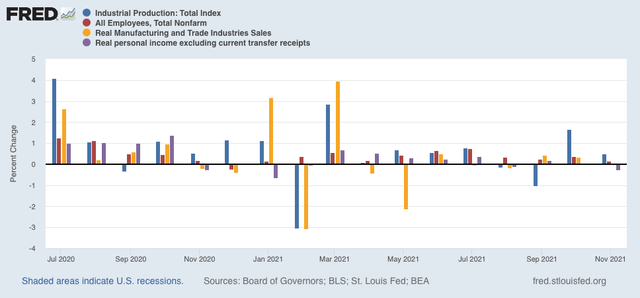

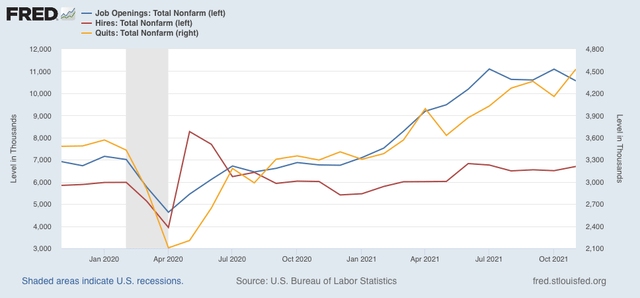

Job openings (blue in the graph below) decreased by -529,000 to 10.562 million, a little below the July peak of 11.098 million. Voluntary quits (the “great resignation,” gold, right scale) increased 370,000 to 4.527 million - a new record high. Actual hires (red) increased 191,000 to 6.697 million, in line with the past few months, and better than the early part of this year:

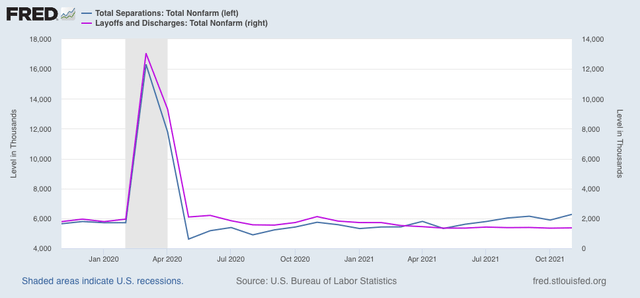

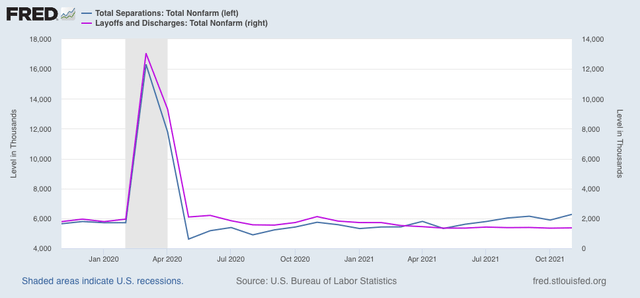

Layoffs and discharges (violet, right scale in the graph below) increased 19,000 from last month’s record low to 1.369 million. Total separations (blue) increased 382,000 to 6.273 million:

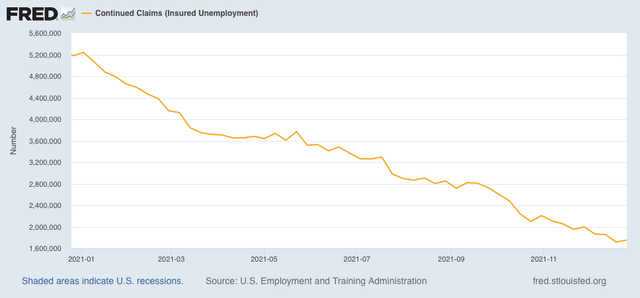

In summary, we continue to have near-record high job openings and low layoffs, new record high quits, with still-strong hiring and total separations; i.e., little progress is being made towards establishing a new equilibrium.

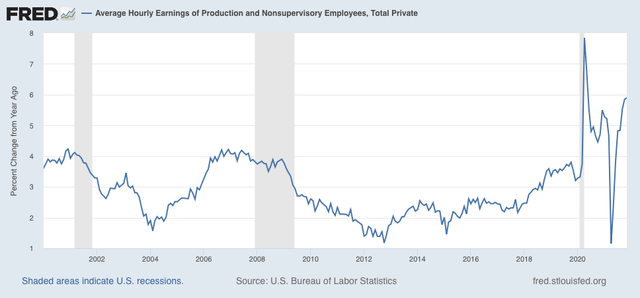

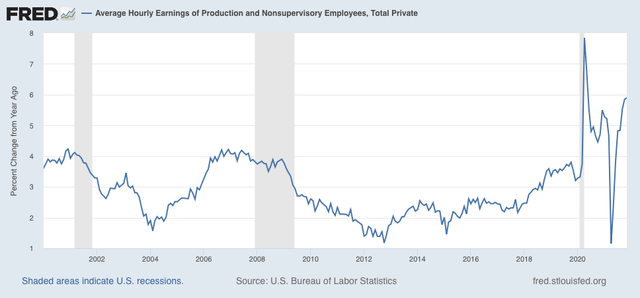

Further, as indicated in last month’s jobs report, wage gains YoY have continued to accelerate, up 5.9% in November, the highest since 1982 except for April and May 2020:

Returning to my rubric of musical chairs, due to the pandemic, there is a persistent shortfall - currently on the level of about 4 million - in the number of people willing to sit in the seats on offer from potential employers. They either are fearful of coming down sick, don’t want to face irate customers, or have to stay home to provide care to their children either due to lack of childcare options or closed schools.

Because of this persistent shortfall, those willing to sit in the chairs can “trade up” to a more desirable chair. As each potential sitter does so, the lowest 10% or so of chairs are consistently left vacant. To fill those chairs with bodies, employers have to offer more money. But so longs as the shortfall persists, there will always be rotating number of vacant chairs, and those potential employers with those empty chairs will have to continually offer more compensation to get people to sit in them.In other words, wages will continue to rise until the potential employer can no longer make any profit off the potential employee for that job.

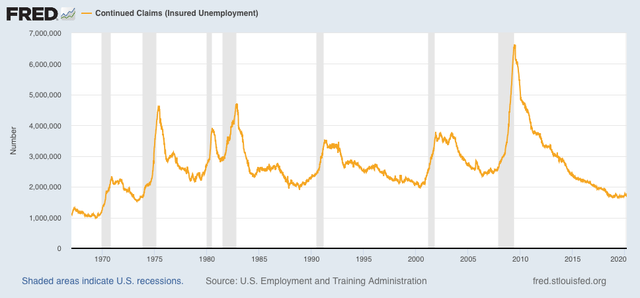

Because the JOLTS data has only been around for 20 years, there are only two jobs recoveries with which to compare the present situation.

In order for the situation to resolve, the first thing I want or expect to see is a further increase in monthly hiring. At the same time, or shortly thereafter, I would expect to see a significant decline in voluntary quits. Only after these two things have occurred would I expect to see a substantial downturn in job openings, and I would not expect to see any significant increase in layoffs until all of those other trends are in place.

In November, we didn’t get an *increased* surge in hiring, and far from declining, quits increased. In other words, we are nowhere near to resolving the current jobs market imbalance - the best situation for employees in half a century.

——

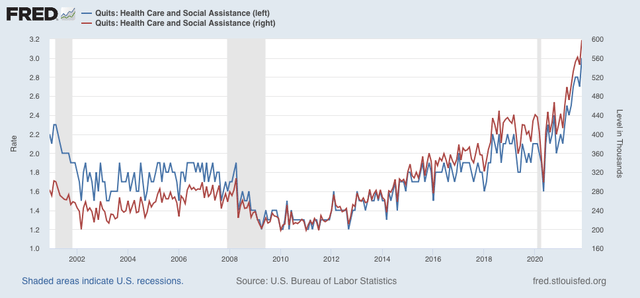

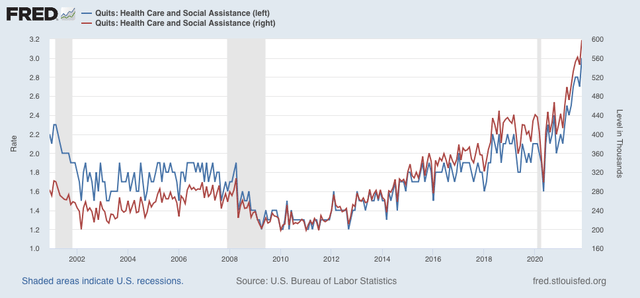

One postscript: I also want to make note of one specific jobs sector. Below is the quits rate (left scale) and number (right) for employees in the health care sector:

Both made new records, and are roughly 30% higher than at any time previous to the pandemic. In other words, employees in a critical sector are leaving their jobs in droves. To me, this points to the utter failure of a system which has been coddling defiant anti-vaxxers and their families. But more on that in my next Coronavirus Dashboard.