Saturday, July 9, 2016

Weekly Indicators for July 4 - 8 at XE.com

- by New Deal democrat

My Weekly Iindicator piece is up at XE.com. The big big news was the record low interest rates.

Friday, July 8, 2016

June jobs report: June takes back May, but deceleration remains

- by New Deal democrat

HEADLINES:

- +287,000 jobs added (would have been 252,000 except for Verizon strike)

- U3 unemployment rate rose from 4.7% to 4.9%

- U6 underemployment rate rose from 9.7% to 9.8%

Here are the headlines on wages and the chronic heightened underemployment:

Wages and participation rates

- Not in Labor Force, but Want a Job Now: declined -231,000 from 5.923 million to 5.692 million

- Part time for economic reasons: declined -587,000 from 6.430 million to 5.843 million

- Employment/population ratio ages 25-54: unchanged at 77.8%

- Average Weekly Earnings for Production and Nonsupervisory Personnel: up +$.04 from $21.47 to $21.51, up +2.4% YoY. (Note: you may be reading different information about wages elsewhere. They are citing average wages for all private workers. I use wages for nonsupervisory personnel, to come closer to the situation for ordinary workers.)

April was revised upward by +21,000, but May was revised downward by -27,000, for a net change of -6,000.

The more leading numbers in the report tell us about where the economy is likely to be a few months from now. These were mixed.

- the average manufacturing workweek was unchanged at 41.8 hours (but May was revised down -0.1 hours. This is one of the 10 components of the LEI.

- construction jobs were unchanged. YoY construction jobs are up +217,000.

- manufacturing jobs increased by +14,000, and are down -29,000 YoY

- temporary jobs - a leading indicator for jobs overall increased by 15,200 (this made a peak in December, and seems to be stabilizing now).

- the number of people unemployed for 5 weeks or less - a better leading indicator than initial jobless claims - increased by +211,000 from 2,239,000 to 2.418,000. The post-recession low was set 10 months ago at 2,095,000.

Other important coincident indicators help us paint a more complete picture of the present:

- Overtime was unchanged at 3.2 hours.

- Professional and busines s employment (generally higher- paying jobs) increased by +38,000 and are up +497,000 YoY.

- the index of aggregate hours worked in the economy rose by 0.2 from 105.2 to 105.4

- the index of aggregate payrolls rose by 0.4 from 128.6 to 129.0.

Other news included:

- the alternate jobs number contained in the more volatile household survey increased by +67,000 jobs. This represents an increase of 2,375,000 jobs YoY vs. 2,164,000 in the establishment survey.

- Government jobs rose by +22,000.

- the overall employment to population ratio for all ages 16 and above fell from 59.7% to 59.6% m/m but is up +0.3% YoY.

- The labor force participation rate rose 0.1% from 62.6% to 62.7% and is now up +.0.1% YoY (remember, this incl udes droves of retiring Bsoomers).

SUMMARY

This month basically took back last month. Clearly there is some seasonality glitch at work, and the best course is simply to average to the two months. This gives us a 2 month average of +149,000 jobs added, and -0.05% monthly in the various unemplyment rates. That is progress, but it is continuing the decelerating progress that we have seen for the last year.

It is mildly encouraging that temporary jobs appear to be stabilizing, but they remain below their peak of 6 months ago. But it is just as mildly discouraging that manufacturing jobs are stalled, and higher paying professional jobs as well as construction jobs are slowing down strongly.

So, late cycle deceleratioin remains the takewaway.

It is mildly encouraging that temporary jobs appear to be stabilizing, but they remain below their peak of 6 months ago. But it is just as mildly discouraging that manufacturing jobs are stalled, and higher paying professional jobs as well as construction jobs are slowing down strongly.

So, late cycle deceleratioin remains the takewaway.

Thursday, July 7, 2016

HOORAY FOR BREXIT!!!

- by New Deal democrat

It may be a political disaster, but it certainly has changed the US long leading indicators. This post is up at XE.com.

Bonddad Thursday Linkfest

German Industrial Production Drops (BB)

UK Sentiment Drops Post-Brexit (BB)

Will Pension Funds Move Into Treasuries? (BB) and FT

German industrial production dropped the most in 21 months in May in a sign that the headwinds from a global economic slowdown and political uncertainty in Europe damped activity.

Production, adjusted for seasonal swings, fell 1.3 percent from the previous month, when it rose a revised 0.5 percent, data from the Economy Ministry in Berlin showed on Thursday. Economists in a Bloomberg survey had predicted a 0.1 percent rise in the typically volatile gauge. Output fell 0.4 percent from a year earlier.

UK Sentiment Drops Post-Brexit (BB)

U.K. business confidence sank to a 4 1/2-year low in the days after Britons voted to leave the European Union, adding to evidence that the decision is blighting growth.

With investors anxiously awaiting data on the consequences, the gauge compounds signs the referendum has hindered an economy that was already losing momentum. Even reports covering the period before the vote are showing signs of fragility, with Halifax saying house-price growth cooled in June. GfK is due to publish a one-off survey Friday that will assess consumer attitudes in the immediate aftermath.

Will Pension Funds Move Into Treasuries? (BB) and FT

Even with yields at record lows, Shyam Rajan, head of U.S. rates strategy at the primary dealer, says pensions are likely to embrace the lower-for-longer mantra and bolster the $13.4 trillion Treasuries market. With only 6 percent of assets in Treasuries, half the peak seen in the 1980s, the retirement funds are primed to join buyers looking for a selloff to pounce. That demand waiting in the wings may depress yields further. Bank of America forecasts yields on 10-year notes will fall to 1.25 percent by the end of September, from about 1.32 percent as of 8 a.m. in New York on Wednesday.

“As a pension fund, you’ve got to be scared that rates could actually go lower,” Rajan, who’s based in New York, said in an interview. “There’s a perceived permanence to this rate rally. If you were assuming that rates were going to go back to 3 percent, that’s not going to happen anytime soon.”

From FT: Risk aversion is dictating the mood in the market for a third straight day on Wednesday, with equity markets coming under pressure and demand for haven assets pushing yields on US government bonds to fresh record lows.

The yield on the benchmark 10-year Treasury note fell by nearly another six basis points to 1.3180 per cent during early morning trading in the US, breaking the previous intraday low of 1.3549 per cent set just yesterday.

It was a similar story for the 30-year Treasury note, with yield hitting a new low of 2.0984 per cent in early trading, easily beating the record intraday low of 2.1294 per cent set just a day earlier.

3-Year Chart of the IEFs

3-Year Chart of the TLTs

Many countries, like those in Latin America, were not particularly impacted by Brexit,” says Goldman Sachs economist Alberto Ramos. “The Brazilian real offers tremendously high carry and Brexit in terms of the outlook of monetary policy will probably lead to even more monetary accommodation among the [major] central banks.”

.....

Brexit may be taking place in a developed country for reasons far removed from the cut and thrust of global economic shifts, yet here was further evidence of how hard it was becoming to quarantine the knock-on effects of the vote to leave around the UK and the EU.

“In the short term, Brexit is a risk-off event and EM unfortunately is likely to suffer,” says Ousmene Mandeng, of EM investor New Sparta Asset Management.

Yet if Brexit shows anything, it is that EM remains more closely linked to trends in the dollar and the Chinese economy. While the Brazilian real fell 2 per cent against the dollar in the aftermath of Brexit, for example, the currency staged a rally on its opening on the following Monday, strengthening 5 per cent.

...

Brexit in effect granted vulnerable economies, such as recession-hit Brazil, more time to adjust by ensuring that global monetary policy was likely to stay loose, analysts say. The Federal Reserve, in particular, now has few grounds to raise US rates, while the Bank of England joins the European Central Bank and the Bank of Japan among those central banks expected to ease conditions in the near term.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.5 percent in June, 3.6 percentage points higher than the May reading of 52.9 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 59.5 percent, 4.4 percentage points higher than the May reading of 55.1 percent, reflecting growth for the 83rd consecutive month, at a faster rate in June. The New Orders Index registered 59.9 percent, 5.7 percentage points higher than the reading of 54.2 percent in May. The Employment Index grew 3 percentage points in June after one month of contraction to 52.7 percent from the May reading of 49.7 percent. The Prices Index decreased 0.1 percentage point from the May reading of 55.6 percent to 55.5 percent, indicating prices increased in June for the third consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in June. Respondents’ comments are mostly positive about business conditions and the economy. Overall, the report reflects a strong rebound from the 'cooling-off' of the previous month for the non-manufacturing sector."

This sustained decline in safe yields is a non-trivial matter. As I have noted before, at some point these ongoing declines in safe yields will hit an effective lower bound. When that happens something else will have to adjust if there is still demand for more safe assets. That something else will be real economic activity as shown by Caballero, Fahri, and Gourinchas (2016). Brexit, in other words, has pushed the global economy closer to a recession.

Wednesday, July 6, 2016

Bonddad Tuesday Linkfest

Sterling first slumped after coming off the gold standard in 1931 in which it had been overvalued, just as it was in 1944 when it joined the Bretton Woods system of managed exchange rates. Another 30 percent devaluation was swallowed in 1949 and then Wilson sanctioned another drop in 1967 amid Britain’s balance of payments crunch.

While the IMF was called in to help avoid a sterling crisis in the 1970s, it fell again in the early 1980s. The U.K. joined the Exchange Rate Mechanism, a precursor to the euro, in 1990 but was forced out just two years later because it couldn’t sustain a link to the deutsche mark.

Now there is speculation that life outside the EU will cost the pound its place in the top tier of reserve currencies. It currently accounts for 5 percent of foreign exchange reserves, according to the IMF.

US Homeowners are Brexit Winners (Adviser Perspectives and BB)

From AP: The promise of continued low rates in Brexit’s wake could be good news for U.S. homeowners, both current and potential. For the week ended June 24, the mortgage rate on a 30-year home loan fell to 3.75 percent, its lowest level since May 2013, according to the Mortgage Bankers Association. Some analysts are even forecasting mortgage rates—which tend to track 10-year Treasury yields—to sink to record lows in the coming weeks. This move is expected to spur a wave of new loan applications and refinancing as borrowers rush to lock in historically low rates.

From the FT: The flight to haven assets by global investors since the Leave vote has already helped push US mortgage rates down to new lows for the year, according to data published by Freddie Mac. At 3.48 per cent, the 30-year fixed-rate mortgage is only 17 basis points shy of an all-time low.

It is a silver lining for US banks whose share prices have fallen since the Brexit vote, given the prospect of higher fees from mortgage refinancings.

Michael Fratantoni, chief economist at the Mortgage Bankers Association, said: “With those lower mortgage rates, we do expect a higher amount of refinance activity and a little bit more purchase activity.”

5-Year Chart of 15 and 30 Year Mortgage Rates

Weekly Chart of the XHB ETF

30 Day Chart of the SPYs

The headline PMI posted 48.1 in June, up from 47.7 in May, signalling a slightly slower rate of deterioration in operation conditions at Japanese manufacturers However, the latest reading contributed to the lowest quarterly average since Q4 2012.

5-year Chart of the Yen Dollar

5-Year Chart of the Yen Sterling

5-Year Chart of the Yen Sterling

Weekly Chart of the Japanese Tracking ETF

Tuesday, July 5, 2016

The expansion and Income inequality: finally clearing the low hurdle of the Bush expansion

- by New Deal democrat

Emanuel Saez has published an update to his data showing how the benefits from this economic expansion have been distributed between the top 1% and the bottom 99%. To cut to the chase, here's the table:

There's good news and bad news in the data. The bad news is that average real income growth in this expansion so far has been poorer than even during the George W. Bush expansion (13.0% vs. 16.1%). The good news is that the bottom 99% saw better real average income growth than during the Bush expansion (7.6% vs. 6.8%), and received a bigger share of the benefits of income growth than during the Bush expansion (48% vs. 35%).

Neither one comes close to the 1990s tech expansion under Bill Clinton.

This is still pretty weak tea, since the 90th through 98th percentiles of income are included in that bottom 99%.

This is still pretty weak tea, since the 90th through 98th percentiles of income are included in that bottom 99%.

But it nevertheless probably means that the below graph from an article by Paulina Tcherneva, which compares income growth for the top 10% vs. the bottom 90%, and which I sometimes still see circulated, can be put to rest:

Tcherneva wrote at the time:

In the postwar period, with every subsequent expansion, a smaller and smaller share of the gains in income growth have gone to the bottom 90 percent of families. Worse, in the latest expansion, while the economy has grown and average real income has recovered from its 2008 lows, all of the growth has gone to the wealthiest 10 percent of families, and the income of the bottom 90 percent has fallen. Most Americans have not felt that they have been part of the expansion. We have reached a situation where a rising tide sinks most boats.

At the time it came out, I criticized the graph for comparing *entire* recoveries vs. the first 4 1/2 years of this recovery.

I want to emphasize that I agree with the thrust of Tcherneva's argument, but it would be nice to see an update to see if the improvement in the lot of the bottom 99% includes more than the top 9% of that group.

In the meantime, it does appear likely that lower gas prices and a tightening job market have finally brought a little growth to the bottom 99%.

Bonddad Monday Linkfest

It is now more likely that adjustments in commercial real estate could tighten credit conditions for UK businesses. Foreign flows of capital into commercial real estate fell 50% in the first quarter of 2016, transaction volumes have fallen further during the second quarter, and share prices of property REITs dropped sharply following the referendum.

In addition, the number of vulnerable households could increase due to a tougher economic outlook and a potential tightening of credit conditions. In particular, there is growing evidence that uncertainty about the referendum has delayed major economic decisions, such as business investment, construction and housing market activity

3-Year Chart of the UK ETF

Benchmark 10-year note yields slid together with those on 30-year securities as signs of slowing growth in Europe ended a five-day gain in global stocks. In the U.S., a jobs report Friday may will offer clues as to the direction of the Federal Reserve’s next interest-rate move. The odds in futures markets of tighter U.S. policy this year fell after the U.K. unexpectedly voted last month to leave the European Union, clouding the outlook for global growth. Treasuries were closed globally July 4 for the U.S. Independence Day holiday.

5-Year Chart of the 30-2 Spread

5-year Chart of the 10-2 Spread

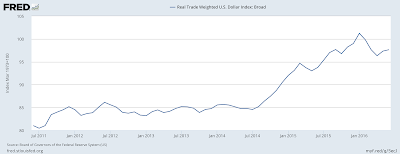

5-Year Chart of the Dollar

5-Year Chart of the Trade Weighted Dollar

This time it’s not Britain’s David Cameron but Italy’s Matteo Renzi, who has called a vote on an ambitious overhaul of the political system aimed at ending the country’s unstable governments. If he loses, Renzi has promised to quit, an outcome that Citigroup Inc. called probably the biggest risk in European politics this year outside the U.K.

The vote is expected in October, though it is already spooking investors and Italian bonds are once more under-performing their Spanish peers. The yield on 10-year Italian securities overtook those on similar-maturity Spanish debt for the first time in almost a year on June 27, a day after Spain’s Acting Prime Minister Mariano Rajoy defied opinion polls to consolidate his position in a general election.

1-Year Chart of the Italy ETF

3-Year Chart of the Italy ETF

At its meeting today, the Board decided to leave the cash rate unchanged at 1.75 per cent.

The global economy is continuing to grow, at a lower than average pace. Several advanced economies have recorded improved conditions over the past year, but conditions have become more difficult for a number of emerging market economies. China's growth rate has moderated further, though recent actions by Chinese policymakers are supporting the near-term outlook.

Commodity prices are above recent lows, but this follows very substantial declines over the past couple of years. Australia's terms of trade remain much lower than they had been in recent years.

Financial markets have been volatile recently as investors have re-priced assets after the UK referendum. But most markets have continued to function effectively. Funding costs for high-quality borrowers remain low and, globally, monetary policy remains remarkably accommodative. Any effects of the referendum outcome on global economic activity remain to be seen and, outside the effects on the UK economy itself, may be hard to discern.

In Australia, recent data suggest overall growth is continuing, despite a very large decline in business investment. Other areas of domestic demand, as well as exports, have been expanding at a pace at or above trend. Labour market indicators have been more mixed of late, but are consistent with a modest pace of expansion in employment in the near term.

Inflation has been quite low. Given very subdued growth in labour costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time.

5-Year Chart of the Australian Dollar and Yuan

3-Year Chart of the Australian ETF

Monday, July 4, 2016

A thought for July 4, 2016: "A republic ..."

- by New Deal democrat

The proceedings of the 1787 Constitutional Convention were shrouded in secrecy. On the last day of deliberations, as he left Independence Hall, Ben Franklin was approached by a curious woman. The conversation went as follows:

"Well, Doctor, what have we got -- a Republic or a Monarchy?"

Frankliln replied: "A Republic . . . if you can keep it."

- from the memoirs of Dr. James McHenry, a Maryland delagate

A thought to keep in mind on July 4, 2016.

Sunday, July 3, 2016

Subscribe to:

Comments (Atom)