- by New Deal democrat

In the past few months, my focus has been on whether jobs gains are most consistent with a “soft landing,” i.e., no further deterioration, or whether deceleration is ongoing. In the last several months I have also pointed out that the Household Survey is probably understating growth because of its large undercount of recent immigrants joining the labor force.

Below is my in depth synopsis.

- 114,000 jobs added. Private sector jobs increased 97,000. Government jobs increased by 17,000.

- May was revised downward by -2,000, and June was revised downward by -27,000, for a net decline of -29,000. This continues the pattern from nearly every month in the past 18 months of a steady drumbeat of downward net revisions.

- The alternate, and more volatile measure in the household report, showed an increase of 67,000 jobs. On a YoY basis, in this series only 57,000 jobs, which round to 0.0%, or no gain at all. With the sole exception of 1952 and one month in 1957, this has always and only occurred shortly before or during recessions.

- The U3 unemployment rate rose 0.2% to 4.3%, triggering the “Sahm rule” recession indicator.

- The U6 underemployment rate rose 0.5% to 8.2%, 1.4% above its low of December 2022.

- Further out on the spectrum, those who are not in the labor force but want a job now rose 362,000 to 5.600 million, vs. its post-pandemic low of 4.925 million in early 2023.

- the average manufacturing workweek, one of the 10 components of the Index of Leading Indicators, declined -0.2 hours to 39.9 hours, and is down -0.6 hours from its February 2022 peak of 41.5 hours.

- Manufacturing jobs rose 1,000.

- Within that sector, motor vehicle manufacturing jobs declined -1,300.

- Truck driving declilned -2,400.

- Construction jobs increased 25,000.

- Residential construction jobs, which are even more leading, rose by 1,700 to another new post-pandemic high.

- Goods producing jobs as a whole rose 25,000 to another new expansion high. These should decline before any recession occurs.

- Temporary jobs, which have generally been declining late 2022, fell by another -8,700, and are down about -500,000 since their peak in March 2022. This appears to be not just cyclical, but a secular change in trend.

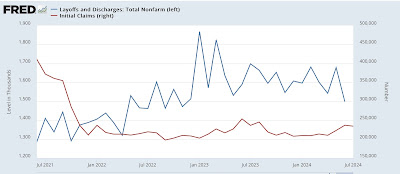

- the number of people unemployed for 5 weeks or fewer rose 223,000 to 2,351,000.

- Average Hourly Earnings for Production and Nonsupervisory Personnel increased $.09, or +0.3%, to $30.14, for a YoY gain of +3.8%. This continues the decelerating trend in YoY growth in wages since their post pandemic peak of 7.0% in March 2022. Keep in mind that this is still significantly higher than the 3.0% YoY inflation rate as of last month.

- the index of aggregate hours worked for non-managerial workers declined -0.2%, and is up 1.2% YoY, basically in trend for the past 12+ months.

- the index of aggregate payrolls for non-managerial workers was unchanged, and is up 5.1% YoY. These have been slowly decelerating since the end of the pandemic lockdowns. But with the latest YoY consumer inflation reading of 3.0%, this remains powerful evidence that average working families have continued to see gains in “real” spending money.

- Professional and business employment declined -11,000. These tend to be well-paying jobs. This series had generally been declining since May 2023, but earlier this year had resumed increasing again. As of this month, they are only higher YoY by 0.6% - a very low increase that has *only* happened in the past 80+ years immediately before, during, or after recessions.

- The employment population ratio declined -0.1% to 60.0%, vs. 61.1% in February 2020.

- The Labor Force Participation Rate increased +0.1% to 62.7%, vs. 63.4% in February 2020. The prime 25-54 age participation rate rose sharply to 84.0%, the highest rate during the entire history of this series except for the late 1990s tech boom.