Saturday, March 9, 2019

Weekly Indicators for March 4 - 8 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

The distortions caused by the government shutdown appear to have ended, which has given the indicators generally a little boost.

As always, clicking on the link and reading should hopefully be educational for you, and helps reward me a little bit for the work I put in.

Friday, March 8, 2019

February jobs report: the first sign of the economic slowdown spreading to jobs?

- by New Deal democrat

HEADLINES:

- +20,000 jobs added

- U3 unemployment rate -0.2% from 4.0% to 3.8%

- U6 underemployment rate -0.8% from 8.1% to 7.3% (NEW 20 YEAR LOW)

Here are the headlines on wages and the broader measures of underemployment:

Wages and participation rates

- Not in Labor Force, but Want a Job Now: down -32,000 from 5.254 million to 5.222 million

- Part time for economic reasons: down -837,000 from 5.147 million to 4.510 million

- Employment/population ratio ages 25-54: unchanged at 79.9%

- Average Hourly Earnings for Production and Nonsupervisory Personnel: rose $.08 from $23.10 to $23.18, up +3.5% YoY. (Note: you may be reading different information about wages elsewhere. They are citing average wages for all private workers. I use wages for nonsupervisory personnel, to come closer to the situation for ordinary workers.)

Is a recession close?

The more leading numbers in the report tell us about where the economy is likely to be a few months from now. These were mixed.

- the average manufacturing workweek fell -0.1 hours from 40.8 to 40.7 hours. This is one of the 10 components of the LEI.

- Manufacturing jobs rose +4,000. YoY manufacturing is up 242,000.

- construction jobs declined -31,000. YoY construction jobs are up 373,000.

- temporary jobs rose +5800. YoY these are up +67,000.

- the number of people unemployed for 5 weeks or less fell by -131,000 from 2,325,000 to 2,194,000. The post-recession low was set nine months ago at 2,034,000.

Holding Trump accountable on manufacturing and mining jobs

Trump specifically campaigned on bringing back manufacturing and mining jobs. Is he keeping this promise?

Trump specifically campaigned on bringing back manufacturing and mining jobs. Is he keeping this promise?

- Manufacturing jobs rose an average of +12,000/month in the past year vs. the last seven years of Obama's presidency in which an average of +10,300 manufacturing jobs were added each month.

- Coal mining jobs increased by 100 for an average of +160/month vs. the last seven years of Obama's presidency in which an average of -300 jobs were lost each month

Other important coincident indicators help us paint a more complete picture of the present:

- Overtime was unchanged at 3.5 hours.

- Professional and business employment (generally higher-paying jobs) rose by +42,000 and is up +537,000 YoY.

- the index of aggregate hours worked for non-managerial workers fell by -0.6%

- the index of aggregate payrolls for non-managerial workers fell by -0.3%

Other news included:

- the alternate jobs number contained in the more volatile household survey increased by +255,000 jobs. This represents an increase of 1,736,000 jobs YoY vs. 2,509,000 in the establishment survey.

- Government jobs fell by -5000.

- the overall employment to population ratio for all ages 16 and up was unchanged at 60.7% m/m and is up 0.3% YoY.

- The labor force participation rate was unchanged at 63.2% and is up +0.2% YoY.

SUMMARY

There are two themes to this report. The first is that it reversed both last month’s establishment and household reports. Last month the first was excellent and the second was poor. This month the establishment survey laid an egg, as featured in the headline number, while the household survey rose smartly, as featured in involuntary part time work, discouraged workers, and both the unemployment and underemployment rates. Positive news also included another good increase in non-supervisory wages.

But this month’s report actually went beyond taking back January’s report. The YoY change in construction, manufacturing, and total jobs for the last two months combined are all lower than they were in December. So we both aggregate hours worked and aggregate payrolls. The manufacturing workweek declined for the second month in a row. It’s also worth noting that the YoY increase in the household report is significantly lagging the establishment report.

In summation, I suspect this month marked the first month in which the economic slowdown showed up in the jobs report.

Thursday, March 7, 2019

Two more leading sectors to watch for in tomorrow’s jobs report

- by New Deal democrat

Yesterday I updated my look at temporary jobs, a known leading indicator for jobs overall. Today I want to look at two more leading sectors: manufacturing and construction.

Unlike temporary jobs, I’m not looking for a possible decline. Rather, I am looking for a deceleration in growth from their recent peaks. Let’s take them in order.

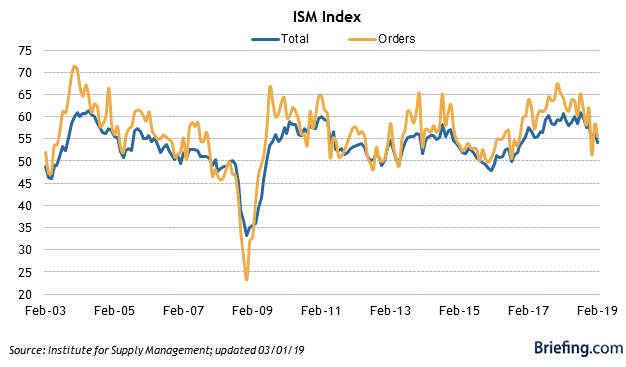

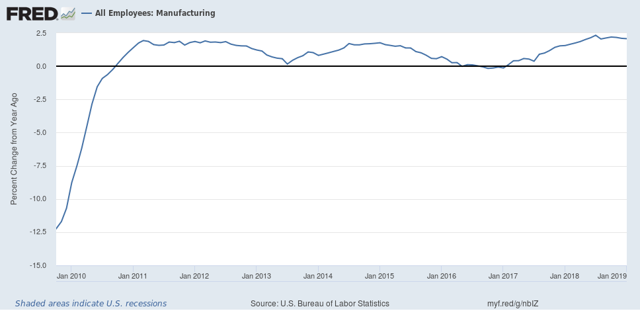

First, manufacturing. Because the ISM is picky about allowing FRED to publish their data, I have to do this in two separate graphs. So, the below two graphs are of the ISM manufacturing index and its new orders sub index, followed by the YoY% change in manufacturing employment:

The important point of the two is that manufacturing jobs tend to follow the ISM index with a 6 to 12 month lag. Thus, for example, the ISM manufacturing index first went into contraction (a reading below 50) in October 2015. Manufacturing jobs didn’t contract YoY until March 2016. By June 2016 the ISM index had turned positive again. Manufacturing jobs didn’t get there YoY until February 2017.

In 2018, the ISM manufacturing index peaked in August. So I am expecting YoY growth in manufacturing jobs to decline. Since one year ago manufacturing added 30,000 jobs in February, I am expecting substantially fewer than that to be added tomorrow.

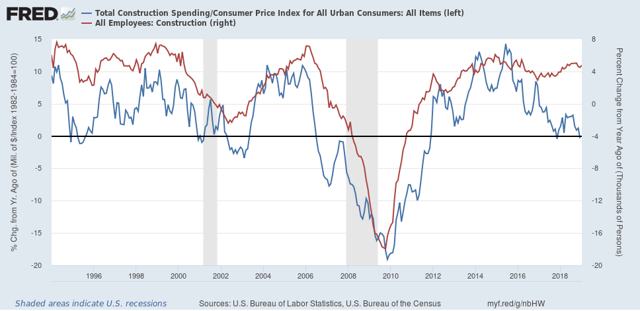

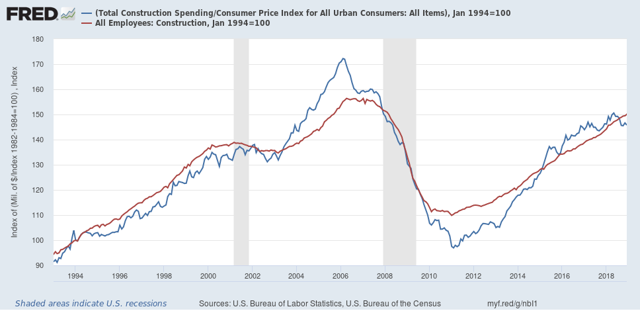

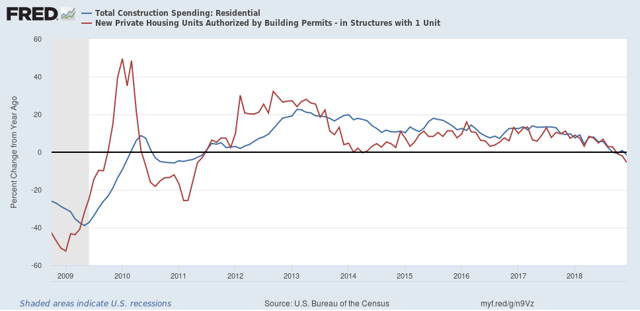

Second, construction. The first graph below compares the YoY% change in construction spending adjusted for inflation (blue) with construction jobs:

Although the former is somewhat noisy, it is pretty easy to see that usually construction jobs have followed spending by a few months — except in the last couple of years, and arguably during the first couple of years (2006-07) of the housing bust.

Looking at the absolute values of the same data series is helpful (note that both series have been normal to 100 as of January 1994):

Looking at the absolute values of the same data series is helpful (note that both series have been normal to 100 as of January 1994):

Now we can see that the two grow or decline at nearly identical rates over the longer term, with jobs following spending with a short lag.

But the other thing that jumps out is how spending outpaced jobs growth (I.e., blue line above red line) during the housing boom, and again during 2015-17. This suggests that during those periods existing workers were getting more hours, rather than more workers being hired. When demand waned, first hours were cut before layoffs began. Since spending has only fallen back below jobs in the past half year, I’m not expecting a decline in construction jobs, but rather a leveling off in the YoY pace.

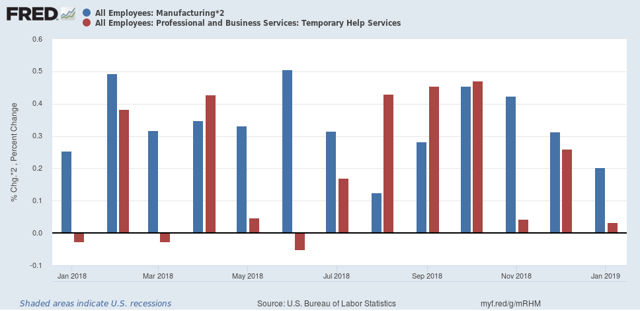

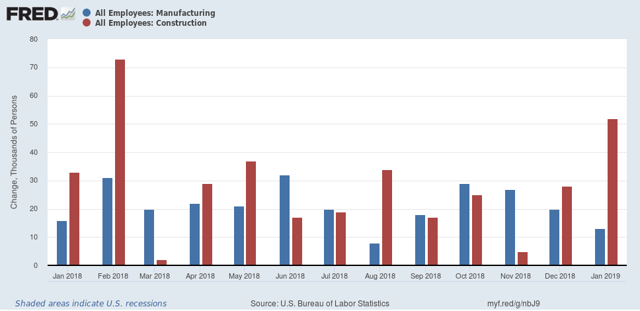

This can be summed up by looking at the monthly gains for the past year in manufacturing (blue) and construction (red):

Tomorrow I am looking for continued gains in both manufacturing and construction, but a cooling in manufacturing vs. continued trend growth to a slight deceleration in construction. In both cases this means gains of less than 30,000, and possibly as low as 5,000. Because the economy is slowing, and this should show up in jobs numbers, if there is a surprise in either or both, it will likely be to the downside.

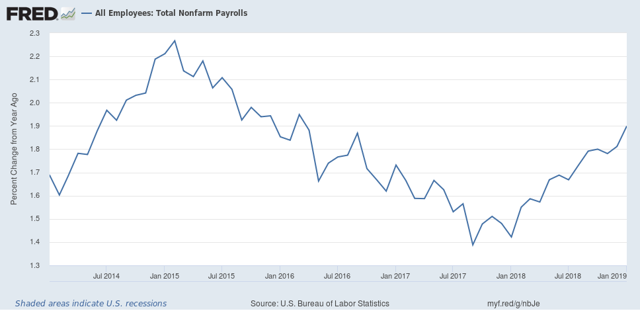

Finally, I expect YoY overall jobs growth to begin to decelerate from its peak last month:

which means a gain of fewer than 200,000:

We’ll see tomorrow.

Wednesday, March 6, 2019

This Friday, watch out for an outright decline in temporary employment

- by New Deal democrat

Almost a month ago I flagged the decelerating staffing index, and showed how it corresponded with the leading sector of temporary jobs in the monthly jobs report:

the Staffing Index isn’t seasonally adjusted, [so] you really have to compare each on a YoY basis. And while the two don’t turn positive or negative at the same time or for the same duration, they do correlate well on YoY direction; i.e., acceleration or deceleration in the YoY comparison.

I concluded:

[This deceleration] makes me think that the deceleration of temp jobs in the monthly report for the last three months, as shown in the final graph below:

hasn’t just been noise, but - while still positive - is demonstrative of real weakness.

Since then, beginning three weeks ago, the Staffing Index has gone negative. As of this week, it is down over -1% from a year ago, and even negative compared with two years ago:

As a result, I expect at minimum that this Friday’s employment report will show that temporary help jobs have also decelerated YoY. Since in last February 12,000 temp jobs were added, that isn’t much of a constraint.

But the average for the last three months has been declined to +3,000 per month. With the Staffing Index having continued to roll over since the beginning of this year, that is a more realistic ceiling on what I am expecting on Friday, and there’s probably a 50/50 chance of an outright decline will be reported for February.

But the average for the last three months has been declined to +3,000 per month. With the Staffing Index having continued to roll over since the beginning of this year, that is a more realistic ceiling on what I am expecting on Friday, and there’s probably a 50/50 chance of an outright decline will be reported for February.

The bottom line is that almost all of the other economic data has been validating the “slowdown” forecast I made beginning last summer, and I expect employment to follow — and temporary jobs will probably lead the way.

Tuesday, March 5, 2019

February services index strong; new home sales in line with bottoming scenario

- by New Deal democrat

Just a quick note on this morning’s economic data.

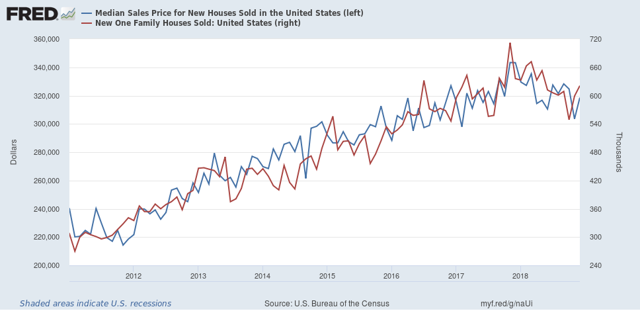

First, new home sales improved in December from October and November’s relatively dismal pace (blue in the graph below). We are back to the levels of last summer, but still down from one year ago (including as the more stable, less noisy 3-month rolling average)(red shows prices, which have been moving in tandem with sales during this expansion):

This is of a piece with yesterday’s December permits and starts data. Both metrics are down, but look likely to bottom within a few months in response to lower long term interest rates.

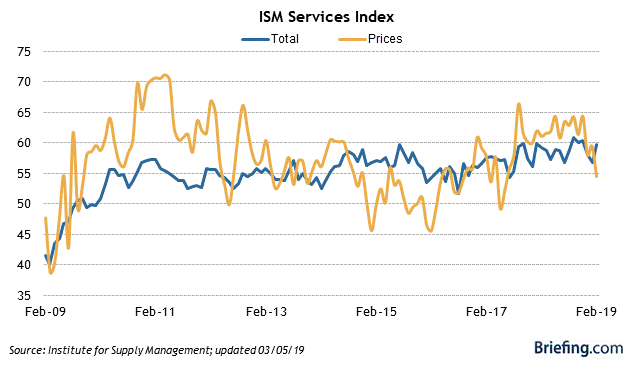

Second, the ISM services, or non-manufacturing, index came in at a very good 59.7. Here is that metric for this expansion (via Briefing.com):

As you can see, this metric is doing very well.

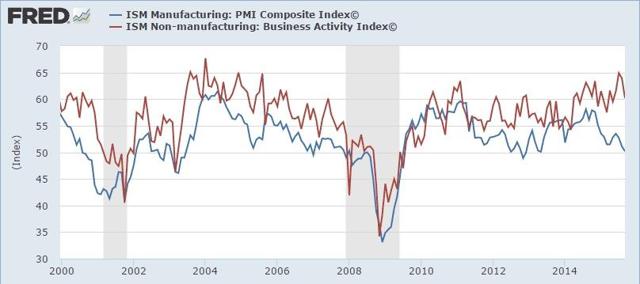

ISM doesn’t let FRED publish their data any more, but fortunately there are long-term graphs since the beginning of the series 20 years ago that are still around. Here’s one from 5 years ago, comparing services with manufacturing:

The important thing here is that, unlike the manufacturing index, which is a leading indicator, services are a coincident, and possibly even lagging indicator (look at 2008). If and when ISM services slips to 50, that will probably mean that a recession is imminent or has already started. But no worries for the moment!

Monday, March 4, 2019

Residential construction declines in December, but looks to be bottoming

- by New Deal democrat

Residential construction spending lags sales, permits, and starts. But it still leads the economy overall, and it is a much smoother data series, with little noise. It is almost all signal, and so it is an important confirmation of the more leading data.

In December, residential construction spending did decline vs. November and also vs. one year ago, but it was higher than September’s and October’s numbers.

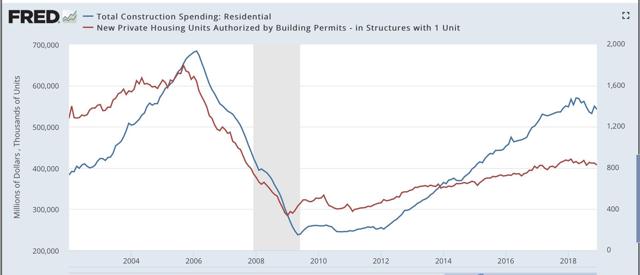

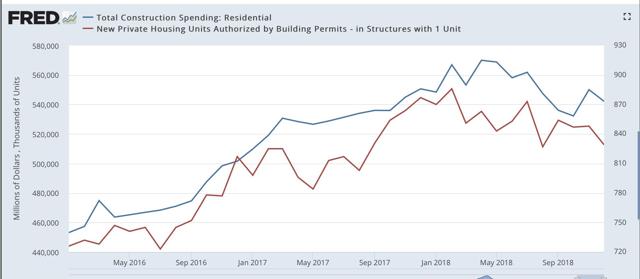

Let’s go to the graphs. Here’s the absolute level of residential construction spending (blue) vs. single family permits (red), first a long term look, and then focusing on the last several years. As usual, I choose single family permits because they are the least noisy of all the more leading data:

That permits lead construction is easy to see. In the second graph, the declining trend in 2018 with construction following permits with a brief lag is also apparent.

Here is the same data as YoY% changes since the bottom in 2009:

Both series are down YoY.

That neither series has made new lows in several months is encouraging. Although I think there is a little further to go in the next few months, Unless the Fed surprises nearly everybody and raises rates again, I strongly suspect that the bottoming process in new home building is ongoing.

December housing summary at Seeking Alpha

- by New Deal democrat

I haven’t done a comprehensive update on housing in a few months, in large part because of the lapse in data during the government shutdown.

With last week’s report on December housing permits and starts, plus several house price indexes, I put up an update over at Seeking Alpha .

As usual, clicking over and reading should be educational for you, and helps me with a bit of $$$.

Also, we’ll get December construction spending later this morning, and new home sales tomorrow. I’ll update further as warranted once these (especially spending) are reported.

Sunday, March 3, 2019

Climate change is the detonation of the Population Bomb

- by New Deal democrat

You know the drill ... it’s Sunday so I speak my mind on things non-economic.....

Way back in the days of the dinosaurs when I was a young teen, I concluded that there were really only two extinction level threats to humanity:

Way back in the days of the dinosaurs when I was a young teen, I concluded that there were really only two extinction level threats to humanity:

1. Nuclear war

2. Overpopulation (a/k/a “The Population Bomb”)

As to the first, fortunately we have gone over 70 years since Hiroshima and Nagasaki. But I find it difficult to conclude that unless something changes, over a long enough time horizon, like 500 years, a nuclear war won’t happen. Just consider the likes of Donald Trump and Kim Jung Un with their fingers on the button, and wonder how long till someone like them makes a fatal mistake.

As to the second, we have the example of Easter Island, where the last tree is cut down, and the last food-source is exhausted. Humanity disappears. All you need to consider is whether the Easter Island experience can be scaled up to the entire planet.

I have thought a lot recently about climate change, and increasingly think it is ultimately a manifestation of the Population Bomb.

I am currently reading historian Yuval Noah Harari‘s “Sapiens: a Brief History of Humankind.” I’m not sure if the book as a whole is very recommendable. Much of it comes across as broad-brush sociological speculation, some of it provocative (e.g., money is the most universally accepted part of human culture. One culture may hate another, but will universally be willing to trade in their accepted coin or currency.), and some of it flimsy (e.g., why patriarchies are much more common than matriarchies). Perhaps the most interesting observation is that what sets humans apart from other social animals is our willingness to cooperate on both an individual and massive scales with complete strangers. A look at human population growth shows just how successful that has been.

The first modern human, our “Eve,” lived about 200,000 years ago. Probably the genetic mutation that she spawned was the dropping of the voice box further into the throat, enabling speech (as opposed to, e.g., grunts or gestures). So magical was the ability to speak that those endowed with it - the new human species - expanded through Africa and then ultimately out of it to Europe and Asia about 70,000 years ago.

What does that have to do with climate change and overpopulation? According to Harari, along the way, something alarming happened.

The first modern human, our “Eve,” lived about 200,000 years ago. Probably the genetic mutation that she spawned was the dropping of the voice box further into the throat, enabling speech (as opposed to, e.g., grunts or gestures). So magical was the ability to speak that those endowed with it - the new human species - expanded through Africa and then ultimately out of it to Europe and Asia about 70,000 years ago.

What does that have to do with climate change and overpopulation? According to Harari, along the way, something alarming happened.

- About 45,000 years ago, humans arrived in Australia. Shortly thereafter, almost all of the large predator and prey species went extinct.

- About 16,000 years ago, humans arrived in the Americas. Shortly thereafter, almost all of the large predator and prey species went extinct.

- About 800 years ago, humans arrived in New Zealand. Within 200 years, most of the large predator and prey species were extinct.

(As an aside, it’s possible that humans had a partner in crime in these extinctions. Below is a still of the last frame of the move “Alpha,” a fictional account of the first wolf that partnered with a human:

I don’t know about you, but if I were a prey animal and I saw a combined human-wolf-pack like that coming at me, I would be thinking, “Oh, sh#t! We are SO dead!” The evidence is that wolves were domesticated long before humans settled into agricultural communities, so almost certainly hunting as a team had something to do with it.)

But that’s not the point. The widespread extinctions of “megafauna” that coincided with the arrival of modern humans on the scene is just one example of the global impact of the “anthropocene” epoch.

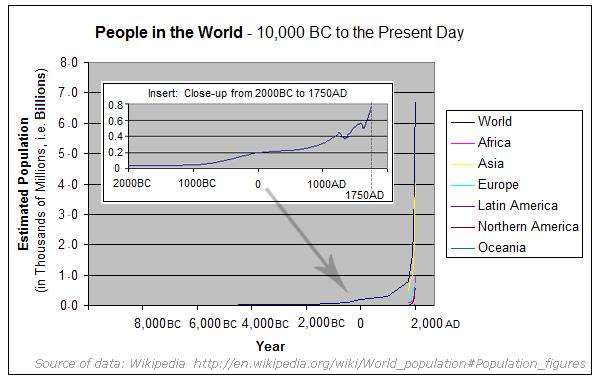

Here is a graph of the entire world population over the past 7000 years:

- About 16,000 years ago, humans arrived in the Americas. Shortly thereafter, almost all of the large predator and prey species went extinct.

- About 800 years ago, humans arrived in New Zealand. Within 200 years, most of the large predator and prey species were extinct.

(As an aside, it’s possible that humans had a partner in crime in these extinctions. Below is a still of the last frame of the move “Alpha,” a fictional account of the first wolf that partnered with a human:

I don’t know about you, but if I were a prey animal and I saw a combined human-wolf-pack like that coming at me, I would be thinking, “Oh, sh#t! We are SO dead!” The evidence is that wolves were domesticated long before humans settled into agricultural communities, so almost certainly hunting as a team had something to do with it.)

But that’s not the point. The widespread extinctions of “megafauna” that coincided with the arrival of modern humans on the scene is just one example of the global impact of the “anthropocene” epoch.

Here is a graph of the entire world population over the past 7000 years:

But this is a case where a chart might is even more devastating, as in the below, which based on figures cited by Harari and others, is what human population growth has looked like ever since that first “Eve” 200,000 years ago:

Years ago. World population doubling rate

200,000 1

75,000 80,000

12,000 8,000,000 ~10,000 years

3,000 80,000,000 ~2800 years

200 800,000,000 ~850 years

Present 8,000,000,000 ~60 years

Not only has the human population exploded in raw terms, but its rate of growth has actually been accelerating ever since the “agricultural revolution” that began roughly 12,000 years ago.

Meanwhile, the last megafauna on the planet, like Siberian Tigers and African Elephants, teeters on the edge of extinction. Two thousand years ago megafauna that we associate with sub-Saharan Africa was also present along the temperate region along the Mediterranean coast. It disappeared via the Roman Coliseum. A little over 100 years ago, partly as an effort to exterminate the Indian tribes, American buffalo were hunted down to about 400. Now we are busy driving even ocean life, for example cod and lobster, towards extinction.

Years ago. World population doubling rate

200,000 1

75,000 80,000

12,000 8,000,000 ~10,000 years

3,000 80,000,000 ~2800 years

200 800,000,000 ~850 years

Present 8,000,000,000 ~60 years

Not only has the human population exploded in raw terms, but its rate of growth has actually been accelerating ever since the “agricultural revolution” that began roughly 12,000 years ago.

Meanwhile, the last megafauna on the planet, like Siberian Tigers and African Elephants, teeters on the edge of extinction. Two thousand years ago megafauna that we associate with sub-Saharan Africa was also present along the temperate region along the Mediterranean coast. It disappeared via the Roman Coliseum. A little over 100 years ago, partly as an effort to exterminate the Indian tribes, American buffalo were hunted down to about 400. Now we are busy driving even ocean life, for example cod and lobster, towards extinction.

As these resources decline, their cost increases dramatically. Two hundred years ago lobster was junk food. Caspian Sea caviar costs a year’s salary. And need we talk about the concept of “peak oil”?

Just in the last year, evidence was adduced that possibly the death of up to 90% of Native North and South American tribes due to diseases introduced from Europe after 1492 caused so much re-forestation that it contributed to the “Little Ice Age.”

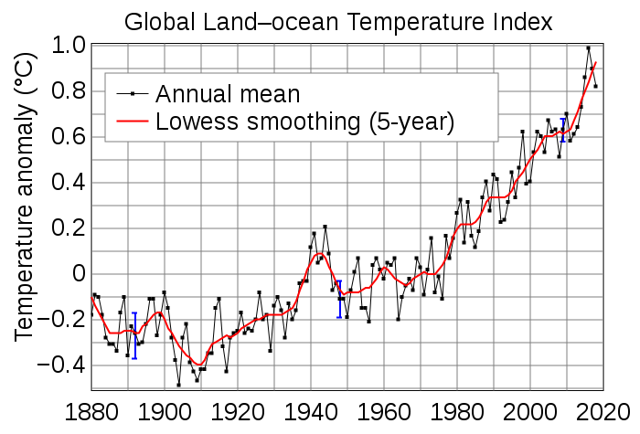

And so now we come to global warming. Here’s a graph of average ocean temperatures in the past 150 years:

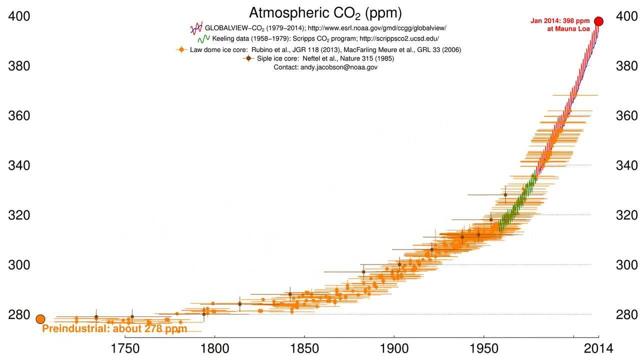

And here is carbon dioxide levels in the atmosphere for the past 300 years:

Does anyone seriously think that the half measures and quarter measures being contemplated — and fiercely opposed — are going to make a meaningful dent in the trend in those two graphs?

The simple fact is, humanity has been slowly — but at an accelerating rate — turning the entire planet into Easter Island. I strongly suspect that we have already crossed the threshold beyond the Earth’s long term carrying capacity for the human race. The planet could handle 8 million, 80 million, and even 800 million humans without widespread damage. There is evidence everywhere in the animal, ocean, and atmospheric environment that it can’t handle 8 billion humans for long.

Want to defeat climate change? A global one-child policy for two generations, bringing total human population down to where it was in about 1950 might be enough. It almost certainly will never happen.

But if human population has already exceeded the carrying capacity of the planet, humanity will get there, willingly or not.

Subscribe to:

Comments (Atom)