- by New Deal democrat

While I was away on vacation, the high frequency data continued to pour in. And so my Weekly Indicators post for the week is up at Seeking Alpha.

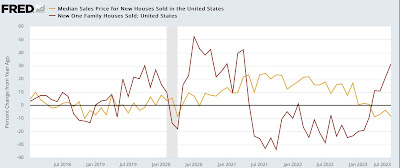

There continue to be some very negative signs associated with interest rates, including important things like both purchase and refinancing mortgage applications, both of which are at or near 30 year lows. Not a good sign for housing, I would say!

Meanwhile consumer spending is showing at least one sign of a renewed increase, and producing is getting “less bad.”

As usual, clicking over and reading will bring you up to the virtual moment as to the shape of the economy, and reward me a little bit for my efforts.