- by New Deal democrat

Like the past few months, I was most interested in three main issues:

1. Is the pace of job growth decelerating? (Yes, but it is still very strong by historical standards)

2. Is wage growth holding up? Is it accelerating? (It is still strong, but decelerated again slightly)

3. Are the leading indicators in the report beginning to flag? (Not yet)

We still have 822,000 jobs, or 0.5% of the total to go to equal the number of employees in February 2020 just before the pandemic hit. At the current average rate for the past 6 months of 505,000 jobs added per month, that’s 2 months from now. Perhaps even more importantly, non-managerial workers are now working in total *more* hours than they did before the pandemic hit.

Here’s my in depth synopsis of the report:

HEADLINES:

- 390,000 jobs added. Private sector jobs increased 333,000. Government jobs increased by 57,000 jobs.

- The alternate, and more volatile measure in the household report indicated a gain of 321,000 jobs. The above household number factors into the unemployment and underemployment rates below.

- U3 unemployment rate was unchanged 3.6%, 0.1% above the January 2020 low of 3.5%.

- U6 underemployment rate *rose* 0.1% to 7.1%, 0.2% above the January 2020 low of 6.9%.

- Those not in the labor force at all, but who want a job now, declined -178,000 to 5.681 million, compared with 4.996 million in February 2020.

- Those on temporary layoff declined -43,000 to 810,000.

- Permanent job losers were unchanged at 1,386,000.

- March was revised downward by -30,000, but April was revised upward by 8,000, for a net decline of -22,000 jobs compared with previous reports.

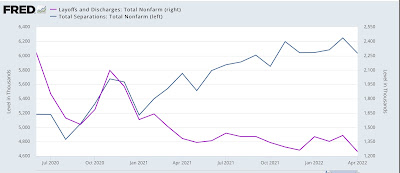

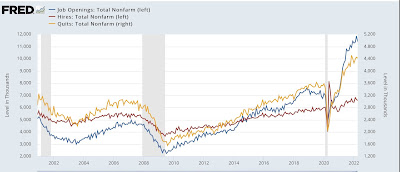

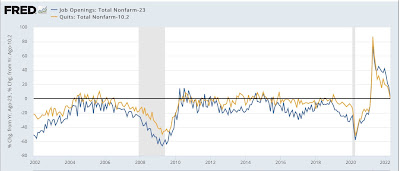

Leading employment indicators of a slowdown or recession

These are leading sectors for the economy overall, and will help us gauge whether the strong rebound from the pandemic will continue. These were positive:- the average manufacturing workweek, one of the 10 components of the Index of Leading Indicators, was unchanged at 41.3 hours (but last month was revised down -0.1%).

- Manufacturing jobs increased 18,000. Since the beginning of the pandemic, manufacturing is now down only -17,000 jobs, or -0.1% of the total.

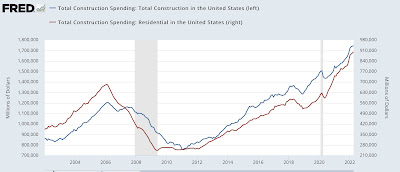

- Construction jobs increased 36,000. All of the jobs lost during the pandemic, plus another 774,000, have been made up.

- Residential construction jobs, which are even more leading, increased 5,000. Since the beginning of the pandemic about 60,000 jobs have been gained in this sector.

- Temporary jobs rose by 19,300. Since the beginning of the pandemic, about 250,000 jobs have been gained.

- the number of people unemployed for 5 weeks or less declined by -161,000 to 2,066,000, which is 57,000 *lower* than just before the pandemic hit.

- Professional and business employment increased by 75,000, which is about 800,000 above its pre-pandemic peak.

Wages of non-managerial workers

- Average Hourly Earnings for Production and Nonsupervisory Personnel: rose $0.15 to $27.33, which is a 6.5% YoY gain, down from its 6.7% peak at the beginning of this year.

Aggregate hours and wages:

- the index of aggregate hours worked for non-managerial workers rose by 0.3%, which is now 0.2% *above* its level just before the pandemic.

- the index of aggregate payrolls for non-managerial workers rose by 0.8%, which is a gain of 14.0% (before inflation) since just before the pandemic.

Other significant data:

- Leisure and hospitality jobs, which were the most hard-hit during the pandemic, rose 84,000, but are still -1,345,000, or -7.9% below their pre-pandemic peak.

- Within the leisure and hospitality sector, food and drink establishments added 46,100 jobs, and is still -750,700, or -6.1% below their pre-pandemic peak.

- Full time jobs rose 733,000 in the household report.

- Part time jobs declined -325,000 in the household report.

- The number of job holders who were part time for economic reasons rose 295,000 to 4,328,000, which is still below their level before the pandemic began, although it is 611,000 above their low this past January.

- The Labor Force Participation Rate rose 0.1% to 62.3%, vs. 63.4% in February 2020.

SUMMARY

One month ago, while the Establishment report was very good, the Household report was not good at all. This month both sides of the jobs report were very positive.

While the pace of jobs growth isn’t as blistering as previously, it is still excellent by ordinary standards. The unemployment rate is still near historic lows. The leading sectors are almost all positive, indicating growth should continue. Wage growth is still very strong. With the exception of labor and hospitality, plus education, almost all sectors of the jobs market have made up, or almost entirely made up, their pandemic losses. In another two to three months we are likely to have more jobs than we did before the pandemic hit. What’s more, non-supervisory workers in total are now working a total of *more* hours than they did before the pandemic hit.

About the only soft spots were the upward tick in the underemployment rate, part of which was the continued increase in involuntary part-time workers, the 0.2% decline from best levels in the manufacturing workweek, and the second month in a row of downward revisions to previous reports.

In short, a little softening, but still very positive.