- by New Deal democrat

According to the CDC, there have been 30.3 Million *confirmed* cases of COVID-19 in the US, and 550,000 deaths.The true number of actual infections is probably much higher.

On the good news front, the CDC says that 36.2% of the entire US adult population has received at least one shot; a full 20%, or 1 in every 5 adults, has been fully vaccinated. Among those 65 years of age or higher, the news is even better: just shy of 3/4’s (72.4%) have received at least one dose, and just shy of 50% (48.4%) are fully vaccinated.

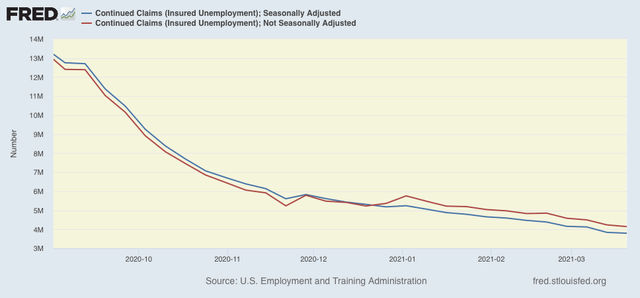

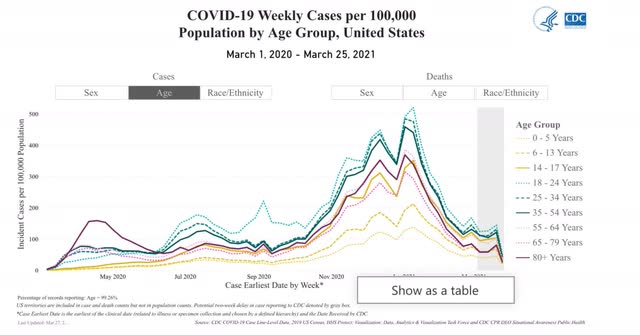

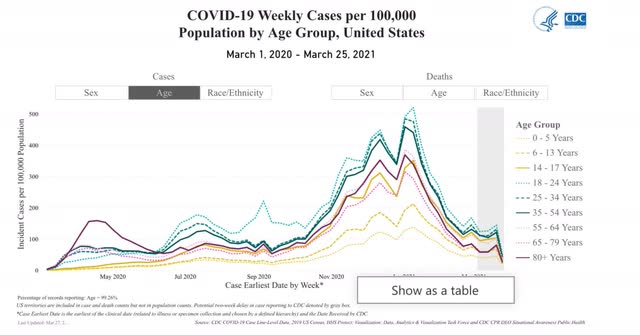

As a result, as of one week ago, both cases and deaths among senior citizens have declined by nearly 90% since their December peak. Here are cases:

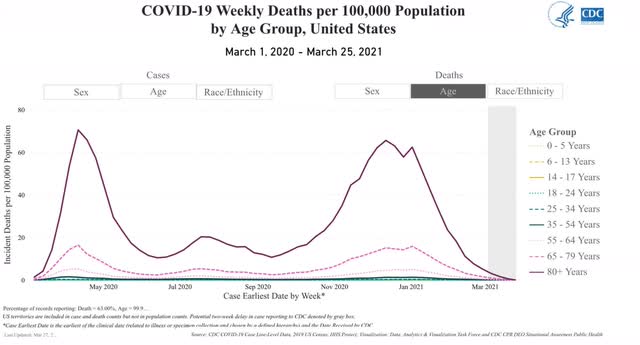

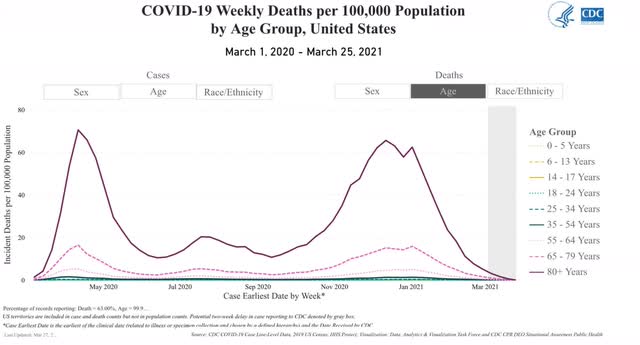

And deaths among senior citizens have all but disappeared:

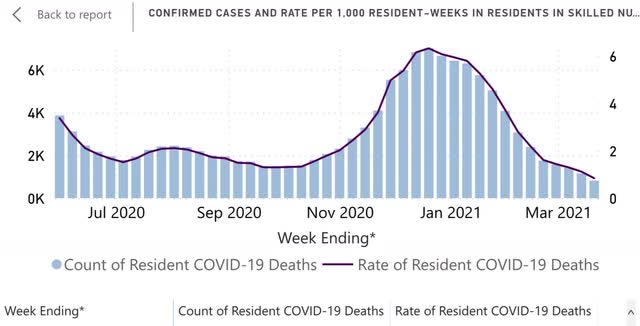

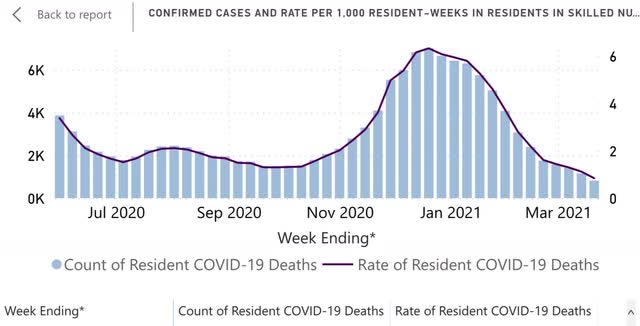

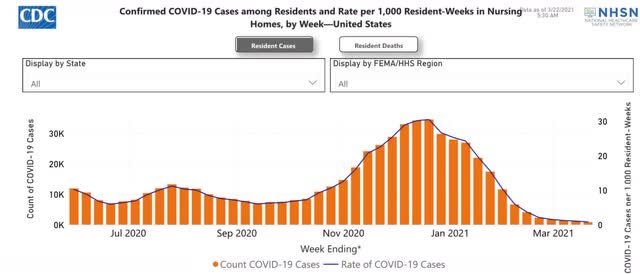

The situation among nursing home and other long term residential care facilities is even better. Cases have declined by 97% from nearly 35,000 to 828 weekly!:

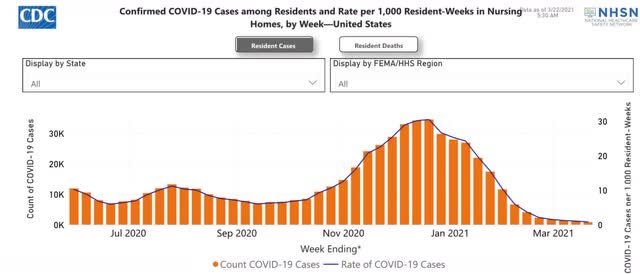

Deaths, which lag by a couple of weeks, are down 89%, from 7,000 to 825:

These can be expected to declined even further.

This is just an excellent, excellent result of the US’s vaccination program.

And now, <sigh> the bad news.

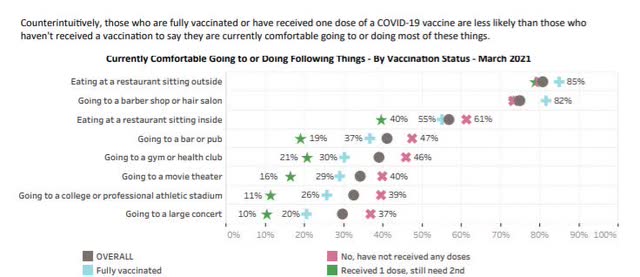

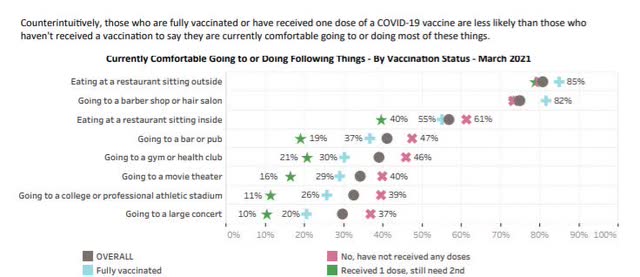

Let me start with this graphic, showing that the unvaccinated (I.e., a *much* younger demographic) are less hesitant to engage in indoor group activities, including those without masks, than those who have already been partially or completely vaccinated (skewing heavily towards seniors):

This, of course, was exemplified by the pictures we all saw of spring breakers in Florida.

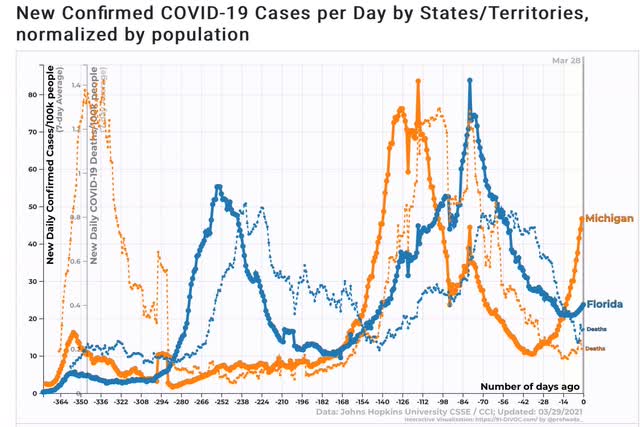

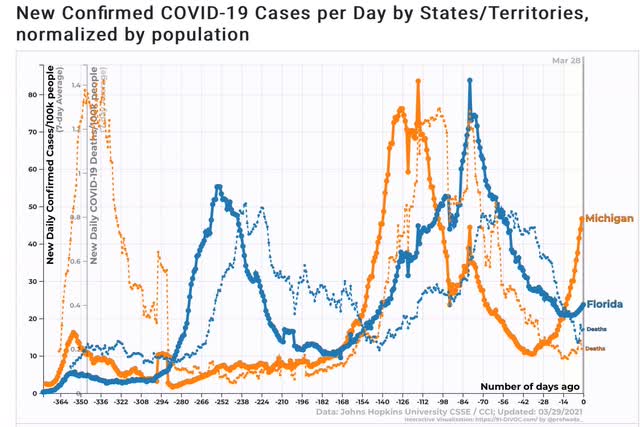

And here is the result, as we see the havoc that has been wrought by the “UK variant” taking hold in Michigan, and the start of a resurgence in Florida:

Michigan is on track to completely undo all of its progress in cases since December over the next 7 to 10 days. Deaths are about 3 weeks behind. Florida, the #1 export of which to other States is new COVID cases, is running about 4 weeks behind Michigan.

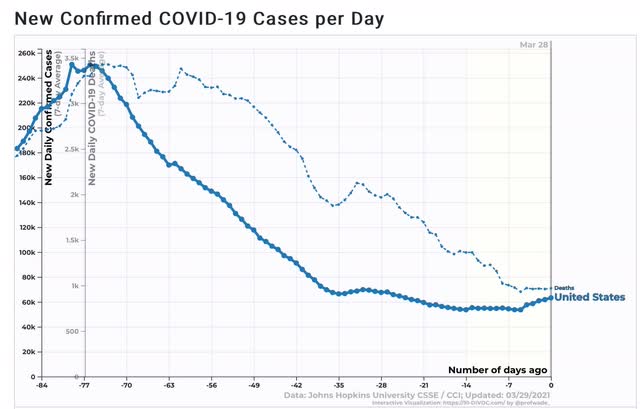

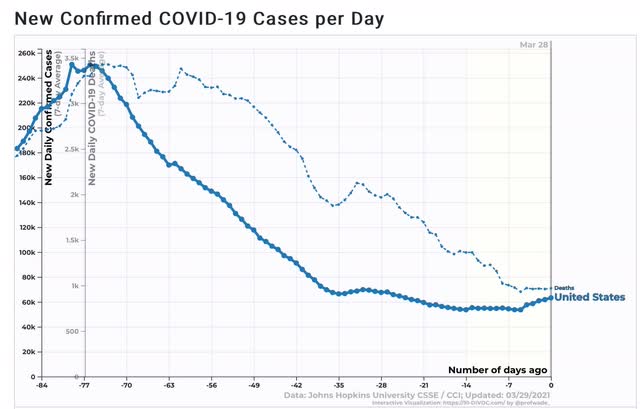

Here are cases and deaths for the US as a whole:

Cases have already turned back up. Deaths have just started to turn back up.

Where Michigan is now is about where I expect the US as a whole to be in 4 to 6 weeks. The only consolation is that another 25% of the US population should be partially or fully vaccinated by that time, meaning that it will be a younger demographic getting sick, and deaths will probably not approach their December peak of 3,000 a day.