- by New Deal democrat

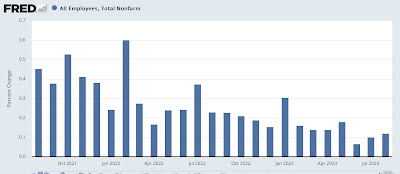

As per my reporting earlier this week, my focus this month was on whether wage and jobs growth continue to decelerate, and whether the unemployment rate would remain “sticky” at its higher, 3.8%, rate.

Two of those three came to pass. The third, jobs growth, emphatically did not! But it may well have been the result of the same unresolved seasonality that we have seen with initial jobless claims in the past month.

Here’s my in depth synopsis.

- 336,000 jobs added. This is the highest since January.

- July and August were both revised higher, by +79,000 and +40,000, respectively. This is the first time we have seen such upward revisions all this year. As a result, the 3 month moving average rose to 266,000 from a revised 193,000, the highest since March.

- Private sector jobs increased 263,000. Government jobs increased by 73,000. Only January and July were higher in the past 12 months.

- On the other hand, the alternate, and more volatile measure in the household report rose by only 86,000 jobs. The YoY% gain in this report is +1.7%.

- The U3 unemployment rate remained at 3.8%, tied with last month for the highest since February 2022 . The civilian labor force, the denominator in the figure, rose only slightly (by 90,000), and the numerator, the number of unemployed, rose very slightly (by 5,000).

- The U6 underemployment rate declined -0.1% to 7.0%, but still close to the highest since May 2022.

- Further out on the spectrum, those who are not in the labor force but want a job now rose 80,000 to 5.450 million, vs. its post-pandemic low of 4.925 million set this past March.

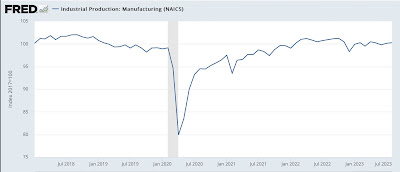

- the average manufacturing workweek, one of the 10 components of the Index of Leading Indicators, was unchanged at 40.7, equal to its lows earlier this year and down -0.8 hours from its February 2022 peak of 41.5 hours.

- Manufacturing jobs rose by 17,000.

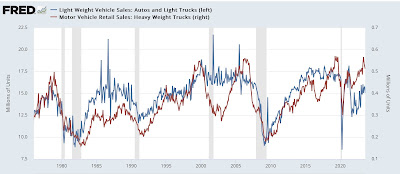

- Within that sector, motor vehicle manufacturing jobs rose 8,900.

- Construction jobs increased by 11,000.

- Residential construction jobs, which are even more leading, rose by 6,700. There has been a sharp rebound in the past two months, but so far It continues to appear likely that January was the peak for this sector.

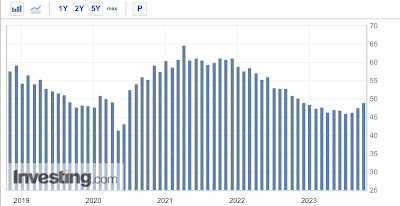

- Goods jobs as a whole rose 29,000. These should decline before any recession occurs. They remain up 1.6% YoY, which remains a very good pace compared with most of the last 40 years.

- Temporary jobs, which have generally been declining late last year, declined further, by -4,200, and are down -233,600 since their peak in March 2022.

- the number of people unemployed for 5 weeks or less declined -170,000 to 2,051,000.

- Average Hourly Earnings for Production and Nonsupervisory Personnel increased $.06, or +0.2%, to $29.06, a YoY gain of +4.3%. This is the lowest since June 2021.

- the index of aggregate hours worked for non-managerial workers increased 0.2%, and is up 1.2% YoY, a slight uptick from July’s recent low of 1.1%, which was the lowest since March 2021.

- the index of aggregate payrolls for non-managerial workers rose 0.4%, and increased 5.7% YoY, a -0.1% decline from last month, and the lowest since March 2021. Nevertheless this is significantly above the inflation rate, meaning average working class families have more buying power.

- Leisure and hospitality jobs, which were the most hard-hit during the pandemic, rose 96,000, -184,000, or -1.1% below their pre-pandemic peak.

- Within the leisure and hospitality sector, food and drink establishments rose 6100, and for the first time ever exceeded their pre-pandemic peak, by almost 30,000.

- Professional and business employment rose 21,000. These tend to be well-paying jobs, But this series has been decelerating, and is currently up 1.2% YoY, its lowest YoY gain since March 2021.

- The employment population ratio was unchanged at 60.4%, vs. 61.1% in February 2020.

- The Labor Force Participation Rate was also unchanged at 62.8%, vs. 63.4% in February 2020.