- by New Deal democrat

As I’ve already mentioned a couple of times, I am seeing posts from the usual DOOOMERS warning that a recession is imminent, if we’re not already in one. Typically - again, as per usual - they cite data that they never bothered with before, and won’t bother with again when it turns up, in support of their claims.

These cherry-pickers have strong narratives, so they get a lot of dedicated (and probably a lot of new, naive) followers. But they’ve been wrong many times before, and they’re probably wrong again now.

Another issue I’m seeing is people projecting the negative or decelerating trends of the last few months ahead. That’s also very typical, and also makes for lots of mistakes. While it is OK to use, e.g., a short leading indicator to project a coincident indicator forward, it is a mistake to project that *same* indicator forward simply because of its recent trend.

I’ve also mentioned before that we are currently in a “boom and bust” type cycle that we used to have before the Federal Reserve actively managed interest rates starting in the late 1950s. So let me very briefly compare an important difference between the two types of cycles.

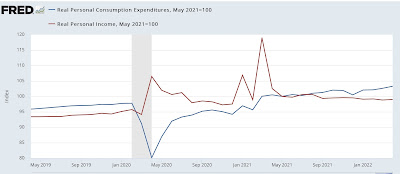

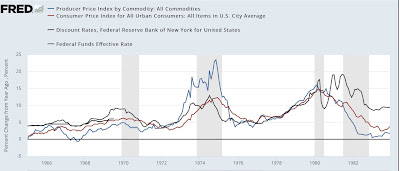

Here are the Boom and Bust cycles from the end of WW2 through the 1950s:

Note that the Federal Reserve basically stayed on the sidelines. In fact, the yield curve never inverted at all until late in the 1950s - and yet there were two complete cycles, typified by sharply accelerating commodity and consumer inflation, which abruptly reversed coursed an decelerated to close to if not outright deflation at the onset of recession. This occurred because consumers could not keep up with the price increases. Typically mortgage rates (not shown) also rose enough to cause big changes in monthly house payments.

Now here are the 1970s stagflationary cycles:

There cycles were also typified by high inflation, but the Fed intervened early, raising rates substantially and (again not shown) causing an inversion of the yield curve. The recessions happened before either commodity or consumer inflation decelerated that much - in two cases not at all!

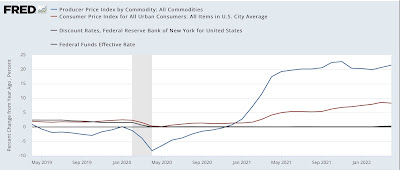

Now, here is our current cycle:

As in the two immediate post WW2 cycles, the Fed has barely intervened - if you squint, you can see the slight rise in the Fed funds rate from zero at the far right. But also, neither commodity nor consumer inflation has cooled at all on a YoY basis.

Until one or both of those markers - an inverted yield curve or a sharp decline in inflation - occur, I do not see any recession in the immediate future.

I plan on examining this in much more detail in a post at Seeking Alpha.