Consider the following from the

latest Conference Board's LEIs of Australia:

The Conference Board LEI for Australia increased slightly in January after declining in the previous two months. Stock prices and money supply made the largest positive contributions to the index this month. Despite the small gain in January, the leading economic index continued on a downward trend, falling 1.0 percent (about a -1.9 percent annual rate) between July 2012 and January 2013, slightly steeper than the decrease of 0.8 percent (about a -1.6 percent annual rate) during the previous six months. Moreover, the weaknesses among the leading indicators have remained more widespread than the strengths in recent months.

Let's look in detail at the numbers:

Looking at the trend, first notice how the LEIs have printed 5 negative months over the last 7. And the month to month increases aren't that strong. In addition, the 6 month percentage change numbers have all been negative for the last 7 readings. Finally, notice that the coincident indicators are have been decreasing from 1.1 in the January to July period to 0.0% over the last two six month periods.

The above chart shows the contributions to the LEI readings over the last six months. I've circled all the negative readings -- of which there are a large number. In fact, only the growth in money supply and share prices have contributed positively to Australian growth over the last six month. Most of the other indicators have subtracted from growth.

As a result:

The LEIs have been decreasing and the conincident indicators are leveling off.

In addition, let's take a look at the latest Minutes from the

Central Bank of Australia's last meeting:

With the national accounts scheduled for release the day after

the Board meeting, members noted that information to hand at the

meeting suggested that the pace of output growth in the December

quarter had been around trend. Coal and iron ore exports had grown

strongly in the quarter, and most components of domestic demand were

estimated to have recorded moderate growth.

While mining investment was reported to have grown further in

the December quarter, it still appeared that mining investment as a

share of GDP was approaching its peak and mining firms remained focused

on containing costs. The gradual shift away from investment towards

production and exports in the period ahead was expected to lead to some

reduction in the demand for labour in the resources sector.

Investment outside the mining sector was estimated to have

declined in the December quarter. However, there were indications that

it would pick up in 2013/14, although this was expected to be modest,

as business surveys of investment intentions and capacity utilisation

were at below-average levels and liaison suggested that some firms were

investing only to cover depreciation. Consistent with this,

non-residential building approvals remained low and office vacancy

rates had risen over recent quarters, reflecting softening demand for

office space. Members noted that business profits had declined a little

and business debt had been growing at a moderate pace of about

4 per cent per annum.

Members observed that dwelling construction activity had picked

up further in the December quarter. Forward-looking indicators such as

building approvals pointed to further growth in construction in the

months ahead. The increase in approvals had been geographically

widespread and the Bank's liaison with builders also suggested there

had been an improvement in buyer interest in some states. Overall,

recent housing market developments pointed to a further moderate

increase in dwelling construction in the period ahead.

Indicators of consumption had been mixed but, overall, growth

appeared to have been only modest in the December quarter. The value of

retail spending was unchanged over the December quarter, although

figures released during the meeting indicated that spending had

increased in January, which was consistent with liaison contacts

reporting stronger retail spending in early 2013. Motor vehicle sales

to households were flat in February but remained at a robust level,

while measures of consumer sentiment had increased further over recent

months, to be a bit above their long-run average levels.

Members noted that conditions in the labour market remained

subdued. The unemployment rate in January was steady at 5.4 per cent,

but the rate of growth of employment remained modest, the trend in

total hours worked remained flat and the participation rate had declined

a little further. While leading indicators of labour demand were down

from earlier levels, they remained consistent with modest employment

growth in the near term.

As expected, the year-ended pace of wage growth continued to

slow, with the wage price index increasing by 3.4 per cent over the

year to the December quarter. This slowing had been broad-based across

states and industries, and was particularly pronounced in the household

services and retail sectors. Information from liaison and business

surveys was consistent with private sector wage growth on a quarterly

basis remaining around current rates over the period ahead.

Overall, there's growth, but it's slowing. Outside of replacing goods to cover for depreciation, business investment is down. Non-residential investment is declining. While retail sales are OK, they're not robust. Most importantly, there is a potential slowing of the labor market: job growth is lackluster; total hours worked was lackluster and the participation rate had declined.

And then there is this analysis from their

latest interest rate decision announcement:

In Australia, growth was close to trend over 2012, led

by very large increases in capital spending in the resources sector,

while some other sectors experienced weaker conditions. Looking ahead,

the peak in resource investment is drawing close. There will,

therefore, be more scope for some other areas of demand to strengthen.

Recent information suggests that moderate growth in

private consumption spending is occurring, though a return to the very

strong growth of some years ago is unlikely. While the near-term outlook

for investment outside the resources sector is relatively subdued, a

modest increase is likely to begin over the next year. Dwelling

investment is slowly increasing, with rising dwelling prices and high

rental yields. Exports of natural resources are strengthening. Public

spending, in contrast, is forecast to be constrained.

The above quick summation gives us more of the same: the investment boom in raw materials is drawing to a close. While the bank is hopeful that something will take its place, they don't mention a specific industrial area that will take its place. They do mention dwelling investment, but the jury is still out as to whether or not that will take the place of resource investment.

And finally, there is

this article from the Financial Times regarding Australia's need to re-balance it's economy.

Let's take this data and apply it to the Australian ETF:

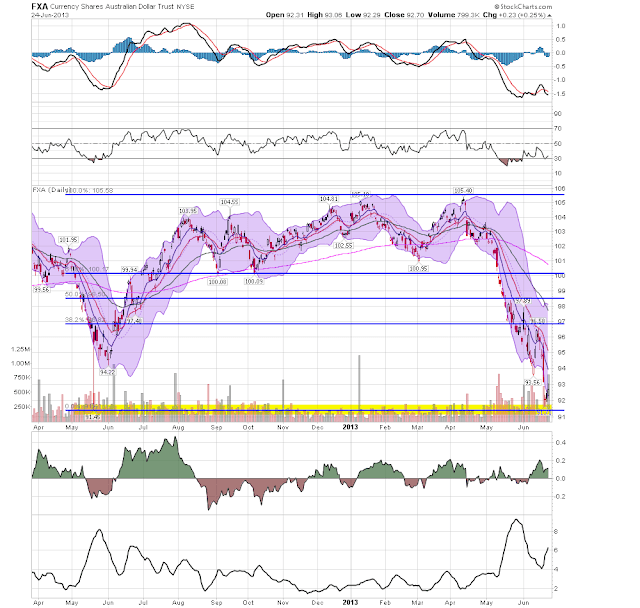

On the daily chart, we see two trend lines. The one that started in mid-November has clearly been broken. However, the one that started in last June is still good. Prices are tangled in the 10 and 20 day EMA -- both of which are also moving sideways. The 50 day EMA looks like it will be the next technical support level. Additionally, momentum is dropping and prices are losing their overall strength. However, there is still a fair amount of money moving into the market.

The weekly chart shows that prices are forming a downward triangle on decreasing momentum on declining volume. There are two ways to read this. The bullish read is that the triangle represents a downward consolidation of the ETF. However, consider that interpretation in light of the weakening LEI picture. When the fundamental information is read into the data, this is looking more and more like a temporary top.