Short summary: the SPYs and DIAs each hit a new high yesterday. In addition, the underlying technicals of both are improving. But, three sectors are responsible for the rise: utilities, health care and consumer discretionary. As two of these sectors are defensive, the strength of the rally is in questions. In contract, the live cattle ETF is near year long lows.

The big news yesterday was the new highs in the SPYs (top chart) and DIAs (bottom chart). The underlying technicals of both are similar. Both have bullishly aligned EMAs (shorter above longer, all rising), prices using the shorter EMAs for technical support and an MACD that has given a buy signal. The primary different is the DIAs have formed a rising wedge pattern and broken through top side resistance.

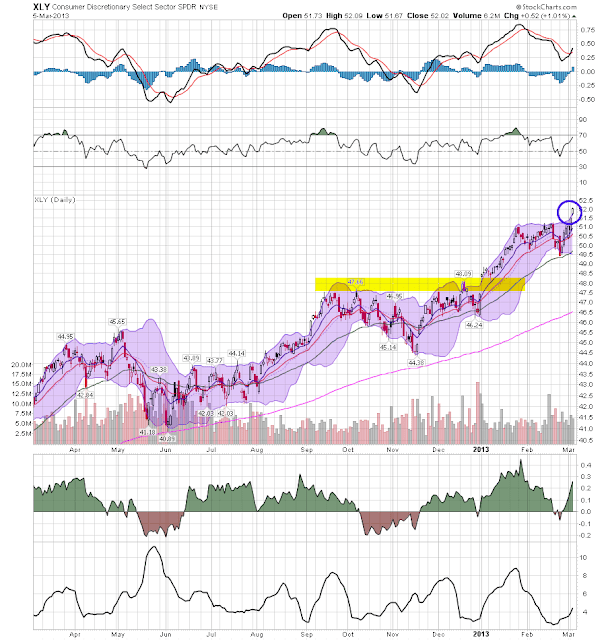

Interestingly enough, three sectors are responsible for the recent price action: health care (top chart), utilities (middle chart) and consumer discretionary (bottom chart). There is no doubt that each of these charts is strong: the health care ETF is in the middle of a year-long rally; the utilities have rallied from a low in late November and consumer discretionary is also in the middle of a year long rally. However, two of these sectors are defensive, bringing the recent price action into questions.

In contrast to the equity markets, the live cattle ETF came near to hitting a record low yesterday. First, notice that for most of the last year, prices have been trading between roughly 27 and 29 -- about a 7.5% trading range. Late last year, they broke the 200 day EMA, but after two attempts couldn't maintain upward momentum. Since the beginning of the year, prices have been dropping sharply; momentum is weak and the CMF is negative.