- by New Deal democrat

We are at somewhat of an inflection point as to consumer inflation. On the one hand, the post-pandemic inflationary effects continue to fade. But on the other, we are waiting for the effects of Tariff-palooza!

In June the waning post-pandemic effects continued to dominate, as the only items still rising at a rate in excess of 4% were Owners’ Equivalent Rent, gas and electric utility services, and motor vehicle insurance and repairs, joined by hospital services, meat and tobacco.

Here’s the more detailed look.

Headline CPI in June rose 0.3%, core CPI rose 0.1%, and ex-shelter CPI was unchanged. On a YoY basis, CPI rose 2.4%, core CPI rose 2.8%, and CPI ex-shelter CPI rose 0.3%. Here is the month over month look at all three:

On a YoY basis, headline CPI was up 2.7%, core CPI up 2.9%, and CPI ex-shelter was up 2.0%:

This graph does suggest that CPI is at an inflection point. While the YoY trend in core inflation appears to be a continuation of slight deceleration (although both it and headline CPI YoY were 0.3% hotter than last month), CPI less shelter shows a slightly increasing trend over the past 9 months - even as it remains under 2.5% as it has for over 2 years. The net effect is that YoY headline inflation appears to have wobbled in the 2.4%-2.8% range over the past year. In other words, overall the post-pandemic disinflationary effects appear to be fading.

Within shelter, actual rent rose 0.2% for the month, and is up 3.8% YoY, while the fictitious Owners’ Equivalent Rent rose 0.3% for the month, and is up 4.2% for the year. Although both YoY metrics declined slightly this month, both rounded to 0.0%. Here’s what both of them look like in comparison with the FHFA house price index:

I do expect the shelter components of CPI to continue to slowly decelerate, following the continued somnolent readings in the FHFA index.

There were only three other significant drivers of inflation last month: transportation services, utility services, and hospital services.

As a reminder, transportation services (mainly maintenance and repair as well as insurance) are even more lagging than OER, since they react to the increased cost of vehicles and parts (note: FRED does not separately break out insurance):

Transportation services as a whole appear close to their pre-pandemic range, while maintenance and repair costs remain slightly elevated.

While the former problems of new car prices have risen only 0.2% in the past 12 months, and used car prices 2.8% (so I won’t even both with the graph), motor vehicle repair prices are still up 5.2% YoY, and motor vehicle insurance is up 6.1%. Even here, both continued to moderate, as on a monthly basis the former were only up 0.2%, and the latter up 0.1%

Hospital services rose 0.7% for the month and are up 4.2% YoY:

This series is somewhat noisy, but the current reading is within the “normal” range for the past 10 years (the 2023-24 YoY increase was due to one big month’s increase in 2023). Whether the jump this month is a harbinger of a future breakout or just noise is completely unknown.

Finally, the only other current problem child is gas and electric utility services, up 0.9% for the month and up 7.5% YoY:

This does appear to be a genuine breakout from its post-pandemic range. Although I won’t bother with the graph, both electricity and gas utility services are participating in the breakout.

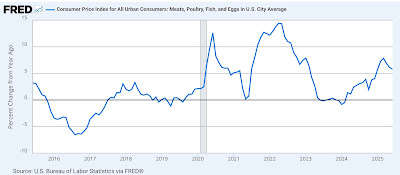

Cleaning up a few other odds and ends: energy prices (mainly gasoline) did increase 0.8% for the month, but remained down -0.8% YoY. Tobacco products increased 0.5% for the month, and were up 6.3% YoY, but these have a very small weighting in the index. Perhaps of more interest, meat and poultry prices declined -0.3% for the month, but remain up 5.8% YoY, although down from their 7.8% YoY peak in March:

To summarize, the takeaway for June is that the slow post-pandemic disinflation, led by shelter and motor vehicle prices, appears to be abating, while several other areas - albeit small - of concern have appeared. On the bright side, there do not appear to be any definite signs of negative impacts from tariff-related price increases yet.