- by New Deal democrat

The post-jobs report data drought finally ends tomorrow. Today, let me take the opportunity to update some important trends that have been affected or caused by the T—-p Administration’s “policies.”

All graphs below showing absolute values have been normed to a value of 100 as of Election Day last November.

First and most notably, since Inauguration Day the US$ has declined more than 10%. Below I show the absolute value of the nominal US$ index (blue, right scale) together with the YoY% changes, going back 60 years (red, left scale):

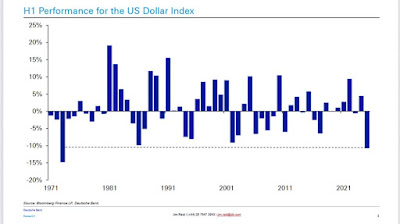

Here is a graph of the H1 decline in the US$ over that same period:

The decline in the absolute value US$ does not look particularly bad vs. several post-recession declines in the past, and on a YoY% basis it is only down 5%. But as the immediately above graph shows, the 10% H1 decline is among the sharpest in the past 60 years. With the exception of the Reagan Administration’s deliberate devaluation strategy, a YoY decline of over 10% would only be normal in a very weak economy where it is part of pump-priming. Needless to say, if we reach such a YoY decline even before going into a recession, that would be a bad thing.

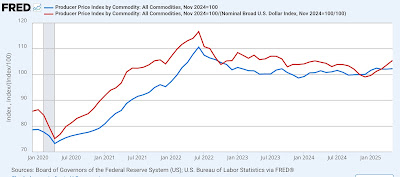

Commodity prices as measured by the PPI are up 2.3% since the election (blue), but since commodity markets are global, how much, eg., lumber can be bought is affected by the US$’s value vs. other currencies as well, and so adjusted, commodity prices have risen 5.5% (red):

In short, it is more expensive to import most commodities now than it was before the election.

As can be found in the Daily Treasury Statement, tariff income has risen to $28.0 Billion during the month of June:

That’s $336 Billion on an annualized basis, and since it is paid by importers and either eaten by them or wholly or partly passed on to consumers, it is a deadweight loss to the economy, particularly in view of the Billionaire Bust-out Budget Bill just enacted.

In the past, GOP budget bills have made sure to include some crumbs for medium and lower income earners, in the form of at least a modest tax reduction. Not this time. This time, especially coupled with the impact of the tariffs, a large majority of American households will actually lose income:

This is, needless to say, not a good thing in an economy which is 70% fueled by consumption.

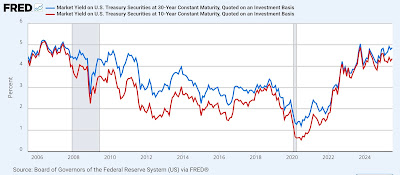

In view of all of the above, the yield on long-dated US Treasury’s has hovered at about 4.4% for the 10 year, but gradually risen to almost 5% for the 30 year bond:

As you can see, both of these are close to 20 year highs. Of course, there is no way to know for sure whether the trend will continue, but it certainly appears as if the bond market is anticipating more inflation, and in the case of foreign holders, a requirement for higher yields to hold US$ denominated assets.

Finally, we come to the contrarian indicator - the US stock market, which made yet another new all-time high last Thursday in the face of T—-p’s latest tariff announcements (blue, right scale):

The market is up over 5% since Election Day.

But as you can see especially from the YoY% change shown by the red line, the pace of increase has slowed considerably.

Usually it is worthless to try to divine “why” the stock market has made a particular move. But in the case of the rally since April, it is almost certainly an indication of the “TACO trade,” which is to say that market participants are not taking T—-p’s tariff pronouncements seriously, and fully expect him to back off.

Paradoxically, this creates positive feedback for T—-p, which in turn makes it more likely that he will carry through on his tariff threats. Which in turn will likely surprise the market and lead to a sell-off. Which is likely to activate TACO again. Rinse, lather, and repeat.

Although lower taxes are normally good for corporate profits, since as indicated above most American households will sustain a net loss from the combination of the tax bill and increased prices due to tariffs, it is hard to see that being the case this time.

Of course, time will tell. But so far the trends from T—-p have been a declining US$, an increase in commodity prices and inflation expectations, and a (small so far) deadweight loss to the consumer economy. Personally, my bet is that the bond market is right, and the stock market is wrong.