- by New Deal democrat

I generally don’t pay too much attention to producer prices, but there are a couple of exceptions. One exception is that sometimes producer prices lead consumer prices by a number of months. That hasn’t been the case recently. But the other exception is that producer prices can tell us whether profit margins are being squeezed or not. *That* is relevant at the moment.

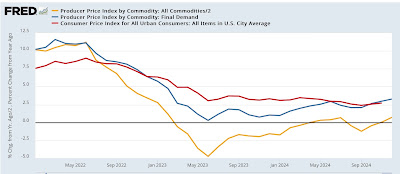

Let me start with the monthly change in raw commodity prices (gold, /2 for scale), final demand producer prices (blue), and consumer prices (red) for the past two years:

The most important component of the above graph is that the downdraft in commodity prices - which are the most upstream prices of all - appears to have ended, as the big declines of 2023 abated except for three months in 2024. And there have been no declines in the past three months. So there is no tailwind likely to help consumers downstream (okay, I’m mixing metaphors but you get it).

Now here’s the YoY look, going back three years:

Again, we see big declines in the year after June 2022, the peak for oil prices after the Ukraine invasion. For the past nine months, commodity prices have been stable on a YoY basis.

Even more importantly, note that final demand producer prices - the ones just before products and services are finished for consumption - have risen YoY for the past several months, from 2.1% in September to 3.3% last month. That compares with 2.7% for the last month reported in the CPI.

Producer prices increasing faster than consumer prices means producers cannot pass on their price increases to consumers, which has the effect of squeezing their profits. And that appears to be happening, as suggested by the latest actual + estimated earnings for Q3 and Q4 of last year as reported by publicly traded corporations (via FactSet):

Earnings barely increased in Q3, and so far are estimated to barely increase again in Q4. And when corporate earnings stall, CEO’s start looking for ways to cut costs.

We’ll see what happens with consumer prices tomorrow, but this is yet another yellow flag suggesting recession risks are rising (albeit still relatively low) for later in 2025.