- by New Deal democrat

On Friday I noted that the July employment report was a perfectly good, solid one in absolute terms, but that almost all the leading components were soft and weakening, as I would expect to see near the final stages of an expansion.

Let’s take a look with some graphs today.

First, the good news.

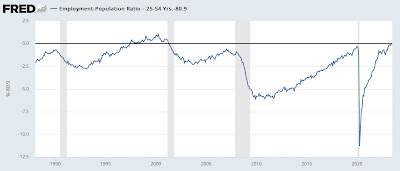

The employment population ratio for the prime age working group, ages 25-54, at 80.9%, is the highest it has ever been except for the tech boom of the late 1990’s:

And the unemployment rate, at 3.5%, is only 0.1% higher than its lowest level during this expansion, and is tied with the lowest levels of 2019, which are the lowest in over 50 years:

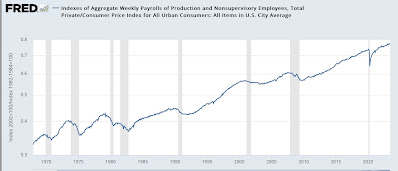

Wages for non-managerial workers rose 0.5% for the month, and at an annual rate of 4.8%, which is 1.7% higher YoY than the last monthly read on inflation:

Wages rising at 1.7% over inflation is better than all but about 7 the last 60 years:

Finally, except for the pandemic it has *always* been the case that real, inflation-adjusted payrolls for workers have peaked a number of months before a recession. Unsurprisingly, this typically causes consumers in the aggregate to cut back spending, an immediate precursor to recessions:

In July in nominal terms aggregate payrolls rose 0.6%, or 6.4% YoY, a full 3.3% higher than inflation as last measured, to another all-time high.

In short, just about everybody who wants a job can find one, and the economy is functioning as close to completely full employment as it has been in over half a century, and those workers are earning wages at a level over inflation better than at almost 90% of all times in the past 60 years.

That is pretty darn good.

Now for the storm clouds out on the horizon.

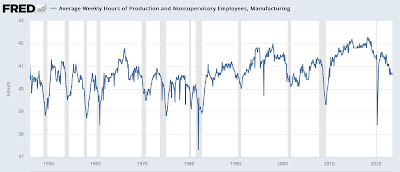

Before industrial producers cut jobs, they cut back hours. And weekly hours for nonsupervisory workers in manufacturing have been cut back by almost 1 full hour, a decline typically seen shortly in advance of most past recessions:

In general manufacturing, residential construction, and temporary help jobs are among the first to turn down before a recession, as shown below for the past 50 years, or as long as records have been kept respectively (note 2 series are shown on right scale for easier comparison):

Now here is a close-up of the past year:

Temporary help jobs are down sharply, residential construction jobs down significantly, and manufacturing jobs are flat. The broader measure of goods-production jobs generally has increased only 0.4% since February, a declining rate typically seen late in expansions:

With the exception of factory hours and temporary help, none of these numbers are what I would expect right before a downturn starts. But definitely later in an expansion, on the order of 12-18 months before a recession.