- by New Deal democrat

Gasoline prices and fictitious shelter prices are once again moving in opposite directions, in a direct reversal of what the situation had been in the past 12 months. During late 2022 into this year, energy prices came down sharply, while owners’ equivalent rent was increasing. Now energy prices are beginning to increase again, while fictitious shelter CPI finally catches up.

Here’s the closer look.

First, both headline and core CPI grew at a mild 0.2% pace in July. The former is only up 3.2% YoY (an increase from last month’s 3.0%), while the latter is up 4.7% YoY:

Headline inflation is really no longer a problem. But when we take out gas, and keep in shelter, it is still elevated.

Which brings us to shelter. Ex-shelter, CPI was unchanged last month, and is only up 1.0% YoY:

If we used actual monthly house price and rents, YoY CPI would probably be up only about 0.6%.

The fictitious owners’ equivalent rent increased 0.5% for the month, which is still better than the 0.7% and 0.8% it was increasing monthly late last year:

So let’s update OER (blue) with the FHFA (red) and Case-Shiller (gold) house price indexes:

Exactly as predicted, OER is following house prices down with roughly a one year lag. OER is up 7.7% YoY now, decelerating at roughly 0.2%/month. The big question is how quickly it will continue to decelerate. If it does so at the same pace as house prices did, it will take only about another 6-8 months to get back to the level of the Fed’s comfort zone. If it continues to decline at only 0.2%/month, it will take several years instead. I lean towards the former outcome, but we’ll see.

Another pocket of high inflation was food prices. This too continues to subside, up 0.2% for the month and 4.9% YoY:

At its current pace of YoY decline, it will be in the Fed’s comfort zone in about 3 more months.

Next, new and used car prices have also been a major driver of inflation. Both declined in July, the former by -0.1% and the latter by -1.3%. They are up 3.5% and down -5.6, respectively, YoY:

Again, it will probably take about 3 more months of this for new vehicles to get into the Fed’s comfort zone.

But the situation is different when we look at “transportation services,” which includes things like insurance, vehicle rentals and repairs. This was up 0.3% for the month, but is still up 9.3% YoY:

I’m giving you the full 35 year history of this series to show how, even with recent steep declines, the YoY rate is still extremely high by historical standards. A lot of this has to do with owners hanging on to older model cars rather than get the full force of new vehicle sticker shock. Those older model vehicles need lots of repairs, and lots of repair shop employees to do the work. Hence a spike in demand feeding a continued spike in prices. Even at the current pace of decline, we’re probably still about 6 months away from a more “normal” rate of inflation here.

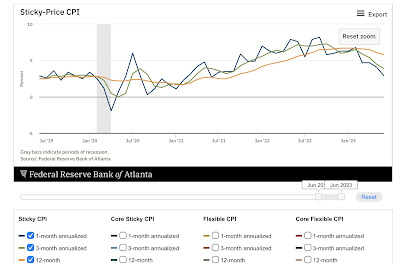

Finally, let me show you the Fed’s preferred metric these days, which is sticky price CPI. On a headline basis, this continues to decelerate slowly YoY, but note that the 1 month and 3 month annualized rates are very close to the Fed’s comfort zone:

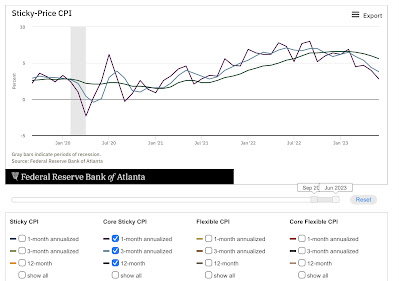

The same is true of the core sticky price metric:

I strongly suspect the Fed will still do at least one more rate hike, although there may be a brief pause. But if current trends continue for 3 more months, then nearly everything except fictitious shelter is going to be close to or within their comfort zone. Which may or may not make a difference to them.

A second final comment is that if there is a mild re-acceleration of headline inflation, but that is coupled with continued deceleration in wage gains, then I would expect to begin to see signs of consumes feeling squeezed within a few months. Which would not be good in tandem with a Fed continuing to raise interest rates.